Author: Amanda Ahne

Bi-Weekly Geopolitical Report – Geopolitical Outlook for 2026 (December 15, 2025)

by the Confluence Macroeconomic Team | PDF

(This is the final BWGR of 2025; the next report will be published on January 12, 2026.)

In mid-December, we publish our geopolitical outlook for the upcoming year, as is our custom. This report is less a series of predictions as it is a list of potential new geopolitical issues that we believe will dominate the international landscape in the coming year. It should also be noted that some of these issues may be important only in 2026, while others will extend beyond. The report is not designed to be an exhaustive list. Instead, it focuses on the big-picture conditions that we believe will affect policy and markets going forward. The issues are listed in order of importance.

Issue #1: Stablecoins to Support Use of the US Dollar Abroad

Issue #2: China’s New Aircraft Carrier and Spheres of Influence

Issue #3: The US Adopts a Modern Monroe Doctrine

Issue #4: The US Makes Its Move in Central Asia

Issue #5: Deregulation in Europe

Issue #6: Data Centers Going Global

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Daily Comment (December 15, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with key takeaways on monetary policy from an interview President Trump did with the Wall Street Journal on Friday. We next review several other international and US developments with the potential to affect the financial markets today, including a preview of tomorrow’s off-cycle reports on the US labor market, a new US investment in a critical-minerals facility, and a conservative’s victory in Chile’s run-off presidential election over the weekend.

US Monetary Policy: In an interview with the Wall Street Journal on Friday, President Trump said he wouldn’t put anyone on the Federal Reserve board who would raise interest rates as economic growth is accelerating. Just days after the Fed cut its benchmark fed funds rate to a range of 3.50% to 3.75%, he also said he would like to see the rate at 1.00% or lower one year from now. The statements are consistent with our view that the Fed will be under strong pressure to cut interest rates more aggressively in 2026 than in 2025.

- In our 2026 Outlook, published last week, we discuss our projections for interest rates and longer-term bond yields. After cutting the fed funds rate three times in 2025, we would expect the central bank to cut rates at least four times in 2026, and potentially more.

- More aggressive rate cuts could unsettle the bond market, but we would expect the administration to keep taking steps designed to cap longer-term bond yields. By implication, that means the yield curve may only steepen modestly in 2026.

US Labor Market: As a preview, the Department of Labor tomorrow will release a combined report on the job market in October and November. The unusually timed report will come out on Tuesday morning at 8:30 AM ET. Analysts currently expect the data to show that November payrolls rose by 50,000 while the unemployment rate rose to 4.5%. However, Fed Chair Powell last week said actual hiring might be much weaker than the recent available data showed, so investor concerns could keep the US financial markets volatile today.

United States-South Korea: Korea Zinc, the world’s biggest zinc-smelting company, announced a deal today in which the US government will enter a joint venture with the firm and back its $7.4-billion investment in a new critical-minerals processing plant in Tennessee. The plant will produce rare earths and other critical minerals. The deal is further evidence that the US is intent on building up its own critical minerals industry to end its reliance on China, even as China builds up its artificial intelligence industry to cut its reliance on the US.

- The news also shows how the US administration appears to be much more willing to work with Asian partners than European ones. Such deals could strengthen US ties to key foreign countries, such as South Korea, even as US ties to Europe fray.

- The news has also given a big boost to Korea Zinc’s share price today. The price reportedly surged as much as 27% when the deal was announced earlier this morning.

United States-United Kingdom: According to confidential sources, the US has told the UK that it will stop implementing a May technology agreement between the two countries to retaliate for Britain being slow to lower its trade barriers. The frozen tech deal was part of the US-UK trade agreement reached in May and called for collaboration on artificial intelligence and nuclear energy. The development is a reminder that the quickly negotiated, relatively vague deals spawned by the US tariff war can carry a lot of implementation risk and may not be final.

Chinese Industrial Policy: Shandong province has released a plan to sharply improve and increase its copper-smelting sector, in part to help boost Chinese exports of the metal. Now that the world has seen in 2025 how China has nearly monopolized the production of rare earth minerals and is willing to embargo them to undermine Western economies, the Shandong plan will likely raise concerns that Beijing wants to do the same with copper. Once concern would be if China were willing to use predatory pricing to put foreign copper producers out of business.

