Author: Amanda Ahne

Daily Comment (September 29, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with reports that China plans to demand an important change in the US’s policy toward Taiwan in return for trade concessions. We next review several other international and US developments with the potential to affect the financial markets today, including the prospects for a US government shutdown this week and a risk that the French government could fall in the coming days.

United States-Taiwan-China: An exclusive weekend report by the Wall Street Journal said Chinese General Secretary Xi plans to leverage President Trump’s desire for a bilateral trade deal to secure a US commitment to “oppose” independence for Taiwan. Such a policy would require a shift from the US’s traditional “strategic ambiguity,” in which it hasn’t explicitly said it would support or oppose Taiwanese independence.

- By easing tensions with China, the shift in US policy could remove a key risk for the financial markets and allow US stock prices to keep rising. However, the shift would likely be alarming to traditional US allies and investors in the Asia-Pacific region, as it might undermine their confidence in Washington’s support against Chinese aggression.

- The potential loss of US support could also undermine long-run prospects for economies and stock markets in other regions, such as Europe.

US Fiscal Policy: President Trump today meets with the top two Republicans and the top two Democrats from each chamber of Congress to try to flesh out a compromise for the funding bill to keep the federal government operating after the current stopgap financing measure ends on Tuesday night. However, the Democrats are demanding an extension to Affordable Care Act subsidies that are set to expire at the end of the year and a reversal of the cuts to Medicaid and other health programs that Republicans made unilaterally over the summer.

- The impasse makes it increasingly probable that the government will face at least a short-term shutdown starting this week.

- As a potential shutdown looms, it is likely that US and global financial markets could become more volatile. Already, for example, gold prices have surged to new record highs above $3,800 per ounce.

US Defense Policy: New reporting says the Pentagon began pushing defense contractors over the summer to dramatically increase their production of 12 important types of missiles to be sure the US has sufficient stockpiles in case of war with China. The missile makers have pushed back because some of the production goals are so aggressive, and they aren’t confident the defense budget will grow enough for them to get paid. Nevertheless, the reports are consistent with our oft-stated expectation for global defense firms to see stronger sales going forward.

US Politics: New York City Mayor Eric Adams has dropped his bid for re-election, boosting the odds that former New York Governor Andrew Cuomo could beat current front-runner Zohran Mamdani. Since Mamdani’s socialist policies threaten to increase regulation and costs for business firms in New York — especially financial companies — a surprise win for Cuomo could potentially give at least a short-term boost to major US financial stocks.

US Private Credit Market: As we had flagged early on, auto parts maker First Brands last night filed for Chapter 11 bankruptcy protection, disclosing more than $10 billion in total liabilities. While details on the firm’s finances haven’t yet been made available, the sudden collapse of the company and the large amount of liabilities will likely make this a key test of the US’s booming private-credit industry. One important issue is whether there will be any spillover into the broader US financial markets.

United Kingdom: Chancellor Reeves has signaled that her proposed budget for 2026 will include big tax increases, adding to the tax hikes in her budget for 2025. Reeves argued the new measures have become necessary due to the wars in Ukraine and Gaza, rising global borrowing costs, the US’s new tariffs, and pessimistic economic projections. The rising tax burden will likely add to the headwind of slow economic growth that has weighed on UK stock prices in recent years.

France: After newly-installed Prime Minister Lecornu rejected budgetary demands on Friday from the leftist Socialist Party, including a large wealth tax on the rich, the Socialists today have warned that they are prepared to withdraw support from Lecornu and topple his government. The threat suggests the Socialists are prepared to launch a no-confidence vote for Lecornu sometime after Friday. If Lecornu loses such a vote, it could potentially lead to early elections and open the door for the far-right National Rally to take power.

Moldova: In the final round of parliamentary elections yesterday, the Party of Action and Solidarity of President Maia Sandu won 55 of the 101 seats in parliament, which should allow it to continue pursuing its goal of having Moldova eventually join the European Union. Meanwhile, the pro-Russian Patriotic Electoral Bloc received less than half the votes that Sandu’s party won.

