Daily Comment (February 1, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

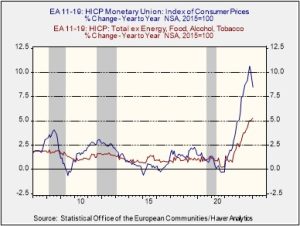

Our Comment today opens with more good news on global price inflation. Data today showed that the Eurozone’s consumer inflation has again cooled modestly, though probably not enough to prompt the European Central Bank to slow its aggressive interest-rate hikes. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a discussion of the Czech Republic’s controversial new president and a preview of today’s interest-rate decision from the Federal Reserve.

Eurozone: The January Consumer Price Index (CPI) was up 8.5% from one year earlier, marking a small improvement from the 9.2% increase in the year to December. However, much of the improvement stemmed from the recent pullback in European energy prices because of the mild winter. Stripping out the volatile food and energy components, the January Core CPI was up 5.2% year-over-year, essentially the same annual increase as in the prior month. The report is therefore unlikely to dissuade the ECB from implementing another aggressive interest-rate hike tomorrow as it continues to battle high inflation in the Eurozone.

Czech Republic: Petr Pavel, the unaffiliated former leader of the Czech army and the former chief of the NATO military committee, has been declared the winner in last weekend’s presidential election. Running on a platform embracing the EU and NATO, Pavel handily beat populist Former Prime Minister Andrej Babiš.

- Although the Czech presidency is largely symbolic and has no executive powers, Pavel’s win is being seen as an important political victory over populism and pro-Russian sympathies in the country.

- Pavel has already risked confrontation with China by taking a congratulatory phone call from Taiwanese President Tsai Ing-wen. He therefore became one of the few elected European leaders who has recently risked Beijing’s ire in such a way. The gesture in support of Taiwan could encourage other European leaders to take a more assertive stance against China’s geopolitical aggression.

- In an interview with the Financial Times published today, Pavel was even more blunt, saying, “This is what we have to be very clear about: China and its regime is not a friendly country at this moment, it is not compatible with western democracies in their strategic goals and principles… This is simply a fact that we have to recognize.”

Russia-Ukraine War: Although the front lines running from eastern to southern Ukraine remain largely static, albeit with heavy fighting in some areas, the Ukrainian government has again warned that it has intelligence that the Russians are planning a major new offensive soon, potentially to coincide with the one-year anniversary of their invasion on February 24. Among the signs of such a new offensive, the Ukrainians note the Russian military’s increased mobilization of resources and intensified troop training.

India: Ahead of the next parliamentary elections in Spring 2024, the government of Prime Minister Modi has released a proposed budget for the fiscal year beginning April 1 that cuts taxes for the upper and middle classes and massively boosts infrastructure spending. The budget assumes Indian GDP will grow between 6.0% and 6.8% in the coming fiscal year, allowing the budget deficit to decline to 5.9% of GDP from an estimated 6.4% of GDP in the current year.

United States-Russia: In a report sent to Congress yesterday, the State Department said Russia has violated the New START treaty, which cut long-range nuclear arms, by refusing to allow on-site inspections and rebuffing the U.S.’s requests to meet to discuss its compliance concerns. With spot checks no longer possible, the U.S. can no longer verify the weapon counts reported by Russia. The violations, which Russia denies, raise the risk that New START, the only remaining Cold War-era arms limitation treaty still in force, will not be renewed when it expires in 2026.

- As important as the New START treaty is in limiting the U.S. and Russian nuclear arsenals, the agreement doesn’t include China at all. China’s strategic nuclear arsenal remains far smaller than the U.S. and Russian arsenals, but it is rapidly building up its inventory of nuclear weapons and could approach the numbers in the U.S. stockpile in several years.

- Abrogation of New START could therefore free the U.S. to expand its nuclear arsenal as needed to meet the new challenge of deterring a potentially combined Chinese-Russian nuclear attack.

United States-China: In a possible retaliation for the U.S.’s stringent new controls on exporting its advanced semiconductor technologies, China is reportedly considering a ban on exporting its own advanced solar energy technologies. If the plan is adopted, Chinese solar manufacturers would be required to obtain a license from their provincial commerce authorities to export such technologies. If put into place, the Chinese restrictions could crimp efforts to expand solar generating facilities and solar equipment manufacturing in the U.S., Europe, and developed Asian countries in the coming years.

United States-India: This week, the Biden administration hosted U.S. business leaders and an Indian delegation led by New Delhi’s national security advisor to discuss ways to shift key technology supply chains away from China and toward India. The meetings are another instance of how seriously the U.S. government, with bipartisan support in Congress, is seeking to decouple from China and its evolving geopolitical bloc in terms of key technologies and commodities.

U.S. Monetary Policy: Fed officials wrap up their latest two-day monetary policy meeting today, with their decision due to be released at 2:00 PM ET. The officials are widely expected to slow their rate hikes at the meeting to just 25 basis points, bringing the benchmark fed funds rate to a range of 4.50% to 4.75%. However, they are also expected to signal that they won’t be finished tightening policy until they make more progress in bringing down inflation.

- We continue to believe the continued rate hikes will help push the U.S. economy into recession in the very near future. That suggests U.S. stock prices could well turn downward again, despite their rally in recent weeks.

- The ECB and the Bank of England will hold policy meetings tomorrow, but they are expected to keep hiking their benchmark interest rates by an aggressive 50 basis points. The narrowing differential between the U.S. and European benchmark rates will probably put continued downward pressure on the dollar.

U.S. Fiscal Policy: President Biden and House Speaker McCarthy will meet today to discuss a range of issues and, more importantly, to begin negotiating a deal to raise the federal debt ceiling. Any lack of results could rekindle concerns about a potential U.S. debt default and spark additional market volatility.

U.S. Regulatory Policy: The Consumer Financial Protection Bureau plans to propose a rule today that would limit the late fees credit-card companies can charge, bringing penalties down to $8 from as much as $41 currently. The rule, which doesn’t require Congressional approval, could go into effect as early as 2024. The expected new rule illustrates the Biden administration’s relatively more aggressive regulatory initiatives.