Chinese Economy: Several data releases today showed Chinese economic growth continues to slow, in part because of its massive excess production. November retail sales were up just 1.3% year-over-year, compared with a rise of 2.9% in the year to October. November industrial output was up 4.8% on the year, compared with an increase of 4.9% in the year to October. Fixed-asset investment in January through November was down 2.6% compared with the same period one year earlier, and had an annual decline of 1.7% in the January through October period.

- As reported last week, Chinese exports continue to surge, producing a record trade surplus of more than $1 trillion so far in 2025. All the same, the weakness in China’s domestic demand helps confirm that the country’s producers are likely dumping product on the global markets because they can’t sell them at home.

- That is likely to continue causing trade frictions between China and its trade partners, including the US. Even if the US and China reach a long-term trade truce, Beijing’s need to keep exporting could make any such deal tenuous.

European Union-France-South America: Paris yesterday urged the European Parliament to delay a vote aimed on the proposed free-trade agreement between the EU and the Mercosur grouping of Argentina, Brazil, Uruguay, and Paraguay. If France is successful in delaying the vote, it would increase the odds of the deal being rejected. Any rejection of the deal would likely help shield European agribusiness firms from a wave of cheaper imports from South America and further signal the end of the post-Cold War period of globalization.

Chile: In yesterday’s presidential run-off election, hardline conservative José Antonio Kast came in first with approximately 58% of the vote, heralding Chile’s most right-wing government in more than a decade. Kast’s success has largely been tagged to his tough positions on crime and illegal immigration. However, he has also championed government spending cuts, lower taxes, and deregulation, all of which will likely be taken well by investors.

Kenya: As foreign aid falls and its people become more resistant to tax increases, Nairobi this week is planning its biggest sell-off of state assets in nearly 20 years to finance a new infrastructure fund. The plan includes selling a $1.58-billion stake in telecom and fintech firm Safaricom, considered the crown jewel of Nairobi’s state-owned assets, to South African telecom firm Vodacom.

- The deals illustrate how the US aid pullback will likely put economic pressure on many less-developed countries.

- Some of the affected countries may respond with better fiscal and regulatory policies, but a key risk is that Beijing might step into the breach with its own aid to curry favor with them and draw them closer to China.

Daily Comment (December 12, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with our examination of growing concerns for an AI bubble. We then provide an update on the strategic dynamics of the Ukraine conflict. The analysis continues with key market-moving stories, including reappointment of Federal Reserve governors, corporate partnerships to build supply chains independent of China, and the Bank of Japan’s hawkish policy shift. Finally, we include a roundup of essential domestic and international data releases to monitor.

Tech Tight Rope: Investor sentiment in the tech sector is fragile, underscoring the high tension between the AI boom’s potential and inherent risks. Broadcom’s earnings fueled this pessimism as its $75 million order backlog missed analyst targets. The company further created uncertainty by withholding 2026 guidance. This disappointment amplified earlier concerns raised by Oracle. The software giant reported weak earnings alongside accelerated capital spending plans, sparking doubts about Oracle’s long-term debt servicing capacity.

- Since October, the market has been plagued by valuation anxieties. This sentiment shift stems from a growing body of evidence indicating that widespread AI adoption is progressing much more slowly within firms than originally anticipated. The resulting disconnect between lofty stock prices and the actual speed of business integration has led investors to scrutinize whether companies can deliver the earnings growth required to sustain their elevated stock valuations.

- This shift has been evident in recent market performance as small and mid-cap stocks have demonstrated strong outperformance relative to their large cap counterparts during this period. Simultaneously, the Health Care sector, which contended with headwinds for much of the year, has generated the majority of its annual gains over the last three months, underscoring the market’s rediscovered appetite for defensive value.

- We maintain the view that AI momentum still has room to run, but we strongly recommend investors broaden their portfolio exposure beyond concentrated growth sectors. Adopting this strategy of diversification will serve to mitigate potential downside risk stemming from any future setbacks or valuation concerns within the AI sector.

