by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with several notes on the U.S. economy, including a new federal bank seizure and sale, and the risk of a writer’s strike in Hollywood. We next review a wide range of other U.S. and international developments with the potential to affect the financial markets today, including big new labor union actions in France and Belgium, and important purchasing managers’ indexes in China.

U.S. Banking Industry: Over the weekend, major banks including JPMorgan (JPM, $138.24) and PNC (PNC, $130.25) placed bids to take over ailing First Republic (FRC, $3.51), the latest mid-sized bank to face falling asset values and deposit flight connected to the Federal Reserve’s interest-rate hikes. JPMorgan ultimately won the day, giving it control of about $200 billion of First Republic’s assets and all of the bank’s $100 billion in deposits. As part of the deal, the FDIC will provide JPMorgan with about $50 billion in fixed-rate term financing and share potential losses on First Republic’s loans.

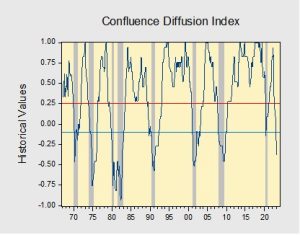

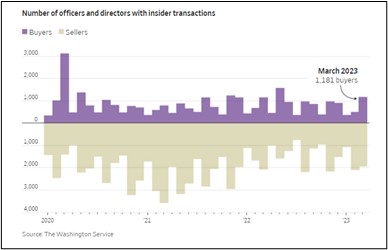

- At least so far, it appears that the First Republic takeover could close the chapter on this spring’s bank crisis. As of right now, we’ve seen no major ripple effects elsewhere in the financial markets, which suggests the federal regulators have managed to contain the idiosyncratic problems at Silicon Valley Bank, Signature Bank, and now First Republic.

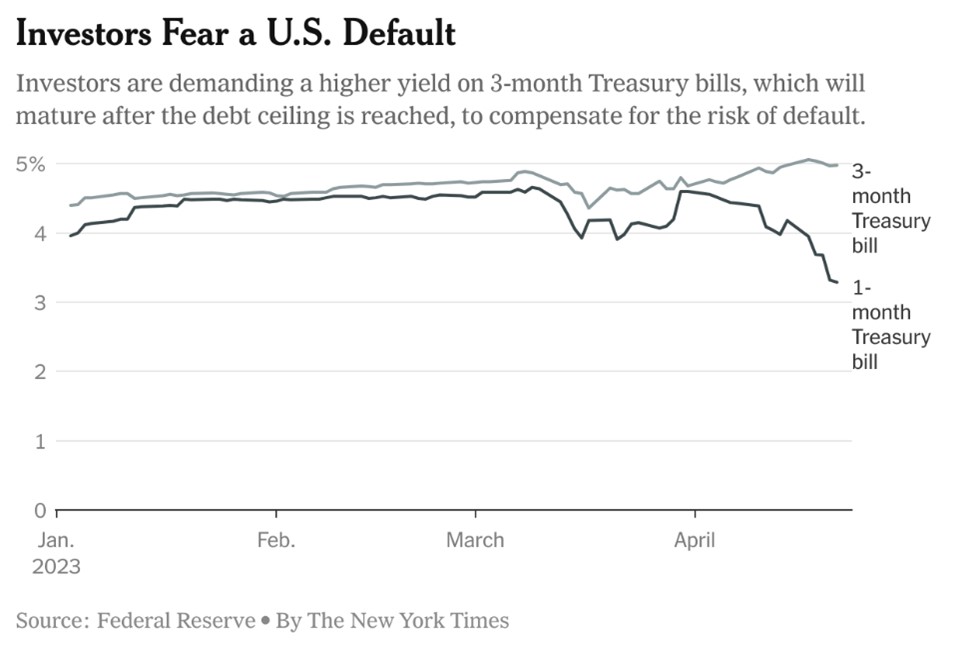

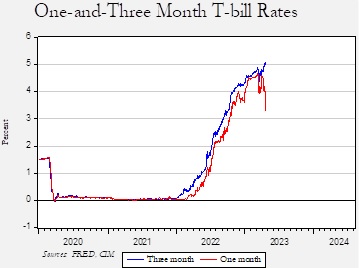

- However, we continue to be concerned about longer-term “disintermediation” risks in the banking sector, as high short-term interest rates prompt savers to move deposits out of banks and into investments such as mutual funds and Treasury bills. The loss of deposits could force banks to pull back further on lending and make the impending recession worse than it otherwise would be.

