Daily Comment (April 26, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, where Russia’s refocus on attacking eastern Ukraine still seems stalled, but Western officials, sensing Russian weakness, continue to call for stronger support for the Ukrainians. We next review a range of international and U.S. developments with the potential to affect the financial markets and close with the latest news on the coronavirus pandemic.

Russia-Ukraine: As Russian forces continue to probe Ukrainian defenses in the eastern region of Donbas and along Ukraine’s southern coast, they also conducted precision missile strikes against five Ukrainian railway stations in central and western Ukraine yesterday. The strikes were likely an effort to disrupt Ukrainian reinforcements to eastern Ukraine, hinder Western aid shipments, and warn the U.S. off from providing more support for Ukraine after Secretary of State Blinken and Secretary of Defense Austin visited Kyiv over the weekend. Meanwhile, local Ukrainian counterattacks retook some territory north of Kherson and west of Izyum. Separately, there are increasing fears of an eventual Russian move on Moldova, where there have been several mysterious explosions this week, including one that destroyed a radio transmission tower used to broadcast Russian-language programming. Some fear the explosions are intended to provide cover for a Russian invasion to protect Russian-speaking inhabitants of Moldova.

- Despite the Russian railway attacks yesterday, Russian precision strike capabilities will probably remain limited and are unlikely to affect the course of the war decisively. According to open-source research organization Bellingcat, the Russian military has likely used 70% of its total stockpile of precision missiles to date.

- As we have warned previously, the increasingly obvious weaknesses in Russia’s conventional military capabilities continue to encourage more aggressive Western responses to the crisis. For example, a high-level British defense official today endorsed the idea that Ukraine could use the weapons provided by Western governments to attack across the border into Russia. The German government also finally agreed to provide heavy anti-aircraft weapons to Ukraine, and the Polish government confirmed that it has sent tanks. Those moves come after Defense Secretary Austin said, over the weekend, that the U.S. would like to see Russia weakened by the war so it could no longer threaten such attacks in the future. While Austin took flak for what some saw as “spilling the beans,” it may well be that the aggressive statement was planned in advance, in part to bolster Austin’s profile, but also in part to signal the U.S. resolve to keep supporting Ukraine as it erodes Russian military strength.

- Faced with the Russian military’s poor performance and the West’s continued support for Ukraine, Kremlin officials have, yet again, engaged in nuclear saber-rattling. Russian Foreign Secretary Lavrov yesterday complained that the West was using Ukraine to fight a proxy war with Russia, creating a “serious” risk of a nuclear confrontation. While a strategic or tactical nuclear strike is not the most likely result of the war, Lavrov’s statement is a reminder that it remains a risk, which alone is a reason for investors to monitor the situation closely.

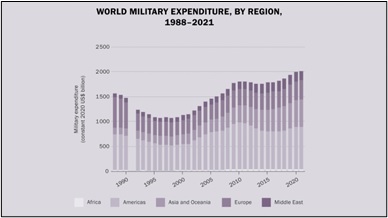

Global Defense Spending: The Stockholm International Peace Research Institute (SIPRI) yesterday issued its annual estimate of global military spending. According to this year’s edition, global military expenditures increased for a seventh straight year in 2021, reaching an all-time record of $2.1 trillion.

- The report indicates total defense spending rose 6.1% in nominal terms last year, but only 0.7% after stripping out inflation. For the average country, military spending in 2021 equaled about 2.3% of gross domestic product (GDP).

- The report showed the U.S. defense budget fell 1.7% last year, reducing the U.S. defense burden to 3.5% of GDP. In contrast, Russian military spending surged 2.9%, lifting the country’s defense burden to 4.1% of GDP.

- As we noted in our Bi-Weekly Geopolitical Report of March 28, many countries began to hike their military budgets around the middle of the last decade after Russia seized control of the Crimean peninsula and fomented a separatist movement in eastern Ukraine. Now that Russia has launched a much more threatening attack on the whole of Ukraine, we believe the world will keep boosting its military expenditure in the coming years. As we note in our report, that could potentially create opportunities for investors in areas like the traditional defense industry, semiconductors, artificial intelligence, and other software, and even in firms producing dual-use goods for both the civilian sector and the military.

China: President Xi has reportedly ordered his economic officials to ensure that Chinese GDP grows faster than U.S. GDP this year, despite the rise in China’s COVID-19 infections and the government’s own disruptive economic lockdowns to combat them. In response to the directive, Chinese government agencies are discussing plans to accelerate extensive construction projects, especially in the manufacturing, technology, energy, and food sectors. They are even considering a plan to issue coupons to individuals to spur consumer spending,

- To justify the order, Xi said it is critical to show that China’s one-party system is a superior alternative to Western liberal democracy and that the U.S. is declining both politically and economically.

