by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the aftermath of Israel’s airstrikes on Iran over the weekend. The bottom line is that both countries are showing signs of restraint, which has reduced the risk of a broader regional conflict and therefore pushed global energy prices down so far today. We next review several other international and US developments with the potential to affect the financial markets today, including an electoral loss for Japan’s ruling party and a new US directive to focus on artificial intelligence in the military.

Israel-Iran: Over the weekend, Israel launched a large number of airstrikes against Iran to retaliate for Tehran’s big missile attack on October 1. However, all reports suggest both the Israelis and the Iranians are pulling their punches and trying to avoid escalating the conflict. For example, the Israelis only targeted military-related facilities, and reports say Tel Aviv secretly warned Iran of the upcoming strikes via intermediary countries. Meanwhile, Iranian officials have avoided dramatizing the strikes and took care not to threaten a near-term response.

- For now, it appears Israel and Iran will keep a lid on their confrontation. That should help reduce the risk of the conflict widening into a regional war. For example, if Israel would have attacked Iran’s oil or nuclear infrastructure, Tehran might well have retaliated by striking Saudi Arabia’s oil facilities, disrupting global energy supplies, and forcing Riyadh to strike back. So far today, global oil prices are down about 5.5%.

- Despite Israel’s discipline in the attacks over the weekend, they probably weren’t inconsequential. Some reporting suggests that by striking Iran’s missile production facilities, Israel has crimped Iran’s ability to produce new replacement missiles, which could discourage it from launching new large-scale attacks against Israel.

European Union: Reports today say automaker Volkswagen plans to shut at least three German plants, eliminate tens of thousands of jobs, and slash pay by 10%. In response, the company’s worker council has hinted that union workers might strike. The downsizing and labor woes reflect the firm’s struggles as it faces intense competition in China, slowing sales across other major markets, and a costly transition to making electric vehicles — challenges faced by auto companies across the EU.

France: Moody’s Ratings today affirmed France’s sovereign bond rating of Aa2 but cut its outlook from stable to negative. The lowered outlook reflects the splintered government’s likely inability to meaningfully cut its budget deficit in the near term. The move is consistent with other recent rating actions and economic forecast cuts by private economists. Nevertheless, the action today has had no apparent effect on the spread between French and German bonds.

United Kingdom: New data shows the fertility rate in England and Wales fell to just 1.44 births over the lifetime of the average woman in 2023, the lowest since record keeping began in 1938 and far below the 2.10 rate that is considered necessary for a stable population with no immigration. The new figure points to further population aging in the UK in the coming years, which will probably put upward pressure on government spending and debt.

Georgia: In national elections on Saturday, officials said the Caucasus country’s Russia-aligned ruling party Georgia Dream came in first with 54.2% of the vote. The results came amid multiple reports of voting irregularities and voter intimidation, following weeks of reported interference by Russia, which wants to keep the country from joining the European Union. The losing opposition parties have called for protests later today.

Japan: In national elections yesterday, the ruling Liberal Democratic Party and its much smaller coalition partner Komeito lost their parliamentary majority, winning just 215 of the 465 seats in the Diet. Since the result was much worse than anticipated for the ruling coalition, Prime Minister Ishiba is widely expected to resign in the coming days. Japan is therefore likely to enter a period of political instability, which we suspect will be negative in the short-term for Japan’s economy, stocks, and currency.

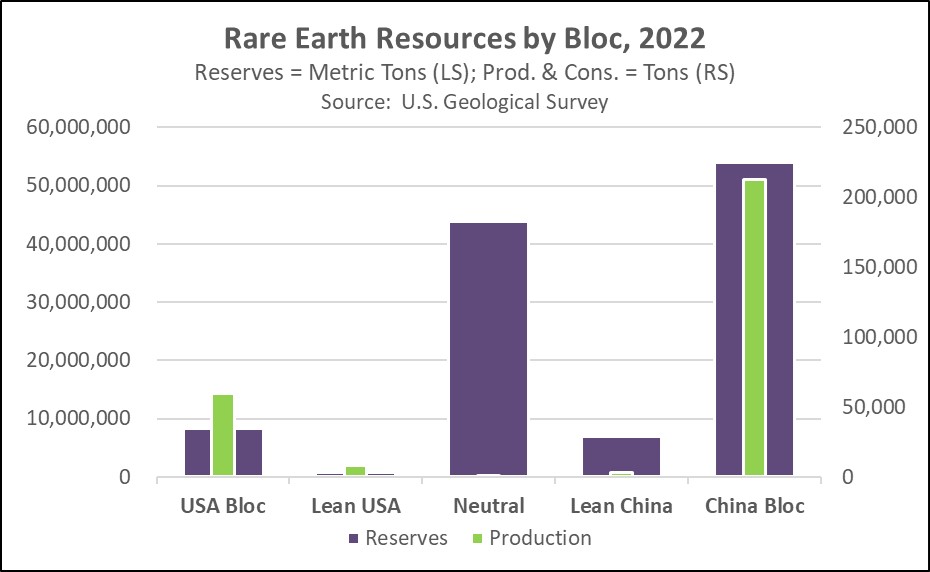

Chinese Rare Earths Industry: According to the New York Times, the last two foreign-owned rare earth refineries in China have been acquired by state-owned companies, giving Beijing even greater control over the exotic minerals that are key to technologies such as advanced semiconductors and electric vehicles. Beijing’s acquisition of the refineries comes as it also tightens restrictions on the export of gallium, germanium, antimony, and other rare earths.

- Most of the world’s commercially viable rare earth resources are in China and the rest of its geopolitical and economic bloc. Not only does that include reserves in the ground, but also production and refining capacity.

- Separately, a new report from Benchmark Mineral Intelligence warns that Chinese companies now control about two-thirds of the cobalt resources in the Democratic Republic of the Congo, which produces about 74% of the global cobalt supply. Cobalt is also a key mineral for the electrification of the global economy.

- As the US-China geopolitical rivalry intensifies over time, we continue to believe that China will increasingly weaponize its control over rare earths, cobalt, and other key mineral resources. By cutting off access to these minerals, Beijing would hope to crimp the West’s economy and drive up prices.

Chinese Demographics: New data from the Ministry of Education shows that the number of operating kindergartens in the country fell by 5.1% in 2023, while the number of enrolled students fell by 11.6%. That marks the third straight year of declining kindergarten enrollment, reflecting China’s low birthrate and the demographic threat to its economic growth going forward.

US Military: The Biden administration issued a directive late last week prioritizing defense-related artificial-intelligence projects. The directive illustrates how information processing and other advanced technologies are increasingly critical to maintaining US military dominance. The directive could also spur even greater government and industry investment in AI projects going forward.

US Immigration Policy: With just eight days to go until the elections and much of the presidential candidates’ rhetoric touching on immigration, the Los Angeles Times last week carried a useful primer on how former President Trump might approach his promise to deport millions of illegal immigrants if he were elected. The article highlights the legal and logistical challenges to mass deportation, as well as the risk that US citizens would be caught up in the program. Another risk could be a disruption to labor supply in certain industries.