Asset Allocation Weekly (May 1, 2020)

by Asset Allocation Committee

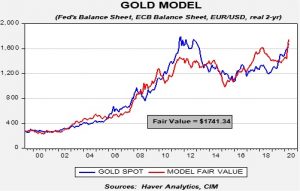

The policy response to COVID-19 has been mostly favorable for gold. Our gold model uses the balance sheets of the Federal Reserve and the European Central Bank, the EUR/USD exchange rate, and the real two-year T-note yield. The only variable that has been bearish for gold is the dollar, but the massive rise in central bank balance sheets and the drop in real yields has lifted the model’s fair value to 1,741.34.

In the coming months, we expect the fair value to rise; both the ECB and the Federal Reserve are likely to continue to expand their balance sheets, adding a broad spectrum of assets. We would also expect some modest declines in the real two-year T-note yield as inflation rises. Weakening the dollar may require direct action by the administration. Although this action may not occur this year, we would not be shocked to see it occur at some point in the future.

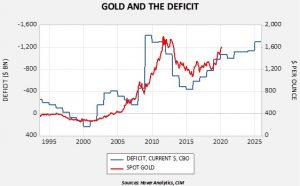

In addition, there is a long-term relationship between gold prices and the level of the fiscal deficit. Although the level of the current deficit does suggest that gold prices might be a bit overvalued currently, the likelihood of expanding deficits should offer underlying support for gold prices. The Congressional Budget Office recently increased its deficit forecasts; we still view them as conservative and would anticipate even higher deficits due to falling tax receipts and rising spending.

Therefore, our short- and long-term outlooks for gold remain positive.