by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment will be broken down into three sections: 1) How the rising U.S. dollar is impacting other countries; 2) How political fracturing in Spain and Brazil is representative of a global trend; and 3) What trade and investment flow data says about the U.S.-China relationship.

Dollar Soaring: The U.S. dollar hit its highest level in six months on Wednesday in a troubling sign for global currencies.

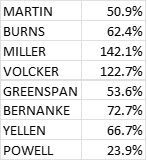

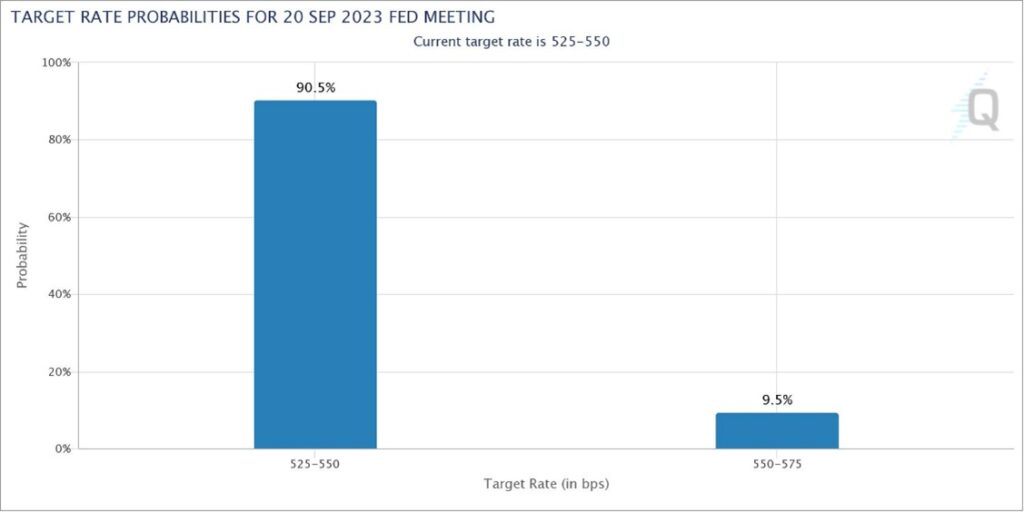

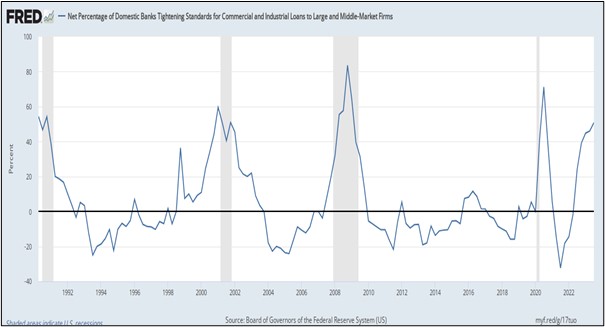

- Investors are flocking to the dollar as a safe haven currency, attracted by the U.S. economy’s resilience in the face of global economic headwinds. The latest Institute for Supply Management (ISM) non-manufacturing index unexpectedly rose from 52.7 to 54.5 in August, beating expectations of 52.5. Similarly, last week’s employment data also exceeded expectations, with the U.S. economy adding 187,000 jobs in July, slightly above projections of 174,000. The better-than-expected numbers have led to speculation that the Federal Reserve will favor at least one more rate hike before the end of the year.

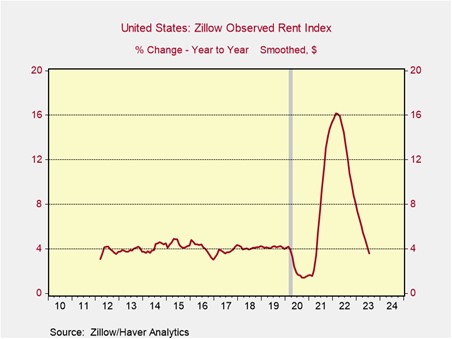

- In contrast, Europe and China are experiencing more signs of economic slowdown in their respective regions. Private sector surveys showed that service activity in China expanded at its slowest pace in eight months in August, while business activity in Europe fell deeper into contraction territory. The divergence in growth expectations has weighed on their respective currencies, with the EUR hitting a three-month low and the Chinese yuan (CNY) falling to its lowest against the USD since December 2007. As a result, policymakers at the European Central Bank and People’s Bank of China are likely to use more aggressive policies to prevent further depreciation.

