Daily Comment (April 14, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! In today’s report, we give a fresh update on the Russian invasion of Ukraine and what it may mean for the global economy. Next is a brief overview of international news, followed by economic and policy news. We end with our COVID-19 coverage.

After peace talks reached a dead end, Russian forces have started to renew their efforts take over southern and eastern Ukraine. Russia has deployed more troops and launched a new airstrike on Mariupol. Currently, there still seems to be a stalemate, as both sides are still finding military success. On Wednesday, Ukraine announced it was able to hit a major Russian warship in the Black Sea. Meanwhile, Russian media stated that a thousand Ukraine marines surrendered in Mariupol. Nevertheless, it is becoming clear that Mariupol is getting closer to being under Russian control. Ukrainian President Volodymyr Zelensky has called on the West to send additional resources to aid the country in the war. The West has responded by expanding its intelligence to Ukrainian forces and sending $800 million worth of additional weapons. Furthermore, the Pentagon has asked defense companies to ramp up their arms production. Russia has responded to the increased support by declaring the weapons in transportation to Ukraine are legitimate targets.

Following its pledge to provide more military support to Ukraine, the West has accused Russia of committing war crimes. The Organization for Security and Co-operation in Europe (OSCE) stated that it has found credible evidence of violations of fundamental human rights. Although the organization fell short of describing the killings that took place in Ukraine as genocide, it did not dismiss President Biden’s characterization of the killings as such. The condemnation comes as the West attempts to portray Russia as an aggressor attacking a hapless victim. As the war rages on, we suspect the West will use claims of war crimes to force countries to choose sides. As we have mentioned in the past, we believe that the Russian invasion will accelerate the world away from globalization and toward regionalization. So far, emerging market countries have been receptive to Russia’s claim that the invasion was to stop NATO expansion, making it harder for the West to find allies in developing countries. The move away from global order could make equities in emerging markets less attractive.

This policy shift is further supported by Treasury Secretary Janet Yellen’s allusion to friend-shoring. Friend-shoring is when supply chains are built using countries that were friendly with the U.S. Earlier this year, Moscow announced a similar approach with its demand for unfriendly countries to pay for Russian commodities using rubles. The move away from globalization puts China in a vulnerable situation. Beijing has expressed sympathy for Russian claims of security concerns, but it has still maintained its relations with Western firms. We believe the breakdown of this order will likely be decided by China. As long as Beijing views strong trade ties with the West as beneficial, the global order will probably stay in place.

Economic Policy and News

- Rising fuel costs are continuing to add to inflation woes. Amazon told its third-party sellers it would add a 5% delivery surcharge to offset the rise in energy prices.

- The International Energy Agency predicts that the global oil market will avoid a “sharp” deficit in oil due to the strategic release of oil by major countries and the slowing demand from China to offset lower Russian production. The agency expects Russian output to decline by 1.5 mbpd in April and double in May.

International News

- Treasury Secretary Janet Yellen announced China could face consequences if it supports Russia in its invasion of Ukraine. The U.S. is trying to apply more pressure on China in an attempt to get Beijing to convince Russia to end its war in Ukraine. The threat of sanctions has prevented Chinese companies from exporting to Russia. However, some firms have started to sever ties with the West to prepare for rising tensions. A Chinese energy company, CNOOC (883 HK, HKD, 11.46) announced that it would exit its operations in Britain, Canada, and the United States. If other countries follow, it could add to further evidence that China is moving away from global trade.

- Finland and Sweden are moving closer to joining NATO in response to the Russian invasion of Ukraine. A poll in Finland showed the majority supports joining the military alliance, while Sweden’s ruling party announced that the country could apply by June. The move has led to speculation that Russian aggression could extend into other parts of Europe. Moscow has vaguely threatened a nuclear response if the two countries were to join NATO.

- French presidential candidate Marine Le Pen articulated her foreign policy views in a 90-minute news conference on Wednesday. She told the French media that her relationship with Putin has been exaggerated but reaffirmed that she would like to pull France out of NATO if elected president. Currently, Le Pen is considered a long shot to win the presidency, according to the prediction market website Predictit. However, if she wins, her appointment could complicate efforts to maintain NATO.

- Although Emmanuel Macron remains the overwhelming favorite to retain the presidency, his status of being wealthy has made voters uncomfortable. A great example of this is seen in the ongoing McKinseygate. Thus, the chance of an upset in the run-off election may be more prevalent than most post polls realize.

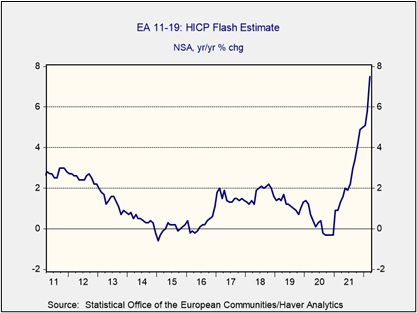

- The European Central Bank is moving closer to announcing that it will raise interest rates this year and withdraw stimulus at a faster pace. A push for higher rates comes amid rising inflation worries in the Eurozone after the flash estimate of CPI showed prices rising above 7% in March. The war in Ukraine will likely make inflation worse as there is growing evidence that the conflict will lead to an increase in food and energy prices. The shift away from accommodative policy raises the likelihood that the currency bloc could have an economic contraction.

- After the German government took over its affiliate groups in Germany, Russian energy company Gazprom(GAZP RX, RUB, 229.32) announced these units would not return to Russian control. This further suggests that Russia may be accepting a permanent change in its relationship with Europe.

COVID-19:The number of reported cases is 501,512,915, with 6,188,577 fatalities. In the U.S., there are 80,518,050 confirmed cases with 987,331 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The CDC reports that 713,605,745 doses of the vaccine have been distributed, with 567,188,881 doses injected. The number receiving at least one dose is 256,489,187, while the number of second doses is 218,622,907, and the number of the third dose, granting the highest level of immunity, is 99,035,505. The FT has a page on global vaccine distribution.

- The Center for Disease and Control and Prevention (CDC) will extend the mandate on public transportation for 15 days as the department monitors a recent rise in COVID-19 cases.

- Pfizer stated that its vaccine booster has been shown to protect children ages 5-11 from Omicron.