Ukraine-Russia Peace Deal? While there appears to be momentum toward ending the conflict, the White House is reportedly struggling to secure unified support for a proposed peace deal. Reports emerged earlier this week that US officials are pressing Ukrainian President Volodymyr Zelensky to agree to a deal with Russia by Christmas. The main sticking point is reportedly the White House’s push for Ukraine to accept territorial concessions in exchange for unspecified security guarantees.

- The European Union is deeply skeptical of the peace deal, fearing Russia’s broader territorial ambitions in Europe. NATO’s leader recently stated that Russia is back in the “empire building business,” while provocations, such as surveillance balloons from Belarus drifting into Lithuania that forced it to shut its airspace and declare a state of emergency, continue.

- In order to calm fears, the White House does plan to offer some security support for Ukraine. It has been suggested that the assistance would come in the form of intelligence or possibly even air support; however, the administration has stated that it is still negotiating between the two sides.

- While Ukraine has succeeded in resisting Russia’s full-scale invasion, Moscow has secured incremental territorial gains that have weakened Kyiv’s negotiating position. However, Ukraine has resisted conceding land to the Kremlin. In a gesture to Western partners, President Zelensky has indicated an openness to holding a referendum in the Donbas region on its future status.

- We assess that active hostilities in Ukraine are likely to conclude by the first half of 2026. The end of this conflict is expected to compel European nations to significantly accelerate their military modernization efforts in response to the enduring Russian threat, providing a substantial and sustained tailwind for the Continent’s defense industry.

Fed Presidents Approved: The Federal Reserve Board of Governors unanimously reappointed the presidents in 11 out of 12 Federal Reserve Banks to new five-year terms. The only exception was Raphael Bostic of the Atlanta Fed, who did not seek reappointment. This action is expected to alleviate worry that the White House would attempt to reshape the Fed’s structure, a concern raised by Treasury Secretary Scott Bessent’s suggestion of a new residency requirement for bank presidents. This should calm fears of the Fed losing its independence.

EU-Mercosur Deal in Jeopardy? The landmark EU-Mercosur trade deal faces significant delays due to European agricultural concerns. France and Poland are leading the opposition, arguing that lower South American production standards would give those farmers an unfair competitive advantage. This ratification failure complicates the EU’s strategic goal of diversifying its economic partnerships away from over-reliance on the US and China.

Supply Chain Resilience: Two US firms have partnered to develop domestically manufactured iron nitride magnets that do not require rare earth elements. This collaboration reflects a growing effort within the American defense sector to lessen dependence on Chinese rare earth supplies. We believe such partnerships signal a broader trend of US innovation aimed at building resilient supply chains, aligning with the White House’s industrial policy goals.

AI Executive Order: The president signed an executive order establishing federal primacy in AI regulation to accelerate innovation by US tech firms. The order empowers the Attorney General to challenge state laws that conflict with the national goal of AI leadership. This move, which follows the failure of Congressional legislation, addresses the tech industry’s complaint that a “patchwork” of state regulations stifles development with complexity and red tape. The order aims to unify regulations and bolster US tech competitiveness.

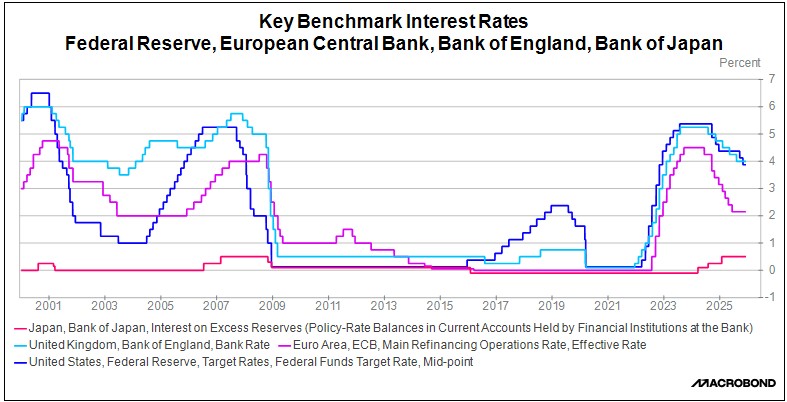

Hawkish BOJ: Senior Bank of Japan officials have signaled that its benchmark interest rate could exceed 0.75%, and potentially surpass 1.00%, by the end of the current tightening cycle. This guidance provides further evidence of the central bank’s decisive shift toward a more hawkish policy stance, as it moves interest rates from stimulative levels toward a more neutral setting. This projected path for higher rates is expected to strengthen the yen, which would likely place downward pressure on the US dollar in 2026.

