by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest on the Israel-Iran conflict. President Trump is reportedly prepared to have the US join in Israel’s attack against Iran, but he still wants to give diplomacy more time before making the final decision. We next review other international and US developments with the potential to affect the financial markets today, including a slew of monetary policy decisions around the world and worsening projections about the health of the US’s social security system.

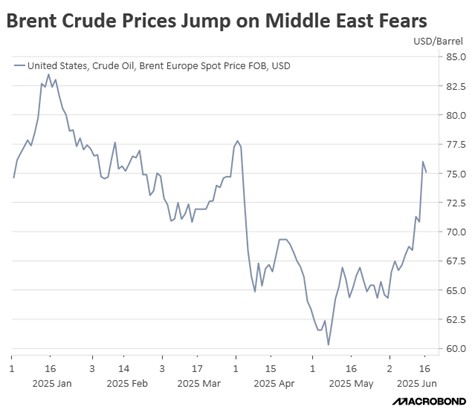

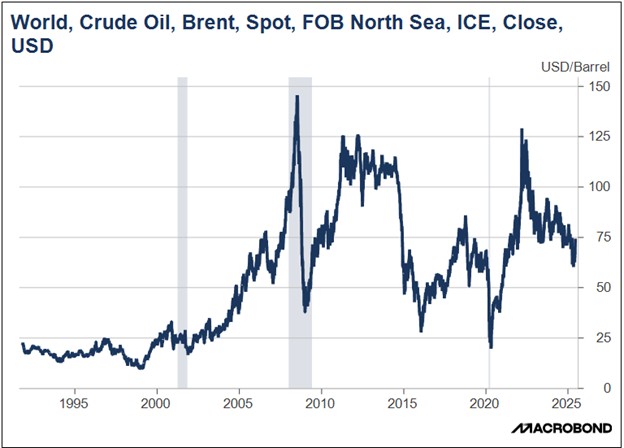

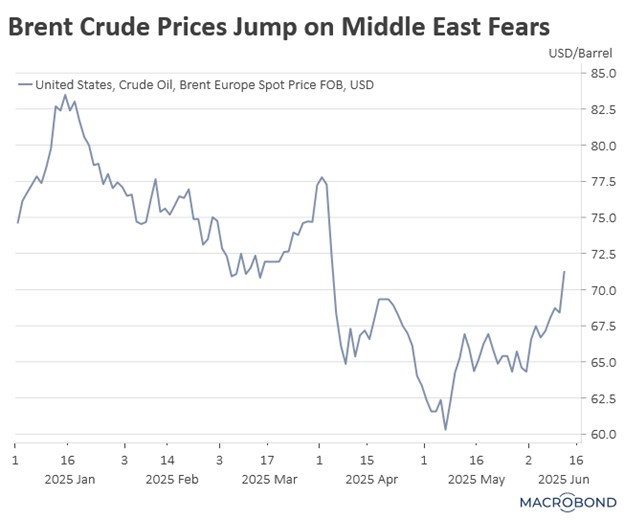

United States-Iran-Israel: Reports late Wednesday, before yesterday’s Juneteenth holiday, said President Trump had approved final US attack plans on Iran, but hadn’t yet given the final green light. Other reports say the US attack would likely come as early as this weekend, involving US stealth bombers dropping massive “bunker buster” bombs on Iran’s underground nuclear facilities to help put a final end to the country’s drive for a nuclear weapon. Meanwhile, both Israel and Iran continue to stage air and missile attacks against each other.

- One senior official close to Trump indicated that he is leaning heavily toward launching the operation because of what he sees as a rare window of opportunity to end the Iranian nuclear threat and cement his legacy, even though the attack would likely undermine the support of isolationists in his political base.

- Of course, the signals from the White House could merely aim to scare the Iranians into a deal to voluntarily end their nuclear program. Trump has reportedly blessed a plan by the German, French, and UK foreign ministers to meet with their Iranian counterpart on Friday, and if that meeting is productive, the president could forego the military attack.

- In any case, even if the attack proceeds, it’s not certain that it will totally end Iran’s nuclear program. Eradicating the program could well require regime change and/or Israeli special forces operations at Iran’s deep-underground Fordow facility and elsewhere.

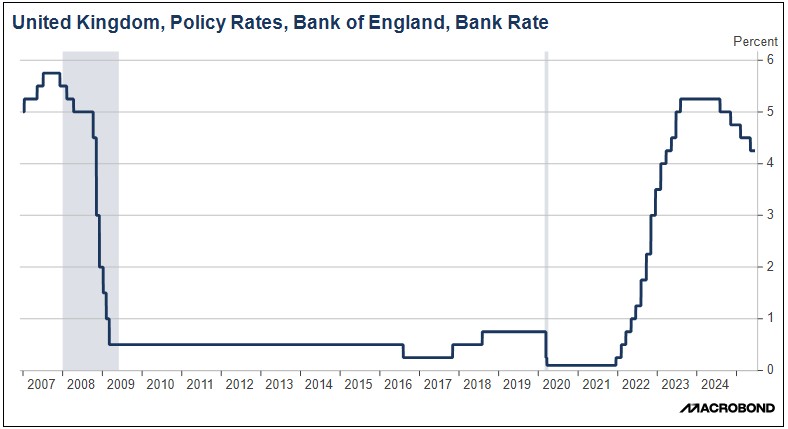

United Kingdom: The Bank of England yesterday held its benchmark interest rate unchanged at 4.25%, as expected. Importantly, BOE Governor Andrew Bailey confirmed that rates are likely to remain on a downward slope, but he cautioned that the pace of decline may be slowed by sticky inflation, including as a result of higher energy prices following Israel’s attack on Iran.

