Daily Comment (December 3, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Good morning! There is great joy in the financial and commodity markets this morning. Here is what we are watching today:

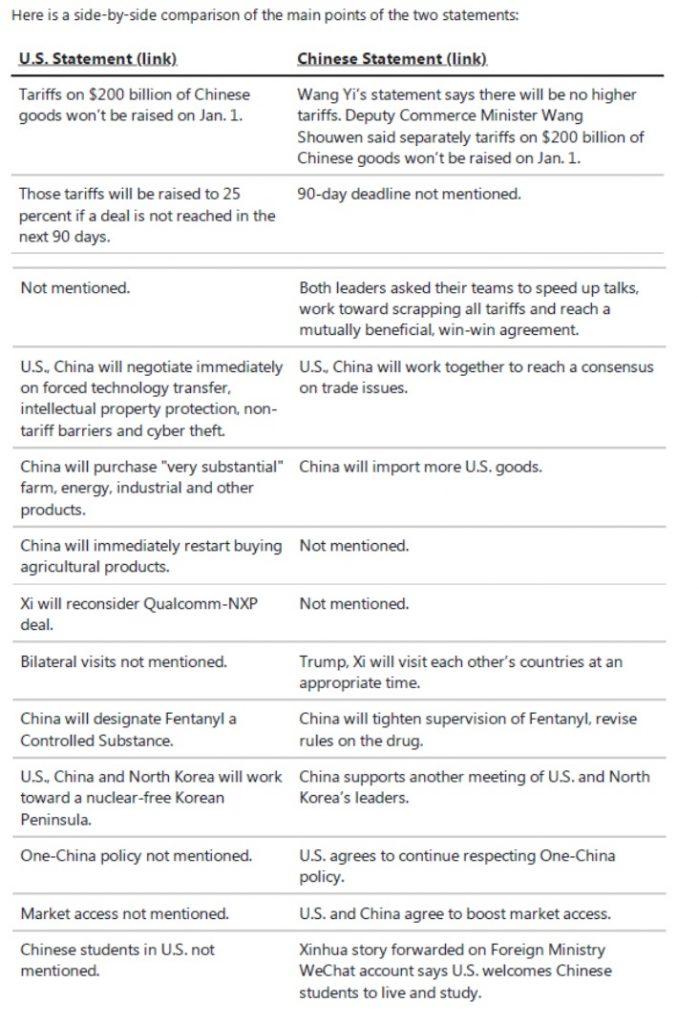

The G-20 and China talks: To some extent, we got the deal we were expecting. Presidents Trump and Xi essentially agreed to a 90-day truce.[1] The U.S. will delay applying an additional 15% to the existing 10% tariffs on $200 bn of Chinese exports to the U.S. China vaguely agreed to buy more U.S. goods. Talks are said to be forthcoming. However, they failed to issue a joint communique on the agreement. The indications from either side were quite different:

Our take on this deal is that both Xi and Trump needed a win. As we noted last week, the Chinese economy is slowing and a weakening equity market in the U.S. was becoming a daily signal of trouble. At the same time, the underlying issues have not been resolved.

Here is a quick sketch of the underlying problems. China is rapidly entering the period in its development where it is facing industrial overcapacity. There are essentially four ways that this issue gets addressed. The first is a massive revaluation of the excess capacity through a debt crisis. That is how the U.S. addressed this issue; we refer to it as the Great Depression. Japan addressed the same problem by slowly adjusting debt (and the underlying asset values) and has endured over three decades of stagnation. The second method is mass war; this either utilizes the excess capacity or sees it destroyed. The third is value chain improvement. In this method, the economy shifts to higher value products, which allows the higher value new capacity to keep the economy intact while the lower value capacity is either closed or rebuilt. Germany did this from the mid-1960s into the mid-1980s (think Volkswagens to Mercedes). The fourth way is through imperialism, where the nation acquires colonies which allows it to force its excess production on a conquered client state. This was the preferred method in the 19th century; examples today include the Eurozone (Germany colonizing the rest of Europe) or China’s “one belt, one road” project.

China, under no shape or form, wants to use the first method, and likely wants to avoid the second. It is trying to move up the value chain (the “China 2025” project), thus deploying the third method, and is clearly also trying to use the fourth approach. The U.S. is attempting to thwart both efforts by preventing China from acquiring U.S. technology (likely necessary to move up the value chain) and by offering alternatives to the “one belt, one road” program. China needs the U.S. to allow it to move up the value chain, which would, of course, put the U.S. and China at trade competition in areas the U.S. currently dominates, such as high tech, aerospace, etc. China also needs the U.S. to allow it to dominate its region so it can utilize its excess industrial capacity through forced exports to the weaker nations in the Far East and Middle East, forcing America to cede its influence in the Pacific. The U.S. isn’t going to allow this to happen willingly. If China isn’t allowed to implement options three and four, it will be forced into option one or two, neither of which looks attractive.

But, the deal does buy time for both sides.[2] For China, this gives its negotiators breathing room to try to cobble together some sort of deal. For the U.S., promises from China to buy soybeans will ease pressure on that sector and, at the same time, the rally in equities will appease the establishment wing of the Trump administration. But, we would not expect the issues mentioned above to be resolved anytime soon.[3]

However, it is premature to suggest this agreement is inconsequential. China may be hoping that a divided U.S. legislature and perhaps the Mueller investigation will become enough of a distraction to the White House that the trade issue might fade next year. In addition, we are already seeing the early stages of the 2020 presidential campaign and thus the White House won’t want to take trade actions that could trigger a recession. Thus, we may have already seen the most aggressive trade actions; from here, the president will likely be leery of doing anything to upset the financial markets and, as we have seen this year, trade wars can do that. In addition, we are watching the establishment wing of the GOP to see if they use the aforementioned distractions to curtail the president’s power on trade.[4] After all, the GOP establishment doesn’t want to see free trade curtailed.

