Author: Amanda Ahne

Asset Allocation Bi-Weekly – The Warsh Doctrine (February 17, 2026)

by Thomas Wash | PDF

When Kevin Warsh, President Trump’s nominee to be the next Federal Reserve chair, last departed the central bank in 2011, it was more than a career move — it was an act of ideological dissent. He cautioned that the Fed’s post-crisis expansion of authority would erode its institutional independence and set the stage for future inflation. Now, nearly 15 years later, he will return with a clear mandate: to unwind those interventions and champion a leaner, less market-intrusive central bank built on a simplified monetary framework.

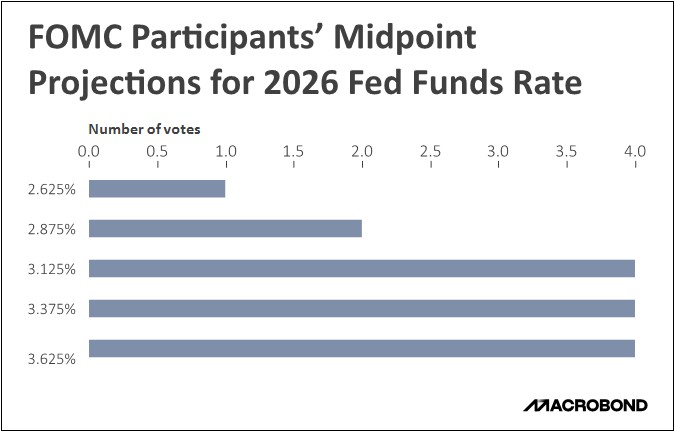

The institution he will rejoin, however, is profoundly transformed. The modern Fed has formalized its once-implicit 2% inflation target and fully embraced aggressive forward guidance. Through more frequent press conferences and the now-institutionalized Summary of Economic Projections, complete with its influential “dots plot,” the central bank has made transparency a core tool of policy. These measures aim to give markets a clearer sense of the Fed’s thinking and its likely policy trajectory.

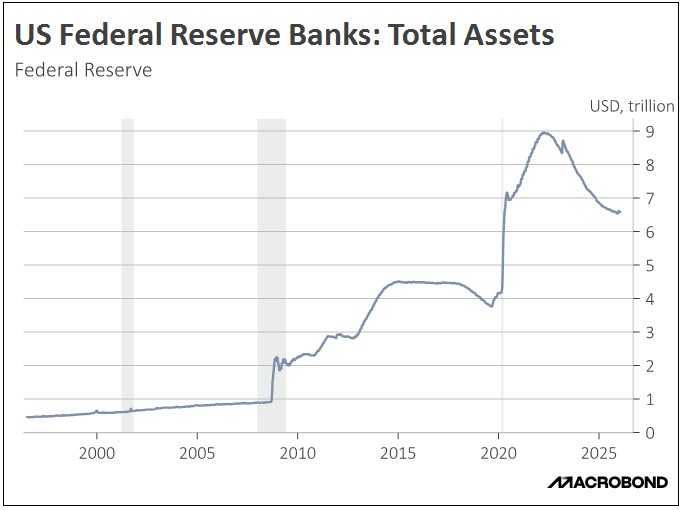

Beyond the expansion of quantitative easing, the Fed has also entrenched its market presence by establishing permanent liquidity backstops. The Standing Repo Facility and the Overnight Reverse Repo Facility were created to reinforce the financial system’s plumbing, ensuring that the central bank can swiftly manage short-term interest rates and ease liquidity strains without resorting to ad hoc crisis measures.

