Tag: exorbitant privilege

Asset Allocation Bi-Weekly – The Erosion of Exorbitant Privilege (February 2, 2026)

by Thomas Wash | PDF

Japan’s pursuit of aggressive fiscal stimulus has put it in a precarious position. Prime Minister Takaichi has called snap elections for February 8 to leverage her popularity and improve her parliamentary majority to pass a major tax cut plan. The market’s response, however, has been a haunting echo of the UK’s “Truss moment,” reflecting a broader crisis of confidence. Investors are signaling that even G7 governments can no longer count on a free pass for unfunded spending hikes, raising the risk of a sustained bond market pushback.

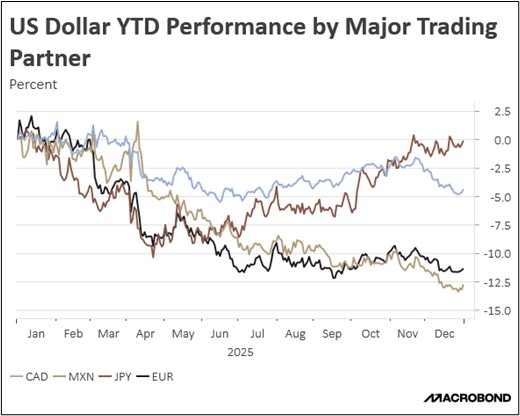

That warning turned concrete with a violent “twin sell-off” in Japan. Soaring government bond yields collided with the yen in freefall toward 160 against the dollar. The stress transmitted instantly to US Treasurys, a correlated sell-off severe enough to prompt US Treasury Secretary Bessent to confer with his Japanese counterpart, Satsuki Katayama. This episode delivers a stark market verdict: core developed nations are sacrificing long-term debt sustainability for short-term political stimulus. More critically, it forces investors to confront a once unthinkable possibility that the sovereign debt of advanced economies is beginning to mirror the structural fragility historically seen in emerging markets.

This twin sell-off is unique because it challenges the core distinction between developed and emerging markets, which is rooted in debt maturity. Historically, an emerging market currency crisis is precipitated when sovereign bond yields and domestic currency values move in opposite directions. Yields spike as investors flee, causing the currency to depreciate. Previous twin sell-offs signaled the collapse of investor confidence during the 1994 Tequila Crisis, the 1997 Asian Financial Crisis, and the recent volatility of the Argentine peso.

The mechanics of such a crisis differ fundamentally in developed markets, mostly due to the maturity structure of their sovereign debt. Unlike emerging markets, which are often forced to borrow via short-term instruments, developed nations have historically enjoyed the “exorbitant privilege” of issuing long-term debt. This extended duration insulates them from the immediate roll-over risk that often paralyzes emerging economies during a market shock.

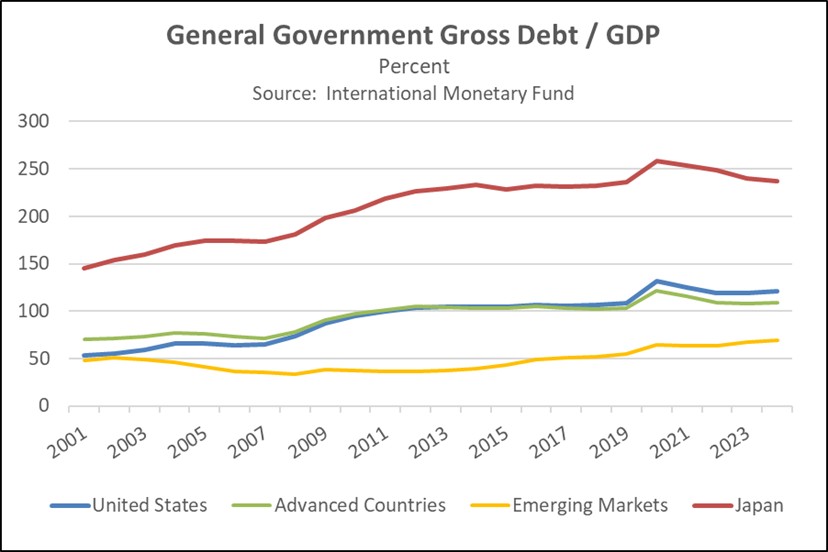

This privilege has afforded more than just insulation; it has effectively enabled developed nations to finance persistent, massive deficits without the immediate specter of a financial crisis. By issuing long-term debt denominated in their own reserve currencies, these nations have utilized a strategy of “extend and pretend,” rolling over maturing obligations while indefinitely deferring the structural reforms necessary for long-term solvency. This buffer is most glaring in Japan, which has sustained a gross debt-to-GDP ratio exceeding 200% for years with no imminent crisis in sight.

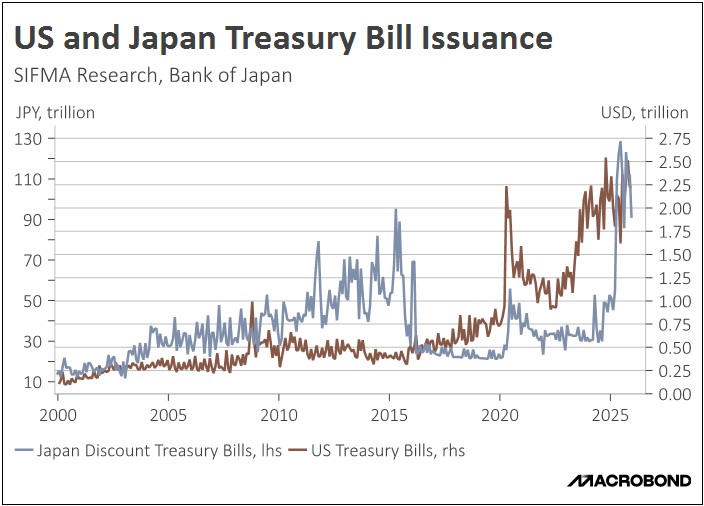

However, recent market volatility suggests that the era of unconditional trust in sovereign debt may be ending. A clear sign of this shift is the growing investor preference for shorter-dated securities, which is compelling governments to shorten their debt issuance profiles in response. For instance, Japan’s Ministry of Finance has moved to scale back the issuance of 40-year bonds and reduce 30-year volumes to stabilize the “super-long” end of the curve. Similarly, the US Treasury has significantly ramped up the share of Treasury bills to meet funding needs, a strategic pivot intended to provide relief to the long-term Treasury market amid fluctuating yields.

While the collective shift toward shorter-term debt temporarily suppresses long-term yields, it imposes significant systemic costs. It heightens the financial system’s sensitivity to monetary policy as frequent refinancing exposes institutions to immediate liquidity strains and rollover risk when rates rise. Ultimately, this concentration of short-term liabilities could handcuff central banks, forcing them to choose between fighting inflation and avoiding a market-wide liquidity crisis.

In this new era of heightened sovereign risk and policy constraint, portfolio management must adapt. A systemic crash is not inevitable, but the structural shift demands a strategic response. Practically, this environment may increase the appeal of non-correlated hedges like precious metals against currency debasement and inflation. Within fixed income, aligning with the prevailing supply-demand dynamic favors intermediate- and short-term securities. Above all, disciplined geographic diversification becomes more critical than ever to mitigate exposure to any single market undergoing a structural repricing.