Confluence of Ideas – #46 “The 2026 Outlook: Implications of the New Techno-Industrial State” (Posted 12/11/25)

The 2026 Outlook: Implications of the New Techno-Industrial State (December 11, 2025)

by Patrick Fearon-Hernandez, CFA, Bill O’Grady, Thomas Wash, and Mark Keller, CFA

Summary of Expectations | PDF

The Economy

Economic Growth

- We expect these trends to be bolstered by stimulative fiscal and monetary policies, ongoing enthusiasm for the promises of AI, and less policy uncertainty.

Recession Risk

- Importantly, we do not expect a recession in 2026, although “tail risks” (e.g., geopolitical events), could trigger an unexpected downturn. However, it should be noted that policymakers have demonstrated they can act aggressively to counteract downturns, which suggests that investors should not over-index to such events.

After its big slowdown in early 2025, we expect the US economy to reaccelerate in the coming quarters, leading to good growth in 2026.

The New Techno-Industrial State

Policy Shifts

- We believe the economy is increasingly being dominated not just by the AI-investment boom, but by a broader policy shift in which government officials more enthusiastically wield influence over the economy, often using industrial policy to advance national security, resilience, or other goals beyond profit maximization.

Navigating a New Era

- With the dawn of this new techno-industrial state, investors need to pay closer attention to the goals and plans of powerful officials in order to understand the evolving investment environment.

Market Outlook

Our asset class expectations call for more moderate performance returns than in 2025, but with balances tipped to the upside, especially for US and foreign stocks.

Fixed Income

- SHORT-TERM

Against the backdrop of a more interventionist techno-industrial state, the Federal Reserve will be under strong pressure to cut its benchmark short-term interest rate more aggressively in 2026 than in 2025. This is especially the case given that the US administration will likely replace several key policymakers at the Fed with more dovish officials. That will likely give a boost to short-term bonds, while weighing on obligations with longer maturities, putting some upward pressure on long-term bond yields. - LONG-TERM

Nevertheless, we expect the government will redouble its efforts to cap long-term yields. Longer-term bonds are therefore expected to produce returns similar to their current yields, while the yield curve should steepen only modestly.

US Equities

- BASE CASE FORECAST

Incorporating our expectations for economic growth, financial conditions, and other factors, our quantitative models suggest that overall corporate profit margins should moderate in 2026 versus their record-high in 2025. We project that S&P 500 operating earnings will equal about 6.3% of gross domestic product, which would put S&P 500 operating earnings at $235.33 per share. - CAPITALIZATION & GROWTH/VALUE

Based on the strong influence of index investing, we expect large cap stocks and growth stocks to continue performing well.

Foreign Equities

- WEAKENING DOLLAR

While our expectation for US stock performance is modest for 2026, we believe that the weakening US dollar and more stimulative fiscal and monetary policies abroad will bode well for foreign stocks. - FOREIGN VS. DOMESTIC

As such, we expect returns on foreign stocks will exceed those of US stocks. Among foreign equities, we continue to favor defense stocks.

Commodities

- We expect global central banks to continue buying gold aggressively, creating continued tailwinds for the yellow metal. However, our modeling suggests gold prices are already stretched, especially if the Fed’s interest rate cuts are backloaded until late 2026. Gold prices may not rise as fast in 2026 as they did in 2025.

- Other major commodities, such as oil, may also struggle against high levels of supply. On the other hand, we think the continuing AI boom will buoy natural gas and uranium prices as those commodities are essential to generating much of the electricity needed for AI data centers.

Daily Comment (December 11, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with an analysis of the Federal Reserve’s latest rate action and the 2026 policy outlook. We then assess rising US-Venezuela tensions and their implications for US foreign policy. This is followed by other market moving events such as China’s strategic dilemma over US chip restrictions, investor skepticism toward Oracle’s AI buildout, and the US-China tax standoff that is delaying the global minimum tax framework. Finally, we include a roundup of essential domestic and international data releases.