Daily Comment (September 26, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins by examining the escalating risk of a direct conflict between the West and Russia over Ukraine. We then analyze the latest GDP figures and explain our cautiously optimistic outlook for the US economy. Additional topics include the looming threat of a government shutdown, the lowball offer by the US for TikTok, and a recent breach of security on devices used by federal government officials. We also provide a summary of key recent economic indicators from the US and around the world.

War in Europe? European diplomats have privately delivered a stark warning to Moscow, suggesting that NATO could potentially shoot down Russian aircraft that violate the alliance’s airspace. This direct threat marks a significant escalation following a series of recent incursions by Russian military planes into the territory of several European countries. These actions are viewed as a deliberate test of NATO’s response. The warning is the closest hint yet that the conflict in Ukraine could directly spill over into the rest of Europe.

- The warning appears to reflect Washington’s hawkish stance toward Russia. This is based on President Trump signaling earlier this week that Europe should down Russian aircraft entering its airspace, as well as comments from Ukrainian President Zelenskyy that he had Washington’s backing to strike Russian energy infrastructure and arms factories with US-supplied long-range weaponry.

- Moscow appears to be taking these threats seriously. Russian Foreign Minister Sergey Lavrov recently stated that Russia may already be at war with its Western rivals. This sentiment was underscored by an incident a day after the warning, when the US scrambled military jets to intercept Russian planes detected off the coast of Alaska, highlighting Russia’s continued ability to project power toward US territory.

- These heightened tensions coincide with the US’s increase of its weapons exports to Europe to help Ukraine defend against the Russian invasion. While European purchases of US weapons have slowed from a peak of nearly 35% of American exports, they remain well above pre-pandemic levels and still account for nearly a quarter of the total. This growing European reliance on American armaments further underscores the risk of deeper US involvement should a broader war break out.

- While a full-scale conflict is not seen as inevitable, the current geopolitical climate suggests that tensions between the West and Russia are arguably at their highest point since the Cold War. This is a precarious moment, and if NATO or the United States were to follow through on threats of retaliation against Russia, it could potentially trigger a broader conflict involving other nations.

GDP Report: The US economy demonstrated surprising resilience in the second quarter, with growth revised up to a 3.8% annualized rate from a prior estimate of 3.3%. Final Sales to Private Domestic Purchasers, a key indicator of underlying economic strength that excludes volatile inventories, government spending, and net exports, was also revised upward from 1.9% to 2.9%. This suggests that core domestic demand was more robust than initially thought. Nevertheless, a closer look at the report’s components reveals a more nuanced situation.

- This upward GDP revision was primarily fueled by a significant surge in consumer spending, which was revised from 1.9% to 2.5% and accounted for the bulk of the growth. The strength in consumption was driven by higher-than-initially-estimated spending on services, particularly in transportation, financial services, and insurance. An additional boost came from nonresidential business investment, led by spending on AI.

- While growth was better than expected, it continues to reflect an economy adjusting to a new normal. The primary contributor to GDP was net exports, driven by a significant drop in imports. This decline occurred because many firms and households had front-loaded their foreign purchases by stockpiling goods in the first quarter, which had caused growth to contract during that period. The subsequent pullback in spending in the second quarter artificially boosted net exports.

- Looking ahead to the second half of the year, we expect growth to remain relatively stable. Despite growing concerns about the job market, households have sustained their spending. One area we are monitoring closely is trade, as a continued decline in imports is artificially supporting growth. Historically, such a trend has indicated that households are becoming more conservative. While we do not anticipate an economic contraction in the third quarter, the outlook for the fourth quarter remains uncertain.

Government Shutdown: The White House is dramatically escalating the government shutdown standoff by requesting that federal agencies plan for mass layoffs targeting employees in programs that would lapse in funding and do not fit the president’s priorities. This move of issuing permanent Reduction-in-Force notices instead of temporary furloughs is widely viewed as an attempt to force the opposition to accept a short-term funding deal before the October 1 deadline. The budget impasse persists as the president seeks to follow through on reigning in spending.