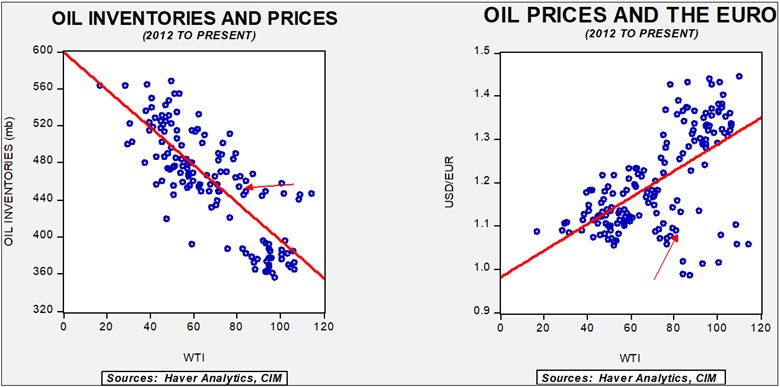

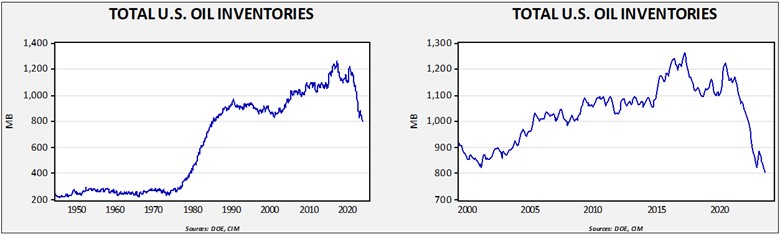

- Central bankers are in a difficult spot. The strengthening dollar is expected to worsen price pressures related to rising commodity prices. On Wednesday, oil prices hit $90 a barrel for the first time in 2023 after Saudi Arabia and Russia agreed to extend voluntary production and export cuts. The combination of a strong dollar and rising commodity prices will likely weigh on global growth by making it more expensive for governments to repay dollar-denominated debt and import energy. As a result, central bankers may be less willing to provide stimulus, which could further dampen economic activity.

Unusual Coalition: Embattled leaders in Spain and Brazil make unsavory deals to stay in power.

- Spanish Prime Minister Pedro Sánchez is considering granting amnesty to Catalan separatists in exchange for their support in forming a government, but only if they also agree to back key legislation over the next four years. Talks between the two sides have not yet begun, but Sánchez’s party is working on a stability pact with the Junts per Catalunya party. If successful, this would allow Sánchez to remain in power. Still, he risks alienating some of his base who are uncomfortable with his perceived concessions to separatist groups within the country. Hence, his party popularity may take a hit.

- Brazilian President Luiz Inácio Lula da Silva reached a deal with the right-wing Progressistas (Progressive) and Republicanos (Republican) parties to secure their support for his agenda. In exchange for the support of these two parties, Lula agreed to give up two seats in his cabinet. The pact is estimated to expand Lula’s support from 250 deputies to 320 out of a possible 513. The growing coalition should make it easier for him to push through difficult legislation such as tax reform. However, there is hope that conservative members of his coalition will be able to check his more radical proposals.

- Political polarization has caused gridlock in the legislatures of Spain, Brazil, and other countries around the world. This has made it difficult to pass legislation, leading to inaction on important issues and the rise of extremism. Situations such as the 2023 attack on the Brazilian Congress and the Catalan Independence referendum in 2017 are examples of how toxic politics have become over the last decade. Although markets sometimes perform well in this environment as the inertia reduces uncertainty about a sudden change in policy, the fragmentation of the electorate suggests that this is not sustainable in the long term, particularly in emerging markets.

