Daily Comment (March 19, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

We have published our latest Weekly Geopolitical Report, which constitutes Part I of our new series on the geopolitics of Central Bank Digital Currencies (CBDC). We also have several other recent multimedia offerings. There is a new chart book recapping the recent changes we made to our Asset Allocation portfolios. Here is our latest Confluence of Ideas podcast. It is Friday, so our most recent Asset Allocation Weekly, chart book, and podcast are also available. Finally, here is our latest Weekly Energy Update. You can find all this research and more on our website.

Good morning, and happy Friday! U.S. equity futures are ticking higher this morning as Treasury yields are steady to lower. Our coverage leads off with the Alaska summit meeting between the U.S. and China; we then turn to other international news. Economics and policy are covered next, with a focus on immigration and Russia. China news follows, and we close with the pandemic update.

Alaska Summit: On Thursday, U.S. and Chinese officials held the first of a two-day meeting in Anchorage. The first face-to-face the U.S. and China have had since President Biden took office started with a bang. Both sides began the meeting by hurling accusations at each other. The U.S. accused China of disrupting the “rules-based order that maintains global stability.” In response, China stated the U.S. should speak for itself and not for other countries and accused it of inciting “some countries to attack China.” Despite the fury exchanges between the two sides, tensions reportedly subsided once the meeting moved behind closed doors.

The clash between the two sides should have been expected. Neither China nor the U.S. wants to appear to be lectured by the other side. That being said, the uncharacteristic outbursts by the two-sides do highlight the growing hostilities between them. The biggest takeaway from this meeting is that neither side appears to be willing to give concessions to the other without receiving something significant in return. It could make China’s goal of getting the U.S. to lift tariffs difficult. We expect the meeting to lay the groundwork for further discussions as the two work through their disagreements. The meeting is scheduled to end today, with the two sides likely holding a press conference. It is doubtful there will be an announcement of a breakthrough.

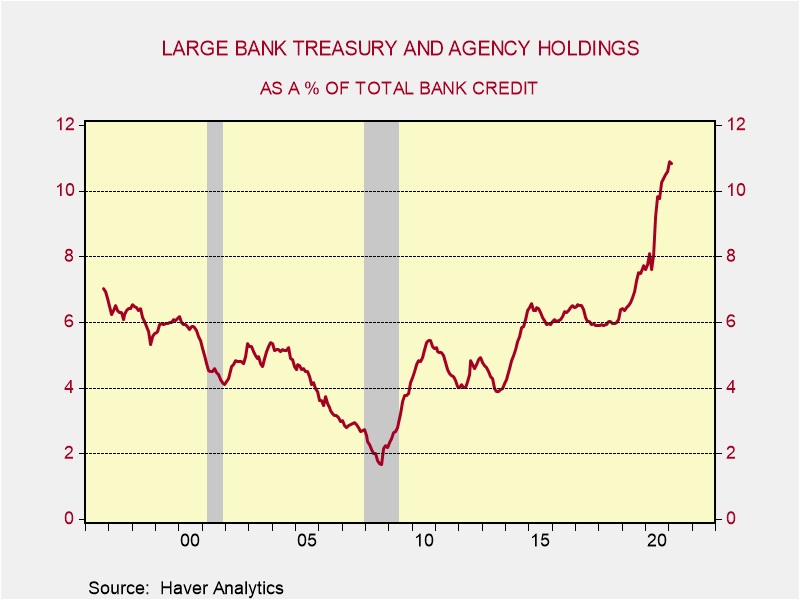

BREAKING–The Supplemental Leverage Ratio (SLR): The Fed has decided not to extend the SLR relief on Treasuries. To review, last year, during the panic, the Fed allowed banks to exclude Treasury holdings from leverage ratios, which allowed banks to hold more Treasuries without adding capital. This helped absorb the increase in Treasury borrowing; by not extending the facility, banks may be forced to dump Treasuries and add supply pressure to an already weak market. However, the New York FRB announced a doubling of the reverse repo facility, from $30 billion to $80 billion. The expansion of the Fed’s reverse repo will allow the banks to repo the Treasuries to the Fed and prevent a “dumping” of the Treasuries. The market’s initial reaction has been to sell long-duration Treasuries. Although the Fed’s action does ease the dumping concern, the end of SLR relief removes a buyer of Treasuries from the market, commercial banks.

As this chart shows, large banks have been aggressive buyers of Treasuries over the past year.

Why did the Fed decide to end this program? Several populist senators were questioning the facility, given that banks didn’t seem to need the support. Although that is true, the impact will tend to lift Treasury yields, ceteris paribus.

International news: The U.S. continues to promote its agenda abroad.

- Four countries, including the U.S., called on the Afghan government and the Taliban to reduce violence and begin discussions on sharing power, in an effort to end the two-decade war. The deadline for the complete withdrawal of American troops is drawing closer.

- The central government officially declared Thursday that the coronavirus state of emergency currently imposed on Tokyo and three neighboring prefectures will be lifted on Monday. Officials are urging the public to stay vigilant to avoid a resurgence of COVID-19 cases.

- According to a survey, British consumer morale struck a one-year high this month as the public became increasingly confident that an economic recovery from the COVID-19 pandemic is approaching and consumers would benefit directly.

