Weekly Energy Update (September 28, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices are breaking out, raising the potential for a move toward $95 per barrel.

(Source: Barchart.com)

(Source: Barchart.com)

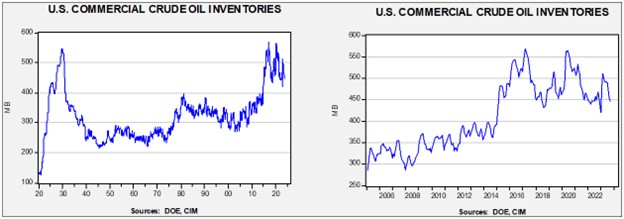

Commercial crude oil inventories fell 2.2 mb compared to forecasts of a 2.0 mb build. The SPR fell 0.3 mb, which puts the net draw at 2.4 mb (difference due to rounding).

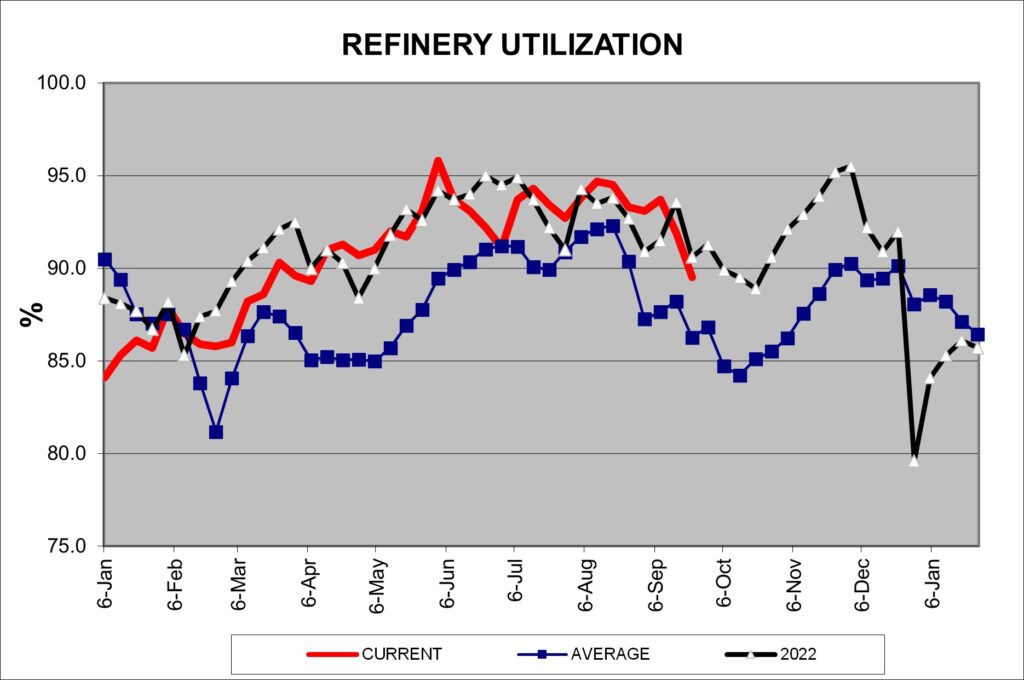

In the details, U.S. crude oil production was steady at 12.9 mbpd. Exports fell 1.1 mbpd, while imports rose 0.7 mbpd. Refining activity fell 1.6% to 89.5% of capacity. We are clearly heading into the autumn refinery maintenance period which should reduce demand.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

(Sources: DOE, CIM)

(Sources: DOE, CIM)

