by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with some notes on the big Shanghai Cooperation Organization summit in Tianjin, China. We next review several other international and US developments with the potential to affect the financial markets today, including a sharp sell-off in British government bonds and the pound today and a few words on the Friday decision by a US appeals court to invalidate most of the administration’s new “reciprocal” tariffs.

China-Shanghai Cooperation Organization: General Secretary Xi welcomed the leaders of about 20 nations for an SCO summit in China on Sunday, including Russian President Putin, Iranian President Pezeshkian, and Indian Prime Minister Modi. To many analysts, Modi’s decision to attend the Beijing-led political and security grouping is a worrying sign that India has now at least partially shifted its allegiance to China and away from the US.

- If New Delhi continues to realign with Beijing, it would potentially dash years of hopes in the West that India would be a bulwark against China’s growing geopolitical and economic power.

- As a reminder, membership in the SCO is one of the factors we use to assign countries into the world’s new geopolitical blocs. It’s also one reason why our methodology currently assigns India to the “Leaning China” bloc. Some observers have questioned that assignment, but it’s consistent with New Delhi’s quick pivot toward Beijing this spring.

China-Russia: Also at the SCO summit, the Kremlin said China and Russia have now finally agreed to jointly build the Power of Siberia 2 natural gas pipeline, an enormous new conduit between the countries. Once completed in the 2030s, the new pipeline would allow Russia to shift its gas exports away from Europe in favor of markets in China, which, in turn, would allow China to cut its imports of expensive LNG. However, it appears that commercial terms are still being negotiated, including pricing issues that have long been a stumbling block for Beijing.

China: The official purchasing managers’ index for manufacturing rose to a seasonally adjusted 49.4 in August, while the private-sector Caixin PMI for manufacturing jumped to 50.5. For a true gauge of what’s happening in the Chinese factory sector, analysts sometimes average the two, and using that method, the reading rose from 49.4 to 49.9. That still leaves the reading below the 50 level that indicates growth, but it does suggest that Chinese manufacturing is now basically just stagnant rather than falling, at least in part because of the government’s stimulus measures.

Japan: Despite Tokyo’s recent decision to double its defense spending and rearm to meet the growing geopolitical threat from China, new reports say it only managed to recruit half the 20,000 fresh troops it planned to hire in 2023. As with many nations in the US geopolitical bloc, military recruiting in Japan is facing challenges such as the country’s poor population growth, tight labor market, low military pay, and the perception of military service as dangerous.

- Those factors will likely make it hard for Japan to respond to US pressure for a more robust military effort.

- In turn, that could mean Japan will be more vulnerable to US moves to punish it for not rearming more aggressively.

Indonesia: The country’s wave of protests against corruption and lawmaker perks intensified over the weekend with looting, arson and deadly violence in multiple cities. The unrest became so bad that President Subianto was forced into an embarrassing cancelation of his trip to the SCO summit in China. He also was forced to strike a deal with several political parties to cut housing allowances and suspend overseas work trips for members of parliament. Those moves have helped calm the situation, but economically disruptive protests could still reignite.

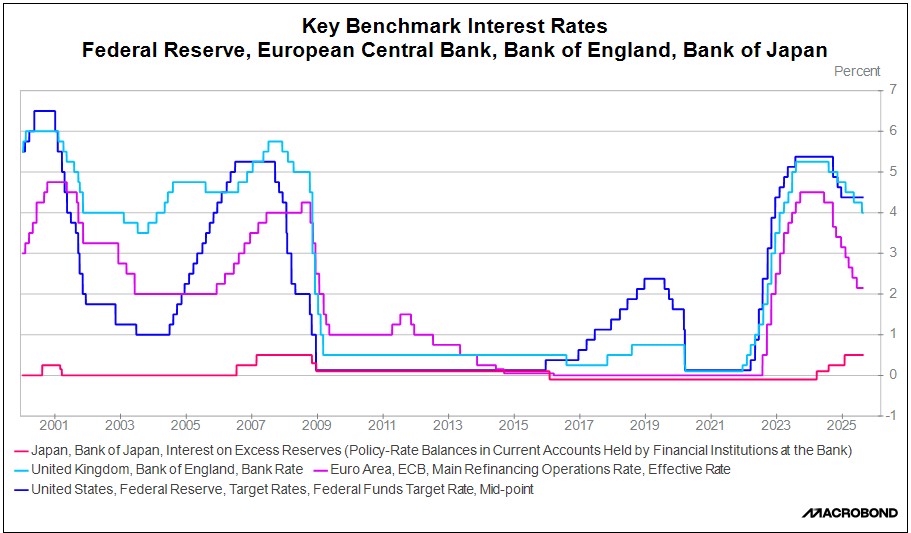

Eurozone: In a report yesterday, the region’s July unemployment rate fell to a seasonally adjusted 6.2%, down from 6.3% in June and marking a new record low. The decline was especially impressive given the eurozone’s recent spate of weak economic growth. The drop in joblessness is expected to discourage the European Central Bank from a further interest-rate cut at its next policy meeting next week.

United Kingdom: In a potential sign of capital flight sparked by slow economic growth and rising public debt, 30-year gilt yields today spiked to 5.72%, reaching their highest level since 1998. Meanwhile, the pound depreciated 1.4% against the dollar, ending at $1.3352. The jump in government borrowing costs will likely put even more pressure on Prime Minister Starmer’s Labour Party government to come up with difficult tax hikes and/or spending cuts, which could further weigh on the economy and UK assets.

Russia-Ukraine War: In a previously unreported development that heralds a new era in warfare, Ukraine has been using drone swarm technology in its defense against Russia’s invasion over the last year. The technology involves loading multiple drones with artificial intelligence so they can operate, communicate, coordinate among themselves, and attack Russian positions or carry out other tasks autonomously, reducing the number of Ukrainian soldiers needed for the task. The technology is now expected to become a big part of the global defense industry.

United States-China: In the latest example of a high-profile scientist leaving the US to return to China, epidemiologist and human microbiome scientist Wang Leyao has left her positions at the University of Massachusetts at Amherst and the National Institutes of Health to join the Shenzhen Medical Academy of Research and Translation (Smart) as a senior research fellow in its Institute of Human Immunology. As we’ve noted before, the string of top scientists returning home could help China overtake or expand its lead over the US in key industries.

US Tariff Policy: A federal appeals court late Friday ruled that the White House’s “reciprocal” and fentanyl tariffs against China, Mexico, and Canada are illegal, upholding a lower court’s decision to block them. However, the court let the tariffs remain in place until October 14 to facilitate a likely administration appeal to the Supreme Court. So far, the decision doesn’t seem to be having much impact on the global financial markets, perhaps reflecting uncertainty that the Supreme Court will invalidate the tariffs.

US “Recession”: As economists and market strategists, we’re always on the lookout for a shift in the business cycle, so we were struck by new research from data analysis group IFS claiming the US is already in recession. However, on closer inspection, it turned out that the report, titled “The Sex Recession,” focuses on survey results showing a big drop in the number of Americans having, er, intimate relations. It’s not clear if this type of recession will affect the stock market, but the researchers note that it points to a further fall in the US birth rate and population growth.