- Tanzania’s leadership faced calls for a smooth succession after President John Magufuli, Africa’s most vehement coronavirus skeptic, died on Thursday following an 18-day absence from public life that drew speculation about his health.

- U.S. Defense Secretary Lloyd Austin arrived in India on Friday in a sign of their strengthening defense ties. Austin will begin discussions about China, Afghanistan, and the Indo-Pacific region. The meeting also intends to kick-start a new phase of the U.S.-India security partnership—one that aims to operationalize the gains made through years of arms sales, technology transfers, and defense agreements.

- The BOJ, like the Swiss National Bank, has been buying equities as part of its balance sheet expansion. It announced it was dropping its annual equity purchase target, although it reserved the right to buy stocks if necessary. This decision may dampen Japanese stocks, which have been very strong recently.

Economics and policy: The Biden administration’s takes on Russia and immigration.

- Over the past five days, confidence among low-and middle-income consumers increased more sharply than confidence among high-income consumers, signaling that the third stimulus bill may help counterbalance the K-shaped recovery in confidence and spending.

- The House voted on Thursday to create a path to citizenship for an estimated four million undocumented immigrants. The move reopens a politically charged debate over the nation’s broken immigration system as President Biden confronts a growing surge of migrants at the border.

- Russia took the rare step of recalling its ambassador to Washington after Biden’s comments in a television interview, warning of the possibility of an “irreversible deterioration of relations.” Seated in a gilded chair on the seventh anniversary of Russia’s annexation of Crimea, Putin all but called President Biden a killer himself.

- During a press conference on Thursday at the South Korean Ministry of Foreign Affairs, SoS Blinken called again for the “denuclearization of North Korea,” a shift in policy from the former administration’s call for the denuclearization of “the Korean peninsula.”

- Three senators demand the Senate Judiciary Committee convene a hearing examining new concerns regarding the Obama-era Federal Trade Commission’s decision not to take antitrust action against Google (GOOGL, $2,021.34) a decade ago.

- NASA said on Thursday that the largest rocket element it has ever built, the core stage of its Space Launch System (SLS), successfully passed its engine test, paving the way for additional future manned launches to the moon.

- The Biden administration is considering additional sanctions to block construction of the nearly completed Nord Stream 2 pipeline from Russia to Germany, potentially including the project’s parent company Nord Stream 2 AG, according to three people familiar with the matter.

- The U.S. government will be “more aggressive” in telling migrants not to come to the United States, a top U.S. official said on Thursday, after earlier warnings failed to stem the flow of thousands of Central Americans to the U.S.-Mexico border.

- On Thursday, U.S. Republican lawmakers reintroduced a bill that would revoke the permanent normal trading status that Washington has had with Beijing for the past two decades. It is the latest in a series of efforts by China hawks in Congress to decouple the two countries’ economies.

China: China continues to show assertiveness domestically.

- Apple (AAPL, $120.53) is expected to roll out changes to iPhones in the Spring that will give users more privacy from mobile advertising. The changes will force apps to ask for permission before collecting tracking data on users. Apple is facing problems in China, where tech companies are testing ways to beat the system and continue tracking users without prompting for their consent.

- Moves by the United States to maintain its loose monetary policy until the end of 2023, at least, to support its economic recovery and labor market have reinforced concerns in Beijing as it tries to reduce the risk of domestic asset bubbles by gradually tapering off stimulus policies enacted last year.

- China’s internet regulator rebuked LinkedIn executives this month for failing to control political content, according to three people briefed on the matter. LinkedIn has been the lone major American social network allowed to operate in China, as it has agreed to censor controversial posts made by Chinese users.

COVID-19: The number of reported cases is 121,708,510 with 2,686,366 fatalities. In the U.S., there are 29,662,431 confirmed cases with 539,215 deaths. U.S. case counts are the lowest since early October. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 151,108,445 doses of the vaccine have been distributed, with 115,730,008 doses injected. The number receiving a first dose is 75,495,716, while the number of second doses, which would grant the highest level of immunity, is 40,981,464. The FT has a page on global vaccine distribution.

Virology

- Germany, France, Italy, and Spain said they would resume using the Oxford/AstraZeneca (AZN, $49.33) coronavirus vaccine after the EU drugs regulator said there was a “clear scientific conclusion” that the jab was “safe and effective.”

- Illinois adults of all ages, except those in Chicago, will be eligible to receive a COVID-19 vaccine beginning in mid-April, Governor Jay Pritzker announced on Thursday while laying out new guidelines aimed at further easing pandemic-era restrictions across the state.

- The Centers for Disease Control and Prevention said on Thursday the U.S. has administered 115.7 million doses of the vaccine, an increase of 2.7 million from the previous day. More than 75 million Americans have received at least one shot so far, equal to 22.7% of the total population and 29.2% of all adults.

- President Emmanuel Macron’s government has put Paris and several other regions under strict lockdown for a third time as hospitals run out of intensive care beds for COVID-19 patients.

- The prime minister said that despite the drop off in vaccine supply in April, “there is no change to the next steps of the roadmap,” and “our progress on the road to freedom continues unchecked.” Johnson said every adult in the U.K. would still be offered a jab by the end of July.

- As Brazil’s coronavirus outbreak spirals out of control, the country is facing a dangerous new shortage threatening to drive fatalities even higher: a lack of staff in intensive care units.