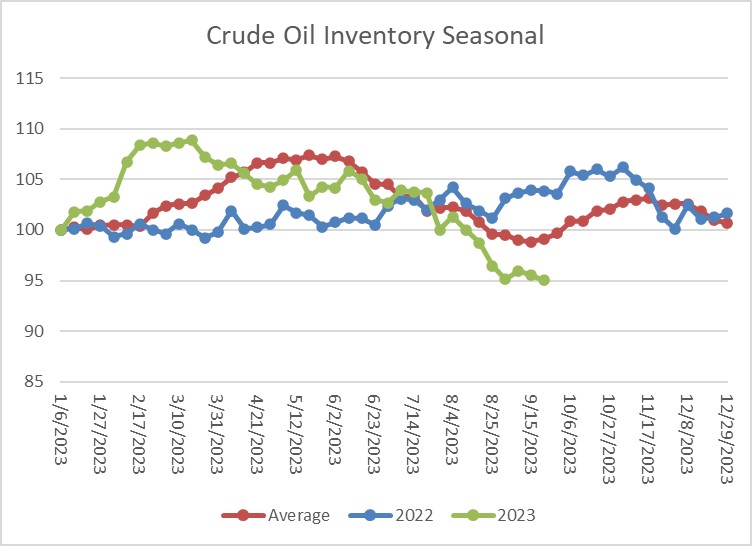

The above chart shows the seasonal pattern for crude oil inventories. Last week’s decline is contra seasonal and thus is bullish for crude oil prices.

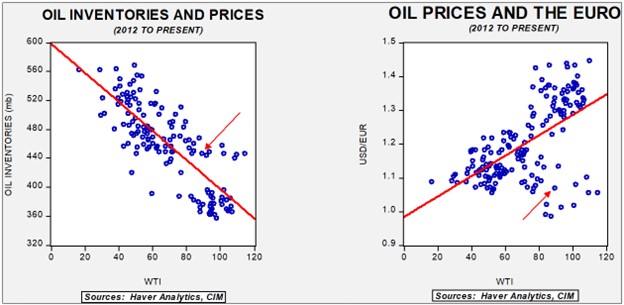

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $74.92. Commercial inventory levels are a bearish factor for oil prices, but with the unprecedented withdrawal of SPR oil, we think that the total-stocks number is more relevant.

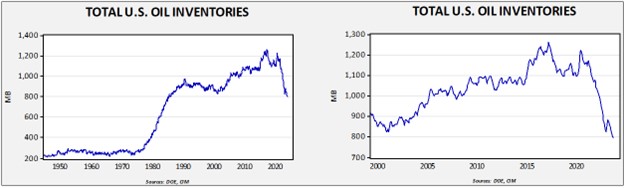

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in late 1984. Using total stocks since 2015, fair value is $95.49.

Market News:

- The IEA issued an updated report detailing what would be necessary to reach carbon reduction goals by 2030. Generally speaking, it is still possible to reach these goals, but the path is narrowing. The IEA claims that fossil fuel demand will need to decline 25% by 2030; we suspect that isn’t likely.

- Oil execs claim that without more support for shale drilling, oil is headed to $150 per barrel. We don’t think that is probable in the near future because OPEC+ has significant excess capacity. However, over time, it could occur. The idea that demand must fall by 25% will likely temper investment activity in oil and gas.

- One of the key factors in shale production is water. There are concerns that Texas is consuming so much water that it may eventually curtail output.

- U.S. oil production is steadily rising and is offsetting some of the production cuts from OPEC+.

- As oil prices continue to rise, the G-7 cap on Russian oil prices has become irrelevant. The restrictions on Western insurance remain in place but are increasingly being ignored as Russia is managing to acquire insurance from other sources.

- Russia has banned product sales in a bid to ensure ample domestic supplies. Russian domestic prices have declined in the wake of the restrictions.

- Although there is still talk about phasing out fossil fuels in the West, China’s climate envoy has made it clear that Beijing isn’t ready to give up on these fuels anytime soon. This comment makes the idea of “peak oil demand” appear a bit premature.

- It was a warm summer, and September has also been warm. The combination of undersea volcanic activity, the emerging El Niño, and the peak of the solar cycle have all combined to lift summer temperatures. We will now be watching to see if we have a mild winter as a continuation of these trends.

- Russia banned the export of distillate products earlier this month, but as prices have increased, it has lifted its ban on bunker fuel, the high-sulfur fuel usually burned by ships.