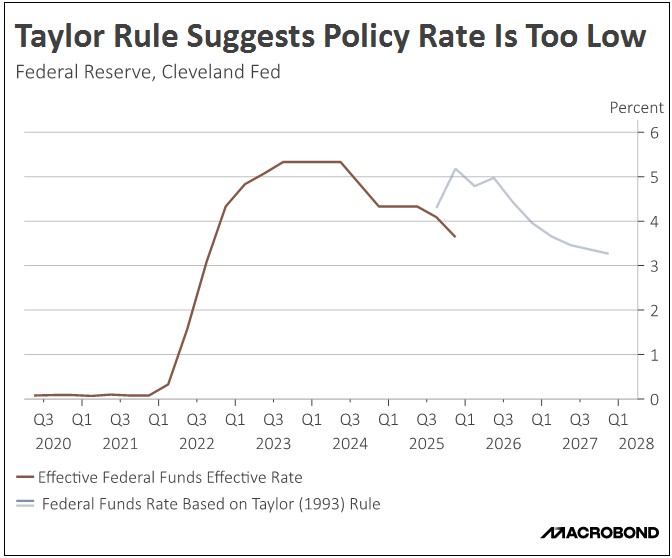

Under a Warsh-led Fed, we are likely to see a pivot toward operational simplicity aimed at reducing market uncertainty, though not without significant caveats. Warsh has historically championed a rules-based framework, where monetary policy is anchored to a transparent set of metrics. This would allow markets to more accurately self-price the direction of rates. However, in recent months, Warsh has moderated this stance, characterizing a “strict adherence” to rules as being more aspirational than absolute.

This evolution hints at a broader philosophical shift. A Warsh-led Fed may bring a chair (like Greenspan before him) willing to look beyond rigid economic models and instead rely on forward-looking judgment. Just as Greenspan saw transformative potential in the internet, Warsh sees it today in artificial intelligence, calling the current productivity surge “the most significant of our lives past, present, and future.”

This conviction clarifies why Warsh has hinted at temporarily overriding rules-based policy prescriptions in favor of lower interest rates, a tactical deviation based on his view of shifting productivity frontiers. His logic is that lower rates will stimulate corporate capital expenditure, thereby boosting investment to expand the economy’s productive capacity. This supply-side expansion could, in turn, help to lower inflationary pressures.

Furthermore, Warsh appears skeptical of a rigid 2% inflation target, having once dismissed it as “arbitrary.” Instead, he has advocated for a flexible inflation target band. Such a framework would grant the central bank greater operational leeway, providing a wider window to assess economic conditions before deciding the optimal course for rate adjustments.

This does not mean Warsh would avoid pursuing a restrictive monetary policy. One area where he seems particularly focused is the normalization of the Fed’s balance sheet. Last May, he stated that if the balance sheet were to grow in line with the broader economy, it would stand at roughly $3.0 trillion. This suggests he might support allowing the current $6.6 trillion balance sheet to continue shrinking until it returns closer to that level.

As Warsh prepares to take the helm of the Fed, we anticipate a decisive but complex pivot. The guiding principle would be a return to a less transparent, more orthodox central bank, likely scaling back forward guidance to force markets toward greater self-reliance. The tension lies in the application. While being openly accommodative toward rate cuts to nurture AI-driven growth, he would almost certainly counterbalance this with a hawkish, determined campaign to shrink the Fed’s balance sheet.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Daily Comment (February 13, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

NOTE: There will be no Comment on Monday, February 16 due to the holiday.

Our Comment opens with our take on the recent “AI scare trade” and its role in amplifying market volatility. We then examine the EU’s push to reduce its security dependence on the United States. Next, we discuss White House pressure on firms to align their business models with its policy agenda, Kevin Warsh’s increasingly contentious confirmation battle, and Moscow’s bid to regain access to the US dollar system after the Ukraine conflict. We close with a summary of key economic data from the US and global markets.

AI Transition: AI may be entering a new phase in its product cycle. Renewed concerns about profitability across the tech sector sparked a broad equity sell‑off on Thursday, following Cisco’s earnings report that, despite solid sales, signaled margin pressure from rising memory‑chip costs. Investors also appear increasingly cautious about potential disruptions to established business models as AI‑driven efficiency gains reshape corporate operations. The retreat comes amid mounting doubts about the durability of the recent market rally.

- In its latest quarter, Cisco delivered a clear “double beat,” with revenue and earnings per share both coming in ahead of expectations, underscoring solid demand across its networking and AI‑infrastructure portfolio. The company also lifted its full‑year outlook, signaling confidence in its order pipeline. However, investors remain focused on signs that profit margins are being squeezed, as rising memory chip and other component costs weigh on gross margins and are expected to remain a headwind in coming quarters.

- These profitability and disruption fears are weighing not only on AI market leaders but also on established companies perceived to be vulnerable to replacement by emerging AI tools. The latest market move was triggered by former karaoke-equipment maker Algorhythm Holdings, now repositioned as an AI logistics firm, which announced a new AI tool designed to reduce “empty miles” and significantly boost productivity. The news sent trucking and logistics stocks into a steep decline.