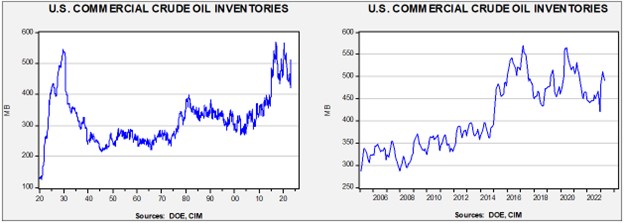

U.S. Construction Industry: Investors continue to look for signs the economy is cooling enough to bring down inflation and allow the Fed to stop hiking interest rates, but we’re starting to focus more on a factor that could delay the slowdown: construction spending. Non-residential commercial construction has grown smartly over the last year and looks set to continue growing in the very near term, in part because of federal fiscal stimulus. Indeed, spending on new factories has recently reached a record high, more than offsetting the decline in residential building. We still think the economy is likely to slip into recession soon, but the momentum in construction spending could be one reason it’s taking so long for the data to show it.

- Even as some firms get cautious about underlying demand and pull back on investment, and even as the ongoing bank crisis threatens to prompt a sharper pullback in lending, those forces will be at least partially offset by:

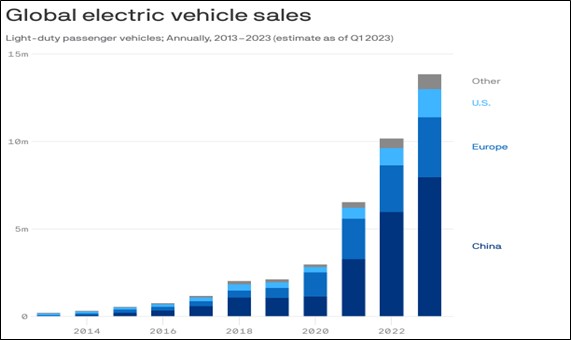

- Increased investment in defense industry facilities as the military budget rises;

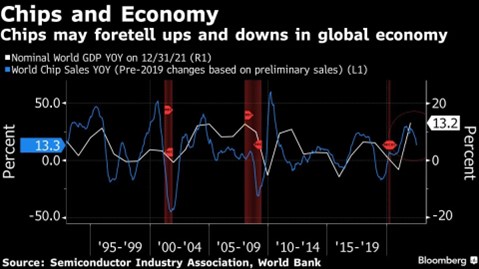

- Higher investment in semiconductor factories because of the subsidies in last year’s CHIPS Act; and,

- New investment in battery plants and other green-technology factories because of the subsidies in last year’s Inflation Reduction Act.

- Although the Fed’s rate hikes pushed residential construction sharply lower over the last year or so, the decline came entirely in the single-family sector. Construction in the multi-family sector has held up well as residential firms try to meet the increased demand for apartments.

U.S. Labor Market: Hollywood screenwriters are expected to go out on strike if they can’t agree on a new contract with the major networks and studios by their deadline later today. In part, the potential walkout reflects the country’s current tight employment market, which has given workers increased bargaining power. However, it also reflects the concern among writers that they’re being shortchanged by new streaming models.