- We note the order also comes ahead of this autumn’s high-level Communist Party meetings, where Xi plans to garner a third term in office.

Japan-South Korea: Today, Japanese Prime Minister Kishida warmly welcomed a delegation of South Korean lawmakers and academics sent by President-Elect Yoon Suk-yeol, arguing that Japan and South Korea must improve relations in order to work better with the U.S. against rogue nations and other foreign challenges. Importantly, better Japanese-South Korea relations would help the U.S. counter China’s geopolitical aggressiveness in the Asia-Pacific region. Better relations could also help improve trade opportunities between Japan and South Korea, potentially boosting economic and financial market performance.

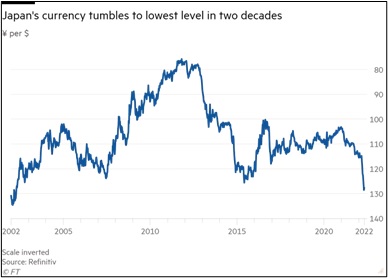

Japan: Even though the yen has rebounded a bit so far this morning, it remains near its 20-year low of almost 130 per dollar, prompting increased speculation that the Bank of Japan might intervene in the market to prop up the currency for the first time since 1998. (Of course, the flip side to the weak yen is the extraordinarily strong dollar, which has been boosted by strong U.S. economic growth and the Federal Reserve’s aggressive plans to boost interest rates. The U.S. Dollar Index, which tracks the greenback against six other currencies, including the euro and sterling, is now at its highest level since March 2020 and is up roughly 12% in the past year.)

Canada: In parliamentary testimony, Bank of Canada Governor Macklem said his policy board would consider another 50-basis-point hike in its benchmark interest rate at its next meeting on June 1. That would follow the central bank’s 50-basis-point hike earlier this month, bringing the benchmark rate to 1.0%. The statement underscores the extent to which some major central banks are panicked about inflation and intend to tighten monetary policy aggressively in the coming months, despite the risk of excessively slowing down economic growth and unsettling financial markets.

U.S. Monetary Policy: The Senate today expects to vote to confirm Lael Brainard as the Federal Reserve’s new vice-chair. The Senate has also taken steps to schedule a vote to confirm economist Lisa Cook as a member of the board. It is still unclear when the Senators will vote to confirm Jerome Powell to a new term as chair or Philip Jefferson as another new board member. In any case, we do not expect the newly confirmed policymakers to change the Fed’s rate-hiking intentions in the near term.

U.S. Consumer Spending: Several sellers of big-ticket consumer goods, ranging from appliances to mattresses, have reported they have seen a drop-off in demand. Corporate leaders ascribe the drop to several factors, including high inflation, rising interest rates, reduced savings balances, and rising pessimism from the Russia-Ukraine war. As we have noted previously, all those factors point to an increased risk of recession and troubled financial markets in the coming 12 to 18 months.

COVID-19: Official data show confirmed cases have risen to 510,286,262 worldwide, with 6,221,232 deaths. The countries currently reporting the highest rates of new infections include Germany, South Korea, France, and Italy. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) In the U.S., confirmed cases rose to 81,043,362, with 991,609 deaths. In data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 219,370,557, equal to 66.1% of the total population.

Virology

- In the U.S., the Omicron BA.2 variant continues to spread, but it is still generating relatively few serious illnesses or hospitalizations. The seven-day average of people hospitalized with confirmed or suspected COVID-19 came in at 15,639 yesterday, up just 4% from two weeks earlier. Because of the low level of hospitalizations and general fatigue with the pandemic, the recent outbreak is generating few new policy responses.

- In China, new Omicron infections remain relatively low compared to other countries. However, the mutation continues to spread rapidly, prompting even-stricter testing regimes and lockdowns by government authorities, with the effort now shifting away from Shanghai and toward Beijing.

Economic and Financial Market Impacts

- As Chinese authorities keep clamping down on economic activity to contain the pandemic, companies throughout the country and Hong Kong continue to face disruptions and lost business.

- The Chinese lockdowns are also showing up in other countries’ economic data. Reports today showed South Korea’s first-quarter GDP was up just 3.1% year-over-year, slowing from a year-over-year rise of 4.2% in 2021’s fourth quarter. The slowdown reflected some impact from slowing exports to China, as well as weaker investment and consumption.

Foreign Policy Responses

- Chinese stocks and the renminbi continue to weaken. To bolster the currency, yesterday, the People’s Bank of China cut its foreign-exchange reserve requirement ratio to 8% from 9% previously. By allowing financial firms to hold less foreign currency to back their assets, the central bank hopes to undermine the demand for foreign exchange and put a floor under the renminbi.