by Bill O’Grady and Thomas Wash

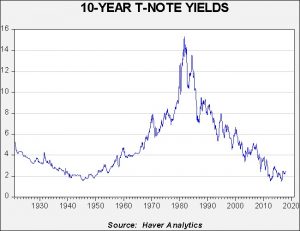

[Posted: 9:30 AM EST] It’s a “red day” as we are mostly seeing trend reversals across many markets—equity futures are pointing to a rare lower opening, Treasury yields have broken 2.70%, foreign exchange is weaker (dollar stronger) and gold is lower. Some of this looks like profit taking, although the continued rise in Treasury yields is a concern. There is a lot going on this week. Here is some of what the week has in store and what we are watching this morning:

SOTU: President Trump is giving his first State of the Union address tomorrow evening. The key unknown is which Trump will give the talk—“Twitter Trump” or “teleprompter Trump”? The financial markets are hoping for a repeat of Davos with a SOTU given by the latter Trump; this is what we are expecting. A teleprompter speech without significant deviations will likely focus on a victory lap of tax cuts and regulatory reduction. There will be comments about immigration and infrastructure but no significant details. Although this describes what we are most likely to see, the president is capable of leaving the track and veering into other areas; again, this isn’t likely, but always possible.

FOMC: The FOMC meets tomorrow with no rate changes expected. This is Chair Yellen’s last meeting, with Jay Powell at the helm from this point forward. There is no press conference or dots at this meeting. The next meeting, in mid-March, will almost certainly bring a rate hike as fed funds futures are putting the odds of a 25 bps increase at over 92%. The next meeting will be a big deal; not only is a rate hike expected, but we will also get our first dots chart and press conference under the Powell regime. Thus, this week’s meeting should be quiet but the March meeting will be closely watched.

Government budget: The government will run out of spending authority again on February 8. Although the deadline is obviously next week, work on avoiding a shutdown should intensify this week. Look for more media commentary on this issue after Wednesday.

A crypto hacking: Coincheck, a cryptocurrency exchange in Tokyo, was hacked late last week and nearly $500 mm of digital coins were taken. The exchange is promising investors it will pay back part of the losses but it isn’t clear it has the resources to do so. Although the blockchain offers security to individual users for transactions, the exchanges where holders park their cryptocurrencies clearly do not. It’s a bit like saying, “The cash is real but the bank isn’t secure.” The promise to make investors partially whole did spark a recovery in bitcoin and other cryptocurrencies, but the problem of insecure exchanges continues to plague the industry.

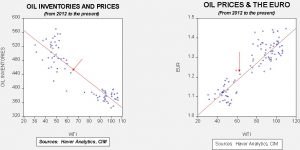

A prince released: Prince Alwaleed bin Talal, a Saudi prince and famous globetrotting investor, has been freed from detention from the Riyadh Ritz-Carlton (MAR, $147.14). It appears he may be the last of the notable princes to be released; we suspect he gained his freedom by giving up some of his immense wealth. It isn’t clear how much this cost him, but it does look as if the crown prince was able to pull off this anti-corruption shakedown without a serious threat to his power (at least so far).

Government in 5G: Axios[1] is reporting that the Trump administration is considering nationalizing the 5G cellular network to ensure the U.S. keeps up with China. The thinking in the administration is that the U.S. needs a centralized network fast and the most efficient way to accomplish this is for the government to build it and then lease it to the telecom providers. If true, this is a serious departure from how the government has been working since 1980. Although the federal government has been in the infrastructure business since the inception of the republic, it has mostly left the buildout of areas that are not obvious public goods to the private sector. This action would be a definite change in policy and may indicate that the government-lite that Reagan introduced is coming to a close. It’s still too early to get overly concerned but this investment does bear watching.

NAFTA optimism: U.S. representatives at the NAFTA talks in Montreal indicated a sense of optimism that talks to renegotiate the trade deal would avoid collapse and gain momentum. Although progress is admittedly slow, as neither Mexico nor Canada is interested in changing the agreement, it does appear that neither wants to see it scuttled, either. Thus, we would expect the U.S. to increase local content on goods that should narrow the trade deficit with both nations.

[1] https://www.axios.com/trump-team-debates-nationalizing-5g-network-f1e92a49-60f2-4e3e-acd4-f3eb03d910ff.html