Daily Comment (April 16, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, all! It has been a relatively quiet news day so far. U.S. equities are expected to open higher following strong earnings from financial firms. We will begin our coverage with more details about the Russian sanctions. International news follows, with Castro stepping down from leadership, the Brexit fallout in the finance sector, and more. Economics and policy are up next along with information about the housing shortage. China news follows, and we close with our pandemic coverage.

As anticipated, the Biden administration imposed new sanctions on Russia due to its involvement in the SolarWind (SWI, $18.20) hack and other cyberwarfare activities. The sanctions included 32 individuals and entities. Additionally, 10 Russian diplomats, who were also suspected of being operatives, were expelled from the Russian Embassy, and American banks were banned from purchasing newly issued Russian government debt. As an olive branch, the Biden administration walked back claims that the Russian government had put bounties on American soldiers, claiming low to moderate confidence in the intelligence. The administration also stated it would like to establish a “stable and predictable relationship” with the Russian government.

In all, the measures taken against the Russian government weren’t the most stringent, but they do provide a guidebook as to what the Biden administration has in store for countries it doesn’t like. By banning the purchase of Russian government bonds, the Biden administration is signaling it is willing to use financial markets as a weapon. Although this isn’t a new strategy, as the country frequently has used the SWIFT network to the same end, it does suggest an escalation. By targeting government debt, the Biden administration is expressing its willingness to make it more expensive and possibly more destabilizing to finance itself. We suspect this decision will likely encourage other countries to develop more elaborate workarounds to the U.S. financial system. This could mean an embrace of digital currencies, which is why we suspect China has begun developing a digital yuan. Accordingly, this could mean that other countries build closer relationships with China, which also has its own issues. Most importantly, if the U.S. continues to use its financial system, it could further accelerate a trend away from globalization as countries will begin to view it as a threat to their sovereignty. Although this deglobalization is unlikely to happen in the foreseeable future, there are increasing signs that the world may be growing fatigued with global integration. We will continue to monitor this situation closely.

International news: Raul Castro steps down, financial firms are leaving London, and Hungary is blocking the EU.

- First Secretary of the Cuban Communist Party and former Cuban President Raul Castro is expected to step down from his position. His departure will mark the first time since the revolution that the country is not being run by a Castro brother. Cuban President Miguel Diaz-Canel is expected to succeed Raul Castro as the leader of the Communist Party. At 60 years old, the relatively young Diaz-Canel is expected to be in favor of economic reforms to grow the Cuban economy. Tourist-reliant, the Cuban economy has been struggling as of late due to the pandemic. His reforms are expected to meet resistance from the elders within the party who don’t want the country to become more capitalist. As a result, it isn’t clear how successful he will be in implementing much-needed reforms within the country.

- The impact of Brexit is already showing itself in the city of London. Over 400 financial firms have shifted activities and $1.4 trillion in assets out of the city to the European Union. The U.K. and EU failed to come to an agreement that would accommodate U.K. financial services. As a result, these firms were forced to adapt. The biggest beneficiaries of this shift have been Dublin, Luxemburg, Paris, Frankfurt, and Amsterdam.

- Hungary blocked the EU from issuing a statement criticizing China over Hong Kong’s new security law. The statement was to be made at a meeting of EU foreign ministers, and it needed to be approved by all 27 EU members. In the past, Hungary, which is a major recipient of Chinese investment, has regarded such statements as pointless. The inability of the EU to agree to address China’s supposed human rights violations highlights the bloc’s difficulty to project soft power.

Economics and policy: The housing shortage, U.S.-China tensions, the infrastructure package, and student debt proposal.

- There is a 8 million single-family home shortage, says mortgage financing company Freddie Mac. According to the report, the shortage of homes is due to a lack of homebuilding. The pandemic has likely made this problem worse as supply chain bottlenecks have made it difficult for homebuilders to keep up with demand. It is believed that 1.1 to 1.2 million homes need to be built each year in order to meet the long-term demand. Even then, that would not be enough to shrink the deficit. A plausible solution would be to reduce regulation, but as more and more families rely on their homes as a substitute for savings, policymakers have been reluctant to do so. Meanwhile, rising materials and labor costs continue to hamper homebuilders. Thus, it is unlikely that this problem will be solved anytime soon.

- The IMF believes the technological rift between the U.S. and China could have a worse impact on global growth than the trade tariffs. The IMF estimated that technological fragmentation could lead to a 5% reduction in GDP for many countries, while the trade tariffs reduced global GDP by an estimated 0.4%. The relationship between the two countries continues to deteriorate as globalization as a whole could also be impacted.

- A group of bipartisan senators has agreed to support an infrastructure package of $800 billion. The package has received tacit endorsement and skepticism from both parties. Republicans have stated that the price tag is still too large, with some asking for a package closer to $600 billion. Democrats have argued that the bill is too little, and it falls well below the targeted $2.25 trillion proposed by the Biden administration. That being said, the bill does seem to have broad support, with many speculating that Democrats could get this bill through Congress and pass the rest through the controversial budget reconciliation.

