Daily Comment (May 4, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning! It’s employment week; we are expecting a very weak report for April, with the unemployment rate in the 16% area. Equity futures are lower. We update the COVID-19 news. Here are the details:

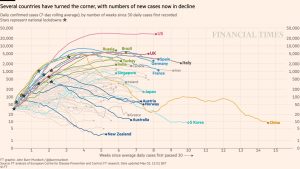

COVID-19: The number of reported cases is 3,523,121 with 247,752 deaths and 1,130,996 recoveries. In the U.S., there are 1,158,341 confirmed cases with 67,686 deaths and 180,152 recoveries. Here is the FT chart:

The virus news:

- The good news:

- Roche (RHHBY, 42.84) has received clearance for emergency use of an antibody test from the FDA. The company claims an impressive accuracy—100% in detecting COVID-19 antibodies and a 0.2% false positive result.

- There are currently 254 therapies being tested for COVID-19 and 95 vaccines. That is good because many of these will fail. Meanwhile, there is also something of a geopolitical race for a vaccine; the soft power a nation would get by being the first to bring a vaccine would be large. So far, the U.S. has shown little interest in global participation to find a vaccine. One would assume that if the U.S. does develop it first, we would protect Americans first and the rest of the world later.

- Here’s another oddity of COVID-19—habitual smokers are underrepresented among those hospitalized. In France, this news has led to a run on smoking-cessation products on the idea that nicotine may act on the lungs in such a way that it slows the invasion of the virus in the body.

- There is increasing investigation of blood plasma to treat COVID-19. Some studies are looking at introducing antibodies from those who have recovered from the virus, while others are looking at regulating the immune response.

- The bad news:

- Meanwhile, in comparison to the Roche test, others have been far less impressive in (a) determining if a patient has been infected, or (b) suggesting they have been infected when they haven’t. We hope the Roche test is as good as they say it is, but, compared to the others, we will go with Reagan’s “trust but verify.”

- There are widespread reports that imported PPE, especially masks, are substandard. The N95 mask, named because it filters out 95% of small particles and gives the standard of protection, is being imported but tests show that about 60% fail. News such as this will undermine confidence in global medical supply chains and bring production back to the U.S.

- There are lingering concerns that if the virus is in the air, HVAC systems could spread it through the ventilation system.

- Although herd immunity can be achieved without a vaccine, the cost is really high.

- Russia is seeing a surge in cases of the virus. The official case count jumped 10k on Sunday.

The policy news:

- The economic data released this month and next will look awful; this is no surprise. However, even though the downturn is well anticipated, the data will likely drive another round of fiscal action. Already, political camps are laying out their goals. Democrats want more aid for state and local governments. Congressional GOP leaders are pushing for liability protection. The White House is flirting with tax cuts and maybe a further delay in filing taxes this year. With divisions this wide, bridging them means that another round of fiscal stimulus will take a while. For now, the official line from the administration is that we should have a “pause” to see how approved spending affects the economy.

- Hurricane season is less than a month away. Forecasts suggest it will be an active season. On average, the Atlantic hurricane season generates 12 named storms of which three become major (category 3+) hurricanes. Most university projections are expecting mid-to-high teens for this year’s season. FEMA is preparing for an elevated season with the added complication of COVID-19; one can imagine hurricane shelters, which often put lots of unrelated people in close quarters, as potential vectors for spreading the virus.

- The EU will begin debating a €1.0 trillion stimulus package to address COVID-19. This comes in the aftermath of a program half this size for the Eurozone. So far, we are seeing widening credits spreads between sovereign yields of the southern nations compared to the northern ones. This spending is, in part, designed to narrow that gap.

The economic news:

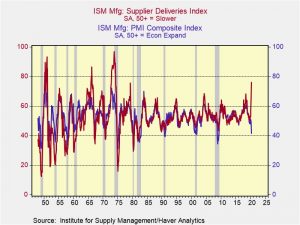

- Last Friday’s manufacturing ISM data came in better than expected. Don’t be fooled. It was much worse than expected. Why? The supply deliveries component has distorted the report. Under normal circumstances, slower deliveries usually coincide with a robust economy. Therefore, the ISM is constructed to treat slow deliveries as positive. However, in the current environment, slower deliveries are an artifact of shutdown orders; in other words, in a really strong economy, bottlenecks in deliveries occur due to tightening supplies. In the current situation, bottlenecks simply reflect the shelter-in-place orders. Here are a couple of charts:

Note that it is unprecedented to see a supplier delivery reading above 70 with an ISM less than 60. In this chart, we adjust the ISM by excluding supplier delivery. This leads to a reading of 33, which is more in line with a deep downturn in the economy.