The deal was clearly welcomed by financial markets. Equities and commodities are higher, although the dollar, curiously, is holding on rather well. On the commodity front, soybeans are up on expected Chinese buying and oil is higher as well (see below). U.S. interest rates jumped despite recent Fed dovishness. Although we have doubts that the long-term issues are any closer to resolution, the pause could very well be longer than 90 days; in fact, it could stretch into the November 2020 elections. If so, Chairman Xi may have done just enough to improve China’s situation.

OPEC+: OPEC has determined that the cartel needs to cut production by 1.3 mbpd.[5] After a rousing greeting between President Putin and Crown Prince Salman, Russia has indicated its cooperation with OPEC will continue, raising hopes of Russian cooperation with price support.[6] But, the real shocker came from Canada, where the provincial government of Alberta has imposed production cuts of 8.7%.[7] We rarely see G-7 nations agree to production restrictions. Although the Canadian action is in response to logistical bottlenecks, the announcement is supportive for oil prices. In related news, Qatar will exit the cartel in January; its production is now centered on natural gas and it is in conflict with Saudi Arabia and thus likely wants to avoid cooperating with the kingdom.[8] Although other nations have left before (and, for that matter, rejoined…see Ecuador), this is the first nation from the Gulf region to leave OPEC.

Shutdown averted? Over the weekend, President Bush (#41) passed away. President Trump has ordered a national day of mourning on Wednesday, which will close the government (and the NYSE). The day of respect for the former president will delay a potential government shutdown and may end up precluding any such action.[9]

Caixin PMI: The November Caixin PMI, the one believed to be more reliable than the official index (it has a broader survey, including smaller firms), came in modestly better than forecast at 50.2, up from 50.1 in October. New orders ticked higher; export orders fell but may lift due to the aforementioned truce.

Macron in trouble: Civil unrest in France continued over the weekend and the scope and persistence is becoming a crisis for President Macron. We are seeing two developments. First, elements of French society, probably best described as anarchists, appear to be participating in the protests as well, increasing their violence. Second, political opponents of Macron are sensing weakness and are mobilizing to use the protests to undermine the government.[10] Macron held emergency meetings with his advisors after he arrived in Paris from Argentina and is considering a crackdown on the protests.[11] The current unrest is being called the worst in a decade.[12] Macron’s election was something of a protest vote; his party was new and he promised to make major changes. However, his policies were akin to the reforms of the 1980s, the supply side revolution of Reagan and Thatcher. These protests suggest that this outcome wasn’t what these voters were looking for. Thus, France avoided a populist outcome in the last election that may not be true in the next election.

Watching Italy: We found the Italian elections to be the most interesting because it brought a government formed almost entirely of left- and right-wing populists. One of the failures of populism has been the inability of both variants to form a coalition based on economic interests. This coalition we dub the “Nader coalition,” who proposed such an arrangement in his book Unstoppable.[13] In practice, in most circumstances, the identity differences have been simply too wide to overcome. Thus, what happened in Italy was notable. However, pro-business elements of the League, the right-wing side of the coalition, are starting to rebel against the party leadership.[14] This development bears watching because it may undermine the right-wing side of the coalition, which, to date, has dominated the government.

[1] https://www.wsj.com/articles/meeting-between-trump-and-xi-went-very-well-adviser-says-1543711542 and https://www.economist.com/finance-and-economics/2018/12/02/the-us-china-trade-war-is-on-hold

[2] https://www.ft.com/content/4c60cec2-f60e-11e8-af46-2022a0b02a6c?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[3] https://www.wsj.com/articles/u-s-china-face-thorny-obstacles-to-lasting-trade-peace-1543785395

[4] https://www.axios.com/chuck-grassley-trump-tariffs-section-232-national-security-613bb759-acac-4a36-9703-9a2ee1958f28.html

[5] https://www.wsj.com/articles/opec-economic-panel-recommends-output-cut-from-october-levels-1543603319

[6] https://www.ft.com/content/7c6d6fa0-f69d-11e8-af46-2022a0b02a6c

[7] https://www.washingtonpost.com/world/the_americas/alberta-government-imposes-oil-production-cuts-for-province/2018/12/02/40acd566-f69b-11e8-8642-c9718a256cbd_story.html?utm_term=.4bce34a6bf12

[8] https://www.ft.com/content/66cc3bee-f6c6-11e8-af46-2022a0b02a6c

[9] https://www.politico.com/story/2018/12/02/trump-assents-to-shutdown-delay-1037152 and https://www.ft.com/content/e58fd762-f660-11e8-8b7c-6fa24bd5409c?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[10] https://www.ft.com/content/222bdc0a-f631-11e8-af46-2022a0b02a6c?emailId=5c04b7e19b0ba30004415a75&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[11] https://www.ft.com/content/3c448d04-f61c-11e8-8b7c-6fa24bd5409c

[12] https://www.washingtonpost.com/world/europe/protest-riot-shocks-paris-leaves-133-injured-412-arrested/2018/12/02/b131eb88-f60e-11e8-99c2-cfca6fcf610c_story.html?utm_term=.901773d5d341&wpisrc=nl_todayworld&wpmm=1

[13] Nader, R. (2014). Unstoppable: The Emerging Left-Right Alliance to Dismantle the Corporate State. New York, NY: Nation Books.

[14] https://www.ft.com/content/eda609a6-f2f2-11e8-ae55-df4bf40f9d0d?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56