Bye-Bye Fed Funds? Dallas Fed President Lorie Logan is proposing to shift the Fed’s primary rate target from the federal funds rate to a repo rate. This reflects the dramatic shrinkage of the traditional interbank market, with institutions preferring the more robust repo market. Targeting the repo rate could make the Fed more effective in directly controlling current financial conditions. However, the move carries an inherent risk of market disruptions or unintended consequences within the interbank lending system.

TikTok Deal: The White House announced that it has valued the forced sale of the popular video-sharing app’s US operations at $14 billion — significantly below the original $40 billion estimate. While officials stated the final price will be determined by investors, the lower valuation highlights the US government’s effort to minimize the cost of acquiring the platform. This move follows a law that mandates the app’s divestiture within 120 days to avoid its shutdown, citing national security concerns.

More Tariffs: President Trump has now targeted tariffs on pharmaceuticals, heavy trucks, and furniture to pressure producers to manufacture more of the goods in the United States. Patented pharmaceutical products could potentially face tariffs as high as 100%. This decision is part of a broader effort to encourage firms to reshore operations. The president has also announced that pharmaceutical companies that begin construction of manufacturing facilities in the US will be shielded from these new tariffs.

Government Hack: A breach has compromised firewall devices used by US federal government officials. While the full scope of the impact is unclear, the threat is considered widespread. The attacks have exploited a backdoor in Cisco devices. This campaign appears to be part of a broader international effort, and although there is no evidence of state actor involvement, investigators believe it is unlikely that the hackers are acting alone.

Business Cycle Report (September 25, 2025)

by Thomas Wash | PDF

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. The intention of this report is to keep our readers apprised of the potential for recession, updated on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

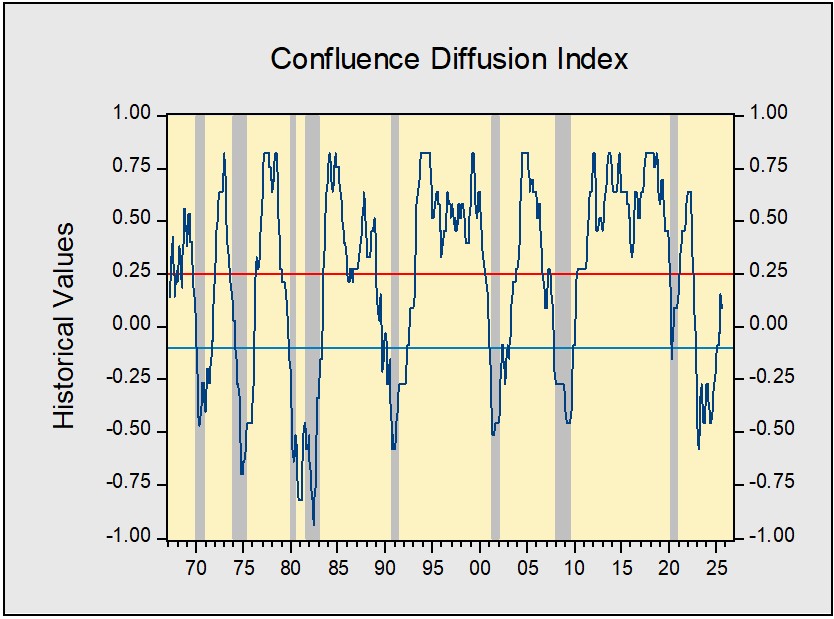

The US economy continued to expand in August, though warning signs are starting to appear. Our proprietary Confluence Diffusion Index remained out of contraction territory for the seventh straight month. Three indicators slipped back into contraction, raising the total number of warning signals to five out of 11. Despite these concerns, both stock and bond markets were bolstered by optimism regarding a potential shift in monetary policy. Signals from the “real economy” remain mixed, with business spending holding up, while households and firms continue to express concerns about the impact of tariffs. The labor market showed a notable slowdown, with firms hiring fewer workers, indicating a weakening in labor demand.