- Bees are critically important to America’s food crops. Lockdown measures have reduced the ability of beekeepers to move their hives to fruit and nut orchards. However, another threat has emerged in the northwest—the Asian giant hornet. This insect, native to Asia, has recently been found in the U.S.

- Around the globe, various levels of government are starting to ease social distancing restrictions. In the U.S., three-fifths of the states are allowing some businesses to reopen. It is unknown how this will go. We don’t know how the virus will behave in the summer months. There is some speculation it could act like influenza and spread less quickly. However, opening businesses is one thing; getting customers is something else. Early evidence suggests that business activity will recover slowly, at best. The other risk, of course, is a return of the virus and the need to reimplement lockdowns.

- Construction firms in the U.S. report slow activity. Although stalled projects have resumed as lockdowns ease, order pipelines show little future activity once current jobs are completed.

The market news:

- In the Great Financial Crisis, investors with cash were able to make investments in stricken firms at favorable rates. Interestingly enough, this time around, the Fed has moved so fast to offer support that these same investors are finding themselves shut out of these opportunities.

- As the first week of May is upon us, landlords and mortgage lenders are bracing for another round of missed payments. This is a classic case of “who bears the cost of adjustment.” Lenders and landlords clearly can’t get money from renters and borrowers who have no income but there has been varying responses on how these missed payments will be handled. Some of the lenders or landlords want a lump sum for the lost payments, which doesn’t appear likely. There have also been calls for organized rent strikes. Although eviction and foreclosure are options, neither is all that attractive for mortgage holders or landlords; there is no guarantee that the unit can be re-rented, and if home prices fall foreclosure can mean a drop in mortgage values. We will be watching to see if the Fed comes to the rescue here as well. As we noted above, we doubt there will be fiscal action to resolve this situation anytime soon.

The foreign policy news:

- As we detailed last week, relations with China continue to deteriorate, and it’s not just the U.S. Punishing China looks to be a major campaign point this November. The U.S. is building alliances in the South China Sea with those who are increasingly worried about China’s aggressive actions in the area. SoS Pompeo continues to argue there is a “significant amount of evidence” that COVID-19 came from a Chinese bio lab. China is also accused of hiding the virus’s lethality in order to hoard medical supplies. The administration is accelerating plans to remove China from the U.S. supply chain.

Turkey: Sensing that President Erdogan is in trouble, the U.S. is increasing sanctions threats to forestall the activation of Russia’s S-400 missile defense system. The Fed has widened swap lines to foreign central banks and created a Treasury repo market for central banks that are not given swap lines so these excluded central banks can access dollars without having to sell their bonds in reserves. It appears that Ankara, facing a dollar supply crunch, will not get help from either source. The Fed won’t give a swap line to such a dodgy borrower and Turkey doesn’t have enough reserves to repo.

Iran: Iran’s new parliament is chock-full of hardliners and the election authorities restricted more liberal candidates. However, just because there is a large majority of a certain political leaning doesn’t mean factions can be avoided. There is an apparent battle for who will replace Ali Larijani for speaker of the parliament.

North Korea: Well, to paraphrase the early Weekend Updates, Kim Jong Un is still not dead. He was seen at a fertilizer factory over the weekend. We do note there was an exchange of gunfire on the DMZ; no casualties were reported.

Venezuela: Although details remain scant, there was apparently some sort of mercenary incursion into Venezuela last month. There is no evidence that the U.S. government was directly involved in the action, but it is possible the U.S. was aware of the event. Apparently, it went badly.

Argentina: Buenos Aries is almost certainly going to default (again!) and require some sort of bailout. However, the economic minister of the country, Martin Guzman, suggests in an FT op-ed that much of the emerging world will require similar support. He seems to be suggesting we may see a broad debtors’ strike which would roil the global financial system. In related news, growing financial stress is leading to trade tensions in South America and may threaten the Mercosur, the free-trade zone on that continent.

Germany: The Social Democrats are arguing that Germany would be better off without U.S. nuclear weapons on its soil. The presence of these warheads has been a sore point for the German left for decades. However, maintaining the alliance has always led Germany to allow the U.S. to deploy these weapons despite the misgivings. As the alliances fray, we may see these nukes go. If they do, Germany will need to dramatically boost its conventional defenses or develop nukes of its own in the face of the potential threat from Russia. Or, Germany could take the route favored by the SDP for ages, which is to improve relations with Moscow. As long as Chancellor Merkel is in power, the nukes will likely stay. But, if the SDP can break free from the current coalition, and perhaps join the Greens, this issue may return.

U.K./U.S. trade: The two nations will launch talks for a free-trade agreement tomorrow. If Brexit comes at the end of the year, it is clear Westminster wants to have a deal with the U.S. prepared.