by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] There is a lot going on this morning. Let’s dig in:

Iran: As expected, President Trump withdrew the U.S. from the multilateral nuclear agreement with Iran. Opinions on the move and projections of the decision’s impact vary widely. We will have more to say on this issue in the coming weeks, but here is a quick view of our thoughts.

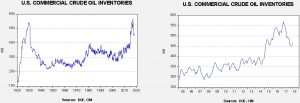

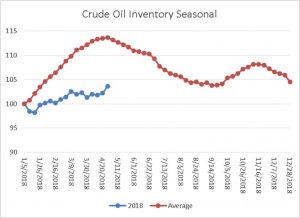

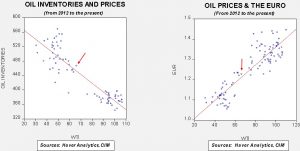

- First, this action is bullish for oil. Although we don’t expect Europe or China to participate in U.S. sanctions, the potential to be isolated from the U.S. financial system and the reserve currency will temper Iran’s ability to export oil. At a minimum, nations accepting Iranian oil will likely require a discount to bear the risk of buying from Iran. The reduction in supply is supportive for oil prices and is being reflected in the market. We note that China is Iran’s biggest customer for oil; it exports about 650 kbpd to China. India is second at just over 500 kbpd. We suspect these two nations will continue to buy Iranian oil regardless of sanctions, although Iran may be forced to accept CNY from China instead of USD. However, South Korea is third at just over 300 kbpd and it will likely respond to the sanctions.

- Second, the administration’s action highlights a growing problem with American foreign policy, in general. Increasing partisanship in the U.S. political system means that each change in administration increases the odds that what was previously in place is at risk of reversal. During the Cold War years, there was remarkable consistency in U.S. foreign policy. Regardless of party, policy shifts were rare and, when they did occur, the changes remained in place after the implementing administration left office. For instance, “Nixon to China” and the policies that followed didn’t shift when Carter took office. That consistency now looks to be at risk. It isn’t difficult to imagine a Democrat administration reaching out to Iran to bring the Obama deal back. However, nations will no longer be sure that any deal made will last past the next presidential election.

- Third, the Trans-Atlantic partnership that was forged after WWII is coming under serious strain. This trend began well before President Trump. President Bush’s decision to invade Iraq was opposed by much of Europe. President Obama’s unenforced “red line” in Syria was not appreciated in Europe, either. President Trump has continued this trend, not only with this action but by supporting Brexit and pulling out of the Paris Accord. There is a natural anti-European strain of U.S. politics that was mostly quashed during the Cold War years. That anti-Europe, pro-isolationist sentiment is on the rise and this decision is part of that trend.

- Fourth, it isn’t obvious how Iran will react to this decision with regard to its nuclear program. President Rouhani had pressed against the hardliners in Iran to negotiate the deal in hopes that the lifting of sanctions would (a) boost the economy, and (b) reduce the power of the Iranian Republican Guard Corps which had increased its grip on the sanctions-affected Iranian economy. Neither outcome has occurred. In fact, the economy’s downward spiral is worsening.[1] The U.S. withdrawal from the nuclear deal will strengthen the hardliners in Iran and reduce the odds of any sort of accommodation with the regime.

- Fifth, the move draws questions about the administration’s Iran strategy. To be fair, the Iranian nuclear deal was seriously flawed. It was limited to uranium enrichment alone when the real concern of the U.S. was Iran’s power in the region. Thus, Iran’s continued covert activity in the Middle East and the expansion of its missile program were seen by the U.S. as evidence of Iranian duplicity. However, Iran can counter that these actions were never part of the deal President Obama negotiated. Our take on the nuclear deal was that President Obama had concluded the pivot to Asia required reduced American involvement in the Middle East, and the nuclear deal was the first step in normalizing relations with Iran to allow it to become the regional hegemon and enforce order in an unruly region. Of course, that normalization required Clinton to defeat Trump and continue Obama’s foreign policy, which wasn’t certain. For obvious reasons, Saudi Arabia, the Gulf Emirates and Israel did not want that to happen. The problem is that none of these powers can effectively offset Iran’s influence without U.S. support. So, either the U.S. must (a) change the regime in Iran, or (b) maintain and build a stronger U.S. presence in the Middle East to contain a strengthening Iran. Given President Trump’s desire to pull out of Syria, it’s hard to see how (b) is the preferred option, and (a) will be difficult. Due to its geography, invading Iran would be really tough—think about invading the Rockies. Perhaps sanctions can force Iran back to negotiations and bring about the deal the U.S. should have secured originally, which is to contain Iran’s ambitions in the region. But, it could just as easily lead to hardline domination in Iran and the resumption of Iran’s nuclear program. If there is a workable plan here, it isn’t obvious. And, when there is no obvious plan, the potential rises for geopolitical risk and market volatility.