- Growing anxiety about how AI will affect profitability across sectors has helped fuel a broad “AI scare trade” in equity markets, with investors dumping stocks seen as vulnerable to AI‑driven disruption or heavily exposed to AI‑related spending. The sell‑off has been most pronounced in the United States, where high‑profile tech names, elevated valuations, and rapid AI adoption have amplified concerns about earnings sustainability and competitive pressures.

- While we believe the AI trade may still have some momentum, activity over the last few months suggests the sector is moving closer to a maturity phase. As a result, we view the recent volatility in tech as part of a natural shakeout, with investors moving away from hype and beginning to distinguish the winners from the losers. This is why we advocate for portfolios to broaden their exposure, including increasing international allocations, which could help balance the specific US tech risks associated with this transition.

European Independence: There are growing signs that Europe is seeking to make itself less dependent on the United States for its security, with renewed debate over a more autonomous European defense posture. A new survey published this week shows that key NATO countries increasingly view the US as an unreliable ally and doubt that American power can still effectively deter their adversaries. This erosion of confidence has led the bloc to take steps to ramp up its defense capabilities.

- Europe’s push to shore up its own security is also spurring investment in advanced defense technology. France and Germany are in early talks with aerospace firm ArianeGroup about a proposed land‑based ballistic missile system intended to enhance Europe’s long‑range strike and deterrence capabilities. The company has also been in the spotlight for successfully flying the most powerful configuration of its Ariane 6 launcher, which recently lifted off under a European Space Agency mission.

- Additionally, the bloc may be beginning to rethink its stance on nuclear weapons. For the first time since the Cold War, European governments and militaries are quietly discussing how they might develop their own nuclear deterrent if US guarantees weaken. Against this backdrop, there is growing speculation that French President Emmanuel Macron will deliver a new speech outlining how France’s existing nuclear force could provide broader protection to Europe.

- Europe’s changing attitude toward its own defense underscores a broader fracturing of the global order. As the US pulls back from its traditional hegemonic role and broad security guarantees, more countries are likely to step up defense spending to protect themselves. In Europe in particular, years of underinvestment mean this rearmament cycle could provide a meaningful tailwind for global defense and aerospace firms.

White House Pressure: Washington continues to signal a growing willingness to pressure private firms to align with the federal agenda. On Thursday, White House advisor Peter Navarro urged JPMorgan Chase CEO Jamie Dimon to lower credit card interest rates as part of an effort to improve household affordability. Simultaneously, the Army chief of staff warned defense contractors that they must modernize their practices or risk losing government contracts. These moves underscore a shift toward a more interventionist approach to guiding the economy.

Warsh Confirmation: Kevin Warsh appears headed for a tougher‑than‑expected confirmation battle as he seeks to take over the Federal Reserve. Senator Thom Tillis (R-NC) has warned that he will withhold support unless the Justice Department drops its investigation into the Fed’s headquarters renovation, which he argues threatens the central bank’s independence. Because Tillis holds a pivotal seat on the Senate Banking Committee, his opposition could significantly complicate Warsh’s path to confirmation.

Trade Restrictions: The White House is reportedly considering narrowing the scope of its metal tariffs. The shift comes as businesses struggle to plan around complex, hard‑to‑model tariff formulas and as the EU presses for changes as part of trade negotiations with Washington. The policy has also faced mounting criticism because much of the burden has fallen on US firms and consumers. If the administration follows through, we expect trade policy to become less restrictive in the coming months, providing a modest tailwind for manufacturers.

Moscow Wants Dollars? Moscow has floated a proposal to rejoin the dollar-based financial system as part of a broader settlement to end the conflict in Ukraine. Under the plan, Russia and the US would pursue an economic partnership that prioritizes continued fossil fuel development over a rapid shift to renewables, alongside joint ventures in other sectors designed to generate substantial windfalls for US companies. Taken at face value, the initiative suggests Moscow is seeking to rebuild and deepen economic ties with Washington once the conflict is resolved.

Daily Comment (February 12, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with our take on the latest jobs report, then turns to US trade policy and why we believe further tariff restrictions are unlikely. We next discuss the CBO’s updated fiscal deficit estimate, upcoming talks aimed at ending the conflict in Ukraine, and the first projects launched under the new Japan–US investment fund. We also include a summary of key economic data from the US and global markets.

