Daily Comment (December 9, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Equity prices have tanked, and the U.S. dollar surged following the hotter-than-expected Producer Price Index report. Today’s Comment begins with discussing the effectiveness of price caps in deterring Russia’s war effort. Next, we examine some possible changes to inflation and how these could impact Fed policy in 2023. We end with a talk about the risks China’s reopening poses to the global economy and markets.

Price Cap, So Far: The EU limit on the price of Russian oil is already causing unintended consequences, but it isn’t clear whether Moscow’s war aims will be affected.

- Confusion over insurance papers have led to a backlog of oil tankers in the Turkish Strait. There are currently 28 tankers carrying more than 23 million barrels of oil being held up because of paperwork. Although Western countries have agreed to ban shipping service providers like insurance companies from delivering Russian oil above the price cap, many of the stuck ships contain Kazakh oil. Turkish and Western officials are working to resolve the matter, but there is still a chance of future problems given the complicated nature of enforcing sanctions. Oil prices were little affected by the event.

- Despite the hassle, there is no guarantee that the price cap will work. The $60 price level is below the $70 a barrel outlined in Russia’s latest budget proposal. Although the limit is beneath the Kremlin’s desired level, the difference can be made up through borrowing or increased spending from the wealth fund. Russia’s ability to fund the war despite the price caps suggests that the West will have to look for other ways to punish Moscow. Currently, the EU is working on a cap for natural gas prices, but countries appear to be far apart on a deal. That said, the limits on Russian natural gas mean that the EU will need to import large volumes of the product to make up for the resulting shortfall.

- There is still no sign of war de-escalation, but an end in 2023 isn’t out of the question. Although Russian President Vladimir Putin insists that the war will likely be long, he downplayed the possibility of another mobilization. His hesitancy to call up new soldiers is likely related to concerns of public outcry over the war. Over 370k Russians fled the country within two weeks of the first mobilization. The large-scale departures highlighted the level of dissatisfaction within the country concerning the escalation of the war. Given that Putin stands for reelection in March 2024, he may be swayed to support a temporary resolution next year if he can spin it as a victory.

- A possible end to the conflict in Ukraine would be favorable to financial assets and reduce volatility in commodity markets.

Inflation Easing: Although the annual change in the Consumer Price Index is well above the Fed’s 2% target, there are signs that price pressures are easing.

- An increase in inventories has led to a slowing of price increases in various sectors. Used car prices, which were a major contributor to inflation in 2021, are finally started to decline from record highs. Meanwhile, an increase in property developments has reduced demand for rentals. Although these are anecdotal evidence of a decline in prices, the recent Purchasing Manager Index data suggests that supply chain issues that prevented firms from getting needed material are much improved from the previous year. As a result, it is likely that inflation will continue its downward trend throughout 2023.

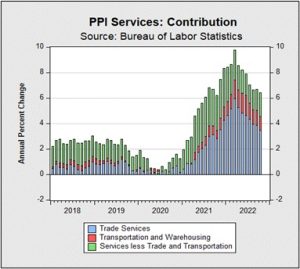

- That said, wage pressure and regulations will likely prevent inflation from hitting the Fed’s 2% target in the coming year. Nominal hourly earnings have remained stubbornly high even as inflationary pressures have eased. Meanwhile, new climate regulations also present a risk to consumers as businesses offset costs through price hikes. Input inflation data collected by the Bureau of Labor Statistics show that trade services, which measure wholesale and retail margins, are well above their pre-pandemic levels and remain one of the primary drivers of supplier price pressures. The November figures indicate that margins are holding up even as the economy slows. As a result, firms have no incentive to shoulder unexpected cost increases due to new regulations.

- Although price pressures are easing, it isn’t clear what inflation rate the Fed will seek before it decides to pause or pivot. Federal Reserve Chair Jerome Powell maintains that the bank needs to see clear progress that inflation has turned a corner before the Fed will change course. The lack of clarity shows that the Fed may not have a consensus. If this is true, there will likely be more dissents after the FOMC meetings, especially as the economy falls into recession. As a result, investors should pay closer attention next year to Fed speeches of voting members for clues on future policy.

COVID Uncertainty: China is expected to relax many of its Zero-COVID policies; however, the impact on the global economy may be more complex than investors realize.

- The removal of restrictions is expected to lead to a massive jump in infections. Although the transition will be slow, it is predicted that the next wave could lead to a total death range between 1.3 and 2.1 million. The rise in infections will likely prevent many workers from returning to their jobs due to fears of contagion. As a result, factories may not be able to produce at very high levels. Additionally, a lack of restrictions could cause infections to spread into neighboring countries.

- As Chinese consumers re-enter the market, the demand for commodities such as oil will likely rise. It is estimated that crude prices could surge above $100 a barrel next year following China’s reopening. This is unwelcome news for the rest of the world, as the recent decline in energy pressures helped push down global inflation. Thus, the rise in commodity prices may make it difficult for major central banks to ease monetary policy. Additionally, it could worsen the energy crisis in Europe and lead to a more severe recession on the continent.

- The impact that the end of Zero-COVID will have on equity markets will likely be revealed over the next several months. If Beijing can ramp up the number of vaccinations, it should save many lives. Additionally, if people decide to isolate themselves while the infections spread, demand for energy products will not be as pronounced. The best-case scenario for markets is for China to take a moderate approach. If they do reduce Zero-COVID restrictions slowly enough for investors to adjust and adapt, the overall impact may be positive for the global markets; however, a hastened approach could lead to disaster.