Author: Amanda Ahne

Daily Comment (June 24, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a new antitrust suit by the European Union against US tech giant Apple. The suit suggests major US tech firms will be in the crosshairs of the EU’s new Digital Markets Act going forward. We next review several other international and US developments with the potential to affect the financial markets today, including new polling showing that the far right and far left are likely to dominate France’s parliamentary elections this Sunday and details on an ongoing cyberattack affecting US auto dealerships.

European Union-United States: The European Commission has accused US technology giant Apple of stifling competition on its App Store. The action marks the first major application of the EU’s Digital Markets Act, which went into effect in March and aims to keep big, powerful online platforms such as Apple’s from squashing competition from start-ups. If found guilty, Apple could face a fine of 10% to 20% of its global annual revenue, or tens of billions of dollars.

European Union-China: European and Chinese officials over the weekend confirmed that the EU and China have agreed to start talks over the growth of Chinese electric vehicles in the bloc, which EU officials fear will put legions of Europeans out of work. The talks aim to diffuse the EU’s planned antidumping tariffs against Chinese EVs, which are due to come into effect in July. At this point, however, we see no reason to think the talks could head off those tariffs.

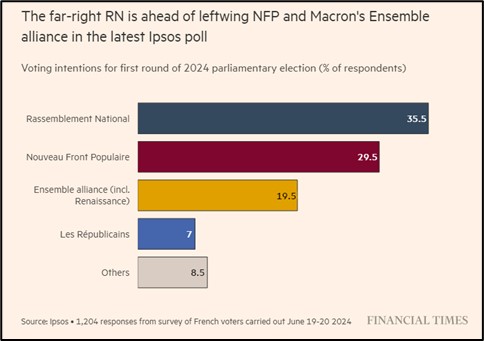

France: Ahead of the snap parliamentary elections next Sunday, a new Financial Times poll shows 35.5% of voters intend to cast their ballot for the far-right populist National Rally, while 29.5% intend to vote for the new far-left alliance called New Popular Front. President Macron’s centrist Ensemble alliance, including his own Renaissance liberals, has the support of only 19.5%. As of right now, the figures suggest the runoff election on July 7 could pit the far right against the far left, guaranteeing a major change in France’s domestic policies.

Philippines-China: Satellite imagery shows the Philippine government has begun building an anti-ship missile base on the west coast of Luzon island, facing the South China Sea. The new base is aimed at deterring Chinese aggression against disputed islands and shoals in the area, including the Second Thomas Shoal, which we think is a particularly dangerous source of friction between China and the Philippines.

Russia-Germany: According to Western security officials, communication intercepts show that a fire last month at a Berlin factory owned by defense contractor Diehl was set by Russian saboteurs trying to disrupt shipments of critical arms and ammunition to Ukraine. Confirmation that the fire was an act of sabotage has prompted a call for similar incidents to be re-investigated for any link to Russia. Of course, such aggressive Russian attacks on NATO soil run the risk of worsening NATO-Russia tensions going forward.

Russia: Terrorists yesterday attacked a synagogue, two churches, and a police station in the restive North Caucasus republic of Dagestan, killing four civilians and 15 police officers. The attacks suggest Islamist militants could be taking advantage as the Kremlin shifts its attention and resources to the war in Ukraine and the fight to control political dissent.

US Cybersecurity: The cyberattack on auto dealership software provider CDK Global that started last week continued through the weekend, disrupting dealership business. Statements from CDK Global suggest the attack involved ransomware, in which the attackers shut down a system until a ransom is paid. The attack illustrates how specialized software for particular types of businesses have the potential to shut down large swaths of an industry.

Asset Allocation Bi-Weekly – Small Caps and the Hope for a Soft Landing (June 24, 2024)

by the Asset Allocation Committee | PDF

They don’t call him Maestro for nothing. In the mid-1990s, Federal Reserve Chair Alan Greenspan achieved what was once thought of as impossible: an economic soft landing. As the US labor market showed signs of tightening, he raised interest rates from 3% to 6% in 1994 to preemptively combat inflation. In 1995, he lowered rates strategically to avoid a recession. The seamless transition from a tightening cycle to an easing cycle led some to believe the Fed could pull the strings in the economy in a way that could both prevent a recession and tame runaway inflation.

The market took notice. Greenspan’s policies helped quell investor anxieties about a repeat of the inflationary surges that plagued the 1970s and early 1980s. Emboldened by this newfound confidence, investors poured money into smaller, unproven companies with strong earnings growth potential. This sentiment was epitomized in 1995, when tech guru Marc Andreessen and his partner Jim Clark did the unthinkable by taking their company, Netscape, public before it had turned a profit, paving the way for what is now viewed as the dot-com bubble.

