Daily Comment (May 19, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with some issues related to President Trump’s big trip to the Gulf region last week. Specifically, trade deals completed during the trip have raised concern about advanced artificial-intelligence technology from the US leaking to China via the Gulf. We next review several other international and US developments with the potential to affect the financial markets today, including the Moody’s downgrade of US Treasury debt and a slew of important elections in Europe.

United States-Saudi Arabia-UAE-China: As President Trump returned on Saturday from his trip to the Gulf states, Congressional leaders and security analysts are sounding alarms over the billions of dollars of deals he signed to give US artificial-intelligence resources to Saudi Arabia and the United Arab Emirates. Since Saudi Arabia and the UAE have increasingly close ties to China, fears are growing that they would let China gain access to advanced AI chips provided by US firms, thereby helping China advance its own AI capabilities.

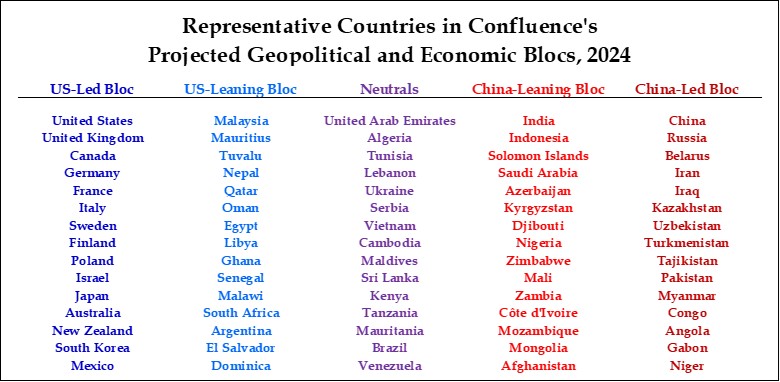

- Despite decades of US security ties with the Gulf states, our analysis of global fracturing puts Saudi Arabia in the “Leaning China” bloc and the UAE is in the “Neutral” bloc. Indeed, both countries have actively sought to play the US and China against each other, suggesting they might be lax in controlling any Chinese access to US technologies.

- The administration’s willingness to give the Gulf countries access to US technology is especially striking given that many in Trump’s right-wing base remain suspicious about Saudi Arabia’s role in the 9/11 terrorist attacks. Therefore, it would not be a surprise if Trump faces political pushback from his own base because of the deals.

- Although the announced deals appear to be quite lucrative for US firms such as Nvidia, it remains to be seen whether they will be fully implemented in the face of any domestic US political pushback.

United States-United Kingdom-China: Data released late Friday confirmed that Japan remains the biggest foreign holder of US Treasury securities, but the UK has now surpassed China to take second place. The data shows that China has continued to whittle down its exposure to US securities, bringing its total holdings down to approximately $765 billion, only about half its holdings in 2011. The data also shows that China has continued to shorten the average maturity of its US Treasury holdings, likely to ensure it can unload those holdings quickly if necessary.

- Chinese officials are likely to be motivated mostly by concerns about geopolitical tensions and security threats related to the US.

- They are likely less motivated by concerns about US fiscal health, despite Friday’s US debt rating downgrade by Moody’s, which is discussed further below.

China: April industrial production was up just 6.1% from the same month one year earlier, decelerating from the 7.1% rise in the year to March. Meanwhile, fixed-asset investment in January through April was up just 4.0% on the year, after an annual rise of 4.2% in January through March. The figures confirm that China’s economy softened considerably at the recent peak of President Trump’s trade war. However, China’s producers will now likely get at least a temporary reprieve as foreign importers rush to take advantage of the current tariff pause.

Australia: Mining firm Lynas Rare Earths said it is now producing dysprosium oxide at its refinery in Malaysia, making it the world’s first commercial producer of heavy rare earths outside of China. The firm also expects to start commercial production of terbium in June. The announcement shows how global concern about China’s stranglehold on rare earths has prompted state-supported investment in alternative sources of the minerals, which are critical for many technologies related to green energy, information processing, and defense.

- Besides its Malaysian refinery, Lynas has a $258-million contract with the US government to build a rare earths refinery in Texas. The company sources its rare earth ore from its mine in Western Australia.

- The new rare earth mines and refineries outside China are still only producing a small amount of the world’s needs. However, if investment in them continues as we expect, they may well eventually break China’s near monopoly on rare earth supplies.

European Union-United Kingdom: Leaders from the EU and the UK today signed a trade and security deal that aims to reverse some of the effects of Brexit and better bind their economies in the face of rising geopolitical threats from Russia and more antagonism from the US. Besides easing EU-UK trade flows, the deal will let British defense firms bid for rearmament programs under the EU’s new 150 billion EUR ($169 billion) defense fund. British defense stocks are therefore likely to get a boost, just as defense stocks on the Continent have been boosted.

Eurozone: Pierre Wunsch, the head of Belgium’s central bank and a member of the European Central Bank’s policy board, said in an interview with the Financial Times that the economic disruptions from the US’s big tariff hikes could require the ECB to cut its benchmark interest rate to less than 2.00%, implying at least two more 25-basis-point cuts. The statement will likely prompt further strength in eurozone bond buying.

