by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with news related to China’s regulation of its technology sector. We next review a range of other international and U.S. developments with the potential to affect the financial markets today, many of which also relate to China and its relationship with other countries. We end today’s Comment with a few positive notes on U.S. inflation pressures.

China: Technology-focused investment bank China Renaissance (1911, HKG, 7.10) said its founder and chairman, Bao Fan, dropped out of sight because he is “cooperating in an investigation carried out by certain authorities” in mainland China. The news seems to confirm that Bao is the target of some kind of criminal or corruption probe. If so, it would probably rekindle concerns that China’s technology sector is still being targeted for discipline, despite recent signs that the government was easing up on it. That’s likely to be a headwind for Chinese technology shares in the near term.

China-United States: New intelligence reports provided to Congress show that the U.S. Department of Energy, which runs several government labs, has now joined the FBI in concluding that the COVID-19 pandemic was caused by a Chinese laboratory mishap. Although other components of the U.S. Intelligence Community still judge that the pandemic began through natural transmission, the new conclusion by the DOE will certainly anger the Chinese and potentially lead them to impose retaliatory measures against U.S. trade and investment.

China-Netherlands-United States: The Dutch company ASML (ASML, $618.38) is virtually the sole supplier of the machines needed to make the world’s most advanced semiconductors. It has reportedly found that a former China-based employee who was accused of stealing technology data from the firm appears to have ties to a Chinese state-sponsored entity which was previously linked to intellectual property theft. The U.S. government is also investigating the incident as a potential case of Chinese industrial espionage.

- ASML is so critical to the production of the most advanced computer chips that it is certainly targeted by China for its technology secrets. Even if the West wasn’t trying to clamp down on technology transfers to China, we suspect Beijing would be trying to steal ASML’s technology so that it could share it with Chinese firms and eventually install a Chinese firm at the top of the global semiconductor equipment industry.

- If ASML’s technology data theft is confirmed to be linked to Beijing, it will further increase Western-Chinese tensions and put investors at an even greater risk of being caught in the crossfire.

China-Russia: U.S. officials provided more details on their announcement last week that they have intelligence indicating that China is considering sending lethal aid to Russia for its invasion of Ukraine. The officials stated that the aid China is contemplating sending could include drones, artillery, and possibly other weapons. The U.S. revelation likely aims to expose China’s assistance to the aggressor even as it publicly paints itself as a neutral peacemaker and a champion of national sovereignty, independence, and territorial integrity. The U.S.’s hope is that such a revelation will discourage Beijing from following through with sending the lethal aid to Russia.

- If China does follow through, then U.S. and European officials have warned that there would be severe consequences for China’s relationship with the West.

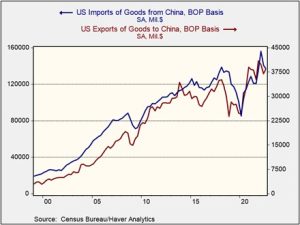

- It may seem that Western-Chinese relations are already as bad as possible, but the West’s recent moves to “decouple” from China have actually been relatively focused, mostly on the flow of advanced technology and critical resources. Overall, Western trades and investments with China have continued to grow.

- That suggests that any further worsening in the West’s relationship with China could lead again to restrictions on a broader range of goods, services, technologies, and capital flows that otherwise wouldn’t be considered sensitive.

- As we have warned many times before, worsening tensions with China have the potential to catch investors in the crossfire.

Russia-Ukraine War: Russian forces have launched a new wave of drone attacks on Ukraine and continue their modest counteroffensives at various places on the front lines running from northeastern to southern Ukraine, but their gains appear to be minimal in the face of strong Ukrainian opposition. Separately, Germany, France, and the U.K. have floated a plan under which the North Atlantic Treaty Organization would provide security guarantees to Ukraine as an incentive for it to begin peace talks with Russia.

Nigeria: Although vote counting continues after Saturday’s presidential election, it appears that outsider Peter Obi of the Labour Party has won the state of Lagos, the country’s economic powerhouse and the home state of his main rival Bola Tinubu. As the electoral authorities struggle with various complications in the country’s new voting system, it is unclear when the final election results will be known. That raises the prospect of intensifying political violence in one of the world’s top oil producers.