Financial Markets

Investors broadened their focus beyond the Information Technology sector. This shift is supported by growing optimism about the wider economy, driven by strong corporate earnings. Leading the performance charge were the Health Care and Materials sectors. In the bond market, yields have begun to fall as recent economic data suggests the Federal Reserve will prioritize maximum employment over price stability. This change in sentiment is largely due to evidence that the hiring slowdown was more significant than initially estimated, while inflation, though still elevated, has remained roughly in line with expectations.

Goods Production & Sentiment

August’s economic data presented a mixed picture. While new orders continued to show signs of strength, the housing market painted a different story. Housing starts fell last month, in an indication that homebuilders remain hesitant to begin new projects due to ongoing uncertainty in the market. At the consumer level, households expressed growing apprehension about the labor market and persistent concerns over rising prices. Conversely, the business outlook, while still subdued, showed signs of improvement as deliveries have picked up, driven by firms actively rebuilding their inventories.

Labor Market

The US labor market showed further signs of deterioration in August, with hiring slowing to a critical level. For the first time since the pandemic, the number of payrolls has dipped into “contraction” territory, a clear signal that labor demand has weakened. While the unemployment rate remains low, it did tick up slightly from the previous month. Nevertheless, initial jobless claims have remained relatively subdued, suggesting that firms are still reluctant to lay off workers. The shift toward a “low-hiring, low-firing” labor market is a notable trend.

Outlook & Risks

The economy may have lost some of its momentum, but it remains in a good state. The possibility of easier monetary policy and continued investment in AI should provide a lift. We believe the markets will continue to focus on monetary policy and corporate earnings as investors seek reassurance that the economy is not being negatively impacted by tariffs. Consequently, we are cautiously optimistic about risk assets, given the strong underlying fundamentals, but we are waiting for confirmation that this growth is sustainable for the medium term.

The Confluence Diffusion Index for September, which provides a composite view of the economy based on 11 benchmarks, remains in expansionary territory according to August data. The index’s value fell from +0.1515 in July to +0.0909 in August, but it is still well above the recovery signal threshold of −0.1000. This shows that while the economy continues to expand, the breadth of that expansion is narrowing. This is further evidenced by the fact that five of the 11 benchmarks are now in contraction, an increase from just two last month.

- Job growth concerns led to a flattening of the yield curve.

- Consumer sentiment is being weighed down by job uncertainty.

- The labor market appears to be in a phase of “low hiring and low firing.”

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is in recovery. The diffusion index currently provides about six months of lead time for a contraction and five months of lead time for recovery. Continue reading for an in-depth understanding of how the indicators are performing. At the end of the report, the Glossary of Charts describes each chart and its measures. In addition, a chart title listed in red indicates that the index is signaling recession.

Daily Comment (September 24, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with a look at a possible pivot in US foreign policy. We then analyze the latest comments from Federal Reserve officials regarding the future path of interest rates. Additional topics include more investment news from the Stargate initiative, the president’s brief encounter with Brazilian President Lula da Silva, and the growing possibility of a government shutdown. We also provide a summary of key recent global and domestic economic indicators.

Foreign Policy Pivot? The president has now opened the door for greater support for Ukraine by arguing that he believes the country can win back all the territory it lost to Russia. His comments represent a significant shift in attitude as he had previously suggested that Ukraine “does not have cards” and should be willing to make concessions for a peace deal. This new, more confrontational stance toward Moscow may signal a change in Washington’s foreign policy approach.

- The White House’s new stance is likely a response to Moscow’s recent attempts to breach NATO territory. Over the last few weeks, Russian drones have been sighted in Romania, Poland, and Estonia, in what appears to be a test of NATO’s resolve and willingness to defend those territories. The president has expressed his frustration with these incursions, stating that NATO should down them.

- Reflecting the shift in the president’s tone, Secretary of State Marco Rubio has also affirmed that the US is prepared to defend “every inch of NATO territory.” These statements, which follow calls from NATO for a more robust response to Russian incursions, suggest that the US is now aligning its policy more closely with its military allies.

- While we remain confident that the White House ultimately prefers peace, we have observed a distinct hawkish shift in both its foreign policy rhetoric and actions in recent weeks. Key indicators include the symbolic renaming of the Department of Defense to the Department of War, the push to reposition troops near Chinese nuclear facilities in Afghanistan, and the recent attacks on Venezuelan vessels suspected of drug trafficking.