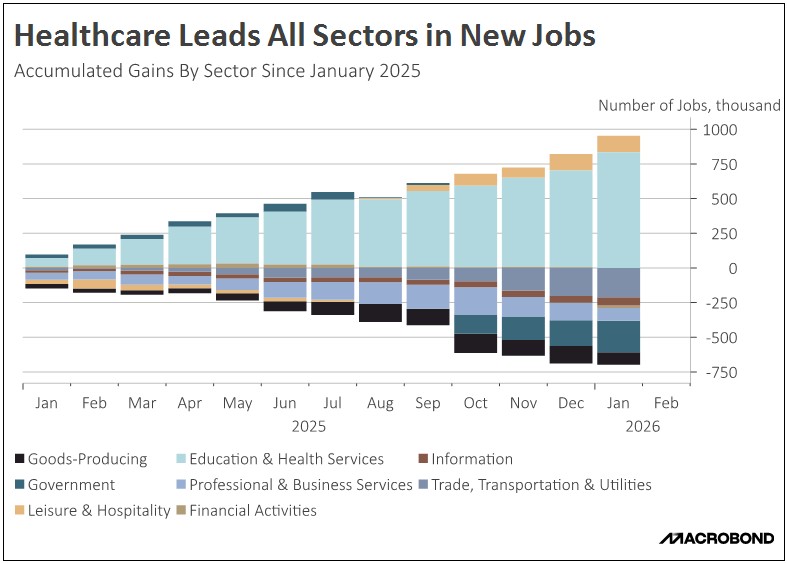

Labor Market Story: US employment data is sending mixed signals on the labor market. The BLS reported 130,000 jobs were added in January, a sharp rebound from December’s revised 48,000 gain. However, benchmark revisions revealed a far weaker labor market in 2025 as total job growth was slashed by 69% to just 181,000, while 2024 was revised down by 24%. The disconnect between the strong monthly print and the dramatic downgrades shows that while the labor market may be stabilizing, it remains on shakier ground than previously thought.

- The January report shows that job gains remain heavily concentrated in health‑related fields, with construction also beginning to rebound. Total private payrolls increased by 172,000, driven by a combined 124,000 new positions in health care and social assistance, while construction added 33,000 jobs, accounting for the bulk of new goods‑producing employment. By contrast, most other major sectors were little changed for the month, with notable job losses in the federal government and financial services.

- While most of the recent commentary has focused on the Tech sector’s role in the economy, far less attention has gone to the steady support coming from Health Care. In 2025, Health Care and social assistance accounted for the vast majority of net job gains. This reflects the sector’s relatively noncyclical demand profile, with resilient consumption and pockets of pricing power pointing to an industry that continues to expand even as more cyclical parts of the economy softened.

- A sharper pickup in construction hiring also points to firmer investment in the broader economy, supported by a mix of reshoring efforts and generous tax and industrial-policy incentives that are driving factory, infrastructure, and data center projects. These gains could signal the early stages of more broad‑based job growth in the months ahead, even if the evidence is still tentative.

- Looking ahead, we believe the sluggish job growth of last year is giving way to a more resilient 2026. Confidence is returning, and businesses are moving forward with investment plans that were previously on hold. We are also seeing the early stages of a major “sector rotation.” As the AI hype stabilizes, investors are seeking value in overlooked areas of the market. This shift suggests that 2026 will be the year the market rally finally broadens from the tech giants to the overall economy.

Trade Tensions: The White House is facing increasing pressure at home and abroad to soften its trade policy approach. In the US, lawmakers are pushing back against the president’s efforts to impose tariffs without congressional approval. At the same time, foreign leaders are expressing growing concern that a trade agreement is becoming politically risky in their own countries. Although these challenges have introduced some uncertainty, we remain confident that trade policy is unlikely to turn materially more restrictive in the coming months.

- The White House suffered two significant legislative setbacks this week regarding its trade strategy. On Wednesday, the House passed a bipartisan resolution to terminate the national emergency that was used to justify a 25% tariff on Canadian goods. This followed a Tuesday night defeat for GOP leadership, where three Republicans joined Democrats to block a procedural rule that would have prevented Congress from calling “snap votes” to repeal the president’s tariff powers until August.

- Additionally, questions are mounting over the implementation of recently announced trade deals. The White House has already eased its India fact sheet under pressure from New Delhi, shifting “commits” to “intends” on planned US purchases and removing references to agricultural pulses and digital tax changes. Meanwhile, the Indonesia framework appears to be back on track after coming under strain when Jakarta pushed for wording changes to make the deal more politically palatable.

