by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with our take on the EU’s efforts to safeguard its institutions from the far right. We then examine the escalating fight over data centers heading into the midterm elections. Next, we discuss how software companies are working to calm AI fears, signs of progress in Iran-US talks, and a possible tax on social media platforms. We close with a summary of key economic data from the US and global markets.

Far Right Fear: As Europe braces for a potential surge in far‑right influence, attention is increasingly turning to the guardians of its institutions. In a bid to shield the euro’s credibility from future populist governments, policymakers are reportedly weighing leadership changes at the European Central Bank and other key institutions. This kind of defensive maneuvering speaks to a deeper anxiety that the bloc’s political cohesion is eroding, casting fresh doubt over the single currency’s long‑term trajectory.

- A key sign of this preparation is the rumored early departure of ECB President Christine Lagarde. Although her term does not officially end until April 2027, there is growing speculation that she could step down sooner, allowing European leaders to install a firmly pro‑EU successor ahead of France’s national elections next year. While no timetable has been announced, expectations are coalescing around a possible exit as early as this summer.

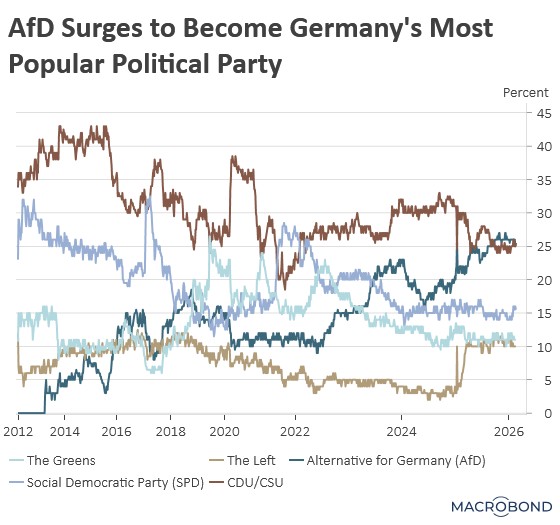

- Her anticipated resignation comes amid mounting discontent with incumbent lawmakers, whose popularity has deteriorated across the European Union, particularly in France and Germany. The French prime minister’s approval rating has fallen to historic lows, while support for Germany’s ruling CDU/CSU has eroded as voters gravitate toward ascendant populist parties such as the AfD and the Left Party, raising the prospect that movements once seen as fringe could move firmly into the European mainstream in the years ahead.

- The mounting fears have led to a push to help make changes to central banks within countries as well. French Central Bank Governor François Villeroy de Galhau is already looking to step down before his term ends in October 2027. While Klaas Knot, the former Dutch central bank chief, is considered a frontrunner for ECB president, Bundesbank President Joachim Nagel is also a top contender, which is a scenario that would allow German Chancellor Friedrich Merz to appoint Nagel’s successor.

- The push to insulate the ECB from rising populist influence should help underpin the euro’s relatively strong performance against the dollar, for now. That could change, however, if right‑wing governments gain enough power to reshape the bank’s structure or dilute its price‑stability mandate — moves that would likely damage the ECB’s credibility and, over time, weigh on the currency.

Data Center Fight: As the midterm elections draw nearer, the rapid expansion of AI infrastructure is coming under heightened political scrutiny. A recent Politico/Public First survey found that nearly half of respondents believe data center development will emerge as a key campaign issue, reflecting growing public concern over the environmental and physical footprint of these facilities. While lawmakers tout such infrastructure as critical to “winning the AI race,” local communities are increasingly pushing back against the real-world costs of hosting it.

- According to the survey, more respondents favor data center construction than oppose it, provided there is no negative impact on their utility costs. Specifically, 37% of respondents supported it, 28% opposed it, and 28% remained undecided. However, a majority of those who initially backed construction stated they would reverse their position if the development resulted in a monthly bill increase of $25 or more.

- The rise of data center corridors follows a surge in infrastructure spending pledged by major tech companies. Currently, the highest concentrations are in Virginia, Texas, and California — states that have become primary targets for investment and are likely to serve as crucial battlegrounds for policy and voter influence.

- To prevent policy reversals, tech companies have begun engaging more directly in the political arena. The super PAC Leading the Future plans to invest heavily in election outcomes to ensure project continuity. Simultaneously, firms like Anthropic are taking proactive measures, such as pledging to cover electricity costs and grid upgrades to shield local communities from the infrastructure’s secondary impacts

- The upcoming midterm elections will likely provide significant insight into the direction of AI development as the industry pushes to expand capacity. While AI-related stocks maintain strong momentum and command a major share of the S&P 500, we believe overlooked sectors offer superior value. This is driven not only by a comparative lack of political risk but also by more attractive valuations.

AI Uncertainty: The market continues to grapple with growing uncertainty over how AI will ultimately affect corporate earnings. In response, a handful of software companies, including cybersecurity firm McAfee, have released earnings ahead of schedule to reassure investors and lenders that their businesses remain resilient to the newly deployed AI tools. Executives have stressed that they are still generating solid demand even as AI systems become more capable of replicating elements of the services and workflows they provide.

Iran Deal Progress: The two sides appear to be edging closer to a deal, even though key issues remain unresolved. Officials in Tehran say they have agreed with Washington on the broad guiding principles of an accord, signaling that a pathway to de‑escalation exists despite the absence of a finalized text. At the same time, Vice President JD Vance has highlighted remaining roadblocks, suggesting the US is still pressing for additional concessions. Any meaningful easing of tensions would likely reduce pressure on commodity prices.

Social Media Tax: Illinois is weighing a proposal to tax social media companies operating within the state. Under the plan, these platforms would pay a monthly fee based on the number of users whose data they collect, and they would be prohibited from passing the cost on to users. The measure is expected to generate roughly $200 million annually, helping to address the state’s budget shortfall. This proposed tax reinforces our long-standing view that investors should diversify into other sectors to reduce concentration risk.