Daily Comment (October 24, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] Good morning! It’s a rather quiet day in earnings season. Mario Draghi holds his last meeting as president of the ECB, Boris Johnson waits for the EU and we have an update on Syria. Here are the details:

ECB: The statement held no surprises. The ECB left rates unchanged and QE of €20 bn per month will begin on November 1. In the press conference, the tone was defiantly dovish. However, market reaction has been very modest, probably because Draghi will be out in just over a week.

In related news, Germany has nominated Isabel Schnabel to the ECB. She appears to be more moderate than her predecessors which may reflect an “olive branch” from the Merkel government.

Brexit update: The EU will decide tomorrow on how long it will give the U.K. to leave the bloc. All indications suggest the decision will be an extension until the end of January. Meanwhile, the Conservatives are trying to figure out if they should press for an election or wait until after Brexit. The argument for an election is that a big win would give Johnson a mandate to push through his legislation without amendments. However, there are three caveats to this decision. First, Theresa May thought she, too, would win a large mandate; instead, she lost her majority and could only govern with an alliance with the DUP. Simply put, the polls could be wrong. Second, the polls could be wrong because the Brexit Party could siphon off Tory votes. If Brexit is completed, there is no reason for the Brexit Party to exist. Third, Johnson can’t call an election unilaterally; he either needs Jeremy Corbyn to agree to a no-confidence vote or convince a two-thirds majority to call an election. Neither option is likely. The downside of waiting for an election is that Parliament will start debating the withdrawal bill in detail, which will require compromises and amendments that will make Johnson look weak. The good news on Brexit is that the odds of a sudden exit have diminished considerably. The bad news is that it will go on longer.

Germany: Christian Kastrop, a former finance ministry official who helped author Germany’s constitutional “debt brake,” said in a Financial Times interview that it’s now time to change the law to allow increased borrowing and greater investment in infrastructure, digital technology and climate mitigation. It’s one more sign that global sentiment is shifting, slowly but surely, toward looser fiscal policy as the impact of loose monetary policy peters out.

Syria: President Trump, satisfied with the ceasefire and the new buffer zone, has removed sanctions on Turkey. Kurds are evacuating the buffer zone. The president couched the quick revocation as a reward for Turkey’s adherence to the five-day ceasefire brokered by the United States, but his statements suggest it was actually a doubling down against the bipartisan criticism he has taken for abandoning the long-time U.S. ally.

China in its place: In a recent speech, SoS Pompeo made the following comment:

We’ve reconvened “the Quad” – the security talks between Japan, Australia, India and the Untied (sic) States that had been dormant for nine years. This will prove very important in the efforts ahead, ensuring that China retains only its proper place in the world.

He did not elaborate on what he means by China’s “proper place.” It’s hard to see how that could be anything other than containment. Needless to say, we are sure that Beijing has read this statement and have no doubts it was not welcomed. Although some sort of trade deal next month is likely, the fundamental relationship between China and the U.S. has changed and won’t return to the status quo ante.

In another interesting comment, an unnamed U.S. military officer told reporters that the Japanese government should do more to explain to its citizens the threat China means for the region, suggesting Japan should consider an offensive-defensive stance. This report is additional evidence that the U.S. is steadily removing itself from the stabilization role that it has performed since the end of WWII.

Other China news: In response to slower housing demand, Chinese developers have been cutting prices to spur sales. It should also be noted that about a fourth of real estate developer debt is dollar-denominated, so any weakness in the CNY could make debt service more difficult. In the absence of pork, rural communities are returning to eating other proteins. U.S. senators are pressing Federal worker retirement funds to cease the use of index funds that hold large components of Chinese equities. In general, economists don’t think that the upcoming “phase one” of the trade deal will reduce recession odds. We also note that M&A activity between the U.S. and China has plummeted.

Global unrest: Although it hasn’t had much of an impact on markets, we are paying attention to widespread unrest and protests. One common theme we are noticing is that seemingly modest changes in charges for public services are not being accepted; in fact, the reaction seems far out of proportion. In general, our observation is that disproportional reactions are usually not due to only the apparent catalyst but have longer roots in the past. Mass dissatisfaction has lots of factors behind it but underlying them all is a belief that societal elites are not looking out for the interest of the general public.[1]

Japan-South Korea: Japanese Prime Minister Abe held a short meeting with South Korean Prime Minister Lee, who was in Tokyo this week for the enthronement of Japan’s new emperor. Unfortunately, however, the talks yielded no progress on the dispute over Japan’s behavior in Korea before and during World War II, which we wrote about in a two-part WGR series on Sept. 30 and Oct. 7.

Canada: Even though his Liberal Party lost its parliamentary majority in Monday’s elections, Prime Minister Trudeau said he will not enter into either a formal or informal coalition with rival parties. That suggests Trudeau will have more freedom to form the government he wants, but it also points to potential stalemates or instability as Trudeau will have to pass legislation – and survive any no-confidence motions – by forming ad hoc coalitions. On balance, Trudeau’s approach is probably negative for Canadian risk assets going forward.

Odds and ends: We have a new emperor in Japan. The Riksbank warned in its latest monetary policy report that it would probably hike its benchmark interest rate to zero in December, compared with -0.25% currently. This action by the Swedish central bank could signal the limits of negative interest rates. The Turkish central bank yesterday slashed its benchmark interest rate to 14.0% from 16.5% previously, citing decreased inflation pressure and a stabilizing lira.

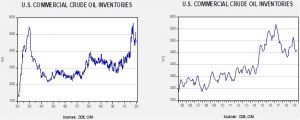

Energy update: Crude oil inventories fell 1.7 mb compared to an expected build of 3.0 mb.

In the details, U.S. crude oil production was unchanged at 12.6 mbpd. Exports rose 0.4 mbpd, while imports fell 0.5 mbpd. The decline in stockpiles was mostly due to rising exports but a rise in refinery demand contributed to the draw.

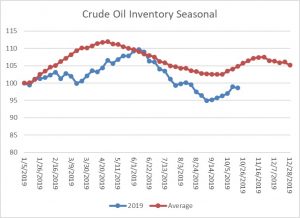

This chart shows the annual seasonal pattern for crude oil inventories. We are now in the autumn build season, which usually lasts into early December. This week’s drop, though modest, is contraseasonal and bullish for crude oil.

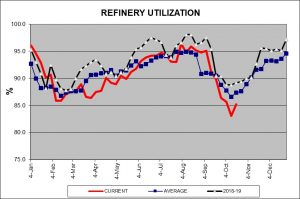

We continue to monitor the autumn refinery maintenance season.

This week’s recovery in utilization turned “on schedule.” We would expect refinery operations to rise steadily into year’s end.

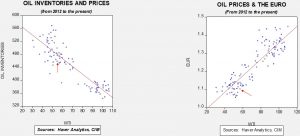

Based our oil inventory/price model, fair value is $62.96; using the euro/price model, fair value is $48.47. The combined model, a broader analysis of oil prices, generates a fair value of $52.73. We are seeing a clear divergence between the impact of the dollar and oil inventories. Given that we are in the maintenance season, we would normally expect inventories to continue to rise. We have been seeing stabilization of oil prices and would expect that to continue for the next few weeks.

[1] A good book on this topic is Ages of Discord by Peter Turchin.