by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with new developments regarding the global and US equity markets, as well as gold. We next review several other international and US developments that could affect the financial markets today, including a dangerous military standoff between Japan and China northeast of Taiwan and a preview of the Federal Reserve’s latest policy meeting coming up this week.

Global Public and Private Equity Markets: Reflecting the push to allow everyday investors to take positions in private equity markets, MSCI has launched a new index to track the returns on a combined portfolio of global stocks and private equity funds. The new MSCI All-Country Public + Private Equity Index blends stocks and unlisted assets into a single benchmark, with unlisted assets set at 15% of the portfolio. The new index could further fuel investors’ interest in private equity and debt investments and new funds to meet that interest.

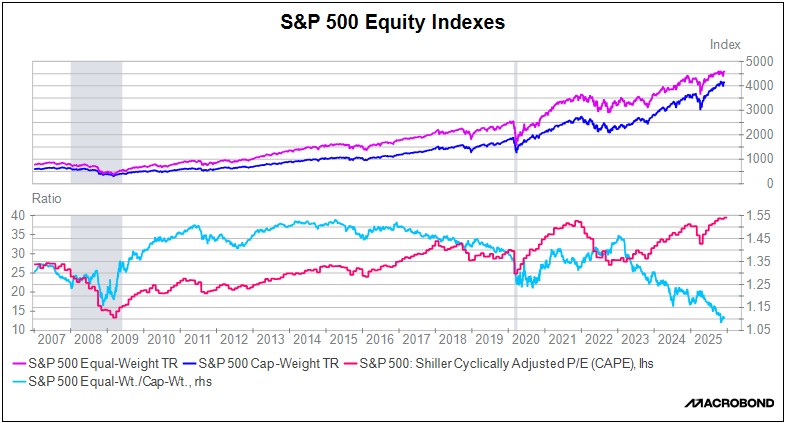

US Stock and Precious Metals Markets: The Bank for International Settlements, often called the “central banks’ central bank,” today issued a report warning that both US stocks and gold are showing signs of being in a bubble. The report notes that the current period is the only instance in the last 50 years when both US stocks and gold have appreciated rapidly at the same time. Of note, the BIS said its research shows the rapid price gains are being driven by “exuberance” among retail investors.

- Clearly, US stock and gold prices are very high and are trading at extraordinarily high valuations. Whether or not they are in a bubble, there is probably a growing risk of a sharp re-pricing at some point in the coming year or two. In addition, US stock prices would be at risk of a correction if corporate profits begin to falter in the face of issues such as tariff disputes, supply chain disruptions, excess investment, or consumer caution.

- We discuss all these issues in our Economic and Financial Market Outlook for 2026, which we expect to publish this week.

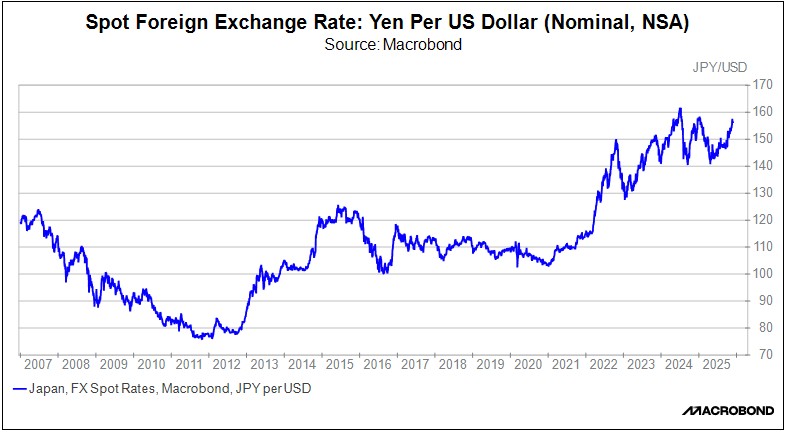

China-Japan: Amid the growing tensions over Prime Minister Takaichi’s recent comments that a Chinese blockade of Taiwan would prompt Japan to intervene militarily, Tokyo said Chinese jet fighters on Saturday twice locked their fire-control radars on Japanese fighters northeast of Taiwan. The radar locks could have potentially been a prelude to firing missiles at the Japanese jets. Beijing responded on Sunday by saying the Japanese planes had come too close to a Chinese aircraft carrier.

