Tag: Warsh

Asset Allocation Bi-Weekly – White House vs. The Fed: The Looming Battle for US Monetary Policy (May 19, 2025)

by Thomas Wash | PDF

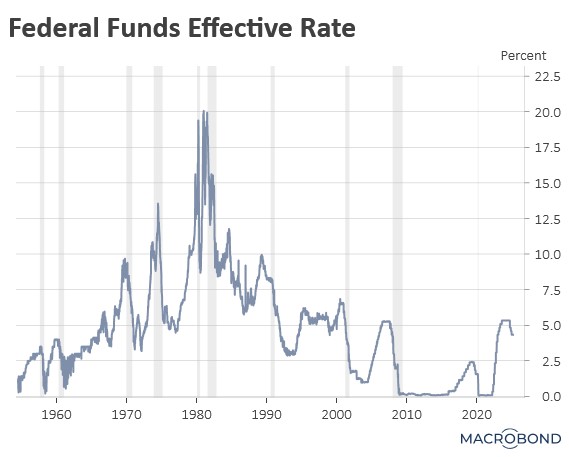

The Federal Reserve’s independence faces its most serious challenge in decades as the Trump White House escalates its criticism of central bank policy. This brewing confrontation echoes historic tensions — most notably the 1951 clash between President Truman and Fed policymakers over yield caps that ultimately led to the Treasury-Fed Accord. Today, the battle lines are being redrawn as the administration pushes for more accommodative monetary policy while it looks to shield the economy from its own trade war.

The widening policy gap between the Fed and its global peers has been highlighted in recent months. While the European Central Bank, Bank of England, and the People’s Bank of China have all lowered their benchmark short-term interest rates to combat slowing growth, the Fed has held its benchmark rate steady — a decision repeatedly criticized by the White House. This policy divergence is further strained by the Fed’s quantitative tightening program, which Treasury Secretary Bessent argues complicates the issuance of longer-term government securities.

The debate has now moved beyond short-term policy disagreements to fundamental questions about the Fed’s role and independence. Former Fed Governor Kevin Warsh, widely seen as the leading candidate to replace Chair Powell when his term ends in 2026, has emerged as a vocal critic of the central bank’s current direction. His critique focuses on two key concerns: first, that the Fed has strayed beyond its core mandate by engaging in issues like climate change policy and diversity, equity, and inclusion; and second, that its operational approach — particularly the frequency of public commentary by FOMC members — has created unnecessary market uncertainty.

Market participants are closely watching several potential flashpoints. The administration has reportedly considered accelerating the leadership transition by nominating Powell’s successor well before his term concludes, a move that could allow markets to price in policy changes gradually. Warsh’s combination of Republican credentials, Fed experience, and Treasury background makes him the probable choice, although some investors question how his well-documented hawkish views might align with the administration’s apparent preference for easier monetary policy.

The stakes for investors are significant. Any perception of compromised Fed independence could trigger a reassessment of risk premiums across asset classes. Treasury yields may face upward pressure, particularly at the long end of the curve, while the dollar could weaken if markets question the central bank’s commitment to price stability. In other words, concerns about reduced Fed independence could exacerbate the budding US capital flight that we discussed in our recent Asset Allocation Bi-Weekly from May 5, 2025. Perhaps most critically, the Fed’s ability to serve as a stabilizing force during future economic downturns could be diminished if political considerations are seen to influence its decision making.

As this drama unfolds, market participants would be wise to monitor three key developments: the timing and nature of any leadership transition, changes to the Fed’s communication strategy, and, most importantly, whether the central bank can maintain its operational independence while navigating increasingly choppy political waters. The outcome of this power struggle will shape monetary policy and market dynamics for years to come.