Sino-American Divorce: Economic data for the United States and China shows the two are going their separate ways.

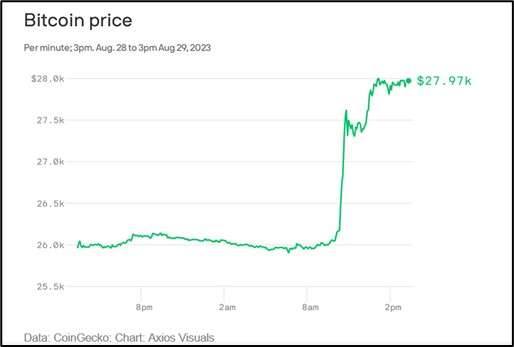

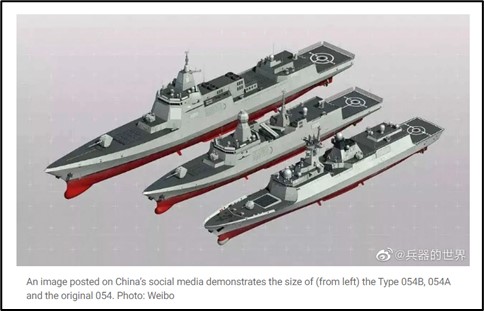

- The latest phone developed by Huawei (002502, CNY, 2.57), the Mate 60 Pro, has led to concerns that China has been able to circumnavigate export bans. The phone caught the eye of U.S. regulators as it was able to download at faster speeds than many of the top 5G phones on the market, including the Apple’s (AAPL, $177.20) iPhone 14 Pro. This has raised questions about whether Huawei has been able to obtain components from American companies in violation of the export bans, as it was widely believed that its Chinese semiconductor producer SMIC (0981, HKD, 19.82) is not known for its advanced chip-making capabilities. In an attempt to get more Chinese consumers to buy phones made domestically, Beijing has banned the use of the iPhone for Government workers.