Fed Decision: The Federal Reserve delivered a quarter-point reduction to its benchmark rate, setting the new target range at 3.50% to 3.75%. The decision was highly controversial, featuring the most contentious vote of Federal Reserve Chair Powell’s tenure with three dissents — a split not seen in six years. To address persistent strain in the repo market, the Fed concurrently announced the imminent resumption of Treasury Bill purchases. Despite these stimulative actions, the central bank clearly signaled a cautious and potentially restrained trajectory for future monetary easing.

- The Federal Reserve’s latest Summary of Economic Projections (SEP) indicates a more confident economic outlook since September. Officials materially upgraded their median forecast for 2026 GDP growth from 1.8% to 2.3% and modestly improved their inflation projection, lowering it from 2.6% to 2.4% for the year. This brighter picture for output and prices was not extended to the labor market, where the unchanged projection implies policymakers still anticipate tepid hiring in the coming year.

- Despite the official vote, significant internal divisions persist within the Federal Open Market Committee (FOMC). Although the rate decision garnered only three formal dissents, SEP revealed a much deeper disagreement. Five officials favored maintaining interest rates at their previous level, while three others projected that the federal funds rate should be higher than the current target range by the end of 2026.

- In his press conference remarks, Chair Powell framed the committee’s internal divisions as a reflection of differing estimates for the long-run neutral rate — the theoretical policy setting that neither spurs nor slows economic activity. He further elaborated that officials’ growth projections rely significantly on productivity gains, which could result in slower hiring. Speaking on inflation, Powell characterized the recent uptick as likely temporary, attributing it primarily to tariff impacts.

- Heading into 2026, the central debate will be whether the Federal Reserve opts to cut interest rates to below the neutral rate. This decision will largely depend on whether inflation continues to ease and if the labor market cools as expected over the coming year. If these conditions materialize, the Fed may have the necessary impetus to implement deeper rate cuts before the next chair assumes leadership.

US Foreign Policy Turns Hawkish: The United States’ seizure of an oil tanker en route to Cuba has heightened diplomatic tensions with Venezuela. Washington justified the action by declaring the vessel stateless, despite its last known registration being from Venezuela. This intervention directly impedes Caracas’s ability to export oil — its primary source of government funding — and raises the potential for a direct conflict within the region.

- This US action marks the latest in a series of escalations with Venezuela. The pattern began with US airstrikes on Venezuelan vessels suspected of drug trafficking. It escalated further with presidential threats of a land invasion, and most recently, with Caracas accusing Washington of sending fighter jets to intrude on its airspace.

- The recent escalation of rhetoric and actions against Venezuela may be viewed as a bid for regional supremacy. Regardless of whether the US intends to intervene directly, its current behavior — characterized by increased external pressure and military signaling — echoes the pattern of strategic aggression seen in Russia’s approach to Ukraine and China’s persistent actions regarding Taiwan.

- Due to the White House’s unwillingness to create volatility leading into the midterm elections, a direct military attack is not expected. Crucially, though, these actions are designed to normalize the view of the Western Hemisphere as a US sphere of influence. The successful establishment of this precedent will likely lead to a more permanent and greater level of US engagement and assertiveness throughout the region.

Immigration Crackdown: New measures from the Trump Administration aim to restrict migration by tightening enforcement in two key areas. First, the White House has mandated a strict English proficiency requirement for commercial truck drivers, allowing for their immediate removal from service. Second, it has proposed using social media screening to deport visa holders. Collectively, these actions may reduce the supply of labor as it will remove or deter foreign workers from seeking work in the US.

China Chip Dilemma: Chinese firms’ continued demand for high-end US chips is straining Beijing’s push for domestic alternatives, as no local product can match the capabilities of NVIDIA’s H200. Recent disclosures — such as DeepSeek’s use of banned chips and a government review of NVIDIA demand — highlight the gap. Regulators now face mounting pressure as they decide how to allocate export permits after President Trump’s limited sales approval. Chinese firms’ need for US made chips is a reminder of the White House’s leverage in talks.

