Daily Comment (September 24, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, all. Equity markets are marking time this morning, but the market tone isn’t very good. A general market comment leads our coverage this morning. The virus update comes next. China news follows. We close with economic, policy, and Brexit news, with a bonus chart that caught our attention. The Fed has released its Financial Accounts of the U.S., known by market veterans as the Flow of Funds. There is a great deal of interesting data that comes from this report, and we will highlight different graphs over the next few days. And, being Thursday, the Weekly Energy Update is available. Let’s get to the details:

About this market: After a remarkable recovery from the lows seen in March, several markets are showing signs of weakness. Equities have clearly come off their highs and are struggling. The star of the past several months, precious metals, is suddenly seeing weakness. And Treasuries aren’t rallying very much. There are a number of factors behind this broad weakness. Here is the short list:

- The political environment is becoming increasingly unsettled. At the start of the year, President Trump looked like he would probably get re-elected. The economy was doing fine, equity markets were doing well, and the Democrats were still sorting through their candidate list. These conditions were upended by COVID-19; the economy has suffered a historic decline in what may be the worst and shortest recession in our history (it may be over already). It is rare for an incumbent to survive re-election if a recession occurs in the election year; polling data and prediction markets are all leaning toward a new president in November.

- Widespread racial protests that developed over several police actions have further divided the country. Yesterday we saw another round.

- The passing of Justice Ginsburg has turned this election into a zero-sum situation. The GOP is moving rapidly to fill the opening; the Democrats are trying their hardest to prevent this from occurring.

- The president continues to suggest he may not concede if he loses. The U.S. has mostly had peaceful transfers of power.[1] The most recent contested election was in 2000, which the Supreme Court resolved. The worry is that the drive to fill the Ginsburg seat is an attempt to have a conservative majority on the Supreme Court in case the election ends up in the courts.

- We closely monitor politics; our stance is that we try to address two questions—who will win and what will they do when they are given power? However, the current situation is different; we are now trying to handicap what happens if the outcome of the election is in dispute. And for that, we have little precedent. We still consider the disputed election as a tail risk, but that risk is growing, and the dispersion of outcomes is widening.

- Next up is the Fed. We have seen a virtual parade of FOMC members call on Congress for more fiscal stimulus, which isn’t likely due to the uproar over the Supreme Court. The underlying message is that the Fed has done about all it can do; if Congress doesn’t act, the Fed’s tools are limited. There is a deep misunderstanding about Fed policy at present. First, it is clear the public has little understanding of the Fed’s new inflation policy. This is understandable, because the Fed, in its drive to maintain flexibility, has not given a clear picture of how it will respond to rising inflation. VP Clarida was on Tom Keane’s podcast yesterday; his comments were a muddle. What this tells us is that Chair Powell either (a) hasn’t been able to create a model for the future path of policy, or (b) he hasn’t really swayed the rest of the committee to abandon the path Paul Volcker put the Fed on since 1978, which was to pre-empt inflation by tightening when the labor market loses slack. It is quite possible the “or” in the above sentence should be replaced with an “and” and the word “either” eliminated.

- There is also a second element. There is a profound misunderstanding of how the Fed backstopped the shadow banking system in March. The markets generally thought the Fed was simply buying everything. That wasn’t really true. What the Fed was doing was following a version of Bagehot’s Rule, which is that in a crisis, the central bank should lend freely on good collateral at a penalty rate. The Fed established a rate where it would act as dealer of last resort in a broad spectrum of markets to create a bid, so the shadow banking system would function (as an aside, the shadow banking system is, for the most part, the actual banking system). The markets thought they had a Fed that would purposely narrow credit spreads. What Fed was really doing was preventing them from “blowing out,” an event that tends to cause the system to seize. Thus, there have been some complaints that the Fed’s balance sheet has stopped expanding, and therefore, the Fed is failing to support the markets. This fear is misguided; the fact that the balance sheet hasn’t expanded all that much is a sign the Fed’s policy is working, because the policy goal was market stabilization, not stimulus.

- The financial markets want a Fed that forcibly narrows credit spreads. We will be watching to see is if the Fed is eventually required to do so.

- In all this, Treasuries haven’t really rallied all that much. We have been worried for some time that Treasury rates have declined to a point where they would cease to act as a hedge to risk assets. We may have reached that point.

- And what about gold and precious metals? They have fallen with the drop in equities. To some extent, both equities and precious metals have been pricing off the same narrative—the Fed was flooding the economy with money. Now that there are concerns the Fed can’t or won’t do much more, there is a repricing underway. Comparing gold to breakeven inflation from TIPS, fair value for gold is around $1,800; gold prices have gotten a bit ahead of themselves. That being said, we do expect the Fed to allow real yields to fall further and view this pullback as normal. It appears to us that currency debasement is becoming the policy of all central banks, which is gold friendly.