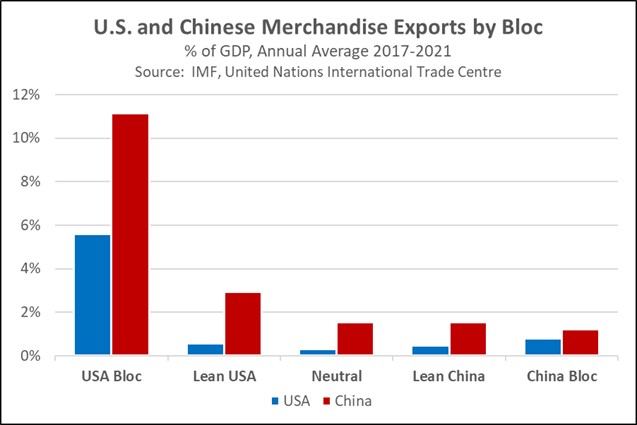

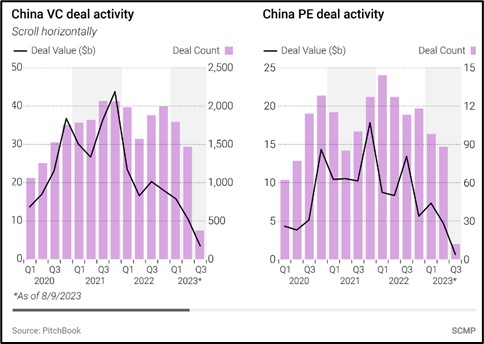

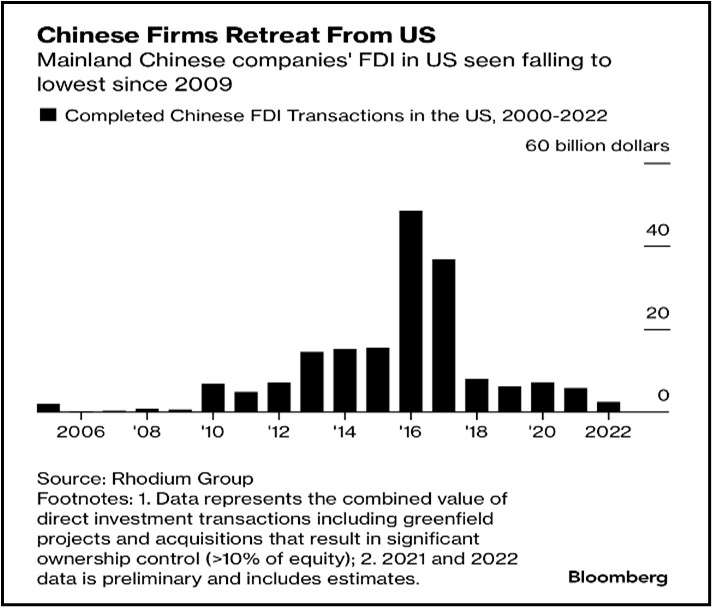

- Frictions between the two largest economies have started to impact trade and capital flows. In July, the annual change in American imports of Chinese goods fell to its lowest since 2006. Additionally, Chinese companies have started to reduce foreign direct investment (FDI) into the U.S. and instead invest in countries with access to U.S. markets, such as South Korea and Mexico. In 2022, Chinese inflows into the U.S. fell to the lowest level since 2009. At the same time, the U.S. government is trying to restrict American investment in Chinese companies, particularly those linked with strategic ties to Beijing’s military.

- The shifting trade and capital flows between China and the United States highlight the intention of the two countries to reduce their economic dependency on one another. As mentioned in previous reports, we do not expect this to happen quickly, but rather gradually over the next few years. This process will likely be beneficial for countries that have exposure to both China and the United States, such as Mexico and South Korea mentioned previously, but also could include countries such as India, Vietnam, and Indonesia.

(Source:

(Source:

(Source: Barchart.com)

(Source: Barchart.com)

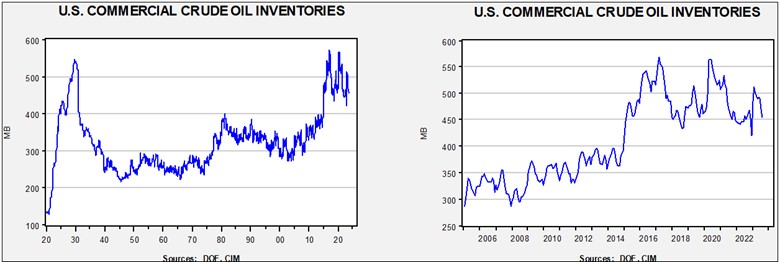

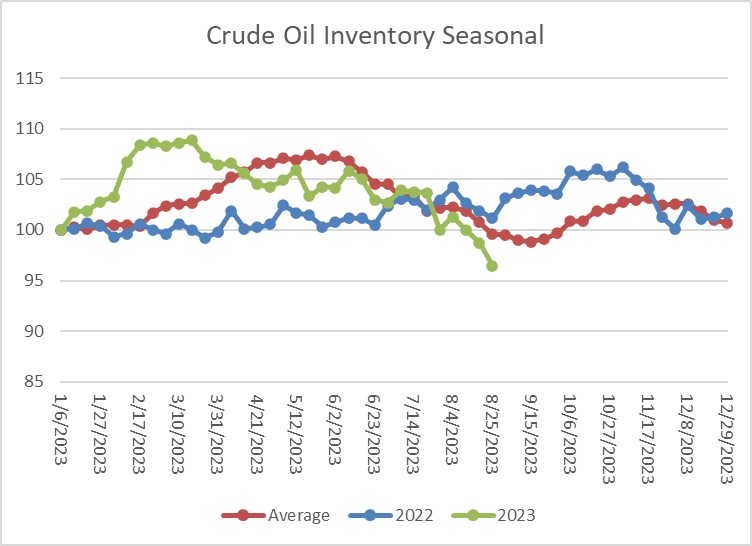

(Sources: DOE, CIM)

(Sources: DOE, CIM)