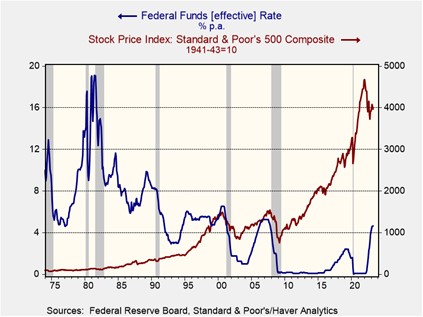

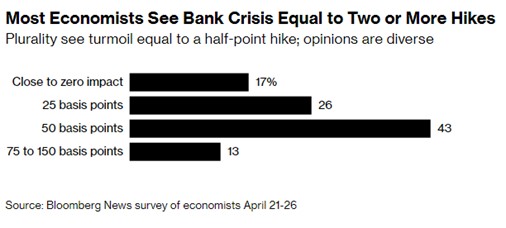

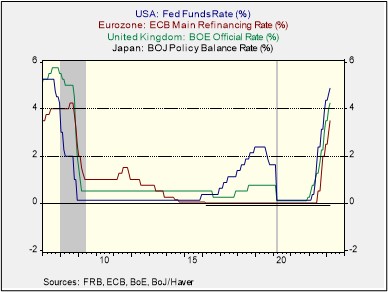

U.S. Monetary Policy: The Fed’s policy making committee will begin its latest meeting tomorrow, with its decision due on Wednesday afternoon at 2:00 pm ET. The policymakers are widely expected to hike their benchmark fed funds interest rate by another 0.25%, to a 16-year high of 5.00% to 5.25%. However, the focus for investors will likely be the post-meeting statement and comments by Fed Chair Powell to see if they provide any hints that the rate hikes are finished.

- Given the damage inflicted on the economy from the current rate-hiking cycle, any hint of a pause could give a boost to equities.

- Any strong signal of a pause in U.S. interest rates would likely be a further negative for the dollar. Factors such as slowing U.S. economic growth and the prospect of continued interest-rate hikes abroad have now pushed the greenback lower by 8.6% from its most recent peak last September.

European Union: Today, May 1, is the Labor Day holiday in much of the world, including the EU. In addition to the holiday festivities, however, the day will be marked by a number of labor protests, including yet another round of demonstrations against President Macron’s pension reform in France and even a wide-ranging set of labor protests in Belgium.

Russia-Ukraine War: The Ukrainian defense minister said his country is close to completing its preparations for a spring counteroffensive, and that it is generally ready to launch the operation. The statement is consistent with a range of signs that the Ukrainians will soon launch a high-stakes attack to push the Russian occupiers back. If successful, the counteroffensive could help shore up Western support for the Ukrainians and reduce political pressure for negotiations.

- Meanwhile, NATO’s top commander, Army Gen. Christopher Cavoli, has told the House and Senate armed services committees that the number of Russian forces in Ukraine has now surpassed the number from when Russia first invaded last year.

- While Russia has the resources to keep fighting in Ukraine for another year, Cavoli said the country’s forces remain vulnerable to Ukrainian weapons, ingenuity, and resolve.

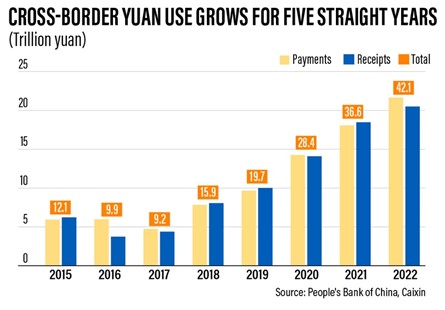

China: The official purchasing managers’ index for manufacturing fell to a seasonally adjusted 49.2 in April, short of expectations and far below the 51.9 reading in March. The April PMI for the service sector also fell, but only to 56.4 from 58.2 in the previous month. Like most PMIs, China’s are designed so that readings above 50 indicate expanding activity. The figures suggest the Chinese service sector continues to recover from the government’s strict pandemic lockdowns, but the factory sector still faces challenges, in part because of weak demand overseas.

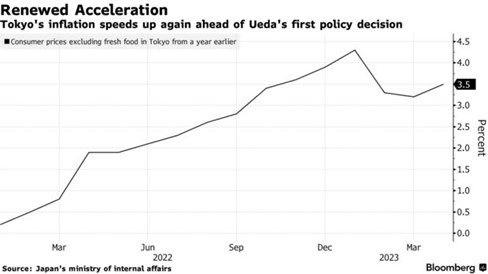

Iran: The government’s statistical bureau has now failed to publish any data on consumer prices for two straight months, leading to speculation that the annual inflation rate has surged to a new record high of more than 49%. Driven in part by U.S. sanctions on Iran because of its nuclear program, the inflation surge risks undermining political stability in the country.