Weekly Energy Update (September 29, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

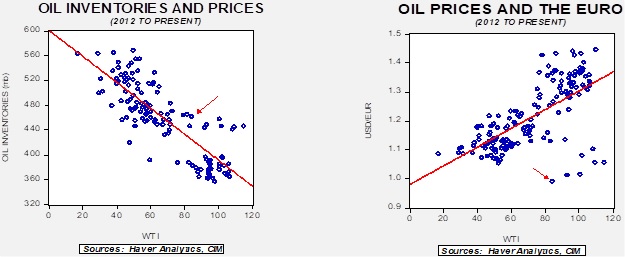

Crude oil prices remain under pressure due to recession fears.

(Source: Barchart.com)

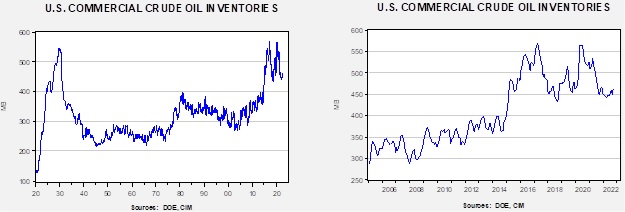

Crude oil inventories fell 0.2 mb compared to a 2.0 mb build forecast. The SPR declined 4.6 mb, meaning the net draw was 4.8 mb.

In the details, U.S. crude oil production fell 0.1 mbpd to 12.0 mbpd. Exports rose 1.1 mbpd, while imports fell 0.5 mbpd. Refining activity plunged 3.0% to 90.6% of capacity. We are in the usual period for autumn refinery maintenance, so falling refining activity should be expected for the next few weeks.

(Sources: DOE, CIM)

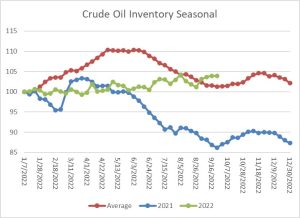

The above chart shows the seasonal pattern for crude oil inventories. As the chart shows, we are at the seasonal trough in inventories. The build seen in October into November is usually due to refinery maintenance. With the SPR withdrawals continuing, the seasonal build could be exaggerated this year.

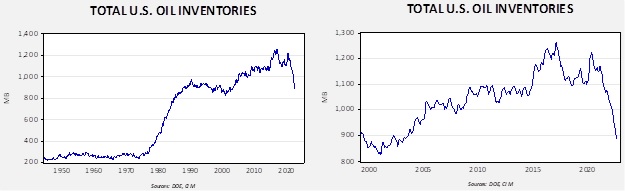

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2003. Using total stocks since 2015, fair value is $107.52.

Market News:

- Hurricane Ian is bearing down on the gulf side of Florida. There isn’t a lot of oil and gas production in the path of the storm, but delays are an issue as the U.S. is exporting a record level of energy products to the world. Hopefully, the delays shouldn’t last long.

- As the G-7 looks to try to sell the world on a price cap for Russian oil (see this report for a primer on how it might work), India appears to be sharply curtailing its purchases. This change in buying pattern doesn’t appear to have anything to do with its attitude toward Russia, but rather it has more to do with higher shipping rates. As rates have risen due to the global scramble to secure oil supplies, it’s now cheaper to buy African crude oil once shipping costs have been taken into account.

- There is a growing consensus that OPEC+ is considering a $100 per barrel target for oil prices.

- One element of the Inflation Reduction Act was a measure that would have sped up permitting, but in its final version it was removed to be considered as a standalone bill. Environmentalists have been using various delaying tactics to prevent pipeline construction or drilling from occurring, even after companies have complied with regulatory requirements. Clean energy has faced similar constraints. Solar and wind power could expand if it were easier to build long distance transmission; however, these structures can also face local opposition. Manchin (D-WV) tried to lead a bipartisan effort to streamline permitting, but that bill has failed. Democratic progressives loathe the permitting of pipelines and other infrastructure for fossil fuels. The GOP didn’t want to give the Democrats a win and likely opposed streamlining permitting for clean energy projects. Sadly, by looking for the perfect, the good was sacrificed. The fact that a compromise couldn’t be reached suggests that both wings of the political spectrum believe they can get exactly what they want. Until that is proven false, we will continue with this world where energy infrastructure is not being built.

- We note that this isn’t just a U.S. problem as Australia is seeing similar issues.

- For U.S. LNG to expand (and help wean Europe from Russia), pipelines will need to be built.

- Natural gas prices in Europe are starting to have ripple effects. With U.S. prices significantly less, EU companies are shifting industrial activities that rely on natural gas production to the U.S. Basics such as bathroom tissue are being affected. There is growing speculation that the EU will expand gas to crude oil fuel switching, which may lift crude oil demand later this year. Germany has secured an LNG deal with the UAE as part of its effort to diversify its natural gas supply chain.

- Even as hedging costs rise, EU regulators are resisting calls for support from the energy industry.

- U.S. utilities are starting to warn customers that home-heating costs this winter are poised to rise due to elevated natural gas prices. Overall prices are expected to increase over 17% from last year.

- Norway’s oil production rebounded in August.