Other Foreign Monetary Policy: Besides the Bank of England, several other major central banks had their policy meetings over the last 48 hours. Taken together, the policy decisions largely reflected concern or complacency about the domestic economic impact of the US’s aggressive tariff policies, as follows:

- The Swiss National Bank cut its benchmark rate by 25 basis points to 0.00% to counter the surging currency, slowing economic growth, and a return to deflation.

- In Sweden, the Riksbank cut its benchmark rate by 25 basis points to 2.00% as consumer price inflation weakens and economic growth recovers more slowly than anticipated.

- In Turkey, the central bank held its benchmark rate at 46% amid concerns about economic instability and rising price pressures. After starting to cut rates late last year, the central bank hiked its policy rate in April amid political upheaval.

- In Taiwan, the central bank held its benchmark rate at 2.00%, marking the fifth consecutive policy meeting with no change. According to Taiwan’s monetary policymakers, the uncertainty surrounding geopolitics and US tariff policy argues for steady policy, as opposed to preemptive rate cuts.

- In the Philippines, the central bank cut its benchmark rate by 25 basis points to 5.25%, marking its second cut of 2025 and bringing its total cut to 1.25% since last August.

European Union-China: The European Commission today confirmed that it will bar Chinese medical devices from EU government procurement tenders. The move was widely expected after a formal probe by the Commission found China to be unfairly blocking EU medical devices from its government procurement programs. Although the EU has flirted with the idea of improving ties with China to make up for the Trump administration’s tough trade policies, the new ban on medical devices will likely exacerbate EU-China tensions and please US officials.

Germany: Steel giant ArcelorMittal has announced that it will turn down 1.3 billion EUR ($1.5 billion) in public subsidies to convert its furnaces in Bremen and Eisenhüttenstadt to use hydrogen rather than coal. The company also warned it may close its flagship ethanol plant in Belgium because of overly restrictive regulations. The announcement is the latest sign that firms around the world are pulling back from green programs, even as some governments are also rolling back their support.

Thailand: Prime Minister Paetongtarn Shinawatra is on the verge of losing her parliamentary majority and facing new elections after a leaked recording of her recent call with former Cambodian leader Hun Sen showed her disparaging the Thai military. The scandal has sparked anger among Thailand’s military-royalist establishment, and one conservative party has already withdrawn from Shinawatra’s governing coalition. Analysts give her only a slim chance of staying in power.

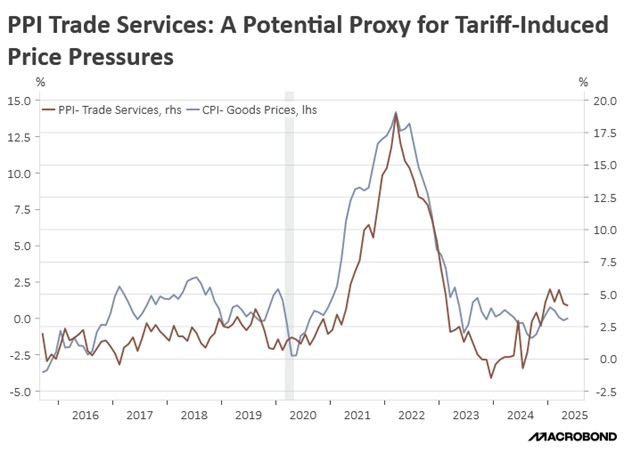

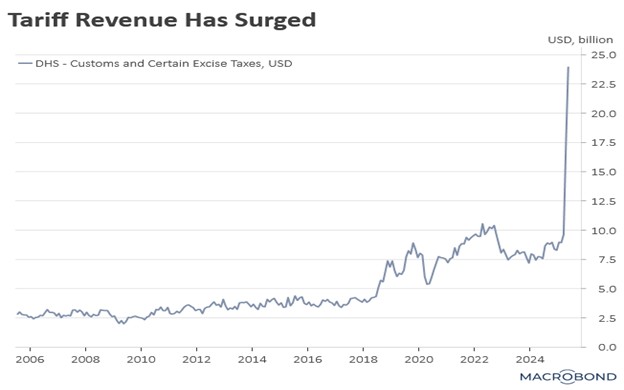

Canada: Prime Minister Carney yesterday said that his government has imposed 100% tariffs on all non-US steel and aluminum imports and would adjust its tariffs on US imports of the metals on July 21, depending on the state of US-Canada tariff negotiations at the time. The move illustrates how the Trump administration’s tariff policies have set off a wave of protectionist measures around the globe, which could well lead to disrupted supply chains, higher costs, and reduced profitability for companies around the world over time.

