by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] The Year of the Pig begins! Several Asian markets were closed and China will be closed all week. Thus, it was a very quiet overnight session. Here is what we are watching this morning:

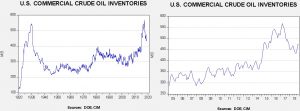

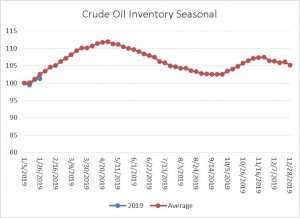

Venezuela: Although the EU did not act as a group to call for Maduro’s exit, Guaido did receive endorsements from a large number of European nations.[1] For the EU to issue anything as a group, it must have unanimity. Hungary and Italy did not cooperate. Protests continue in Venezuela but the key to removing Maduro rests with the military. There have been a few notable defections, including the acting head of the Venezuelan Air Force, Gen. Francisco Yanez.[2] Overall, though, the military still seems to cling to Maduro. It should be noted that history shows sentiment within the military can swing quickly, so we could see the military shift to the opposition at some point. Meanwhile, the oil markets appear to have discounted the turmoil for now as prices are stabilizing.

Brexit: There isn’t a lot of news to report. PM May goes back to the EU this week[3] to renegotiate her Brexit plan. We don’t expect much to change. Hardline Brexit supporters are warning May that mere promises from the EU won’t be enough—they want an entirely new treaty.[4] That is unlikely to occur. May is likely betting that the hardliners will blink at the prospect of a hard Brexit; that probably isn’t true. May might be able to get her plan through Parliament with mere promises from the EU, but only with significant Labour support. At some point, May might be forced to choose between saving her party and saving her plan. She probably can’t do both. So far, May appears unwilling to go down in history as the party leader who destroyed the Tories and would rather go down in history as the PM who led to a hard Brexit.

Another blow against globalization: French industrial policy has tended to support “national champions,” which are state-supported firms that are given special favors to achieve global prominence. In practice, this means these firms are protected from foreign competition to achieve scale. In development theory, this is known as the “infant industry argument,” which postulates that nations trying to develop should nurture and protect small companies to allow them to grow. It might be legitimate for a developing nation but it is mostly pure protectionism for a large economy. Being a major global exporter, Germany has tended to avoid national champions but, in the face of rising competition from China and the U.S., Germany is about to propose new industrial policies to help create national champions.[5] One of the other factors that has tended to prevent France from fully developing such policies is that the EU would block them due to its anti-trust rules. However, one of the key nations that supported general market liberalization was the U.K. Thus, Brexit may be creating conditions where France and Germany will cooperate on protecting companies. This new policy is a reflection of the general retreat from globalization that is now underway; simply put, nations are now viewing each other as enemies and are less open to cooperation.

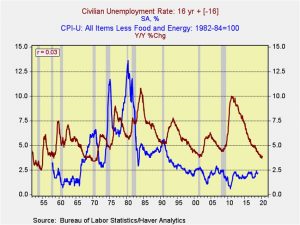

The growing war on capital: Populism is a direct threat to capital. Whether it comes from the right or left, over time, populism will reduce margins and increase inflation. The right-wing version tends to be less dependent on tax rates and direct transfers; instead, it presses for regulation that reduces the supply of labor and lifts wages, reducing margins. Regulations usually include work rules that require a certain number of workers for a job regardless of whether or not regulation has eliminated them. For example, until the Staggers Act of 1980, U.S. interstate commercial traffic was regulated by the Interstate Commerce Commission. This act, along with others, led to the deregulation of the railroads, airlines and trucking. In the aftermath, cabooses were no longer put on freight trains with the required labor inside, airlines competed on price and the Teamsters Union was deeply undermined as truckers became independent. Right-wing populists would support bringing back such measures; in addition, they tend to support significant barriers to legal immigration to keep the supply of labor curtailed.

The left-wing variant tends to support regulation as well, although it is less strict on immigration. However, the left-wing variant is much more supportive of new public transfers (bigger safety net) and higher taxes on upper incomes and capital. For example, the Democrats are looking at expanding Social Security. To maintain the fiction of the program being a retirement plan, the payroll tax rate would rise to 14.8% and incomes above $400k would be included in the payroll tax (creating a “dead zone” for the tax between $132,900 and $400,000 that would not be taxed).[6] Senators Schumer and Sanders are calling for legislation to limit stock buybacks.[7] Anti-trust rules appear to be turning back to an earlier period where size alone was enough to trigger action.[8] In the mid-1980s, anti-trust rules reflected the idea that as long as consumers were not harmed by the firm, size was generally acceptable. What legislators failed to grasp was that size could create labor monopsony, which means that businesses had enough power to restrain wages.

Overall, this issue isn’t something that will affect financial markets today; on the other hand, we have been warning for several years that we are coming to the end of an efficiency cycle that will be replaced by its opposite, an equality cycle. Although equities can thrive in an equality cycle (as evidenced by the 1960s equity market), that only comes after equities revalue from the high margin/high multiple efficiency cycle (the revaluation that occurred during 1929-1957). When does the equality cycle begin in earnest? Not next week, but likely in the next decade or sooner; as we referenced above, the evidence of a turn is growing. After all, it wasn’t so long ago, under President Bush, that reforming Social Security meant reducing benefits. That era seems long past.

[1] https://www.wsj.com/articles/juan-guaido-recognized-as-venezuelas-president-by-major-eu-countries-11549275207

[2] https://www.washingtonpost.com/world/the_americas/venezuela-protests-guaido-vs-maduro/2019/02/02/ef043b00-2660-11e9-b5b4-1d18dfb7b084_story.html?utm_term=.05b98c6a4e6c&wpisrc=nl_todayworld&wpmm=1

[3] https://www.politico.eu/article/theresa-may-vows-to-battle-in-brussels/?utm_source=POLITICO.EU&utm_campaign=5f84c6d0b5-EMAIL_CAMPAIGN_2019_02_04_05_33&utm_medium=email&utm_term=0_10959edeb5-5f84c6d0b5-190334489

[4] https://www.ft.com/content/01ca3026-278f-11e9-a5ab-ff8ef2b976c7?emailId=5c57bb738d8e400004ee789f&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[5] https://www.politico.eu/article/germany-industrial-plan-signals-europes-protectionist-lurch/?utm_source=POLITICO.EU&utm_campaign=5f84c6d0b5-EMAIL_CAMPAIGN_2019_02_04_05_33&utm_medium=email&utm_term=0_10959edeb5-5f84c6d0b5-190334489

[6] https://www.nytimes.com/2019/02/03/us/politics/social-security-2100-act.html?action=click&module=Top%20Stories&pgtype=Homepage

[7] https://www.nytimes.com/2019/02/03/opinion/chuck-schumer-bernie-sanders.html

[8] https://www.ft.com/content/c27a517a-2631-11e9-8ce6-5db4543da632?emailId=5c57bb738d8e400004ee789f&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22