Oracle Disappoints: The cloud computing company reported disappointing financial results on Thursday, missing sales and profit estimates while raising its capital expenditure plan. This lackluster performance has amplified existing market concerns, specifically, that the aggressive spending on AI infrastructure is outpacing the immediate returns and earnings growth. This growing disconnect between investment and realization will likely lead to greater investor scrutiny and a push for more realistic valuations across the technology sector.

Global Pushback: The White House’s aim to exempt US multinationals from the global minimum tax has met with resistance from OECD nations, led by China. The group was set to finalize this arrangement as part of the second pillar of the global tax regime. While the full plan was expected to be released this year, objections from Beijing, which is advocating for a similar exemption for its firms, have delayed its publication. This holdup has led to speculation that the US could revive the retaliatory tax measures that it contemplated earlier this year.

Daily Comment (December 10, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with an analysis of President Trump’s decision to push for new governance in the EU. Next, we provide a primer for today’s pivotal Fed rate decision. We then offer an overview of critical global developments, including Denmark’s security concerns regarding the US, China’s restrictions on US chip sales, and a breakthrough in French government budget talks. Finally, we include a roundup of essential domestic and international data releases.

Trump on the EU: The US president expressed significant displeasure with current EU governments during a recent Politico interview, signaling a potential rupture in transatlantic relations. He levied specific criticism against the bloc’s leadership, citing its inability to control migration flows and its hesitation to fully back his strategic objectives for Ukraine. The president then intensified the statement by announcing he will openly endorse European candidates who share his outlook, suggesting an increasingly interventionist US foreign policy in the domestic politics of its allies.

- His remarks come as the US is embroiled in several disputes with European leaders, including disagreements over trade, technology regulation, and the approach to ending the Ukraine-Russia conflict. These setbacks have hampered President Trump’s efforts to pivot foreign policy toward containing China’s growing global influence. This tension suggests that the administration may not view its European counterparts as equals, but rather as subordinates to core US interests.

- While an alliance with right-leaning parties in Europe is imperfect, these groups nonetheless are facilitating several policy initiatives that the White House favors. This alignment stems from shared objectives, notably the desire for a swift end to the Ukraine war, a preference for greater national sovereignty within the EU bloc, and a rollback of climate change regulation.

- Despite shared political goals, the informal coalition between right-wing European parties and the US faces some internal friction. This stems from allegations that members within groups such as the Alternative for Germany (AfD) have been compromised, with some members reportedly passing sensitive data to Beijing. Furthermore, some members have pushed for closer energy ties with Russia to secure access to inexpensive resources, a position that directly conflicts with the US strategy of expanding its market share in the European energy sector.

- That said, the president’s statement that he will endorse right-leaning governments appears to be part of a growing trend of political statecraft. The US is actively seeking to reshape its relationships with foreign governments to facilitate deals that may benefit its broader strategic goals. Overall, this increased US involvement could make election outcomes in targeted countries far less certain, as past US interference has yielded mixed results, potentially introducing volatility into the equities of those nations.

- Additionally, the president’s stated aim is likely intended to encourage the EU to become more autonomous, urging the bloc to reduce its reliance on US influence and chart its own path forward. While we suspect the EU will continue to prefer strong ties to the United States, it may seek to balance this influence by entertaining closer relations with China and could even begin competing directly with the US for geopolitical influence in third countries.

Fed Primer: As its two-day meeting concludes, the FOMC is anticipated to lower the benchmark rate by 25 basis points, with future guidance being seen as critical for markets. Deliberations that have occurred since the November meeting have revealed a struggle within the Committee over whether to prioritize the price stability or the maximum employment side of its dual mandate. This tension culminated in unusual, conflicting dissents last time, as one policymaker pushed for a deeper cut while another favored maintaining the current rate.

- This division is likely to dominate the chair’s press conference, as markets remain uncertain about the future policy path. The latest CPI report revealed that core inflation is now rising at the same pace as headline inflation, signaling a potential broadening of price pressures. Meanwhile, the October JOLTS data showed an increase in job openings, even as hiring and quit rates stagnated — a mixed signal for the labor market.