- In conclusion, it looks like conditions are going to be unsettled for the next 6-12 weeks. Beyond that, the situation should improve. The recovery should continue, the Fed should keep rates low indefinitely, and earnings should get better. In the meantime, volatility is the order of the day.

COVID-19: The number of reported cases is 31,920,652 with 977,311 deaths and 22,002,729 recoveries. In the U.S., there are 6,935,414 confirmed cases with 201,920 deaths and 2,670,256 recoveries. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. And the weekly Axios state chart is out; infections are rising, mostly in the Rockies.

Virology:

- A new study has indicated that COVID-19 is mutating. This isn’t a huge surprise; viruses tend to do this, some more than others. For example, we have to get a flu shot every year because the virus that is likely to affect us changes over time. Some viruses don’t change all that much, so (a) getting the disease once confers lifetime immunity, and (b) one vaccine will also tend to confer immunity. Thus, the news of this mutation, which seems to make the virus more contagious, is a complicating factor for vaccine production (which is why we still think anti-viral treatments are more important than a vaccine). However, mutating isn’t all bad news; it is not unusual for the virus to mutate into a less virulent form over time.

- On the vaccine front, the K. is planning “challenge” trials, where a vaccine recipient is deliberately exposed to the virus. Such trails are ethically challenging, but they do offer rapid proof of success or failure. Johnson and Johnson’s (JNJ, 144.44) vaccine, which is in its final stage of clinical trials, has some very attractive features; it doesn’t require a follow-up booster shot, and it doesn’t need to be kept frozen. The AstraZeneca (AZNCF, 112.00) trial in the U.S. remains on hold due to safety concerns but has restarted elsewhere. This division has raised concerns among medical researchers. Here is a recap of the current vaccine candidates.

- As we have noted, COVID-19 has generated a broad set of effects, from asymptomatic infections to those with lingering health issues. The latest is that in some patients, damage to the heart has resulted from infection, even if the initial symptoms were not severe.

- As infections around the world rise, it looks unlikely that widespread lockdowns will be implemented. Instead, we are seeing localized responses. This trend should mitigate some of the economic damage from the virus. Younger people are now the largest contingent of infections.

- And finally, Finland is using dogs to “sniff” out COVID-19 infections at the Helsinki airport.

China news:

- Earlier this week, Presidents Xi and Trump offered dueling messages at the U.N. Divisions between the two powers are clearly widening.

- It appears that Beijing is expanding its detention centers in Xinjiang. It may be following a similar script in Tibet.

- One of the trends we saw during the Cold War was the use of the defense budget to justify the funding of private sector activity. President Eisenhower warned of the “military/industrial complex” as he departed office. We may see something similar developing with the electrification of transportation; military and business leaders are warning that electric cars may be overly dependent on China in the supply chain.

- India is increasingly seeing China as a threat and is starting to realize that China’s greatest vulnerability is similar to that of Japan’s; it needs resources from abroad and doesn’t have control of the seas. India’s navy can act to break up China’s supply chains, and it is increasing cooperation with the U.S. Navy to this end.

Economy and policy news:

- Insurance works on the idea of non-systemic risk; in other words, actuaries can use statistics to model the risk of certain events as long as they are not widespread. Thus, one can insure against the risk of losing a house to fire, but not from a broad wildfire. Therefore, homeowners and business owners often find that they are not covered in a mass event (earthquake, hurricane, wildfire), because it is a systemic risk, and thus excluded from most policies. The pandemic is leading some trade-credit providers to stop providing coverage on insuring against trade risk from default.

- Financial firms are increasing their activity in the single-family rental business. This situation may actually lead to increased homebuilding.

- The DOJ is seeking Congressional curbs on immunity for social media firms.

Brexit:

- As the U.K. and EU move towards a hard Brexit, snags at borders look increasingly likely. The prospect of seven thousand trucks being stuck in Dover looks increasingly likely. The Johnson government is planning on requiring an “access permit” to facilitate shipping, which is not going well with trucking companies. Meanwhile, JP Morgan (JPM, 92.74) is moving some $230 billion in assets from the U.K. to Germany in advance of Brexit.

Bonus Chart:

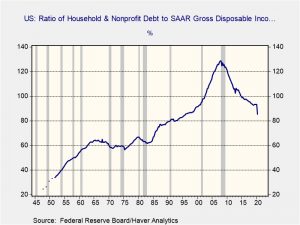

This chart shows household debt compared to after tax income. We have seen a downtrend in debt relative to income since 2007, but in Q2 it fell sharply. This is because of the massive level of transfers due to the CARES Act. Although we do expect households to eventually spend down their savings, what this does show is that it is possible to improve household balance sheets by effectively moving the debt to the public balance sheet. Our belief is that if we saw this ratio fall below 80%, the chance of a stronger, more durable recovery is likely.

[1] The election of 1876 is a notable exception. We will have more to say on that in an upcoming AAW and WGR.