Portugal: In parliamentary elections yesterday, the center-right Democratic Alliance of Prime Minister Montenegro came in first with 32.1% of the vote, while the center-left Socialist Party came in second with 22.6%. Importantly, the far-right Chega party saw its support surge to 22.6% as well, putting it in a tie with the Socialists. Montenegro is now expected to form a new coalition government of centrist parties, but Chega’s new-found political strength will likely push Portuguese immigration, security, and other policies to the right.

Poland: In the first round of Poland’s presidential election yesterday, it appears that the winner was Rafał Trzaskowski, the liberal mayor of Warsaw and a member of Prime Minister Tusk’s center-left Civic Platform party. Ballot counting so far suggests Trzaskowski received 30.8% of the vote. In second place was Karol Nawrocki, backed by the hard-right Law and Justice party, who took 29.1%. The two will now face off in the final round of voting on June 1.

- Since the current Law and Justice president has thwarted many of Prime Minister Tusk’s reform initiatives, a win by Trzaskowski in the second round would let Tusk accelerate his efforts to reverse the illiberal right-wing policies passed by the previous government.

- More broadly, Trzaskowski’s surprising victory underscores how right-wing nationalist politicians in some countries have been undermined by the global reaction against President Trump’s aggressive right-wing policies in the US.

- Nevertheless, it’s important to note that the third- and fourth-place winners in the vote were right-wing parties. That suggests Nawrocki could still win the presidency and continue the pushback against Prime Minister Tusk’s policies.

Romania: In the second and final round of Romania’s presidential election on Sunday, the winner was Nicuşor Dan, the centrist mayor of Bucharest, with about 54% of the vote. Dan unexpectedly beat the right-wing nationalist George Simion, who had styled himself after President Trump but only received 46% of the vote. As in the recent elections in Poland, Canada, and Australia, the results suggest that at least some right-wing nationalist politicians who ally themselves to President Trump may now be at a disadvantage in much of the developed world.

- Importantly, Simion had been preparing his supporters to protest a potential loss in the days before the vote. Any significant “Stop the Steal” effort by Simion could potentially spark political instability or paralysis in Romania.

- At the same time, if Dan is confirmed as the winner, it would avoid the risk of Romania becoming another eastern EU country supporting authoritarian Russia and opposing further support for Ukraine as it fights off the Russian invasion.

United States-Russia: President Trump this morning is scheduled to have a phone call with President Putin to discuss ways to stop Russia’s invasion of Ukraine. We suspect that Putin will continue to ostensibly signal openness to Trump’s desire for a quick end to the war, but with impossible demands on Ukraine that would reveal his true intent to keep fighting. If so, a key question is whether Trump would finally recognize the Kremlin’s culpability in the invasion and swing US support back toward Ukraine.

US Fiscal Policy: Late Friday afternoon, Moody’s cut its rating of US debt to Aa1, becoming the last of the major credit rating firms to remove the country’s top-tier assessment. According to the firm, the rating cut reflects the failure of Congress and successive administrations to agree on ways to reverse the US’s big fiscal deficits and rising interest costs. Now that Moody’s has cut its assessment of US debt, it also shifted its outlook to “stable” from “negative,” meaning it doesn’t foresee a further downgrade in the near future.

- Moody’s rating cut will likely factor into the Republicans’ on-going effort to pass its big tax-and-spending bill through Congress, mostly by giving ammunition to the fiscal hawks looking for more spending cuts and resisting certain tax changes. Officials in the Trump administration also slammed the Moody’s decision for not reflecting their promise to tighten fiscal policy going forward.

- Republicans in the House were successful in pushing the tax-and-spending bill through the Budget Committee last night, but its future on the House floor and in the Senate is uncertain. Budget analysts project that tax cuts and spending increases in the bill would offset its spending cuts and expand the US budget deficit by a cumulative $3 trillion over the coming decade.

- All the same, it isn’t clear that the downgrade will have much practical effect in the near term. As we’ve written previously, the administration’s dramatic and erratic tariff war and other policies had already raised concerns about US economic performance, debt sustainability, and financial market stability, sparking at least some measure of capital flight from the US.

- So far today, US bond values have only slipped marginally, pushing the yield on the benchmark 10-year Treasury note up to 4.558%. The dollar has been affected more dramatically, with the US dollar index falling about 0.9%.

US Tariff Policy: After retail giant Walmart warned last week that the administration’s import tariff hikes would force it to raise prices, President Trump on Saturday lashed out at the firm and said it should “eat the cost” of the imposts. The statement underscores the risk that companies will come under both market pressure and political pressure to accept lower profit margins as a result of the tariffs. Indeed, as we have written, incoming economic data suggests the tariffs are already pushing down profit margins for many firms.

- Separately, Treasury Secretary Bessent yesterday warned that any country that isn’t negotiating “in good faith” over its trade relationship with the US will face a snap back to the full, ultra-high tariffs outlined by Trump in his “Liberation Day” announcement.

- Bessent’s statement is a reminder that investors shouldn’t be lulled into complacency by Trump’s decision to pause his high “reciprocal” tariffs for 90 days until early July. For some countries, the tariffs could well snap back to the initial high levels, at least temporarily. In other words, uncertainty about US trade policy has not gone away.