- This policy dilemma unfolds against a backdrop of political pressure from the White House. The president has hinted at nominating Kevin Hassett for Fed chair, while also considering candidates like former Fed Governor Kevin Warsh and current Governor Christopher Waller. Notably, the president has publicly advocated for lower rates, a position echoed by Hassett, who has argued for a cut larger than 25 basis points.

- The market has shown a mixed response to the prospect of Fed rate cuts. While the anticipation of lower rates has boosted equities, concern over the possible loss of Federal Reserve independence — fueled by the potential appointment of a politically-aligned figure like Kevin Hassett as Fed chair — has provided support to 10-year Treasury yields, a development arguably more significant than the equity rally.

- The market will likely be paying close attention to the forward guidance provided by the Fed as it reviews the Summary of Economic Projections and the subsequent press conference. The prevailing expectation is that the Fed will cut rates by 25 basis points but signal an indefinite pause while it awaits further economic data. While we agree that a rate cut is more probable than not at this meeting, we suspect the Fed will continue to be less concrete on the path forward but will likely still leave the door open for additional cuts.

Denmark Fears the US: For the first time, the Danish Intelligence Agency (FE) has described the US as a potential security risk in its annual threat assessment. This unusual designation follows the US’s public pursuit of acquiring Greenland, a Danish territory. The agency’s report explicitly noted that the US is increasingly prioritizing its own self-interest, often at the expense of its allies. While this development is unlikely to have immediate market ramifications, it is a clear indicator of growing strategic mistrust between the US and its long-standing partners.

Pentagon Picks Google: Defense Secretary Pete Hegseth announced that the department has selected Gemini for its government systems to address its artificial intelligence (AI) needs. This selection is another example of the growing coordination between the US government and the technology sector, and it underscores the increasing reliance of tech companies on government contracts for sales. This major purchase is likely to boost Google’s stature as a significant and capable challenger to OpenAI in the competitive AI space.

China Blocks Nvidia: Beijing is reportedly preparing new limits on companies seeking to purchase the H200 chips recently cleared by the White House for export. The move is intended to push Chinese firms toward domestically produced alternatives, consistent with China’s broader goal of strengthening technological self-sufficiency. It also carries a political dimension as Beijing aims to avoid the appearance of yielding to US pressure — particularly amid reports that roughly 20% of the chip revenue is expected to go to the US government.

French Budget Passed: The French parliament passed the 2026 social security budget on Tuesday, a critical step toward approving the full state budget by year’s end. While the move was welcomed, concerns remain that Prime Minister Sébastien Lecornu may lack the votes needed for the broader bill, having alienated key allies with concessions to the Socialist Party. Nevertheless, finalizing the budget should help ease pressure on French bond yields.

Daily Comment (December 9, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with changes to Washington’s policy limiting Chinese access to advanced US computer chips and what the changes say about power dynamics in the US and between the US and China. We next review several other international and US developments that could affect the financial markets today, including a shift in investor expectations regarding foreign interest rates and an update in US artificial intelligence policy.

United States-China: President Trump yesterday said his administration will lift its ban on Nvidia selling its nearly cutting-edge H200 artificial-intelligence computer chips to China. In return, the US will get a 25% cut on all Chinese revenue from the H200s. The deal marks the federal government’s latest extraordinary intervention into private markets and suggests the administration is continuing to favor the “tech bros” element of its political coalition over its “China hawks” element.

- Nevertheless, reports this morning say Beijing plans to limit access to the H200 chips as it focuses on achieving self-sufficiency in semiconductor production. Sources say Chinese firms will likely have to apply to the government to buy the chips and show why they can’t rely on domestic semiconductors.

- Taken together, these developments illustrate a changing, complex balance of power within and between the US and China. Domestically, the US government is sharply expanding its power over the private sector and has become much more willing to flex its muscles. Internationally, however, the US this year has often discovered that it has less leverage against China than it thought, and that China is less dependent on US goods and technology than previously expected.

European Union Immigration Policy: The EU’s national internal affairs ministers yesterday signed off on a dramatic tightening of the bloc’s immigration policy, making it easier to deny asylum claims and allowing failed asylum seekers to be detained and deported to “return hubs” outside the EU. The modifications still must be negotiated with, and approved by, the European Parliament. However, whatever their final form, they are likely to herald much tighter immigration into the EU, despite the region’s low birth rates and weak population growth.