Today’s elevated interest rate environment has sparked nostalgia for another soft landing. Eager for a repeat of Greenspan’s success, investors were waiting for a decline in rates to re-enter the market. However, their hopes were dashed in June 2023. Not only did Fed policymakers raise rates following the collapse of Silicon Valley Bank, but they also signaled their intention for two additional hikes that year. This spooked markets as investors were concerned that the central bank may keep rates high for long enough to tank the economy.

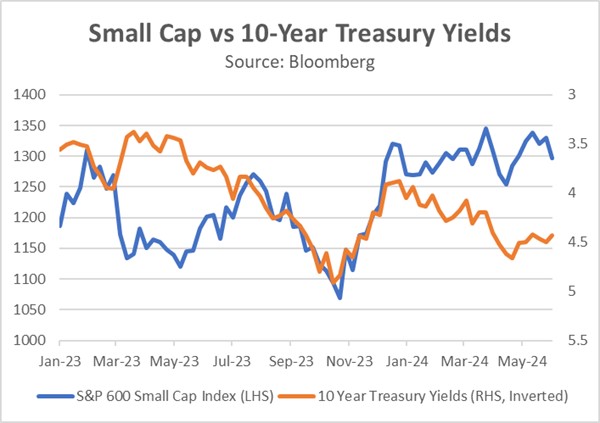

This commitment to raising interest rates discouraged investors from holding riskier assets, particularly those with floating rate exposure. Further pressuring the market were concerns about the rising national debt, which prompted Fitch to downgrade the US credit rating. Investors responded by offloading riskier assets within their portfolios. As a result, the 10-year Treasury yield soared to approximately 5%, a level not seen in over two decades, while the S&P SmallCap 600 Index plummeted to a nine-month low.

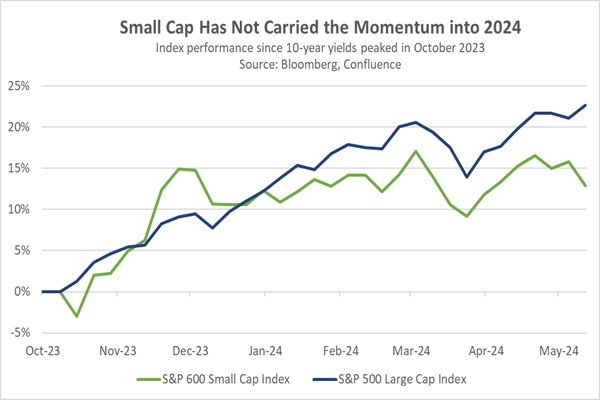

The tide began to turn in late October of last year. The US Treasury’s reallocation of bond issuance toward shorter maturities, coupled with Fed officials signaling an indefinite pause in rate hikes, significantly impacted market sentiment. Investors piled into longer-term bonds and risk assets in anticipation of the Fed’s next move, positioning themselves for an imminent rate cut, which they thought could take place in the first quarter of 2024. From October to December, the S&P SmallCap 600 Index outperformed the S&P 500, with a return of 21.5% compared to 13.7%, respectively.

Unfortunately, the early strength of small caps faded quickly as the S&P 500 recaptured its leadership position at the beginning of 2024. This new weakness in small caps stemmed from concerns that the Fed wouldn’t cut interest rates as deeply as the market anticipated, following a series of strong Consumer Price Index reports in the first quarter and a persistently tight labor market. This situation led investors to reduce their holdings of longer-term Treasurys and refocus on large cap companies due to their relatively strong earnings potential and resilience to changes in financial conditions.

In fact, recognizing this trend early on prompted us to take action in the second quarter. We strategically reduced our exposure to small cap stocks within the conservative portfolios of our Asset Allocation program. This decision also reflected our growing concern that small cap stocks may face longer-term challenges due to certain structural market factors, including the rising popularity of passive funds that funnel money into large cap stocks and the increasing ability of private equity firms to acquire the most promising small cap startups. Hence, an emphasis on quality while screening for indicators such as profitability, leverage, and cash flow should mitigate some of these factors.

Currently, the S&P SmallCap 600 Index has been in a holding pattern as investors await signals regarding the Fed’s next policy move. Should Chair Powell manage to orchestrate another soft landing in the coming months, it could attract investors back to small cap stocks. With the current multiples for the S&P 500 outpacing those of the S&P SmallCap 600 by the widest margin since the dot-com era, small cap stocks present appealing valuations compared to their larger counterparts. With that in mind, we think small cap stock values could rebound in the coming months if US economic growth remains healthy and both inflation and interest rates fall.

