Weekly Geopolitical Report – The Italian Elections: Part I (February 12, 2018)

by Bill O’Grady

(Due to President’s Day, the next report will be published on February 26.)

Italy will hold elections on March 4, 2018. Given that recent elections in the Eurozone have run an emotional gamut, it is difficult to predict the outcome. There was great fear before last year’s elections in France that a National Front victory could undermine the Eurozone. The National Front is a nationalist, right-wing Eurosceptic populist party. In light of surprise populist victories around the world,[1] there were worries that France would be the next major win for populism. Emmanuel Macron’s surprising landslide put those fears to rest. On the other hand, there was little concern surrounding last autumn’s elections in Germany as Angela Merkel was expected to win easily. However, mainstream parties in Germany saw their popularity decline, offset by surprising strength for the AfD party, an anti-immigrant and Eurosceptic party. Since winning the election, Chancellor Merkel has struggled to build a ruling coalition. She recently made a deal with the Social Democrats (SDP) to form another “Grand Coalition” government, but in the process she was forced to give the SDP key ministries that will likely provide Germany more flexibility in managing the fiscal rules of the EU but will make the conservatives less likely to support this government for an extended period.

Thus, expectations for the French elections proved to be too pessimistic, while expectations for the German elections were overly sanguine. It appears the anticipated outcome for the upcoming Italian elections is similar to that of Germany; although there is clear evidence that populist parties are growing in popularity in Italy, predictions call for a hung parliament and the eventual creation of a center-right coalition that will not threaten the stability of the Eurozone. This sentiment is evident in the financial markets.

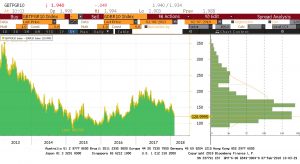

This chart shows the spread between Italian and German 10-year sovereign yields. Although German yields declined relative to Italian yields into early 2017, the spread has steadily narrowed since April 2017 to the present. If there were serious concerns about the Italian elections leading to Italy’s exit from the Eurozone, Italian yields would be rising relative to German yields.

Although we think the consensus case is the most likely outcome, there is potential for a negative surprise. Given that Euroscepticism is high in Italy, even a consensus outcome may not be all that favorable.

In Part I of this report, we will begin with the basic geopolitics of Italy with a focus on the natural divisions in the country that make it difficult to govern. From there, we will examine the political economy of Italy, especially how Italian political leaders managed the economy to deal with the sharp divisions between the north and south. In Part II, using this background, we will analyze the polling for this election and the potential outcomes. We will also touch on the issue of German influence in the EU. As always, we will conclude with potential market ramifications.

[1] The presidency of Donald Trump and Brexit are two examples.