- While these setbacks could still lead to marginal adjustments, we do not believe they signal a reversal of the broader shift toward a less restrictive trade stance. In our view, the White House appears to be moving away from escalating tariffs as its primary policy tool and is instead gravitating toward stabilizing rates at more moderate levels to ease pressure on consumers and businesses. As a result, although some countries may see their relative standing shift, we do not expect a return to the scale of disruption seen last year.

- As noted in our previous reports, an easing trade environment is likely to support a broader sector rotation. Last year, markets flocked to areas best positioned to navigate trade-related challenges; this year, we expect the focus to shift toward firms poised to benefit from the relaxation of those policies. Accordingly, we continue to see merit in adding exposure to non-AI-related sectors, which may finally receive a boost given their relatively attractive valuations.

Deficit Expectations: The Congressional Budget Office (CBO) has raised its fiscal deficit projections, underscoring the growing urgency for policymakers to address the long-term debt trajectory. The nonpartisan agency now expects cumulative deficits from 2026 to 2035 to be roughly $1.4 trillion higher than forecast in January 2025, a revision driven largely by last year’s One Big Beautiful Bill Act and tighter immigration policies. Over time, larger deficits could potentially put upward pressure on longer-dated US government bond yields.

Ukraine Update: Ukraine is preparing for another round of discussions on a possible settlement to its conflict with Russia. Ukrainian President Volodymyr Zelensky has indicated that negotiations have moved to the sensitive question of territory, including proposals related to a special economic zone in the eastern Donbas region, though both sides remain far apart and reluctant to make binding concessions. At this time, we continue to remain confident that the conflict between the sides appears to be coming to an end.

Japan and US Fund: Washington and Tokyo are working to operationalize a joint investment fund aimed at developing strategic sectors in the US. Current discussions reportedly include three flagship projects: large‑scale data center infrastructure, a deep‑sea energy terminal in the US Southwest, and synthetic diamond production for semiconductor applications. The initiative illustrates how tariff and industrial policies are being used to attract foreign direct investment into strategically important industries and could provide an additional tailwind for markets.

Daily Comment (February 11, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with an analysis of why markets remain resilient despite ongoing economic headwinds. We then turn to developments in the status of the nuclear program negotiations with Iran, followed by a discussion of the potential US withdrawal from the USMCA and rising tensions between the White House and the EU. We also include a summary of key economic data from the US and global markets.

Consumer Credit: Delinquency rates reached their highest level in nearly a decade during the fourth quarter, according to the latest Household Debt and Credit Report from the New York Fed. The overall delinquency rate rose to 4.8% of all outstanding debt. While student loans and mortgage delinquencies were the main contributors, credit card and auto loan delinquencies also saw notable increases. This rise in missed payments underscores how equity markets can continue climbing even amid growing signs of financial strain in the broader economy.

- The disconnect between the stock market and the real economy is primarily a result of sector composition. Throughout much of 2025, market enthusiasm was concentrated in AI-related firms. These companies largely bypassed the inflationary pressure of trade policy due to preferential tariff exemptions and utilized tax incentives to fuel the AI momentum carried over from the previous year.

- However, this momentum did not lift all boats. Cyclical sectors and consumer-facing firms have struggled as lower-income households, which are facing stagnant real wages and job insecurity, pulled back on discretionary spending. This sentiment was echoed in the Conference Board’s Consumer Confidence Index that recently plummeted to 84.5, its lowest reading since 2014.

- We suspect this divergence stems from pervasive uncertainty. Shifting tariff policies made long-term corporate planning difficult, leading to a wait-and-see approach in the labor market. While mass layoffs were avoided, hiring slowed, disproportionately impacting younger and lower-income workers. This labor stagnation likely exacerbated the repayment struggles identified by the New York Fed.

- Despite these headwinds, we believe the tide is turning for the overall economy. As the “tariff fog” begins to lift, small business surveys are showing a sharp uptick in real sales volume expectations, suggesting a renewed willingness to commit capital. We are already seeing this transition reflected in the markets: the Consumer Staples sector has significantly outpaced the NASDAQ year-to-date by rising 12.5%. This rotation suggests that the market rally may finally broaden beyond Tech and into the bedrock of the domestic economy.

