Daily Comment (June 29, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with the market reaction to Wednesday’s financial stress test report. Next, we review the political risks central bankers face as they look to raise rates. Lastly, we will expand upon yesterday’s comments about potential curbs by the U.S. on AI sales and how they could contribute to tensions between the U.S. and China.

Banks on the Rise: Investors are beginning to dismiss concerns of an impending banking crisis as the financial system demonstrates its resilience since the turmoil in March.

- All 23 banks were able to pass the Federal Reserve’s annual stress test. The review examines these banks’ ability to weather a severe financial crisis while continuing to provide credit throughout the economy. The positive results lifted investor sentiment regarding the sector after the failure of several regional banks sparked concern over the financial system in March. Banks are expected to benefit from a relaxation of capital requirements, which should make it easier for them to issue more loans and may lead to higher shareholder payouts.

- Despite major banks catching a potential tailwind from the passage of the stress test, new regulations are expected in the coming months. Federal Reserve Chair Jerome Powell has stated that he is open to additional bank limits to protect against a repeat of the banking events that took place in March. During a conference in Madrid, Powell insisted that the regional banking turmoil would have been much worse had the largest banks been undercapitalized and illiquid. Hence, we do not think the optimism will likely spread into regional banking stocks anytime soon.

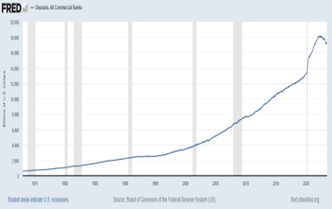

- Disintermediation remains the greatest risk to banks as the Federal Reserve continues to raise policy rates. As the chart above shows, commercial banks are losing deposits at their fastest rate in at least 60 years. This trend has slowed over the past couple of months but will likely not reverse anytime soon as depositors look to take advantage of higher-yielding alternatives such as U.S. Treasury bills and money market funds. We do not think this is a major problem right now, but we do believe it could get worse as the Fed increases its policy rate.

Future Clash: As central bankers prepare the world for more hikes, lawmakers are starting to push back.

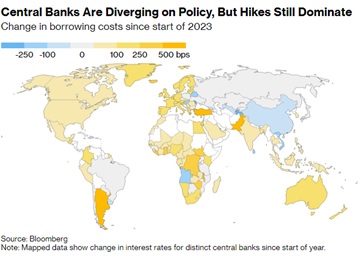

- On Wednesday, several central bank leaders vowed to push through further rate hikes as they aim to restore price stability. Fed Chair Powell insisted that policy rates are not restrictive enough to bring down inflation. At the same time, European Central Bank President Christine Lagarde and Bank of England Governor Andrew Bailey made similar statements. The hawkish tone among monetary policymakers comes as the labor market remains relatively tight in much of the developed world. Futures markets expect the end-of-year policy rate to be 25 basis points higher than current levels in the U.S., 50 basis points higher in the EU, and 100 basis points higher in the U.K.

- The seemingly never-ending monetary tightening cycle is starting to unnerve lawmakers. Italian Prime Minister Giorgia Meloni argued that the rate hikes would hurt other Eurozone economies. This sentiment was echoed by American lawmakers, led by Senator Elizabeth Warren, who wrote a letter to Fed Chair Powell requesting him to pause rate hikes. Meanwhile, members of the British Tory Party are growing worried that the impact of the BOE interest rate hikes on mortgages will hurt them at the polls. The furor over the central banks’ handling of the economy is unlikely to subside, with politicians already starting to point fingers at the institutions as their economies head into recession.

- Tightening monetary policy is a relatively straightforward decision when inflation is rising and economic growth is strong. However, the situation becomes more complex when a recession is looming. The EU is already in an economic contraction, and the U.S. and U.K. economies are expected to decline in the second half of the year. This means that policymakers will likely face more political pressure to ease away from tightening to prevent exacerbating a potential downturn. So far, market participants seem to believe that the next recession will be relatively mild. However, these opinions may change if central banks continue to tighten monetary policy.

Chip Wars: Semiconductor firms get caught in the crosshairs as the U.S. and China tangle for AI supremacy.

- Following reports that China has been able to access banned chips through the black market, the U.S. is considering implementing new export restrictions on semiconductors. The South China Morning Post reported on Tuesday that firms in China have been able to purchase banned chips from the Chinese social media site Douyin. This has drawn the ire of the Biden administration, which is expected to offer updated restrictions by the summer. Regulators are considering requiring companies to apply for a license to send chips to China. Speculation about the updated export controls to China is likely to hurt revenues for chip companies.

- Despite the tech-heavy NASDAQ closing up 0.3% on Tuesday, the Philadelphia SOX index, which tracks semiconductor companies, fell 0.9%. This suggests that so far investor wariness has not led to an overall sell-off of tech stocks.

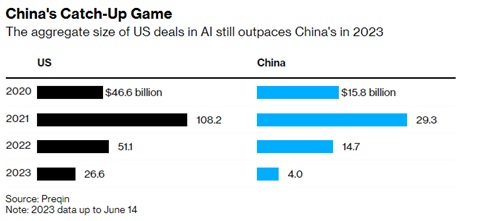

- In addition to black market purchases, China is still trying to convince native investors to develop the country’s AI industry. Beijing hopes that billionaires within the country will pour money into AI as it tries to bridge the gap between tech companies in Silicon Valley. Although two major powers are home to the top seven AI companies in the world, Chinese investment into the sector still lags behind the U.S., which totaled $26.6 billion in the year to mid-June versus China’s $4 billion. Additionally, the decision to spur domestic investment is also related to expectations that President Biden will unveil limits on investment in China.

- The battle over AI is likely to add another layer to the overall tense relationship between the U.S. and China. The U.S. has an advantage in chipmaking and investment, which currently gives it an edge , but this lead may not last long. According to Kai-Fu Lee, a prominent AI specialist and Chinese influencer, Chinese chatbot technology is likely to lag behind its American competitors for now but should catch up relatively quickly. The competition between the two countries is likely to lead to increased state aid for the AI industry in both countries, which should provide a tailwind for tech companies. However, AI-related stocks may experience bouts of volatility due to uncertainties over regulation.