Daily Comment (June 21, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Equity futures are holding steady as investors wait for fresh economic data to guide their next move. On the sports front, Argentina emerged victorious against Canada with a 2-0 win, setting the stage for the Copa América. Today’s Comment dives into three key topics: the persistently low bond yields, the recent restrictions on Chinese electric vehicle imports, and the performance of banks. We’ll wrap up the report with a look ahead to today’s domestic and international data releases.

Bonds are Back: Bond investors continue to doubt whether the Fed will hold rates steady as the economy continues to show signs of slowing.

- The yield on the 10-year US Treasury note remains stubbornly low, closing below 4.3% for the tenth consecutive day on Thursday. This defies expectations given several headwinds: the Fed’s recent shift towards fewer rate cuts, stubbornly high inflation, and a ballooning Treasury supply. Investor demand for bonds seems fueled by a confluence of factors. One is the hope that inflation will continue to cool in the coming months. Additionally, economic uncertainty is driving a flight to safety, pushing investors towards the perceived security of Treasurys. Finally, a string of weak economic data has reinforced the cautious market sentiment.

- The Fed’s recent slowdown in quantitative tightening, from $60 billion to $25 billion a month, might also be contributing to the decline in bond yields. This shift in policy suggests a less aggressive approach to draining liquidity from the financial system, potentially making long-duration assets more attractive to investors. While the two-year quantitative tightening program nears its final phase, the Fed plans to use the reduced pace of balance sheet reduction to ensure a smooth transition from abundant liquidity to ample liquidity. Phasing out this program will likely ease pressure on bond yields and provide support for stocks.

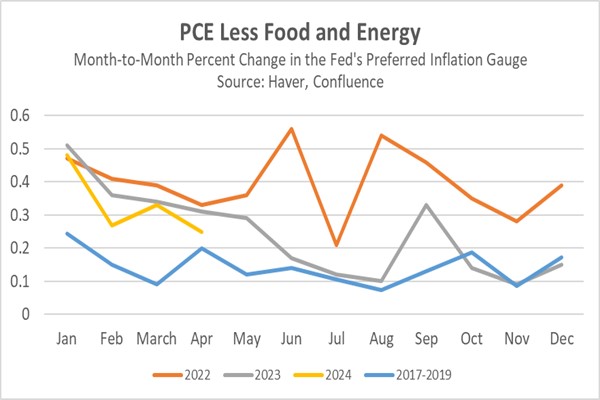

- However, further declines in Treasury yields are unlikely in the short term without clear signs of inflation subsiding. The Fed’s May decision to accelerate balance sheet reduction reflects its confidence in remaining patient as inflation pressures ease. Notably, the core PCE price index, the Fed’s preferred inflation measure, has shown a slower pace of increase in the first four months of this year compared to 2022 and 2023. For sustained confidence in inflation’s retreat, the index should continue this trend and align with pre-pandemic levels over the next three months.

The West’s EV Problem: Tensions escalate in the West-China trade dispute as Canada joins the fray.

- Canada is considering raising tariffs on electric vehicles (EVs) imported from China. This move aligns with similar actions taken by its allies such as the United States and the European Union. The concern is that China’s rapid growth in EV production could harm domestic auto industries. Earlier in 2024, the US significantly increased tariffs on Chinese EVs to 102.5%, while the EU implemented tariffs as high as 38% on specific vehicles. Canada, with its current 6% tariff, is exploring raising it to match the approach of its partners. However, a final decision on Canadian tariffs remains pending.

- The proposed tariff increase on Chinese electric vehicles comes as the Western green industry faces challenges. Weak domestic demand is hindering growth, as evidenced by EV startup Fisker’s recent bankruptcy after halting production. At the same, Tesla’s stock price also reflects these difficulties, dropping nearly 27% this year following its announcement of a tough industry outlook. Europe shares these struggles, with a particularly sharp decline in Germany. Last month, EV sales in the Continent’s largest economy plunged by 30%, while the broader European market saw a 12.5% drop.

- The fight for leadership in green technology shows no signs of slowing down, even though Western nations face challenges in attracting consumers to some eco-friendly products. Affordability appears to be the biggest hurdle, with electric vehicles remaining out of reach for many households and governments becoming more selective when offering subsidies. Tariffs on Chinese EVs might not be the silver bullet. While they could limit Western sales, they might also boost demand in emerging markets. In the meantime, Western governments may need to acknowledge that consumers are not yet fully prepared to abandon their gas-powered vehicles.

Higher-for-Longer and Banks: Banks in the US and abroad are facing headwinds as they struggle to attract deposits and protect their balance sheets, but there are no signs of a crisis.

