by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with the latest key developments from China’s “two sessions” government meetings. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including another round of strikes in France against President Macron’s proposed pension reform. We also preview Federal Reserve Chair Powell’s semiannual testimony before Congress, which begins this morning.

China-United States: At the Chinese government’s big “two sessions” meeting yesterday, President Xi took the rare step of calling out the U.S. directly and accusing it of leading a multinational effort aimed at “all-round containment, encirclement and suppression against us, bringing unprecedentedly severe challenges to our country’s development.” In a follow-up statement today, Foreign Minister Qin Gang praised China’s friendship with Russia, decried what he called a “new McCarthyism” in the U.S., and vowed that China will respond tit-for-tat to any additional steps the U.S. might take to confront his country.

- Taken together, the two top-level declarations should provide investors with all the proof they need that U.S.-China tensions are likely to keep spiraling. The statements show that China will work to counter every step the U.S. belatedly takes to preserve its military, economic, technological, diplomatic, and political leadership around the world.

- Although there is strong bipartisan support for the U.S. to assert itself against China’s growing geopolitical aggressiveness (e.g. Former House Speaker Pelosi’s provocative visit to Taiwan last summer), Taiwan’s president has reportedly convinced incumbent House Speaker McCarthy not to make a similar trip for now in order to avoid a dangerous Chinese military response.

- Instead, McCarthy will meet President Tsai Ing-wen in California when she visits the U.S., Guatemala, and Belize in April.

- As we have mentioned many times before, worsening U.S.-China tensions will put investors at risk, especially as the two countries clamp down on trade, technology, and capital flows between their respective geopolitical camps.

China-Sri Lanka: Officials in Colombo said China has finally agreed to support their country’s debt restructuring, a step the International Monetary Fund said it would require before releasing a $2.9-billion rescue package. While China has lent hundreds of billions of dollars to developing countries around the world under its “Belt and Road” initiative, it has proven reluctant to restructure any such debts or take any significant haircuts when they’ve gone sour. These actions feed into international concerns that China is really setting up debt traps as a way to get control over the projects or other collateral posted for the loans.

Russia-Ukraine War: Even though Russian forces continue to make incremental gains in their effort to surround and capture the northeastern Ukrainian town of Bakhmut, it now appears that the Ukrainians intend to pull back from some areas of the town but will otherwise keep defending it as a way to inflict even higher casualties and equipment losses on the Russians.

- Ukrainian President Zelensky said yesterday that both the commander in chief of his military, Valeriy Zaluzhnyi, and the commander of ground forces, Oleksandr Syrsky, have recommended reinforcing the city rather than giving it up.

- If the Ukrainians do decide to keep defending Bakhmut and keep inflicting high casualties on the Russians, one key additional goal may be to pin the Russians down while the Ukrainians await new shipments of advanced tanks and other weapons from the West.

France: The country is facing a fresh new round of strikes today as labor unions and other groups protest President Macron’s proposal to raise France’s retirement age. In a tactical change, some unions representing public transport workers, truckers, and nuclear plant technicians said they will go on rolling strikes, unlike the less-disruptive daylong walkouts that have taken place since January. Almost two-thirds of primary schoolteachers are also expected to strike.

- As a result of the strikes, today France’s national railway has cancelled three-quarters of trains, while airlines have cancelled about one-third of their scheduled flights.

- So far, however, Macron continues to insist that the pension reform is needed to prevent the government’s budget deficit from exploding and to preserve the overall pension system.

Greece: In an interview with the Financial Times, Bank of Greece head Yannis Stournaras said he was confident that global credit rating agencies would upgrade Greek bonds to investment grade again within months, so long as Greek lawmakers signal their intent to maintain the country’s fiscal reforms and lower the country’s debt burden. If that happens, Greek debt would be rated investment-grade again for the first time in 12 years.

Israel: Protests against Prime Minister Netanyahu’s judicial reform have now spread to the country’s armed forces, sparking concerns that they will compromise their readiness even as the government considers a military attack on Iran to destroy its growing nuclear weapons program.

- To protest the reform, which sharply curtails the powers of the Supreme Court, hundreds of reservists have signed letters expressing a reluctance to participate in nonessential duty or have already pulled out of training missions.

- The affected units include a key division that deals with signals and cyber intelligence and whose graduates have helped drive the country’s tech industry, as well as elite combat units.

United States-Mexico: The U.S. Trade Representative’s office has formally requested consultations with Mexico under the U.S.-Mexico-Canada trade agreement to address Mexico’s decision to ban genetically modified corn and other crops from north of the border by 2024. The U.S.’s filing aims to protect farmers who would otherwise lose an important foreign market. For perspective, the U.S. exported some $5 billion of corn to Mexico last year, about 90% of which was genetically modified.

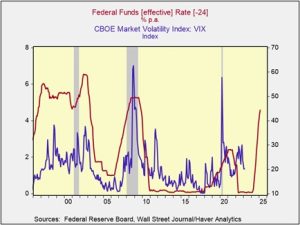

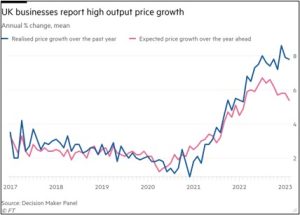

U.S. Monetary Policy: Fed Chair Powell will begin his semi-annual testimony to Congress today with an appearance before the Senate Banking Committee at 10:00 AM EST. He’ll appear before the House Financial Services Committee tomorrow at the same time. In each case, we suspect that Powell will continue to talk tough on consumer price inflation, stress the need the raise interest rates further, and make the case for keeping monetary policy tight for an extended period. Indeed, he also appears to have most of the policymaking committee behind him. Over the weekend, for example, San Francisco FRB President Daly made similar hawkish statements at a Princeton University event.

- In other words, Powell will keep trying to convince investors that the Fed will get control over inflation and eventually bring it down to the Fed’s target. Investors will be especially focused on any signs that the policymakers will hike rates by an aggressive 50 basis points at their March 22 meeting.

- If Powell deviates from that message in any meaningful way, markets could react strongly. That’s especially true given that investors are likely to be on edge ahead of the two critical inflation reports due to be released in the next seven days: February’s employment report on Friday and the February consumer price index next Tuesday.

U.S. Housing Market: A bipartisan group of Senators has introduced legislation to spur the renovation of single-family homes in blighted neighborhoods to help boost the U.S. housing supply. If passed into law, the legislation would create a new tax credit to cover a developer’s costs when the renovation of a crumbling building exceeds a home’s potential selling price so the project becomes feasible. Although it’s questionable whether the new tax credit would have an appreciable effect on the nation’s housing supply, it would likely lead to a frenzy of efforts to game the system and take advantage of the credit.