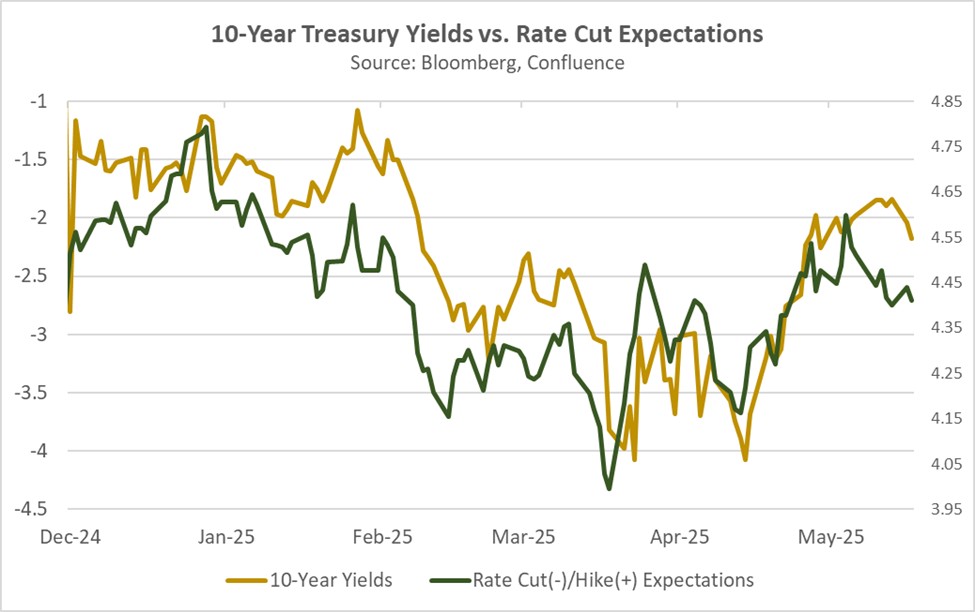

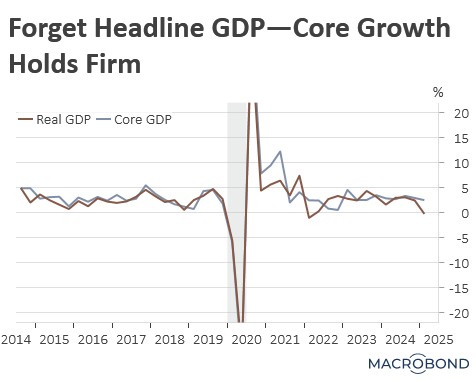

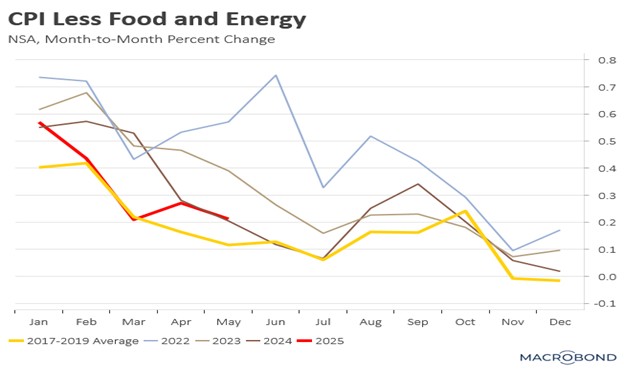

US Monetary Policy: As widely expected, the Fed on Wednesday held its benchmark fed funds interest rate unchanged at a range of 4.00% to 4.25%. Moreover, Chair Powell suggested that policymakers are still in wait-and-see mode as they look for evidence of a possible rekindling of consumer price inflation due to the Trump administration’s increase in import tariffs or an economic slowdown. That stance would seem to preclude a cut in rates at the next policy meeting in July.

- All the same, the accompanying “dot plot” of the policymakers’ economic projections was instructive. Compared with the policymakers’ last projections in March, the new projections show they expect weaker economic growth through 2026, higher unemployment, and faster price increases.

- Against this environment of “staglation,” the policymakers expect the fed funds rate to decline more slowly than they did in March. That’s consistent with our long-held view that investors are too optimistic about future rate cuts.

US Social Security Program: In their annual report on Wednesday, the Social Security trustees projected that the program will run out of resources to pay promised benefits by 2034, one year earlier than projected last year. The worsening situation reflects multiple issues, including more baby boomers retiring, falling birth rates, and a recent law extending Social Security retirement benefits to certain public-sector workers.

- If the Social Security trust fund is depleted and payroll taxes don’t increase, the report finds that benefits would have to be cut about 19% in 2034.

- It is widely believed that Congress would step in to top up the trust fund, increase payroll taxes, or otherwise make good on promised benefit. However, such action is not guaranteed.