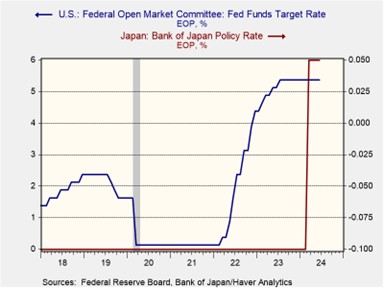

- Japan’s regional banks are facing increased scrutiny as interest rates rise. Moody’s rating agency warned last month that higher rates could lead to capital flight, potentially harming these banks. Similarly, S&P Global expressed concerns earlier this month that rising rates could pressure the capital ratios of regional banks, especially those with high buffers. This isn’t a solely Japanese issue. US banks are also under the microscope. Moody’s recently placed several American banks on watch for downgrades due to their exposure to the potentially risky commercial real estate market.

- The threat to bank profitability appears likely to persist as long as interest rates remain high. This current rate cycle has negatively impacted bank balance sheets, putting pressure on some major institutions. For example, Norinchukin Bank, a Japanese agricultural lender, announced it would unload $63 billion in low-yielding US and European government bonds. This move aims to stem losses following an unsuccessful gamble on falling interest rates. In contrast, US banks have been increasing their holdings of short-term, floating-rate collateralized mortgage obligations (CMO) backed by Ginnie Mae. This strategy aims to protect themselves from potential deposit flight if interest rates continue to rise, but exposes the banks if rates fall significantly as it could lead to a wave of refinancing.

- While rising interest rates pose challenges for the financial system, there aren’t immediate signs of a crisis. This can be maintained if central banks prioritize clear and open communication about their interest rate expectations. Additionally, banks must avoid excessive risk by not over-committing to specific forecasts on Federal Reserve decisions. The pandemic highlighted the dangers of banks relying too heavily on, or outright contradicting, Fed guidance. This approach may be viable in a stable environment, but it becomes riskier during periods of high inflation volatility and geopolitical uncertainty.

In Other News: Purchasing Managers Index (PMI) surveys suggest European economies are not as robust as previously thought. This could fuel expectations of further rate cuts from the ECB. US car companies face challenges from cyberattacks, highlighting the need for further investment in cybersecurity. The Philippines’ undisclosed reinforcement of a ship in the South China Sea could lead to heightened tensions with China.

Daily Comment (June 20, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Equities are starting the day strong despite another round of disappointing economic data. In sports, Texas A&M dominated Florida, bringing them closer to clinching the College World Series title. Today’s Comment will explore why Nvidia’s momentum may wane, discuss the renewed investor interest in the US dollar, and explain the latest rate decision from the Bank of England. As always, we conclude with a roundup of international and domestic news.

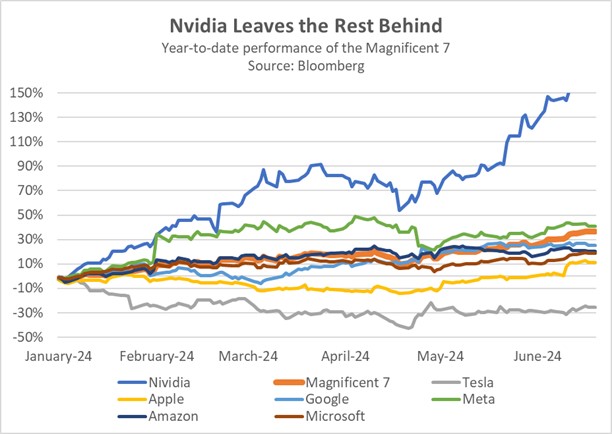

Hype Keeps Growing: Nvidia’s stock price keeps climbing, but there’s growing worry that the current enthusiasm might not be sustainable.

- The US chip designer overtook Microsoft as the world’s most valuable company on Tuesday. This rise is fueled by the ongoing excitement surrounding artificial intelligence (AI), which continues to captivate investors. The company’s recent strong performance is partly due to its decision to split its stock 10-to-1. This move made the shares more affordable for retail investors, increasing their accessibility. Nvidia sits at the forefront of the AI revolution, controlling an estimated 80% of the market for AI-specific chips. This takeover marks a historic shift, with the top spot last held by a non-Microsoft or Apple company being claimed by Cisco in 2000.

- While Nvidia’s stock soars, the momentum has not carried over to other AI-related stocks. Nearly 60% of the companies within the S&P 500 have seen gains this year, while more than half the stocks in Citi’s “AI Winners Basket” have seen a decline. The problem may be related to valuation. The “Magnificent Seven,” a group of prominent tech companies, trade at a significant premium compared to their large-cap peers. Their average price-to-equity ratio is a hefty 36.6, compared to 21.6 for the S&P 500 when those seven stocks are excluded.