- The president’s increasingly hardened stance toward Moscow may primarily be a tactical maneuver to compel Russia to negotiate a peace settlement. However, this shift also serves as a broader signal to international actors that the United States is prepared to confront aggression. While we assess that the probability of direct conflict remains relatively low, it is likely higher than what is currently reflected in market valuations.

Fed Speaks: Following the Fed’s first interest rate cut in a year, Chair Jerome Powell underscored a flexible approach to future monetary policy. Speaking to business leaders in Providence, Rhode Island, Powell described rates as “modestly restrictive” and stated that balancing near-term inflation risks with potential threats to employment presents a “no-risk-free path.” His nuanced view on labor market risks is likely to fuel speculation that the central bank remains undecided on its future monetary policy direction.

- His comments highlighted the deep divisions within the Fed, a sentiment already suspected by investors after last month’s meeting. The committee’s “dots plot” revealed an almost even split between members who favor one or fewer rate cuts this year and those who anticipate at least two.

- This internal debate has become public in recent speeches. For example, Chicago Fed President Austan Goolsbee has explicitly stressed the need for inflation to return to the 2% target. In contrast, Fed Governor Michelle Bowman argues that the central bank was late in addressing labor market imbalances, urging for swift rate cuts.

- A senior White House official and current Federal Reserve governor, Stephen Miran, has also entered the debate. He argues that the administration’s policies — specifically on deregulation, immigration, and tariffs — are fundamentally reshaping the economic landscape. According to Miran, these changes are lowering the neutral rate, therefore paving the way for as much as 200 basis points of interest rate cuts from current levels.

- Fed officials are likely to remain data-dependent, and their lack of a clear policy direction highlights this. Chair Powell’s view that policy is “modestly restrictive” hints at a preference for lowering rates. However, more aggressive rate cuts will require evidence of a cooling labor market, while signs of persistent inflation could force rates to remain on hold.

GPS Jamming: A growing number of European flights are experiencing attacks on their GPS systems. Most recently, a Spanish military plane traveling to Lithuania faced interference. Although the attack was ultimately blocked, it marks another incident of GPS tampering. A few weeks ago, a plane carrying European Parliament President Ursula von der Leyen experienced a similar situation. This pattern of interference, likely originating from Russia, signals a potential ambition to broaden the conflict beyond Ukraine.

Stargate Data Centers: OpenAI, SoftBank, and Oracle have announced plans to develop five new data centers for the “Stargate” project, an initiative being pursued in collaboration with the US government. This move is part of a broader effort by major tech firms to build out AI infrastructure, aimed at ensuring the United States maintains its technological edge. Such significant investment spending reinforces the narrative that has buoyed AI stocks and continues to provide underlying support for the economy.

Trump Meets Lula: In a bid to resolve their differences, the presidents of the US and Brazil adopted a conciliatory tone during a meeting at the UN’s annual gathering in New York. The exchange came after Brazilian President Lula, who had taken subtle jabs at the US president earlier in the day, had a brief, impromptu conversation with him and subsequently requested a more formal meeting. The conversation helped boost demand for financial assets in Brazil.

Government Shutdown: The risk of a government shutdown has intensified in recent days as the president has yet to meet with Democratic leaders to negotiate a budget deal. The primary point of contention is healthcare funding, which faces significant cuts in the proposed Republican budget. While the president has not entirely ruled out a meeting, he has stated he will not be bullied into accepting demands he opposes. Complicating the situation for Republicans is that they will need the support of at least seven Democratic senators to pass the bill.

AI Global Push: Technology equities worldwide are receiving a boost as countries embrace the AI revolution. In China, Alibaba’s plans for new spending have helped lift the stock, while stronger-than-expected performance from Micron Technologies has bolstered sentiment for domestic tech stocks. We believe tech stocks will maintain their momentum for the foreseeable future. However, as expectations grow, so does the risk of disappointment if goals aren’t met. As a result, we think it remains prudent for investors to maintain exposure to other sectors as well.

