Tag: bonds

Confluence of Ideas – #45 “Reviewing the Asset Allocation Rebalance: Q4 2025” (Posted 11/3/25)

Asset Allocation Bi-Weekly – #148 “Stopping the Bond Vigilante: How Fiscal Dominance Is Reshaping Global Markets” (Posted 9/22/25)

Asset Allocation Bi-Weekly – Stopping the Bond Vigilante: How Fiscal Dominance Is Reshaping Global Markets (September 22, 2025)

by Thomas Wash | PDF

The bond bull market that began in the early 1980s lasted nearly four decades. Its longevity was largely built on the assumption that governments would always prioritize the health of their bond markets, even if it meant imposing economic pain on their own countries. This thinking fostered the legend of the “bond vigilante” — a mythical force that would supposedly punish irresponsible government spending by selling off bonds, thereby holding policymakers in check.

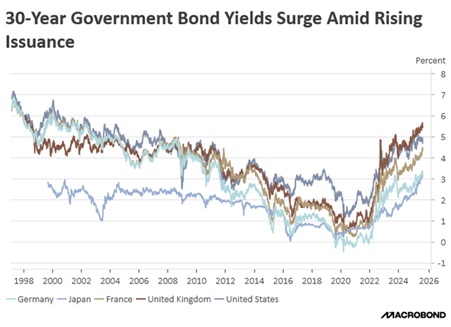

The bond market’s core assumption — that it would curb government overspending — has been severely tested since the pandemic. The initial, one-time surge in borrowing was necessary to prevent a global economic collapse. However, that precedent has been exploited. Many governments now use debt to finance a variety of pet projects, from infrastructure and green initiatives to energy subsidies and tax cuts. This increase in spending, detached from any corresponding increase in tax revenue or spending cuts, has been the primary driver behind the recent increase in bond yields around the world (see chart below).

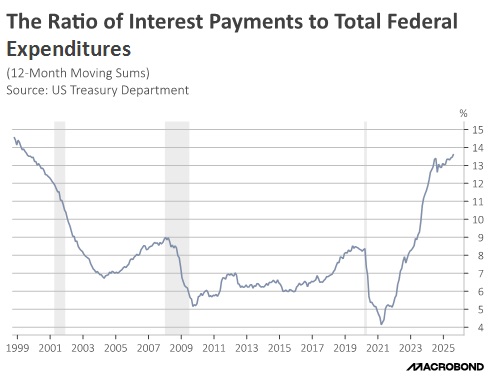

A primary focus of attention is the potential for a supply/demand imbalance in the bond market. The concern is that rising bond issuance is occurring simultaneously, with a shift in investor preferences toward short-duration bonds driven by growing anxieties about inflation, economic growth, and central bank policy. As a result of this mismatch, yields on 30-year government bonds globally have risen to their highest level in over 20 years. This rise in sovereign bond yields is largely attributable to growing concerns over US credit quality, triggered by Moody’s Ratings’ decision to downgrade the US credit rating from Aaa to Aa1 on May 16. The agency justified its move by highlighting the US government’s perceived unwillingness to address deteriorating fiscal conditions, specifically citing structurally large annual deficits and escalating debt servicing costs.

These concerns were compounded by a poorly received 20-year Treasury auction on May 21, which served as an immediate test of market confidence. The auction results were weak, and yields rose above 5% for the first time since October 2023. Although not the sole driver, this weak auction amplified selling pressure across the yield curve, with the 30-year yield surpassing 5%.

Concerns about the US government’s credit quality have also raised fears about the creditworthiness of other developed countries. In the same month that the US had its weak bond auction, Japan also experienced poor demand for a 30-year bond offering. Furthermore, yields have risen across Europe and in the United Kingdom, driven by concerns that these countries may struggle to meet their own budget targets.

On the supply side, although interest rates remain elevated, governments are taking proactive measures to mitigate their impact on the broader economy. Notably, the US, Japan, and the UK have begun increasing their issuance of shorter-duration sovereign bonds. This strategy aims to reduce supply pressure on longer-dated bonds, which helps to curb the rise in long-term borrowing costs. Meanwhile, France is in a debt standoff as it looks to address its budget situation through a combination of spending cuts and tax increases.

On the demand side, most central banks are actively adjusting their strategies to ensure liquidity in the bond market. The Federal Reserve, Bank of England, and Bank of Japan have all focused on modifying the pace of their balance sheet reduction to add liquidity back into the system. While the ECB has not formally stated its intention to use its tools to help bring down yields, particularly in France, it has expressed a willingness to do so through its Transmission Protection Instrument in case of a crisis.