- AI’s rising popularity is being met with increasing regulatory hurdles. The US is taking further steps to curb China’s chipmaking capabilities by limiting access to advanced chips. This week, a White House official will meet with counterparts from Japan and the Netherlands to discuss stricter chip export restrictions to China. Domestically, US antitrust watchdog and FTC Chair Lina Khan has announced her intentions to prevent large tech firms, particularly in the AI space, from further expansion. Earlier this year, she blocked the proposed Nvidia-ARM merger, which would have been the largest ever in the semiconductor industry, citing concerns that it would stifle innovation.

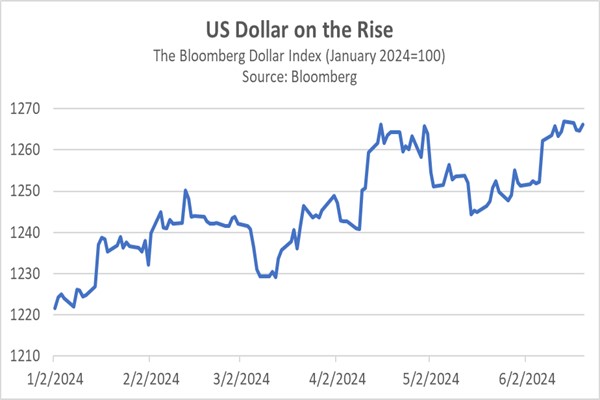

The Dollar Comeback: The Bloomberg Dollar Spot Index is on the verge of setting a new high for the year as investors view the US currency as being safer than its European counterpart.

- The US dollar has risen sharply since May. Investors are seeking the greenback due to rising uncertainty in the eurozone. Earlier this month, the European Central Bank cut its benchmark policy rates by 25 basis points, despite signs that inflation might be about to resurge. Meanwhile, the Federal Reserve surprised markets with a hawkish turn, despite evidence suggesting that inflationary pressures are easing. These contrasting policy moves have widened interest rate differentials, as investors rotate out of European bonds and into US Treasurys, in a sign that they are growing confident in America’s ability to control inflation.

- Political uncertainty has bolstered the US dollar, with French elections set to take place in 10 days. There is widespread concern that populist parties will win a significant number of seats, which is fueled by the rising popularity of the National Rally party and a potential coalition of left-wing populist movements that could gain control of parliament. Although French President Emmanuel Macron’s position is not on the ballot, the election may act as a referendum on his presidency, potentially rendering him a lame duck if his party suffers a serious defeat. A populist victory could see a slowdown or even a reversal of some of his pro-market reforms.

- Although the dollar has some momentum, concerns over US growth could prevent it from a breakout. The latest retail sales data suggests that consumers are starting to become price sensitive, while the labor market has shown signs of cooling. This weakness may lead investors to price in another rate cut for the year, rather than just the one that the Fed outlined in its summary of economic projections. Additionally, a less disruptive than expected election outcome could entice investors back to European markets. Consequently, the dollar may enter a holding pattern in the coming weeks as investors seek greater clarity.

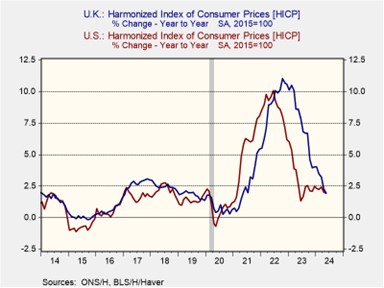

No Action in the UK: The Bank of England held rates steady at its latest meeting despite inflation falling to target in May.

- The BOE kept its key policy rate at a 16-year high of 5.25%. The decision not to move was not unanimous, as two members of the committee voted in favor of a cut. While inflation did return to 2% in May, policymakers signaled concerns that service inflation and wage pressures remained a problem and could hinder the central bank’s target of maintaining price stability, while others showed that elevated components of the reports were likely temporary. That said, the committee seems to be satisfied with the level of inflation progress.

- The BOE’s cautious approach mirrors the Fed’s latest decision from earlier this month. Both central banks expressed concerns about a potential resurgence of inflation in the second half of the year during their explanations for their recent actions. The BOE’s meeting minutes stated that they believe price pressures may rise later in the year as energy prices stop acting as a drag on the inflation index. Meanwhile, Fed Chair Jerome Powell argued that the rollover impact of the core PCE price index could also cause the Fed’s preferred inflation measure to increase due to these temporary effects. However, both central banks maintained that a cut is still likely this year.