- Despite high prices, U.S. E&P company capex remains constrained.

Geopolitical News:

- In the wake of the Iran/U.S. prisoner swap, there is hope that the two parties will use this event to improve relations. Although we have our doubts that this will work, there are parties trying to foster negotiations.

- Qatar is offering to facilitate talks between the U.S. and Iran about moving forward on a new nuclear deal.

- On the other hand, Iran’s foreign minister, who was in New York for the UN General Assembly meetings, was unable to visit Washington for talks.

- Robert Malley, who we discussed in an earlier Weekly Energy Update, appears to be part of a deep influence campaign by Iran.

- President Raisi of Iran is calling for the U.S. to leave the Middle East.

- Iran claims to have thwarted a massive bombing campaign. Tehran blames Israel.

- In a bid to conserve foreign currency reserves, Iraq will restrict all internal transactions to the IQD. Usually when a central bank puts such restrictions in place, the action reduces trade.

- Over the past few weeks, we have discussed Saudi/Israeli normalization. The barriers to a deal remain high, but talks appear to be continuing. As a potential deal looms, Iran is trying to figure out how to respond. A KSA/U.S./Israel deal would create a formidable obstacle to Iran’s goal of dominating the region.

- As negotiations continue, we note that the new Saudi envoy to the Palestinians has visited the West Bank. Also, Israel’s tourism minister has visited the KSA, which makes the minister the highest ranking official to actually visit Saudi Arabia.

- One of the key elements of the geopolitics of oil is that Europe lacks enough oil and natural gas to be energy independent. Thus, it needs imports to meet its energy needs. The U.S. wants Europe to be dependent on America. Europe, obviously, wants diversity of sources. Washington has historically tolerated Europe getting supplies from the Middle East and Africa but has consistently opposed Europe getting oil and gas from Russia. As the war in Ukraine has disrupted Russian supplies, the EU is finding itself increasingly dependent on the U.S., especially for natural gas.

- Mexico is planning to join the ranks of LNG export nations.

- Chevron (CVX, $170.23) announced it will resume drilling activity in Venezuela. The country has been under sanction for some time, but in the wake of the war in Ukraine, Washington has gradually lifted sanctions in a bid to keep oil prices under control.

- At the same time, Citgo, the large U.S. refiner that is a subsidiary of the Venezuelan state oil company PDVSA, will be auctioned off to pay Venezuelan debt. So far, the Maduro government hasn’t taken measures to stop the sale.

Alternative Energy/Policy News:

- European officials warn that the region must diversify its solar panel supply chains away from its dependence on China. The U.S. industrial policy is attempting to support a domestic solar panel industry.

- The EU is getting increasingly aggressive in protecting its auto industry, threatening not only China but also U.S. EV producers with trade restrictions.

- China is also dominant in rare earths mining and processing. Vietnam is vying to compete with China in this market.

- Vietnam is also making headway in the EV market and hopes to become a source for the EU now that Europe is considering restricting Chinese EVs.

- Ford (F, $12.55) halted work on a battery plant in Michigan. The plant, which uses Chinese licensed technology, has been controversial. The UAW, which is currently striking, has claimed that this halt was designed to influence the union’s wage efforts. However, the company claims it isn’t sure it can “competitively” operate the plant.

- Chinese firms are investing in Moroccan phosphate, which they use in batteries.

- Looking for a good primer on EV batteries? This report from The Economist lays out the different battery technologies and where new developments are going.

- Geothermal energy remains an attractive alternative energy. So far, it has mostly been restricted to regions with volcanic activity but there are hopes that it can be deployed more broadly. In addition, there is research under way to make current geothermal power more efficient.

- There is also research in progress that could transform CO2 into synthetic natural gas.

- The U.S. is aiming to build a nuclear fusion facility within the next decade.

- Microsoft (MSFT, $310.65) is funding small modular reactors to provide energy to the company. This energy is designed to, in part, provide electricity for its AI efforts.