Geopolitical News:

- The Nord Stream 1 and 2 pipelines have been sabotaged. It is unclear who did this, but there is evidence of a gas leak in the Baltic Sea. Although the Nord Stream pipelines were not sending gas to Europe, the lines were pressurized, and the gas that is leaking was in those pipelines. The CIA has warned that pipeline infrastructure in Europe is vulnerable. The leak could mean that no gas from Russia will be available to Germany even if relations were to improve. Speculation is rife that Russia attacked the pipes (the broad scale of the attacks mostly rules out an accident), although no party has been officially blamed. Scandinavian seismic stations reported explosions around the pipelines before the leak was discovered.

- This attack is ominous because it could signal a new element of this war— targeting critical infrastructure. Russian submarines have been noted prowling around undersea cables. Russia has already been accused of severing fiber optic cables between Svalbard and Norway that are key communication links for NATO. If Russia decides that attacking energy and communications infrastructure is necessary to win the war in Ukraine, a new risk element will be introduced. The EU has vowed to protect its energy infrastructure, but given the miles of pipelines involved, no government can guarantee it will protect everything.

- A key reason for the creation of the EU was to manage competition within Europe. After all, the continent suffered two world wars due to unresolved competition, and thus avoiding another one was important. The EU has expanded and grown to include influence on economic matters. So far, Brussels has tried to manage the scramble for energy resources. However, the IEA is warning that if more isn’t done, competition to secure oil and natural gas could lead to chaos and spiraling prices.

- As we have noted earlier, EU demand has cut supplies of fuel to the emerging world.

- Last week, we noted the unrest that followed the death of a feminist in Iran who was accused of improper head covering. The unrest has continued to spiral, with now over 75 deaths being attributed to the protests. Even conservative women are joining the protests, which suggests a broadening threat to the regime. There are reports suggesting that some cities in Iran are no longer controlled by the government. Historically, the regime tends to react harshly to protests. As we noted last week, the government has interfered with the internet to undermine the protestors’ ability to coordinate their actions. Those efforts have expanded, and in response, the U.S. has relaxed rules on tech firms so they can provide services to Iran to help the protestors. The Starlink system, a satellite internet service built by Elon Musk that has blanketed space with small satellites, is said to be operative and giving protestors internet access. Although we doubt the regime is at risk, it should be noted that Ayatollah Khamenei is said to be gravely ill, but the most recent reports suggest he may have recovered to some extent. It bears watching to see if some sort of change in government emerges from Tehran.

- Protests against Iran have spread to the West.

- Iran has also launched attacks against Kurdish groups in Iraq. Tehran is accusing various groups of supporting the protests in Iran. Attacking groups on foreign territory highlights how little sovereignty Iraq has over Iran.

- Iran has withdrawn its “morality police” that were responsible for the death of Mahsa Amini from public view. We doubt this is permanent, but for now, it looks like Iran is trying to placate the protestors.

- In related news, the Biden administration says it will continue to engage in talks to return to the JCPOA. Given the protests, making an agreement with Iran looks like a long shot, but the fact that the White House hasn’t broken off talks looks politically risky.

- Although the G-7 continues its plan to introduce a price cap on Russian oil, and the EU is moving toward an embargo and an insurance ban, the U.S. has ruled out secondary sanctions for now. Secondary sanctions would penalize nations and firms that buy Russian oil and gas in violation of sanctions. The fact that secondary sanctions have not been implemented suggests the West isn’t really serious about inflicting damage on the Russian economy. Most likely, leaders in the G-7 realize that seriously reducing Russian oil supplies would subject the world economy to crippling increases in oil prices.

- Sanctions on Russian oil shipments are preventing local ship captains from controlling oil tankers from Russia that are traversing the Danish straits. Without the local captains, the likelihood of an oil spill is increased.

- The U.S. has been mediating a natural gas sharing arrangement between Israel and Lebanon. The two nations have both claimed offshore natural gas fields. Although a deal hasn’t been struck yet, reports suggest they are “close.”

Alternative Energy/Policy News:

- As urbanization continues, people are being separated from the basic notion that producing any commodity has an impact on the earth. Drilling, mining, farming, and ranching all disturb something. This op-ed, lamenting the cutting down of forests for a solar farm, is an example. Solar power is a low-density source of electricity. To generate it at scale requires great amounts of space. Clean energy may disturb things less than other forms of energy (or not), but make no mistake, changes will be necessary.

- China is aggressively moving to become a world leader in nuclear power. It has built 39 reactors over the past decade, which is a bit more than 57% of the global total. The process of building reactors increases the country’s expertise in construction and engineering and provides its economy with electricity that would be hard to disrupt by an outside power. While the West continues to impede the development of nuclear power, it runs the risk of falling behind China.

- The DOE is providing funding for building green hydrogen infrastructure, setting off a scramble to secure the needed resources.

- Firewood and wood pellet prices are up 20% in France as demand rises.

- One of the problems with forecasting is that models all use past history and relationships to predict the future. Accounting for changes in technology requires guesswork that is highly unreliable. We note that agriculture researchers are using AI to figure out how to make plants drought-resistant.

- According to the IEA, clean energy progress is lagging.

- As the EV industry grows, recycling the traction batteries from cars will become more important. South Korea has been taking the lead in this industry.

- The scramble for rare earths is heating up. The world is currently heavily dependent on China for this resource.