- The possibility of rate cuts in late summer or early fall remains on the table for both the BOE and the Fed. The chart above shows that when inflation is adjusted for comparison with other countries (harmonized inflation), UK inflation is roughly in line with US inflation. However, it’s important to note that recent declines are largely due to falling energy prices, which may not reflect the underlying trend in other parts of the economy. Reflecting this concern, the Bank of England may consider a cut in August, while the Federal Reserve will likely wait for data releases, particularly inflation reports from July and August, before deciding on a September rate cut.

In Other News: In a move to counter isolation by the US, Russia signed a mutual defense treaty with North Korea. This highlights Russia’s efforts to forge alliances with countries opposing the West, potentially to bolster its war effort in Ukraine. Meanwhile, Dutch Prime Minister Mark Rutte was selected as the new head of NATO, and his seamless transition will likely help the military alliance maintain unity as it looks to take on threats from Russia and China.

Daily Comment (June 18, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Note: There will be no Daily Comment tomorrow due to the holiday.

Our Comment today opens with a new World Gold Council survey showing global central banks are likely to keep buying large amounts of gold, supporting prices for the yellow metal. We next review several other international and US developments with the potential to affect the financial markets today, including unexpected business support for the far-right party ahead of France’s June 30 parliamentary election and several notes on US political and economic developments.

Global Gold Market: According to a new World Gold Council survey, 81% of central bankers think reserve managers will continue to increase their gold holdings in the coming year. That share is the highest since the group’s 2019 survey and reflects growing interest in gold reserves as a hedge against geopolitical and economic risks and as a source of good investment performance. The figures are consistent with our positive outlook on gold and our view that central bank buying is more than offsetting the headwinds from high interest rates.

China: In its latest review of global nuclear arsenals, the Stockholm International Peace Research Institute (SIPRI) highlighted how China is now expanding its arsenal of nuclear weapons faster than any other country. According to SIPRI, China built some 90 new nuclear warheads last year, bringing its total arsenal to 500. It is also rapidly expanding its fleet of intercontinental ballistic missiles to deliver those warheads, and it may have started deploying its weapons at a higher state of readiness.

- The SIPRI figures regarding China’s growing arsenal are consistent with the estimates we made in our Bi-Weekly Asset Allocation Report from April 15, 2024, where we attempted to calculate the incremental global demand for uranium related to weapons.

- Not only is China’s rapid nuclear buildup an unheralded reason for the recent jump in spot uranium prices, but it is also likely to intensify tensions between China and the West. As more Western leaders and voters come to appreciate the growing nuclear threat from China, we think there is a good chance that they will push for stronger defense spending.

China-Philippines: The Chinese government yesterday accused the Philippines of trying to deliver construction materials to the Sierra Madre, a Philippine navy ship grounded on a disputed shoal in the South China Sea to assert Manila’s claims to the area. In turn, Manila denied the accusation and said a Chinese coast guard ship rammed a Philippine vessel during the incident. The worsening Chinese-Philippine tensions remain a key risk for investors, as discussed in our Mid-Year Geopolitical Outlook, published yesterday.

France: As the June 30 parliamentary elections draw closer, business leaders are racing to embrace the surging far-right National Rally (RN), both to express their support and to influence the party. The development is a reaction against the far-left New Popular Front (NFP), which has issued a radical tax-and-spend agenda and is RN’s main competitor in the race.

US Foreign Policy: In a new poll by the Ronald Reagan Institute, 54% of respondents said US leaders should be more involved in international affairs, up from only about 40% in each of the previous three years. The share saying the US should be less engaged internationally remained at 33%, close to where it has been for the last several years.

- We continue to believe US voters have become weary of the costs of global hegemony over the last decade and a half, leading to increased populism, isolationism, and “America First” attitudes. One key question is whether those attitudes will continue to strengthen and ultimately force the US to give up its global leadership role, or whether the resulting challenge from China/Russia geopolitical bloc will spur a recommitment to international engagement.

- Now that US hesitation on the global stage has encouraged the authoritarian states of the China/Russia bloc to become more assertive, the Reagan Institute poll suggests US voters may indeed be embracing a stronger international stance again. If so, it will likely lead to even more tensions between the US bloc and the China/Russia bloc, as well as continued increases in US defense spending.

US Immigration Policy: President Biden has announced a new program that will give legal status to the spouses of US citizens who are in the country illegally, provided that they have been in the US for at least a decade and meet other criteria. The program is expected to help up to several hundred thousand people get work permits, deportation protection, and a path to citizenship. The announcement comes just two weeks after the president imposed a blanket ban on illegal immigrants claiming asylum after crossing the southern border.