Iran Target Change: Israeli Prime Minister Benjamin Netanyahu is set to meet President Trump in Washington today to discuss the escalating tensions with Iran. The meeting follows the president’s recent statement that he is considering deploying a second aircraft carrier to the region to reinforce the “armada” already on standby, should diplomatic talks regarding Iran’s nuclear and weapons programs fail. Netanyahu is expected to urge the US to adopt a red-line policy that includes the demilitarization of Iran’s ballistic missile program as a condition for any deal.

- Growing US pressure to curb Iran’s missile program is likely to raise tensions in negotiations between Washington and Tehran. Iran has consistently insisted that talks be restricted to its nuclear program, maintaining that it has the right to enrich uranium for civilian use and to develop ballistic missiles for its defense.

- Israel has pushed to ensure that Iran cannot pose a major military threat, particularly through its nuclear and missile programs. Although Israeli officials describe last year’s US and Israeli strikes on Iran’s facilities as operationally successful, they have repeatedly warned that Iran remains highly dangerous and that it is working to rapidly rebuild key parts of its arsenal.

- Still, there is hope that talks can deliver a strong outcome and stave off escalation. Iran indicated Tuesday it is open to widening negotiations beyond its nuclear program, though it offered no specifics. If uranium enrichment and ballistic missiles are off limits, this could point to potential curbs on Iran’s proxy networks, another major sticking point in the process.

- While we remain confident that current tensions will not escalate into direct military conflict, the risk profile is undeniably elevated. In the event of an exchange, we anticipate a swift rotation out of risk assets and into established safe havens. Despite recent volatility in gold and silver, we expect that asset class to see increased crowding as investors seek a reliable hedge against heightening geopolitical uncertainty.

No More UMSCA: The president is said to be leaning in favor of withdrawing from the US-Mexico-Canada trade agreement, which he himself brokered. He has reportedly tasked his aides with presenting arguments against such a withdrawal. This development comes amid persistent friction between the White House and its North American partners, with Mexico over cartel-related security concerns and with Canada over its accommodation of Chinese economic interests. A US exit from the pact would likely exacerbate market uncertainty.

Alphabet Bond Sales: Google’s parent company has entered the bond market to strengthen its liquidity position amid significant investments in artificial intelligence. The firm is raising capital across multiple currencies and varying maturities, with plans that include a sterling-denominated 100-year bond. On Monday, Alphabet announced it had secured more than $32 billion within 24 hours. The magnitude of the offering, coupled with robust demand for Tech sector debt, points to a possible crowding out of other corporate borrowers.

Trump Buys Coal: The White House is preparing to expand federal support for coal‑fired power, including using government funds and long‑term power purchase agreements to keep selected plants running that might otherwise retire. This direct intervention comes as the US seeks to shield parts of the domestic coal sector from competitive pressure, even as market forces increasingly favor cheaper natural gas and renewable energy. The proposal is another reminder of the government’s increasingly active role in the economy.

EU Pivot: French President Emmanuel Macron has accused the United States of pursuing an anti-EU agenda by asserting in a recent speech that the White House’s broader objective is to dismantle the European bloc. His remarks underscore mounting tensions between the transatlantic allies. In response, the EU is expected to pursue greater strategic autonomy, aiming to reduce its reliance on the US in both trade and defense.

Daily Comment (February 10, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news that the White House this week will launch a major rollback of environmental regulations. We next review several other international and US developments that could affect the financial markets today, including an announcement of performance reviews for US defense contractors and growing investability issues for the Indonesian stock market.

US Environmental Policy: In an exclusive report this morning, the Wall Street Journal says the Trump administration this week will repeal the 2009 scientific finding that serves as the legal basis for federal greenhouse-gas regulation. The move will reverse the “endangerment finding” under which the federal government has limited emissions from power plants and autos. It will also end the regulatory requirements to measure, report, and certify compliance with emission standards.

- According to EPA chief Lee Zeldin, “This amounts to the largest act of deregulation in the history of the United States.”

- Whether or not that’s true, we would agree that the planned change, if implemented as reported, would be a significant deregulation with potentially far-reaching economic impacts.

- Given the US’s large political constituency favoring policies to address climate change, especially among younger voters, the move could also increase polarization and affect the midterm Congressional elections in November.

