Weekly Energy Update (December 15, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

(This will be the last report of 2022; we will resume publication on January 12, 2023.)

Crude oil prices continue to come under pressure on worries over economic growth. There was likely some bullish positioning in front of the Russian price cap which is probably being liquidated.

(Source: Barchart.com)

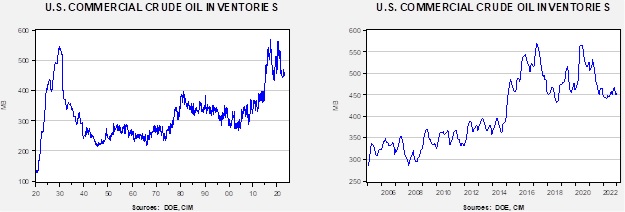

Crude oil inventories jumped 10.2 mb compared to a 3.8 mb draw forecast. The SPR declined 4.7 mb, meaning the net build was 5.5 mb.

In the details, U.S. crude oil production fell 0.1 mbpd to 12.1 mbpd. Exports and imports rose 0.9 mbpd. Refining activity fell 3.3% to 92.2% of capacity. Pipeline issues caused the drop in refinery activity.

(Sources: DOE, CIM)

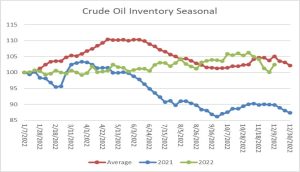

The above chart shows the seasonal pattern for crude oil inventories. This week’s data reversed the recent contra-seasonal pattern of the past few weeks, most likely due to the drop in refinery activity caused by pipeline issues.

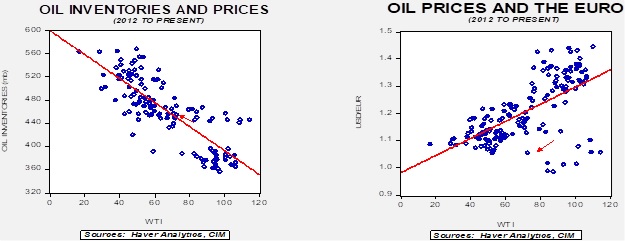

Shortly after the war started, we stopped reporting on our basic oil model that uses commercial inventory and the EUR for independent variables. We have now updated that model, which puts fair value at $73.60 per barrel. We are currently trading near fair value for the first time since the war began.

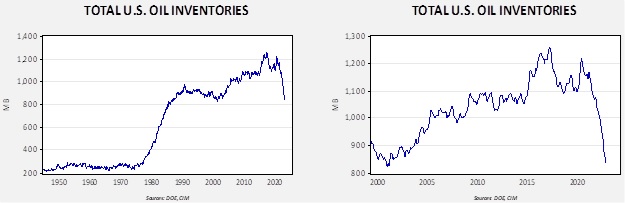

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $104.10.

Market News:

- We are continuing to watch how the Russian price cap is working. As we noted last week, the first reaction was that shipping was disrupted around the Black Sea. Russia’s fiscal situation could suffer as well, and although Russia’s breakeven is thought to be around $20 per barrel, fiscally it needs $70 per barrel to balance its budget. We still don’t know if the price cap is low enough to curtail Russian output, but the disruptions have cut exports.

- President Putin has threatened to cut oil output in the wake of the price cap.

- We also note that the gas price cap in the EU has not come together yet.

- The Keystone pipeline has suffered a rupture in Kansas, leaking 14,000 barrels worth of oil. The leak will disrupt oil flows to at least two refining centers. We may see a drop in production in the coming weeks if the outage persists.

- Up until now, Europe has been helped by mild weather. That string of good fortune appears to be fading, which will likely lift oil and gas demand, and therefore, prices as well.

- France is reportedly ramping up nuclear power as temps fall.

- Amos Hochstein, the White House international energy envoy, described the U.S. shale industry as “un-American.” He wants the industry to expand production, even though the government has sent rather clear signals that the future of oil demand is in doubt, in part due to policies of the same government. If the goal is to encourage the industry to lift output, name-calling probably won’t have the desired effect. At the same time, to be fair to Mr. Hochstein, his “beef’ is mainly with Wall Street, who is demanding a focus on shareholder returns rather than output. Even with that emphasis, we note that production is rising in the shale patch, although the pace isn’t exactly rapid.

- Germany is making remarkable progress in building out its LNG infrastructure.

- With South Korean ship builders at capacity, orders for new LNG tankers are being sent to China.

- Europe has tentatively passed a carbon tariff. When a nation implements environmental rules of any type, it usually increases the costs of production. This change puts domestic producers at a disadvantage relative to foreign producers who are likely not under similar restrictions. In some sense, it is a form of protectionism, but for social goals. The ability of the tax to level the playing field for European industry is still uncertain. The levy is designed to be placed on the carbon content emitted during the production of the product, which may not be all that precise. If the levy is too low, it will still be cheaper to buy it from the “dirty” foreign producer. If it’s high enough to prevent the import, it will increase costs.

- The IEA is warning that oil markets will likely tighten next year.

- Infrastructure matters—we note that natural gas prices in the Permian Basin have fallen to $0.05 per MMBTU due to the lack of pipeline infrastructure.