- The apparently contradictory goals of the spousal program and the blanket asylum ban reflect the contradictory political and economic environment for immigration policy.

- Politically, large numbers of Americans want the government to clamp down on the flow of new immigrants and the lack of control over migration at the southern border, but there are still many in Biden’s Democratic Party base who prioritize immigrant rights and the ability of immigrants to bring family members to the US.

- Economically, as we mentioned in our Bi-Weekly Geopolitical Report from May 20, 2024, the post-pandemic labor shortages, especially in lower-skilled jobs, have been an important driver of consumer price inflation. Giving more immigrants the right to work would likely help fill those labor shortages and cap wage rates, bringing down price pressures.

US Apartment Market: While overall apartment rental rates in the US are nearly unchanged from the previous year, new data shows a surprising upswing in rents outside the Sunbelt. Brokers and property owners say the rent hikes in places such as Kansas City and Washington, DC, reflect a dearth of new supply and renters’ inability to buy a home because of sky-high prices and elevated interest rates.

- The figures suggest US rents have already reached a bottom and may be turning up again. Since apartment rents have a big weight in the key gauges of consumer price inflation, any upswing in rents could keep inflation from falling to the Federal Reserve’s target.

- In turn, that would likely force the Fed to keep interest rates higher for longer.

US Electric Vehicle Market: The number of US electric-vehicle startups that have filed for bankruptcy has now risen to three after Fisker threw in the towel yesterday. Fisker’s filing follows the earlier bankruptcies of truck maker Lordstown Motors and bus maker Arrival. While press reports indicate the failures stemmed largely from operational and financial problems specific to the failed companies, they also reflect unexpectedly soft demand for EVs in the US market.

Bi-Weekly Geopolitical Podcast – #49 “Mid-Year Geopolitical Outlook: Uncertainty Reigns” (Posted 6/17/24)

Bi-Weekly Geopolitical Report – Mid-Year Geopolitical Outlook: Uncertainty Reigns (June 17, 2024)

by Patrick Fearon-Hernandez, CFA, Thomas Wash, Daniel Ortwerth, CFA, and Bill O-Grady | PDF

As the first half draws to a close, we typically update our geopolitical outlook for the remainder of the year. This report is less a series of predictions as it is a list of potential geopolitical issues that we believe will dominate the international landscape for the rest of the year. The report is not designed to be exhaustive. Rather, it focuses on the “big picture” conditions that we think will affect policy and markets going forward. We have subtitled this report “Uncertainty Reigns” to reflect the fact that chaos and unpredictability have become entrenched as the post-Cold War era of globalization gives way to a new period of Great Power competition. Our issues are listed in order of importance.

Issue #1: China – South China Sea

Issue #2: Russia-Ukraine-NATO

Issue #3: Israel-Hamas-Iran

Issue #4: The US Elections

Issue #5: US Defense Rebuilding

Issue #6: Global Monetary Policy

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Daily Comment (June 17, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

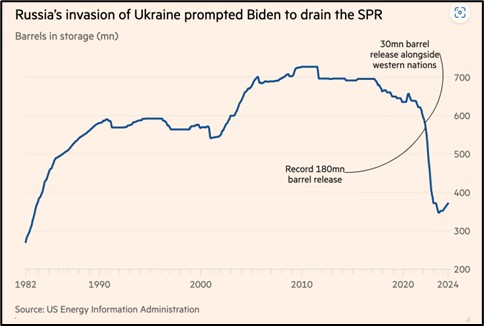

Our Comment today opens with new data confirming the growth of US and European defense businesses as global military budgets rise. We next review several other international and US developments that could affect the financial markets today, including more evidence of a potential trade war between China and the European Union and signs that the Biden administration may release more oil from the Strategic Petroleum Reserve to hold down US gasoline costs ahead of the November elections.

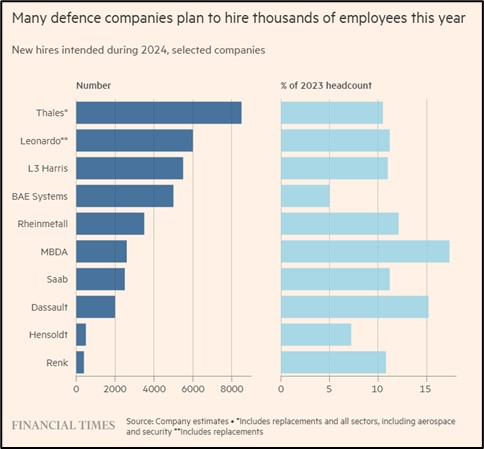

Global Defense Industry: New research by the Financial Times shows top US and European defense contractors have tens of thousands of job openings and are trying to hire at the strongest pace since the Cold War. Based on a survey of top defense firms, the data shows that the companies are looking to boost their workforces by about 10%. The figures are consistent with our oft-stated belief that global defense spending is likely to rise persistently in the coming years in response to the growing tensions between the US and China/Russia geopolitical blocs.