Daily Comment (September 23, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news of an important video showing flight operations aboard China’s newest aircraft carrier. We discuss the investment implications of this Chinese success, and we recommend watching the video. We next review several other international and US developments with the potential to affect the financial markets today, including a major international institution’s forecast of more aggressive interest-rate cuts in the US and a potential hiccup in the US’s booming private-credit market.

China: State media yesterday released what appears to be the first-ever video of flight operations taking place aboard China’s new, domestically produced aircraft carrier, the Fujian. The video shows various aircraft types, including airborne warning and control system (AWACS) planes and J-35 jet fighters, taking off from the deck of the carrier with the help of its advanced electromagnetic catapult and then landing back on the deck. The flights were apparently practice sorties ahead of Fujian’s planned commissioning near the end of 2025.

- We think the video was clearly aimed at sending a message that China can now replicate US-style power projection anywhere its fleet can sail. However, Fujian and China’s other two carriers are smaller than US carriers. In addition, China’s carriers run on diesel fuel, as opposed to the US carriers’ nuclear propulsion, which limits the capabilities of the Chinese carriers. The Chinese will likely also need considerable time to reach the operational expertise and efficiency of the US carrier fleet.

- All the same, Fujian and future advanced carriers are likely to help China even the balance of military power in the Asia-Pacific region. That means China will probably become increasingly confident that it can take control of Taiwan or achieve other territorial goals in the region while deterring intervention by the US and its allies.

- For investors, China’s rising military power and increasing ability to deter US and allied military pressure could be a double-edged sword. On the positive side, finely balanced military power could force Washington and Beijing to avoid war, precluding a conflict that would likely devastate each side’s economy and financial markets. On the negative side, China’s rising military ability could help it to eventually displace the US as the global hegemon and gradually constrict US economic power and financial performance.

China and Hong Kong: Super Typhoon Ragasa is slamming into the southern provinces of China today, forcing hundreds of thousands of people to evacuate their homes and leading to hundreds of flight cancellations. The storm is the strongest typhoon to hit the area so far this year and is expected to cause significant damage and temporarily disrupt economic activity. The storm could potentially lead to the shutdown of the Shanghai and Shenzhen stock markets today, but the Hong Kong market is expected to stay open.

OECD-US Monetary Policy In its interim economic outlook published today, the Organization for Economic Cooperation and Development said slowing US economic growth could justify the Fed cutting its benchmark fed funds interest rate to as low as 3.25% by next spring. That would imply three 25-basis-point rate cuts in the coming six months or so, which is slightly more than Fed policymakers and many outside observers have projected.

- The OECD’s projection for faster rate cuts is also consistent with our view that personnel changes on the Fed’s policymaking board will likely result in faster rate cuts next year.

- Faster rate cuts would likely give a boost to the US economy in 2026 and support further price gains for assets ranging from stocks to gold. However, the rate cuts could add more downward pressure to the dollar.

Sweden: The Riksbank today unexpectedly cut its benchmark short-term interest rate by 25 basis points to just 1.75%, its lowest level in about three years. According to the central bank, the decision reflected continued weak economic growth, which the policymakers saw as likely to bring consumer price inflation down in the coming months. The policymakers also signaled that they did not foresee any further rate cuts going forward.

Denmark-Norway-Russia: Major airports in Copenhagen and Oslo were forced to close for several hours late yesterday after large drones were spotted in or approaching their airspace. According to Danish police, the drones came from several directions, and their size and flight patterns suggested they were sent by a “capable operator.” The incidents show how Europeans are increasingly on edge after Russia’s recent jet fighter and drone incursions into the airspace of Poland, Romania, and Estonia, potentially setting the stage for a market-shaking miscalculation.

France-Israel: At the UN General Assembly yesterday, French President Macron officially recognized Palestine as a state, a day after the UK, Portugal, Canada, and Australia did the same. With the General Assembly continuing this week, more major countries could follow suit, further isolating Israel in an attempt to punish it for its aggressive war against the militant Hamas government in Gaza.