European Union Environmental Policy: EU officials early today agreed to sharply curtail the bloc’s controversial supply-chain regulations, which aimed to address environmental and social concerns throughout supply chains touching the EU. The changes will sharply limit the rules to a relatively small number of huge enterprises that will be more able to absorb their costs. As we note in our upcoming Geopolitical Outlook for 2026, the shift reflects a nascent, politically driven trend toward deregulation in the EU that could help boost the region’s economic growth.

Eurozone Monetary Policy: For the first time, swap market trading suggests investors now think the European Central Bank is more likely to hike its benchmark interest rate in 2026 than to cut it. Investors also expect the Canadian and Australian central banks to start hiking their rates next year, while the Bank of England is expected to stop cutting its rate by mid-2026. The change in sentiment reflects less pessimism about economic growth and more concern about price inflation and debt. The Bank of Japan began slowly hiking its interest rates in early 2024.

- Even if the key foreign central banks do start hiking their interest rates, we continue to believe the Fed will cut its benchmark fed funds rate more aggressively in 2026 than in 2025 as it faces a softening US labor market and outside political pressure.

- Any rise in foreign interest rates while US rates are falling would likely put additional downward pressure on the dollar. As we have noted many times in the past, periods when the greenback is depreciating have typically led to better returns for foreign stocks than for US stocks.

US Monetary Policy: The Fed today begins its latest policy meeting, with its decision due tomorrow at 2:00 PM ET. This meeting will also include the policy committee’s updated economic and financial projects (the “dot plots”). Based on futures prices, investors are virtually unanimous in expecting the policymakers to cut their benchmark fed funds short-term interest rate by 25 basis points to a range of 3.50% to 3.75%.

US Artificial Intelligence Policy: President Trump yesterday said he will sign an executive order this week to prevent US states from imposing their own regulations on the AI industry. Instead, the order will give the federal government the sole right to impose a uniform set of regulations, with the goal of fostering a rapid build-out of the industry.

- The order will be further evidence that the administration is favoring the tech industry over other interests, including states’ rights.

- The administration’s preference for the tech industry is probably one reason why tech stocks have performed so well this year.

US Energy Policy: A district court judge in Massachusetts yesterday nixed President Trump’s January order freezing federal approvals of new wind energy projects, arguing that the order was “arbitrary and capricious.” Despite the setback, however, the order is likely to be appealed, and the ban could well be reinstated. In other words, the court decision doesn’t definitively clear the road for further green energy projects in the US.

US Agriculture Industry: President Trump yesterday announced a $12-billion federal bailout of US farmers, who have been struggling with low prices due to record production and weaker purchases by China. According to the American Farm Bureau Federation, more than half of US farmers are currently losing money. The new aid will likely help buoy demand for a range of agricultural inputs and help support the stock prices of firms ranging from agricultural equipment manufacturers to seed and fertilizer producers.

US Stock Market Strategy: According to the Wall Street Journal yesterday, banking giant JPMorgan Chase has not only launched its $1.5-trillion fund to invest in US defense firms and other enterprises building US innovation and resiliency, but it has also formed a panel of outside advisors for the fund ranging from Amazon CEO Jeff Bezos to former US Secretary of State Condoleezza Rice.

- We at Confluence have long argued that the growing US-China rivalry and global fracturing will create investment opportunities in defense firms and companies related to economic resiliency.

- JPMorgan’s establishment of a large fund dedicated to the theme, along with an advisory board stocked with high-level executives and national security experts, is evidence that the opportunities are finally being recognized even by big, traditional financial firms.

Global Energy Market: According to the chief economist at commodities trading giant Trafigura, the global oil market could face a “super glut” in 2026 as huge new supplies arrive and global demand weakens. For example, the economist cited the completion of big, new production projects in Brazil and Guyana but slowing demand growth in China as it relies more heavily on electric vehicles.

- The top oil trader at Trafigura recently said that he expects Brent crude prices to fall below $60 per barrel in the near term, versus about $62.50 today and more than $80 in early 2025.

- If the current oil glut does worsen as Trafigura expects, it would naturally help hold down consumer price inflation, but it would also weigh on global energy equities.