US Housing Policy: Lawmakers are reportedly refusing to include the administration’s proposed ban on institutional investors buying single-family homes in either of the two major housing bills currently making their way through Congress. The ban is generally opposed by free-market advocates, the financial industry, and the housing industry. Therefore, lawmakers reportedly may fear that tacking it onto either of the housing bills would scuttle the legislation that they have spent months developing. For now, financial and housing interests appear to be having their way.

US Defense Industry: Late last week, the Pentagon reportedly sent a letter to major defense contractors warning them to brace for sweeping performance reviews to identify companies that aren’t fulfilling their contracts. The reviews apparently are to implement President Trump’s January order threatening to cancel the contracts of underperforming defense companies that buy back their shares or pay dividends.

- The administration’s approach to the defense industry has been complex. Shortly after President Trump’s second inauguration last year, for example, he ordered significant cuts to the defense budget. The new order demonstrates his intent to squeeze efficiencies, improvement in quality, and faster turnaround times for weapons purchases — all at the expense of defense industry investors, if necessary. On the other hand, the president has recently called for a massive 50% increase in US military spending.

- As our longtime readers know, we have had a positive view of global defense stocks for the last few years. Because of the administration’s tough stance toward the defense industry, we have been more positive on defense firms outside the US. The Pentagon’s new warning seems to validate that stance. All the same, we are closely watching to gauge whether a big increase in the defense budget will offset any of the financial challenges implied by the tougher contract scrutiny.

United States-Taiwan: The Financial Times late yesterday scooped that the White House’s forthcoming tariff plan for advanced computer chips will include exemptions for chips from Taiwan Semiconductor Manufacturing Co. based on how much the firm invests in new US fabrication facilities. The plan would aim to strike a balance between imposing tariffs to encourage domestic chip manufacturing and removing obstacles to US hyperscalers building new data centers for artificial intelligence.

United States-Canada: In a post on social media yesterday, President Trump said he will block the opening of the new Gordie Howe International Bridge linking Canada and Detroit unless the US “is fully compensated for everything we have given them, and also, importantly, Canada treats the United States with the Fairness and Respect that we deserve.”

- The bridge, which is reportedly close to completion and has been paid for fully by Canada, was supported by the president during his first term as a way to relieve congestion in the vital US-Canada trade corridor.

- The president’s last-minute demands likely constitute an effort to squeeze concessions from the Canadian government ahead of this year’s renegotiation of the USMCA trade agreement, despite the risk of worsening frictions between the US and its longstanding ally.

United States-Cuba: The Cuban government has reportedly told international airlines that it won’t be able to supply them with jet fuel starting today. As a result, Air Canada has announced that it will suspend flights to the island, and other foreign airlines are likely to be affected as well. The disruption suggests that the US effort to cut fuel supplies to the island are having their intended effect of strangling Cuba’s economy. However, it is still too early to know if the effort will force political change in Havana as intended.

China: The China Media Project, a research group, has issued a report showing that Alibaba’s popular Qwen model has been built to say only positive things about China. The report is the latest in a series examining how China’s increasingly popular open-source AI models have been manipulated for apparently political purposes. As China’s models become more widely used, the result is likely to be a skewed portrayal of China around the globe.

Indonesia: Two weeks after index provider MSCI said it will downgrade Indonesia to a “frontier market” from an “emerging market,” over investability and transparency issues, index provider FTSE Russell today said it has postponed a review and update of its Indonesia exposures over uncertainty in determining the free float of the country’s stocks. The blemishes on the Indonesian stock market threaten to limit how much it can benefit from investors’ growing interest in international stocks.

United Kingdom: Following our note yesterday about Prime Minister Starmer being pressed to resign over scandals including the naming of an Epstein associate as ambassador to the US, a meeting of Labour Party lawmakers yesterday reportedly offered him strong support, reducing the risk of a forced resignation for the time being. Nevertheless, Starmer’s political position continues to weaken, suggesting it will be increasingly difficult for him to drive policy initiatives in the near term.