Mexico: Tens of thousands of protestors rallied in Mexico City yesterday against President Andrés Manuel López Obrador’s “reform” of the electoral system, which passed Congress last week. The changes will slash funding for Mexico’s electoral authority, which is expected to lead to the dismissal of 85% of its professional staff and could potentially put the credibility of the country’s elections in doubt. The protests are a welcome sign that significant numbers of Mexicans are willing to push back against the president’s growing authoritarianism.

European Union-United Kingdom: Several weekend statements by Prime Minister Sunak and his ministers suggest the EU and the U.K. could announce a deal this week to restructure the controversial “Northern Ireland Protocol,” which is the part of the Brexit agreement that keeps shipments from the U.K. to Northern Ireland from flowing duty-free into the EU. The very latest reporting indicates that Sunak could announce the deal as early as today.

- However, even if Sunak announces a deal, there is a strong chance that the far-right wing of his Conservative Party will oppose it on sovereignty and nationalism grounds.

- Such an event could destabilize the Sunak government, potentially prompting some of his ministers to resign and encouraging unionists in Northern Ireland to keep blocking the formation of a coalition government for the province.

United States-European Union: In an important interview with the Wall Street Journal, European Commission Executive Vice President Vestager toned down her criticism of the new U.S. subsidies for green technology investments found in last year’s Inflation Reduction Act. According to Vestager, a closer analysis of the subsidies suggests that the main threats to European competitiveness will be limited to a handful of sectors, and that even if some European companies may be incentivized to shift their capital investments to the U.S., the subsidies won’t necessarily be the deciding factor.

- Vestager’s comments indicate that the U.S. subsidies have become much less contentious, as we have long suggested they would. In part, that’s probably because the U.S. has been encouraging the Europeans to adopt similar industrial policies that would offer support for their own green technology industries over time.

- In any case, Vestager’s comments imply that the controversy over the U.S. subsidies will soon subside. That means they won’t be a serious threat to U.S.-European unity going forward.

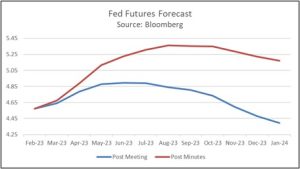

U.S. Labor Market: The Financial Times released an analysis of the latest corporate earnings reports showing that U.S. companies are now finding it “dramatically” easier to hire, despite recent data pointing to an extraordinarily tight labor market. The report could help reassure the Federal Reserve that wage pressures will soon ease and that the policymakers can soon stop hiking interest rates to slow the economy.

U.S. Apartment Market: Rental housing website Apartment List released data showing the average rental rate on new apartment leases fell in every major metropolitan area in the U.S. over the six months through January. This, in part, likely reflects a spike in supply as newly built apartments become available. According to the data, renters with new leases in January paid a median rent that was 3.5% lower than they would have paid last August. Falling rent prices should eventually help bring down consumer price inflation, although their impact can be slow to show up in the data.

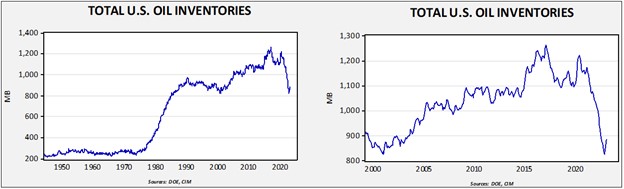

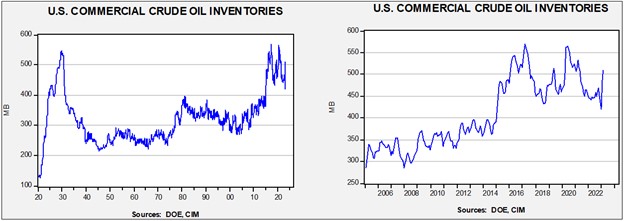

(Sources: DOE, CIM)

(Sources: DOE, CIM)