by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the new US trade deals with Japan, Indonesia, and the Philippines, which were announced late yesterday. We next review several other international and US developments with the potential to affect the financial markets today, including several news items related to European security issues and an industry official’s suggestion that the US should start to develop a strategic reserve of critical minerals.

US Trade Policy: President Trump last night said the US and Japan have agreed to a trade deal in which the US will set a 15% tariff on Japanese imports (including autos), the Japanese will open to trade including cars and trucks, rice and other agricultural products, and Japanese entities will invest $550 billion in the US, with the US receiving 90% of the profits from those investments. However, it isn’t clear whether Japan will be spared Trump’s “sectoral” tariffs of 50% on imported steel and aluminum products.

- Separately, Trump also said Indonesia has agreed to a framework deal in which the US will set a 19% tariff against most Indonesian imports, with a 40% rate charged on goods from Indonesia with a high level of foreign content, especially from China. Indonesia will eliminate almost all tariffs on US goods, supply the US with critical minerals, and buy billions of dollars of US airliners, farm products, and energy goods.

- Trump also said Manila has accepted a trade deal in which the US will impose a 19% tariff on Philippine imports while US goods will enter the Philippines tariff-free.

- On the heels of the news, the S&P 500 stock price index rose to a new record high, likely on investor relief that the US tariffs are coming in near the levels expected and provide some hope for an end to the recent uncertainty regarding trade policy.

- Still, looking forward, it’s not clear how successful Trump’s trade policy will be in promoting US re-industrialization and improving the lot of his working-class base. His tariffs and other policies will likely encourage added investment in some US industrial sectors, but in other sectors, domestic and foreign firms will probably continue to prefer investing abroad for structural reasons, such as the availability of low-cost workers, better supply chains, production expertise, or the opportunity to produce close to customers.

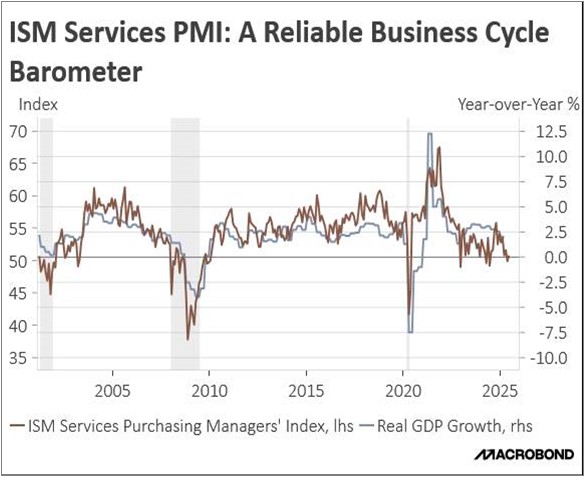

Asia-Pacific Region: The Asian Development Bank today again lowered its economic growth forecasts for member countries, citing the US’s evolving high-tariff policy. The institution said it now expects the developing countries of Asia — including China, India, and South Korea — to see their gross domestic product growth to slow from 5.1% in 2024 to just 4.7% in 2025 and 4.6% in 2026. The forecasts are consistent with expectations that the new US tariffs will be especially challenging for emerging markets.

Japan: With the US-Japan trade deal prompting investors to shift their buying to equities, and with some starting to bet that Prime Minister Ishiba will now resign, today’s auction of 40-year Japanese government bonds (JGB) generated extremely weak demand. Indeed, its bid-to-cover ratio came in at just 2.127, marking the lowest ratio for a 40-year auction since 2011. In response, yields on 10-year JGBs today have rebounded to the 17-year high of 1.597% reached last week.

Germany-France-Spain: In a key test of Europe’s re-armament effort, the leaders of Germany and France today are meeting today to settle a dispute over which country should lead the effort to build a joint German-French-Spanish fighter jet. The project, known as the Future Air Combat System (FACS), could be important to the fortunes of European defense contractors such as Airbus and Dassault, but it is in danger of being further delayed by the leadership dispute.

United Kingdom-Germany-Turkey: Berlin today reportedly approved the UK’s sale to Turkey of up to 40 Eurofighter Typhoon fighter jets, Europe’s current joint fighter that is produced by the UK, Germany, Spain, and Italy. We expect that Europe’s re-armament effort will continue to boost sales for firms in the Eurofighter program until the FACS program begins production.

Russia-Germany: In an interview this week, Berlin’s military counterintelligence chief warned that Russian spying and sabotage efforts in Germany in the first half of 2025 have doubled from 2024. Strikingly, she said Russian operatives have even been able to sabotage German navy ships by cutting cables, putting oil in water systems, and dropping metal shrapnel into a motor drive train. The incidents illustrate President Putin’s aggressive, risk-tolerant stance toward European democracies, which we think will fuel continued rearmament in the West.

Russia: According to Ukrainian intelligence, the Russian defense industry can now produce 170 large Shahed-class strike drones per day. The analysis says Russia’s increased production is allowing it to stage large-scale drone attacks on Ukraine with ever-greater frequency and will soon let it launch 2,000 or more drones in a single attack. As we have noted previously, Russia’s frequent drone-swarm attacks are a key reason why its forces have recently accelerated their territorial gains in their invasion of Ukraine.

- While Russia and other countries ramp up their output of cutting-edge drones, making the weapons perhaps the most dominant part of the modern battlefield, a video this week illustrates how behind-the-curve the US effort is.

- In the video, the US Army touts a new ability to drop hand grenades from small drones that have been modified to pull the safety pin from the weapons before dropping them. The video, which celebrated the Army’s first-ever drop of ordinance from a drone, was widely panned for how minor the accomplishment was in comparison to the advanced drones being developed by Russia, Ukraine, and other countries.

US Critical Minerals Industry: Randall Atkins, CEO of Ramaco Resources, said yesterday in an interview with the Financial Times that the US is “long overdue” in establishing a stockpile of critical minerals to blunt China’s near monopoly on them. Atkins argued for stronger public involvement in the industry, such as the recent deal in which the US government bought a stake in rare-earth producer MP Minerals. The statement may portend ever greater government support and guaranteed prices and demand for firms in the sector going forward.

US Stock Market: The meme-stock frenzy has suddenly returned to US stock markets, but with a new cast of characters. Among the fast-rising stocks over the last week or more, retailer Kohl’s yesterday saw its stock price double before ending up almost 40%. Other members of the new meme-stock craze include real-estate platform Opendoor Technologies, QuantumScape, and Rigetti Computing.