Geopolitical News:

- President Xi made a state visit to the Kingdom of Saudi Arabia (KSA) last week. The two nations inked a “strategic partnership” but, in reality, if the KSA is threatened by its neighbors, we doubt its first call will be to Beijing. Still, the visit does highlight a drift in the KSA’s relations with the U.S.

- Fin-Twitter was ablaze with commentary concerning reports that the KSA and China were about to begin settling oil sales in CNY. The fear is that pricing oil in a currency other than USD would undermine the reserve role of the greenback and lead to all sorts of potential ramifications. However, the change might not be as groundbreaking as it is portrayed. First, the KSA runs a modest trade surplus with China. If the KSA is okay with accepting CNY instead of USD, we suspect Riyadh will find investments in China that will be acceptable. Chinese financial markets are not as deep as U.S. ones, and as the real estate situation shows, in a workout agreement, Chinese investors are given preference. At the same time, the treatment of USD reserves held by Russia and Iran have to give any nation pause as clearly getting “offside” with the U.S. can have a potentially bad outcome. So, diversifying away from the dollar would make sense for the KSA, whose relations with the U.S. have become rather strained.

- The “big deal” would be if the KSA demanded CNY for all oil sales. That would drive up demand to run trade surpluses with China in order to acquire CNY. Given China’s reluctance to run large trade deficits (and incur the negative impact on employment), we doubt this action will spread beyond the bilateral relationship.

- China is a newcomer to the region’s geopolitics, and it is getting a feel for just how fraught the region can be. During President Xi’s visit to the UAE, he agreed to a statement supporting the Emirates’ claims that the islands of Greater Tunb, Lesser Tunb, and Abu Musa should be submitted to some sort of international adjudication. These three islands were part of the UAE when it was formed following the British withdrawal in 1971. Iran decided to take advantage of the British leaving and seized the islands. The UAE has wanted them back ever since, but Tehran has no interest in acquiescing. Either the Chinese diplomats are siding with the UAE in this dispute, or they more likely walked into a conflict. Iran was quite upset with the communiqué following the China/UAE meeting and is demanding an explanation.

- Iran and China have had a longstanding relationship as the latter has helped Iran evade Western sanctions. It is worth noting, however, that the relationship may be more transactional than anything else. As China is acquiring more oil from Russia, its overall trade with Iran is declining.

- Iran’s economy continues to suffer, but that sluggish economy has not led the state to ease its repression. At the same time, Russia and Iran are deepening their military relationship, a situation that will complicate the security of nations aligned against Tehran.

- A hack of Islamic Revolutionary Guard Corps documents details some of the discussions tied to the renewal of the 2015 nuclear deal. Although the veracity of the reports isn’t confirmed, the information provided does suggest that the two sides were always far apart.

- We note that gold purchases by central banks have been rising rapidly, with most of the purchases coming from emerging market central banks. It is quite possible that these banks are worried that the U.S. could reduce the value of their foreign exchange reserves as Washington did to Russia and Iran. It should be noted that gold has other uses for central banks. Iran has been trading fuel to Venezuela in return for gold. Both nations have been under sanctions and have used gold to evade those sanctions.

- The KSA warns that if Iran develops/acquires a nuclear weapon, then “all bets are off,” which suggests a nuclear arms race in the region is likely.

- The U.S. made an outreach to Africa this week as part of a broader program to secure rare earths and other minerals critical to the energy transition. It is not obvious if the African nations will find the American effort useful, however. Ultimately, Africa needs infrastructure investment (in which China tends to excel) and market access (which the U.S. is reducing from all nations), so this may turn out to be more rhetoric than reality. Still, the U.S. is promising funding as part of the meeting, which will likely be welcomed.

Alternative Energy/Policy News:

- Nuclear fusion, the same process that powers the sun, has held the promise of being the energy of the future, but sadly, more often seems to instead represent a future that never arrives. Thus, the news of a breakthrough should be viewed with hope but also a degree of skepticism. Fusion generates power by fusing atoms together, as opposed to the conventional fission, which generates power by splitting atoms. The promise of fusion is game breaking as it would be power that is clean, free of byproducts, and cheap. Thus, reports that scientists at the Lawrence Livermore National Laboratory had achieved “net energy gain” made headlines. Net energy gain means that more energy was generated relative to what was deployed to create fusion. It is still likely years before commercial applications are possible, but if nuclear fusion is ever achieved, its impact on human life would be astounding.

- The U.S. is funding numerous mineral projects abroad in a bid to secure materials for the energy transition.

- Lithium prices have been strong due to EV demand, but it does appear that the supply side of the market is improving.

- Meanwhile, government funded research is making progress in developing batteries that are lighter and more energy dense.

- There are reports that China and Australia are working on sodium-sulfur batteries which would likely be deployed by utilities to smooth electricity flows.

- The UAW has organized a U.S. auto battery plant.

- Although India continues to talk about clean energy, its behavior suggests that coal will remain its most important energy source.

- As drilling rises in tropical forests, there are rising concerns that those activities will weaken the carbon-absorbing value of the forests

- HSBC Holdings (HSBC, $30.82) announced it will no longer fund oil and gas development.