US Military: The US Army has confirmed that it will cut 6,500 of its 30,000 active-duty aviation jobs over the next two fiscal years as it transitions away from its iconic helicopter systems to unmanned platforms. The move is the latest sign of how drones are becoming key weapon systems for militaries around the world. However, it still isn’t clear to what extent major publicly traded defense contractors will benefit from the trend.

US Pharmaceutical Industry: At a White House event late yesterday, the administration warned that acetaminophen, the active ingredient in Tylenol, is a potential cause of autism. Health and Human Services Secretary Kennedy also said this department would update the warning label for acetaminophen and conduct an awareness campaign about the potential link to autism, despite a range of scientific studies that, taken together, have shown no link.

- Tylenol maker Kenvue’s stock price cratered about 7.5% ahead of the announcement, bringing its total decline to about 21% over the last month.

- The steep decline in Kenvue’s stock price illustrates the regulatory risk with many healthcare and consumer products companies as the administration rapidly shifts US health policy.

US Private Credit Industry: Private credit firms today are rattled by the sudden bankruptcy of privately held auto parts firm First Brands, which grew rapidly in recent years using debt-fueled acquisitions. Up to $10 billion of the company’s private loans and financial obligations are reportedly plunging in value amid uncertainty over what the lenders might get from the bankruptcy proceedings. The situation could test the resiliency of the booming private-credit industry and potentially have spillover effects for the rest of the financial markets.

Bi-Weekly Geopolitical Podcast – #73 “The Great AI Race: A Sputnik Moment for the 21st Century” (Posted 9/15/25)

Bi-Weekly Geopolitical Report – The Great AI Race: A Sputnik Moment for the 21st Century (September 15, 2025)

by Thomas Wash | PDF

On his first full day in office, President Trump convened a group of prominent tech leaders in what he characterized as an effort to secure the United States’ technological future. This meeting launched the largest artificial intelligence infrastructure initiative in US history, named Stargate Project. The strategy forged a major public-private partnership with firms such as OpenAI, SoftBank, and Oracle, creating a joint venture with a fund that will exceed $500 billion over the next four years in order to cement US global dominance in artificial intelligence (AI).

This initiative placed the US at the forefront of a struggle with China that transcends a mere contest for technological supremacy; it is a fundamental clash of economic systems. While both are engaged in industrial state policy, China employs a state-guided, top-down model, using its bureaucracy to steer markets toward national objectives. In contrast, the American industrial approach is decentralized and industry-led, relying on private enterprise to drive innovation and growth.

The outcome of this contest will do more than anoint a global technology leader. It will also determine the dominant economic framework of the 21st century, which could not only profoundly reshape the world economy but also the architecture of the global financial system. Thus, much like Sputnik, this isn’t just about a single technological achievement; rather, the future of the global order could be at stake. In this report, we discuss the AI race between the US and China and what it means for markets going forward.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Daily Comment (September 12, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with an analysis of OpenAI’s pivotal shift from a non-profit structure and its broader implications for the AI sector rally. We then explore the market’s optimistic anticipation of potential rate cuts at the upcoming Federal Reserve meeting. Our discussion extends to the latest round of US-China trade negotiations in Madrid and the notable warming of relations between the US and India.

OpenAI Goes Public: The AI company is restructuring its relationship with parent company Microsoft, moving toward a more traditional for-profit model. It will gain greater control over a new public benefit corporation, allowing it to balance generating profits for shareholders with its public-benefit mission. This shift away from its unconventional structure comes as market focus intensifies on AI companies .

- In recent months, the market’s reliance on tech companies for growth has accelerated. A prime example is the “Magnificent 7,” which, despite initially dragging on the broader S&P 500 Index this year, has since surged and now outperforms the combined growth of the other 493 companies.

- This pattern echoes the “safety trade” observed in 2023 and 2024, wherein investors flocked to established tech giants for capital appreciation. This strategy was driven by the companies’ robust earnings power, which provided a haven during a period of significant economic uncertainty caused by concerns over high interest rates and persistent inflation.

- Much of the hype around these companies has come from the optimism that they will become monopolies within their sector and generate substantial future returns. However, there are signs that this may not happen.