- Beijing’s responses to Takaichi’s statements so far have focused on sharp rhetoric and various trade and travel restrictions, but it has avoided deploying its most powerful economic sanctions and has kept a lid on military responses.

- Nevertheless, the incident on Saturday is a reminder that the current tensions carry a risk of boiling over. Investors have seemed complacent over the China-Japan tensions, but they should remember that it would only take a small miscalculation or accident to spark a more serious crisis or even conflict between the two nations, which would almost certainly disrupt the global economy and financial markets.

- As the US continues to shift its foreign policy away from the global hegemony it practiced for decades, and as the rise of revisionist states such as China and Russia continues to spur global fracturing, we have long asserted that geopolitical tensions will worsen over time. This new, tension-filled backdrop to the global investment environment is a key reason we favor assets such as Asian and European defense stocks and gold.

Japan-Australia: Underscoring the geopolitical tensions mentioned above, the Japanese and Australian defense ministers announced a new “framework for strategic defense coordination” between their respective countries on Sunday. Although short of a full mutual defense treaty, the new program aims to boost national security coordination between Japan and Australia as the two countries face the challenge of China’s rising geopolitical aggressiveness and a cooler commitment from the US.

China-Southeast Asia: Research by the Financial Times shows that Chinese exports to the Southeast Asian countries of Indonesia, Singapore, Malaysia, Thailand, Vietnam, and the Philippines in the first nine months of 2025 were up 23.5% from the same period one year earlier, about double the growth rate in the previous four years. The figures suggest the new US import tariffs against China are indeed prompting Chinese firms to dump or reroute their goods to nearby countries, which could weigh on those nations’ economies and firms.

Thailand-Cambodia: The Thai military today launched airstrikes against positions in Cambodia, claiming Cambodian troops had fired across the disputed border in violation of a truce brokered by the US in July. Thailand has evolved in recent decades as an important manufacturing hub in the region, and China is now routing many final goods and manufacturing components to it (see discussion immediately above). The fighting therefore has the potential to disrupt local and international supply chains, possibly affecting Thailand’s economy and stock market.

US Monetary Policy: The Fed holds its latest policy meeting this week starting on Tuesday, with its decision due on Wednesday at 2:00 PM ET. This meeting will also include the policy committee’s updated economic and financial projects (the “dot plots”). Based on futures prices, investors are virtually unanimous in expecting the policymakers to cut their benchmark fed funds short-term interest rate by 25 basis points to a range of 3.50% to 3.75%.

US National Security Policy: In a speech to the Ronald Reagan Defense Forum in California on Saturday, Secretary of Defense Hegseth said the US government is now prioritizing defense of the homeland and the Americas region. The statement is consistent with the administration’s new National Security Strategy released last week, which de-emphasized the military threats from Great Powers such as China and Russia or rogue nuclear states such as Iran and North Korea.

- The new, regionally focused security strategy likely implies major changes in the size of the US armed forces, what weapons the armed forces buy, and how they operate.

- For example, prioritizing the interdiction of drug-running boats or immigrants close to US shores while maintaining a smaller deterrent force for non-regional threats could potentially require fewer troops, less expensive operating tempos, and fewer major weapons systems. That is one reason why we think foreign defense stocks may offer better returns than US defense firms in the coming years.

US Food Industry: Amid rising political pressure over the cost of living, President Trump yesterday signed an order creating task forces to probe price-fixing and other anticompetitive behaviors in the food supply chain. The order calls for a particular focus on the market behavior of foreign-controlled companies. We suspect such an effort will have little direct effect on food prices. However, it could present regulatory risks for consumer staples firms, especially if they are headquartered abroad.