by Thomas Wash | PDF

There is perhaps no market force more fearsome than a true short squeeze. In our increasingly digitized financial world, a perilous gap often emerges between “paper” positions and physical reality. A short squeeze occurs when entities that have sold a promise to deliver an asset, be it a stock, a commodity, or a derivative, are forced to purchase the actual underlying asset to meet that obligation. This triggers a frantic scramble for limited supply, compelling short sellers to bid against each other and driving prices exponentially higher. We witnessed how this dynamic can unleash chaos during the GameStop episode, and now, compelling evidence suggests the same pressures are mounting in the physical metals market.

Prices for gold, copper, platinum, and silver have rallied sharply in recent weeks. The advances in gold and copper appear structurally sound, underpinned by persistent central bank accumulation and robust industrial demand, respectively. Silver typically takes its directional cue from gold but tends to exhibit greater volatility. However, the current price increase appears to be at least partially driven by a deepening supply deficit. Investors are increasingly concerned that “paper” silver obligations vastly outpace available physical holdings, which has driven the price up nearly 200% over the past year as market participants scramble for remaining inventory.

Rumors of silver price manipulation have persisted since a major bank’s conviction for distorting the market. Between 2008 and 2016, the bank engaged in “spoofing” — a deceptive practice where futures orders are placed with no intent of execution to manipulate prices. Although the bank was hit with a massive fine and began accumulating a large silver inventory, critics remain skeptical about whether their market behavior has truly changed.

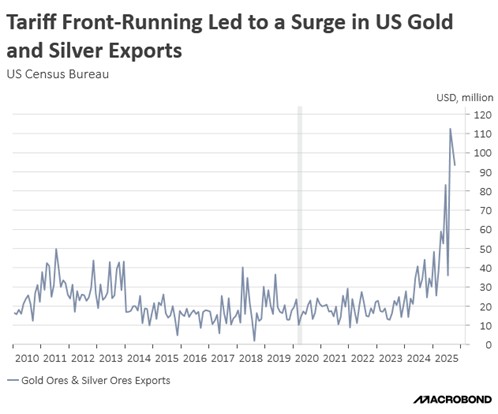

While long-term speculation surrounds the bank case, recent market volatility is more directly tied to shifting trade policies. Since President Trump’s “Liberation Day,” a surge in precious metal stockpiling has been occurring as corporations and financial institutions brace for new tariffs. Initially focused on gold, the momentum shifted to silver following its US designation as a critical mineral in November, which led to speculation that it could soon face tariffs. This demand intensified significantly when China began restricting export licenses, further straining global supply.

The danger of a commodity short squeeze lies not only in skyrocketing prices, but in the risk of a market panic. As long as firms can meet their delivery obligations or offer a cash settlement for the amount, volatility remains largely insulated within the commodities sector. However, when liquidity dries up, the results can be catastrophic. Historically, the missed margin call by the Hunt Brothers in 1980 triggered a wave of financial instability, much like how the 2021 GameStop squeeze necessitated a multi-billion dollar rescue of Melvin Capital by Citadel and Point72 to prevent a broader market collapse.

Thus far, the financial system shows no overt signs of distress. JPMorgan, often viewed as the institution most vulnerable to a liquidity run in a silver crisis, remains stable and has successfully navigated the persistent market pressures of early 2026. While the current short squeeze may prove transitory, volatility is expected to return if the White House formally expands import tariffs to include silver, which could further add to the global shortage.

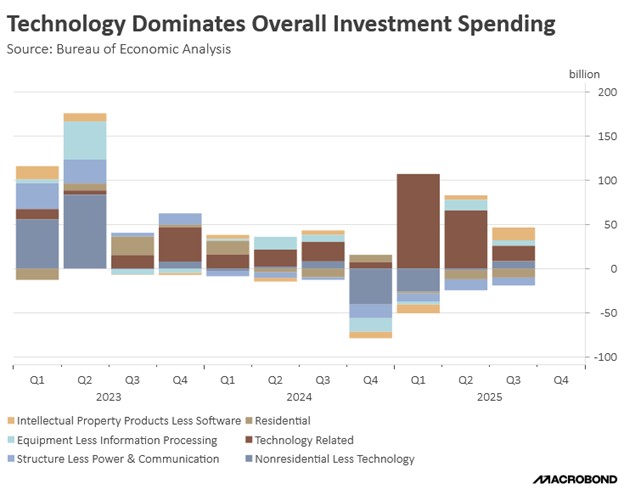

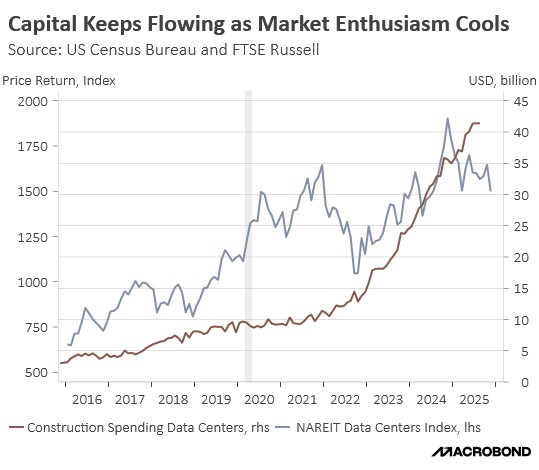

Unlike the speculative “meme-stock” volatility of GameStop or the regulatory driven collapse of the 1980 Hunt Brothers crisis, silver appears positioned for a price consolidation. While recent price action has been aggressive, the metal retains its core appeal as a safe-haven asset and a hedge against currency debasement amid ongoing Fed uncertainty. Crucially, silver’s fundamental support is now bolstered by an inelastic industrial demand; its role in high-efficiency semiconductors, AI infrastructure, and the global solar transition creates a “valuation floor” that was absent in previous speculative cycles.