Daily Comment (December 8, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Today’s Comment begins with our thoughts about the deepening yield curve inversion and who stands to benefit. Next, we explain why we think major powers will look to make friends with commodity-rich countries. We end our report with a discussion on the impact that global fracturing will have on tech stocks.

Breaking news: WNBA player Brittney Griner was freed in a prisoner swap for an arms dealer.

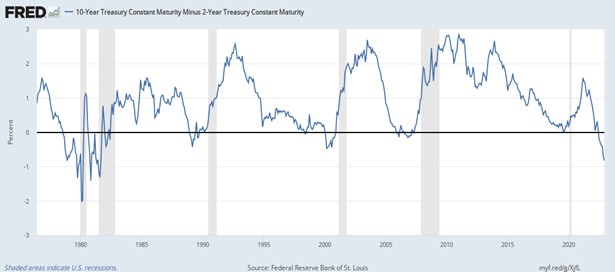

Inversion deepens: In recent weeks, we have seen a general decline in U.S. Treasury yields. However, the bulk of the declines have occurred in the longer duration segment of the yield curve, causing a deeper inversion. Interestingly enough, the decline in interest rates has supported international equities.

- Recession fears and doubts about the Fed’s willingness to further tighten policy have led to a decline in both the short and long end of the yield curve. The two-year Treasury has dropped 40 bps from a month ago, but the ten-year Treasury has fallen even more, at 70 bps over the same period. As a result, the yield curve inversion is at its lowest point in over 40 years. The depth of the yield curve inversion has added to concerns that the recession could be worse than the market anticipates; however, the decline in interest rates has some unexpected beneficiaries.

- The decline in U.S. Treasury yields has made riskier assets more attractive. Despite being down nearly 9% on the year, the Euro Stoxx 50 index is up more than 18% on the quarter. The rally in European equities is related to optimism that inflation is close to peaking, the dollar is in decline, and the situation in Ukraine won’t markedly deteriorate. Although Europe is still expected to fall into recession next year, it seems that the market is starting to believe it won’t be as bad as originally thought.

- Although the market has been pricing in a U.S. recession over the last several months, investors are still unclear as to whether the downturn will be severe. There are likely three scenarios that will lead to a deep recession: a financial collapse, a housing market crash, and a major geopolitical event. At this time, any of these events could occur. In fact, the National Association of Home Builders suggests that the housing market is already in recession. Meanwhile, deteriorating financial conditions and the ongoing war in Ukraine are also current risks. Investors have likely discounted most of these risks, but there may still be more room for equities to drop. In the event of a crisis, the Fed could be swayed to cut rates drastically; thus, next year could lead to a strong rally.

An Uncertain World: Commodity-producing countries present a major risk to the global economy.

- Peruvian President Pedro Castillo was replaced by Dina Boluarte after his failed attempt to change the constitution in order to avoid impeachment. Boluarte will be the country’s sixth president in less than five years. All things considered, the transition of power went rather smoothly, but Boluarte will likely be plagued by the same corruption scandals as her predecessor. At the same time, her not being elected to office will likely encourage the opposition to push for new elections. Political turmoil in a resource-rich country like Peru has the ability to cause volatility in commodity prices such as copper, gold, and zinc.

- Meanwhile, U.S. officials are fretting over how the Chinese reopening will impact the price caps on Russian oil. Hopes of an increase in Chinese demand have boosted crude prices after four sessions of declines. Russian Urals crude oil trades at about a $20 discount to benchmark crude prices, suggesting a price of around $57 per barrel as of this morning. Although the cap is set at $60 per barrel, there are concerns that if the market price for the Urals rises above that limit, Russia will stop supplying oil to certain countries. Although the agreement to establish price caps allows for readjustment every two months, a limit set above $60 per barrel would undermine this effort to punish Moscow for the war.

- Although price caps remain above the Russian production cost, estimated to be $40 per barrel, it is still below the $70 per barrel needed for Russia to maintain its fiscal budget.

- Securing commodities within these countries will likely worsen as the world forms into blocs. As a result, leaders of the groups, who we assume will be China and the U.S., will have to increase their engagement in other parts of the world to ensure that the commodity markets remain stable. This new reality likely explains why the U.S. is relaxing tensions with Venezuela, and why China is building closer ties with Saudi Arabia. As a result, commodity-rich countries could become major investment targets as the U.S. and China vie for their interests.

- Saudi Arabia and China are expected to sign an investment agreement and discuss the possibility of pricing oil in CNY.

Tech Pushback: Government restrictions and political scrutiny are leading to headwinds for the tech sector.

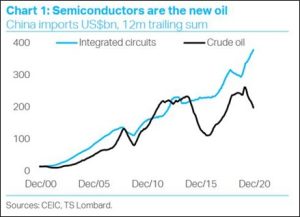

- The West is attempting to block China from securing advanced chips for defense purposes. The Netherlands is working with the U.S. on plans to curb the export of semiconductors to China. The decision comes as the U.S. and EU team up to reduce China’s ability to impose its influence worldwide. China is heavily dependent on chip imports, and it is estimated that the country spends more on semiconductors than it does on oil (see following chart). As a result, foreign suppliers to China will take a revenue hit, while domestic chipmakers could see a boost in investment.

- Meanwhile, social media giants are also being caught in regulatory crosshairs. The Biden administration is pushing the Supreme Court to hold social media companies liable for hate speech promoted on their platforms. Similarly, the push to ban TikTok is gaining momentum after South Dakota barred the use of the app for state agencies over national security concerns. Social media sites generate much of their revenue based on clicks and the data collection of their users; thus, limits on either would hurt the profitability of these firms. As a result, social media sites’ abilities to generate money is likely to be constrained by government regulations.

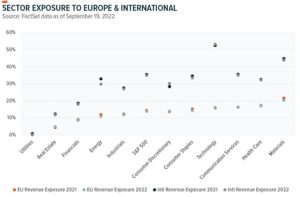

- The tech sector thrives in a globalized world, and therefore, regional fracturing would significantly disrupt the industry. Tech has the highest exposure to foreign markets when compared to its peers (see the following chart). Its vulnerability to foreign markets means that restrictions will likely have an adverse effect on the industry’s ability to generate revenue. As a result, we believe that investors should be hesitant to pile into tech stocks without a deep understanding of these companies’ susceptibility to regulatory risks. Hence, a Fed pivot should not be the only factor when investing in tech stocks.