Bi-Weekly Geopolitical Report – US Foreign Policy: Comparing the New vs. the Old (February 9, 2026)

by Patrick Fearon-Hernandez, CFA | PDF

In our Bi-Weekly Geopolitical Report from January 26, we posited that the United States under the new administration has adopted a foreign policy quite distinct from that of the previous eight decades. We showed how the new US policy is a type of neo-imperialism with elements of neo-colonialism. We emphasized that our characterization of the new foreign policy is not meant to be pejorative. It is merely descriptive, to help us understand how it works and what its implications might be. After all, the new foreign policy could well be positive for US citizens, and especially the working class, which shouldered much of the costs of the old policy focused on maintaining the US role as global hegemon. In this report, we look closer at the differences between these policies and their implications for investors. We show that the politics and economics of the two policies suggest very different investment strategies.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Bi-Weekly Geopolitical Podcast – #81 “US Foreign Policy: Comparing the New vs the Old” (Posted 2/9/26)

Daily Comment (February 9, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with some quick notes on the monumental election in Japan yesterday. We next review several other international and US developments with the potential to affect the financial markets today, including a recap of elections in Thailand and Portugal, growing signs that UK Prime Minister Starmer may need to resign, and new data confirming that US software firms are facing increased financial stress.

Japan: In elections yesterday, the ruling Liberal Democratic Party of Prime Minister Takaichi won in a landslide, securing an estimated 316 of the 465 seats in the lower house, up from 198 seats previously. This marks the first time since World War II that a party has won a 2/3 super majority in the Diet. The conservative Takaichi will also have support of her coalition partner, the Japan Innovation Party. The result is likely to be positive for Japanese stocks and the yen, as it supports Takaichi’s plan for more stimulative fiscal and monetary policies.

- Indeed, Japanese stocks are soaring so far this morning, with the Nikkei 225 price index up about 3.9% to a new record high.

- The yen has strengthened about 0.8% to 155.99 per dollar ($0.0064).

Thailand: In another election at the weekend, the conservative Bhumjaithai Party came out on top with an estimated 194 seats in the 500-seat legislature, while the progressive People’s Party will end up with only about 115. The results mark a dramatic return to conservatism after many years of liberal rule in Thailand.

Portugal: In yet another weekend election, Socialist António José Seguro won the presidency with approximately 65% of the vote, holding off right-wing nationalist André Ventura. All the same, the presence of the far-right Ventura on the ballot is being taken as a warning that populist conservatives have a following in Portugal and could drive policy to the right in the coming years.

United Kingdom: Prime Minister Starmer has now lost two high-level aides over their part in recommending that he name Lord Peter Mandelson as UK ambassador to the US — a toxic nomination given Mandelson’s prominent place in the Epstein files recently released by the Justice Department. Today’s resignation was from Tim Allan, who was Starmer’s communication director. Just one day earlier, Morgan McSweeney resigned as chief of staff. As a result, Starmer is coming under increasing political pressure to resign.

- Even though Starmer had already sacked Mandelson, the new staff resignations are adding to the political pressure from a series of scandals and policy missteps.

- Nevertheless, the potential exit of the Labour Party prime minister has so far been taken in stride by investors, with UK stock indexes and the pound continuing to appreciate. Those trends suggest investors could well look favorably on a political change in the UK, despite some short-term volatility if Starmer is forced to resign.

US Immigration Policy: According to the Financial Times, the US Embassy in London and other embassies around the world have begun to deny visas to even top business executives on the basis of past arrests for relatively minor criminal infractions, such as barfights and marijuana possession. Some visas to visit the US have reportedly been denied even for minor arrests as far back as the 1970s.

- Of course, the administration’s barriers to trade, technology, and capital flows are much higher in profile.

- Nevertheless, the new restrictions would presumably slow cross-border economic activity, including the inbound investment that the White House is seeking.

US Software Industry: New research from Axios shows that an increasing share of the loans backing software firms are trading at “distressed” levels, or below 80 cents on the dollar. The data indicates that $25 billion in software loan volume was marked at distressed levels by the end of January, more than double what it was in December. While technology leaders have begun to push back on the recent concerns that artificial intelligence will devastate software companies, these hard data points would suggest that real problems exist.

Chinese Food Policy: New data shows the proportion of soybean meal in domestically produced animal feed stood at 13.4% in 2025, unchanged from the previous year despite government efforts to replace the largely imported material with other sources of protein. The government’s effort aims to make China less reliant on foreign food supplies, but the new figures suggest the country remains quite reliant on supplies from the US and Brazil, giving them some leverage in trade negotiations and other disputes.

Chinese Demographics: As the country continues struggling to arrest its steep drop in birth rates, which has led to an aging population and outright population declines, the government has reportedly imposed a 13% value-added tax on condoms and other contraceptives, ending their previous tax-free status. However, we haven’t seen the intimate details of the change, so we won’t comment further.