- Although some firms, such as Adobe, have shown that AI can boost profits, evidence suggests its practical impact remains limited. An MIT study revealed that a mere 5% of AI implementations have yielded significant returns or productivity gains — a finding supported by census data indicating that AI adoption rates among large companies have begun to fall.

- While we believe the AI momentum trade may still have legs, adding some exposure to value stocks could be a beneficial portfolio addition. During the equity sell-off earlier this year, value stocks outperformed their growth counterparts, suggesting they could act as a shock absorber if AI sentiment were to unexpectedly reverse.

Rate Cut Optimism: Equities rallied on Thursday as fresh economic data bolstered investor confidence that the Federal Reserve remains on track to cut rates next week. The rally occurred despite a key labor market report showing initial jobless claims jumping to their highest level in nearly four years, signaling continued softening. Furthermore, the latest inflation reading rose precisely in line with forecasts, reassuring markets that price pressures remain within expected bounds.

- Although this data all but guarantees a rate cut at the next meeting, it also raises serious questions about what follows. The primary headwind for future cuts is somewhat elevated inflation, with the monthly increases in July and August marking the highest in two years. Conversely, the startling jump in jobless claims may be less sinister than it appears; it could simply be a seasonal anomaly exacerbated by the unusual clustering of holiday weekends, which notoriously distort the data.

- The mixed economic data will likely fuel vigorous debate among FOMC members as significant concerns over persistent inflation remain. Several Fed officials — including voting members like St. Louis Fed President Alberto Musalem, Kansas City Fed President Jeffrey Schmid, and Chicago Fed President Austan Goolsbee — have already expressed reluctance to cut rates, citing inflationary pressures exacerbated by recent tariffs.

- The upcoming FOMC meeting will be pivotal for the sustainability of the current market rally. Markets have currently priced in 75 basis points of rate cuts for this year, with an expectation that the Fed will start with a 50-basis point cut next week. Consequently, the updated “dots plot” will be scrutinized as it outlines the projected path of future policy rates. A signal of aggressive easing is likely to buoy risk assets, while any suggestion of a moderate approach to easing could dampen investor risk appetite.

Brazil President’s Sentence: A Brazilian Supreme Court justice has sentenced former President Jair Bolsonaro to 27 years in prison for his role in plotting a coup after his 2022 election defeat. The ruling is poised to strain relations with the United States, where some lawmakers have called the arrest politically motivated. Prior to the sentencing, the US had imposed 50% tariffs on Brazilian steel, and Secretary of State Marco Rubio suggested further trade penalties could follow.

US and China Meet in Madrid: The US and China will meet in Madrid next week for talks on trade and TikTok. This follows the White House’s decision to extend the deadline for a trade agreement until November 10. The discussions will offer insight into the progress made over the past month, with both sides seeking concessions. While we do not expect a full resolution, the apparent unwillingness of either side to escalate tensions going into the meeting is a positive signal for markets.

ECB Holds Rates Steady: The European Central Bank decided to hold rates steady at its latest meeting, expressing optimism that growth and inflation remain broadly consistent with its goals. The bank revised its annual growth outlook upward by 30%, while acknowledging upcoming headwinds. Conversely, it revised its inflation forecast downward to 1.9% for the year. This strong outlook will likely boost the euro against the dollar but may act as a headwind for US investors holding European equities.

US and Poland Disagree: Polish Prime Minister Donald Tusk has rejected the White House’s assertion that a recent Russian incursion into Polish airspace was unintentional. This disagreement coincides with Poland’s request for additional military assistance to defend against future Russian provocations. The US willingness to give Russia the benefit of the doubt may suggest a hesitancy to getting more deeply involved in European security. The incident provides more evidence that the EU needs to shore up its own defenses amid the lack of US assurances.

US and India: Washington and New Delhi are close to finalizing a trade agreement, according to the White House. It also stated that the US views India as one of its most important strategic trade partners as it seeks to shape a future economic order. Simultaneously, the US is reportedly advocating for G-7 nations to impose tariffs on India due to its support for Russia’s invasion of Ukraine. This announcement aligns with the US employing a “carrot-and-stick” approach to encourage India to distance itself from China.