So, from a market perspective, this is bullish for oil and likely gold (look for Iranian gold demand to rise). It may be bullish for cryptocurrencies which offer an alternative to gold, although we suspect the Mullahs will try to prevent cryptocurrencies from gaining share, fearful it would undermine the regime. It may support Treasuries if conditions in the region deteriorate. It is also supportive for energy equities and defense stocks. However, it’s a potential negative for equities, in general, as conflict isn’t something that lifts multiples.

North Korea: Kim flew (yes, flew) to Dalian, China yesterday for a second meeting with Chairman Xi. We suspect Kim wanted some sanctions relief. Xi wants to be sure that he doesn’t face a hostile power on the Korean border so he wants Kim to remain an ally. Meanwhile, Secretary of State Pompeo visited Kim and is bringing back three Americans held in North Korea, which will be seen as a goodwill gesture. We expect the summit to occur, but what emerges from it is anyone’s guess.

NAFTA: Mexico has offered a compromise on automobile manufacturing, raising North American parts content to 70% from 62.5%. The U.S. has pressed for 75% but may be willing to concede that point. Mexico also wants a gradual implementation, which is probably slower than the U.S. would prefer. The U.S. and Canada have pressed Mexico for wage calibrations that would force Mexican wages to U.S. and Canadian levels. Mexico, fearful of the loss of competitiveness, has pushed back against this demand. However, it is showing some flexibility on the issue. Still, it does appear that negotiations are moving forward, which is a positive sign.

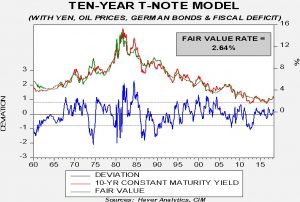

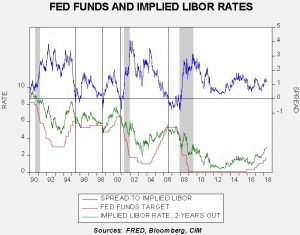

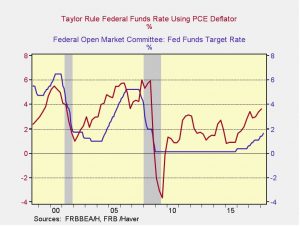

Warsh speaks: Ben White is a columnist for Politico, focusing on the financial markets. In a recent podcast, he interviewed Kevin Warsh, a former Fed governor who was being considered for the Chair position that eventually went to Jay Powell. Warsh noted that in his discussions with President Trump the president didn’t really seem to understand that the Fed is an independent entity. Warsh’s comments confirm our suspicions that President Trump is ending the informal truce that has existed between the Fed and the White House since Bob Rubin convinced President Clinton that leaving the Fed alone to implement policy would lead to a better economy and improve Clinton’s popularity. Since then, it has been rare to see the White House interfere with Fed policy. Our feeling has been that President Trump has no interest in an independent Fed. Instead, he wants all levels of government to do his bidding. It should be noted that central bank independence was not brought down from Mount Sinai by Moses as part of the 10 Commandments. Central bank independence has been steadily adopted by industrialized nations over the past 70 years, but there was a theory that monetary and fiscal policy should be coordinated to improve their effectiveness. It was only when policymakers decided that quelling inflation was their key goal and elected officials could not be trusted to do the job that central bank independence became generally accepted wisdom. If Warsh’s insights are correct, it would suggest that if monetary policy begins to “bite” then the White House will lash out at the Fed and try to stop further rate hikes. Such actions will raise fear of a return to the Arthur Burns/G. William Miller years of persistently accommodative monetary policy and rising inflation. If the Fed’s independence comes into question, it would be profoundly bearish for the dollar, bullish for commodities and gold and bearish for equities and bonds.

[1] https://www.nytimes.com/2018/05/08/world/middleeast/iran-crisis-nuclear-deal.html?wpisrc=nl_todayworld&wpmm=1