While rising government debt remains a problem, it appears that, at least in the short to medium term, governments have the ability to prevent yields from rising to very high levels. The trade-off is that governments worldwide may remain vulnerable to rollover risk when short-term bonds expire. This could force them to take more proactive measures to prevent rates from destabilizing the economy.

We believe the need to mitigate these fiscal risks could pressure governments into a regime of fiscal dominance, where monetary policy is subordinated to keep public debt servicing costs manageable. A key feature of this environment would be central banks tolerating higher inflation, effectively abandoning their strict price stability and leading to structurally elevated price pressures. In such a scenario, a barbell bond strategy — favoring both short-term and long-term bonds while avoiding the middle of the yield curve — could be advantageous in the near to medium term. Furthermore, peripheral European countries that have demonstrated a credible commitment to fiscal sustainability could become particularly attractive investment opportunities for those seeking international exposure.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Confluence of Ideas – #44 “Reviewing the Asset Allocation Rebalance: Q3 2025” (Posted 7/28/25)

Confluence Mailbag – #1 “A Mixed Bag of Bonds, Buffett, Defense, and Crypto” (Posted 6/10/25)

Asset Allocation Bi-Weekly – #139 “US Capital Flight and the Implications for Investors” (Posted 5/5/25)

Asset Allocation Bi-Weekly – US Capital Flight and the Implications for Investors (May 5, 2025)

by Patrick Fearon-Hernandez, CFA | PDF

Oh, what a difference one calendar quarter can make! Shortly after Donald Trump was sworn in to his second term as president of the United States, we wrote that the US seemed to enjoy exceptional advantages versus the rest of the world in terms of its economic growth, political stability, and stock market returns. Other economists and market commentators echoed those views. However, just three months into Trump’s new term, many investors seem to be losing confidence in the US’s economic growth and management. As we discuss in this report, the evidence pointing in that direction includes a rise in the yields on US Treasury obligations, a depreciating dollar, and surging gold prices. Below, we discuss these trends and what they may mean for world financial markets going forward.

Reduced Bond Buying / Rising Bond Yields. As shown in the chart on the next page, the yield on the benchmark 10-year Treasury note stood at 4.57% on the first business day after Trump’s inauguration in January. Investors continued to scoop up Treasurys in the weeks following the ceremony, driven by expectations of slower economic growth, easing inflation pressures, and further interest rate cuts by the Federal Reserve. As the administration revealed more about its tariff plans and other aspects of economic policy, growing concerns about the US economy pushed 10-year Treasury yields as low as 4.01% in early April. Since then, however, Treasurys have sold off sharply. Importantly, it appears that foreign institutions in Japan and elsewhere have been a big part of the sell-off. In any case, 10-year Treasury yields have spiked to more than 4.40% since mid-April. The yield on 30-year Treasurys has spiked to as high as 4.91%.

A Depreciating Dollar. Just as US Treasurys have sold off, the dollar has depreciated against many key currencies. The chart below shows the Fed’s nominal US Dollar Index, which tracks the value of the greenback against a broad range of foreign currencies. The broad index shows the dollar has lost about 4.10% of its value since Inauguration Day, with an especially sharp drop since Trump announced the pause in his “reciprocal” tariffs on April 9. The dollar has especially fallen sharply against developed country currencies, such as the euro.

Rising Gold Prices. Rising bond yields and a falling dollar point to falling confidence in the US among global investors, so it should be no surprise that gold — the quintessential safe haven — has appreciated sharply. As shown in the next chart, gold prices have even reached a record high above $3,400 per ounce, with much of the increase coming since early April.

Of course, many long-term investors have been more focused on the recent volatility in US risk assets, especially stocks. In our view, the unique combination of market forces described above may be the more important underlying story. The rise in US bond yields, the decline in the dollar, and the surge in gold represent a rare alignment of market trends that may indicate some measure of capital flight from the US. This pattern of market moves suggests that global and even some domestic investors are trying to cut their exposure to US assets and the dollar. The likely culprit is the administration’s effort to rapidly and fundamentally change the US economic relationship with the rest of the world. As long as that endeavor continues, and investors are unsure of where the to-and-fro of policymaking will take them, these trends are likely to remain in place. Therefore, over the coming months and quarters, the most attractive assets may be much different than what we and other observers had expected at the start of the year. In particular, any continued US capital flight is likely to favor foreign equities, foreign currencies, and gold in the near term.