European Union: The leaders of the 27 members of the EU today are expected to endorse Ursula von der Leyen for a second term as president of the European Commission, the region’s executive body. Although some EU leaders had floated other names (including Mario Draghi, the former chief of the European Central Bank), they have apparently decided to prioritize stability and von der Leyen’s tough approach to foreign affairs.

- If approved at a more formal meeting of the EU leaders in the coming weeks, von der Leyen would also have to be approved by a simple majority of the newly elected European Parliament.

- If von der Leyen is successfully installed for a second term, a key implication is that the EU would continue to toughen its approach to Chinese economic predations and boost its defenses against the rising threat from Russia.

China-European Union: Beijing yesterday said it is probing whether the EU has dumped pork products on the Chinese market at unfairly low prices. The antidumping investigation is widely seen as retaliation for the EU’s recent probe and imposition of antidumping tariffs against Chinese electric vehicles. The Chinese probe is designed to put maximum political pressure on Brussels, as any tariffs against EU pork products would disproportionately hurt influential farmers in countries such as Belgium, the Netherlands, Denmark, Germany, and Spain.

China-Australia: In a new sign of the rebounding China-Australia relationship, Australia’s total trade with China (the value of exports plus imports) rose to a record $125 billion in 2023, beating the pre-pandemic record of about $112 billion in 2019. China had imposed strict barriers against key Australian exports from 2020 to 2022 in retaliation against Canberra’s call for a probe into China’s role in the coronavirus pandemic. Over the last year, however, Beijing has loosened those restrictions, giving a boost to Australian exports and economic activity.

China-Philippines: On Saturday, the Chinese government again accused the Philippines of provocative activity in the South China Sea, after Manila sent coast guard boats on Friday to land at islets in the area that are claimed by Beijing but internationally recognized as part of the Philippines. The new accusation came just a day before the start of a new Beijing rule allowing the Chinese coast guard to detain foreigners and their vessels that stray into the disputed areas.

- As we note in our “Mid-Year Geopolitical Outlook,” due to be released later today, the growing Chinese-Philippine tensions represent what is perhaps the world’s most dangerous confrontation through the rest of 2024. Although we don’t necessarily think the two sides will come to blows, there is an elevated chance that they could.

- If China and the Philippines do come to blows, the US-Philippine mutual defense treaty could force the US to come to Manila’s aid, leading to a direct US-China conflict.

China: May new home prices were down 4.3% from the same month one year earlier, versus a 3.5% decline in the year to April. The value of home sales in January through May were down a whopping 30.5% year-over-year, reflecting both weaker prices and reduced transactions. Even though some homebuilders have seen an uptick in sales over the last couple of months because of the government’s new program to ease mortgage rules and support home purchases, the data shows that the key property sector remains a major drag on Chinese economic growth.

Israel: Following the resignations of centrist politicians Benny Gantz and Gadi Eisenkot last week, Prime Minister Netanyahu has dissolved the unity war cabinet he formed after Hamas’s October 7 attack on Israel. The move does nothing to undermine Netanyahu’s power, but it could mean that Israel’s war against Hamas will be prosecuted without the input of more moderate voices. In turn, that could potentially lead to a longer, more intense conflict that might further isolate Israel politically and weigh on its economy and financial markets.

Russia-United States: The Kremlin announced the espionage trial of Wall Street Journal reporter Evan Gershkovich will be held in secret, beginning next week. The US government and the newspaper vehemently deny that Gershkovich was involved in spying, so the secret proceedings are likely to further strain ties between Russia and the US going forward.

US Corporate Governance: Days after Tesla shareholders approved a $56-billion pay package for CEO Elon Musk, new data shows the median pay for CEOs in S&P 500 companies in the first four months of 2024 was up some 14% from the same period one year earlier. That compares with an average increase of 4.1% for the average worker. That disparity could help explain the increasing concern about US income inequality and the rise of populism.

US Energy Policy: Amos Hochstein, President Biden’s top energy advisor, said the president would release more oil from the Strategic Petroleum Reserve to cap any surge in gasoline prices during the summer driving season. Such a move would be on top of the massive oil releases Biden already ordered in 2021 and 2022, as prices began to rise following the pandemic and Russia’s invasion of Ukraine. Such a move would also be further evidence that presidents facing re-election will try to curry favor with voters by bringing down energy costs.