- Senators Mitt Romney (R-Utah) and Krysten Sinoma (D-Arizona) announced a plan that would help low-income students pay for college. Under the Learn to Earn Act, for every $1 placed into a savings account, states and nonprofit institutions could match it with $8. The legislation is similar to a program offered in Arizona that has helped students graduate debt-free.

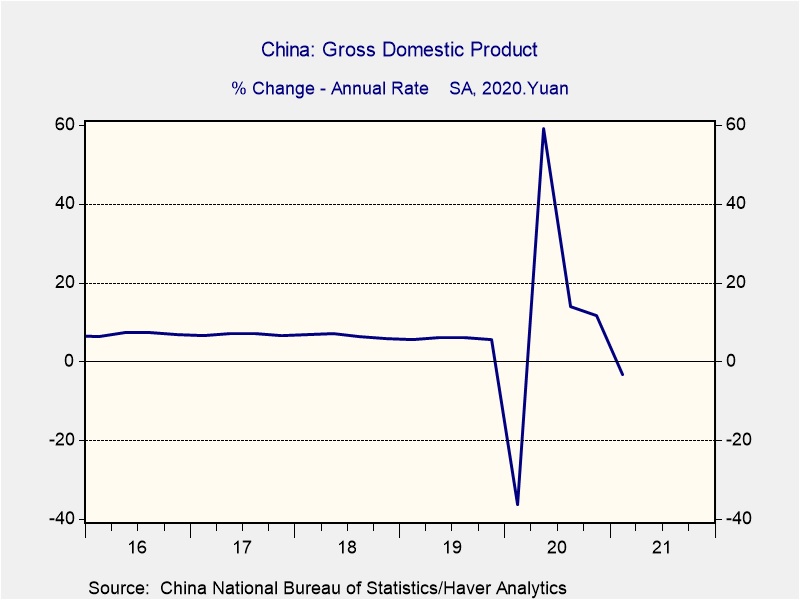

China: Chinese growth is not as impressive when looked at closely, and China in Afghanistan.

- The Chinese economy rose 18.3% in the first quarter from a year ago. Although the number seems impressive on its face, the quarterly numbers suggest the economy may be slowing. Looking at growth compared to the previous quarter, the Chinese economy contracted at an annualized pace of 3.25%. The slowdown in GDP is largely due to a reduction in consumption and investment spending.

- China is considering sending its troops into Afghanistan following the U.S. withdrawal on September 11. China, which shares a tiny border with Afghanistan, is concerned that unrest caused by a U.S. withdrawal could spill over into Xinjiang. The occupation could be the first test for China as it tries to get an idea of its own level of military prowess.

COVID-19: The number of reported cases is 138,581,232 with 2,977,619 fatalities. In the U.S., there are 31,455,995 confirmed cases with 564,715 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 255,400,665 doses of the vaccine have been distributed with 198,317,040 doses injected. The number receiving at least one dose is 125,822,868, while the number of second doses, which would grant the highest level of immunity, is 78,498,290. The FT has a page on global vaccine distribution. The weekly Axios map shows rising cases in about half the country.

Virology

- Pfizer’s (PFE, $37.60) CEO announced on Thursday that vaccine recipients will likely need a third vaccine six months to a year after receiving their second dose. As new variants begin to circulate, boosters will be given to ensure that people remain immune.

- Pharmaceutical companies have been pushing back against requests from developing countries to have patent rights waived in order to combat the virus. Developing countries have complained that the patent restriction has made it difficult for them to administer more vaccines throughout their countries.

- The Center for Disease Control and Prevention (CDC) announced that 5,800 fully vaccinated people have contracted the virus out of a possible 75 million. This suggests that the vaccines are performing in line with trial data expectations. Out of those 5,800, only 74 died. The data suggest that the chance of death after receiving the vaccine is exceptionally rare. However, the CDC recommends people continue to wear masks and practice social distancing.

- Denmark may allow its citizens to choose whether to receive the AstraZeneca (AZNCF, $102.00) vaccine. On Thursday, Denmark’s government began exploring the possibility of allowing its citizens to choose whether they would like to receive the vaccine, possibly reversing its decisions last year to remove the vaccine from its rollout.

- Hong Kong has begun expanding vaccinations to include people 16 years and older. The city has done a fairly good job of containing the virus but has seen a relatively low turnout for vaccinations. Less than 10% of the population has received one dose of the vaccine since its February rollout.

- The spring wave of the virus has affected almost every state over the past week, leading to a sharp uptick in hospitalizations. Thirty-eight states reported an increase in cases last week, with Michigan being one of the hardest hit. The recent surge has disproportionately affected young and middle-aged adults.

- The United Nations is urging developed countries to donate excess vaccines to developing countries through the COVAX vaccine-sharing facility. Developed countries have been reluctant to share vaccines as logistical hurdles have prevented them from providing vaccinations to their own citizens.

In related news, the United States is seeing a rise in unused vaccines as demand has significantly slowed as of late. About 37% of Americans have received the first dose of the vaccine, far below the estimated 80-85% needed for the country to achieve herd immunity.