Weekly Energy Update (September 23, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Prices continue to hold above $70 per barrel.

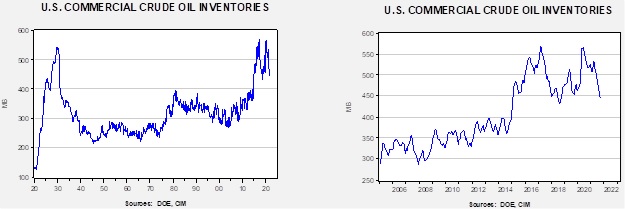

Crude oil inventories fell 3.5 mb compared to the 2.8 mb draw forecast. The SPR declined 1.2 mb, meaning the net draw was 4.7 mb.

In the details, U.S. crude oil production rose 0.5 mbpd to 10.6 mbpd, still below the 11.5 mbpd pre-Ida but also clearly recovering. Exports rose 0.2 mbpd, while imports increased 0.7 mbpd. Refining activity rose 5.4% as hurricane recovery continues.

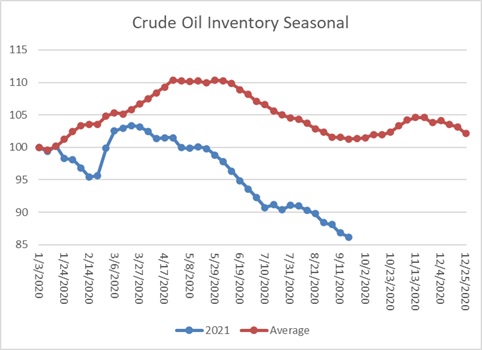

This chart shows the seasonal pattern for crude oil inventories. We are in the autumn consolidation and build season. Note that stocks are significantly below the usual seasonal trough. Our seasonal deficit is 78.1 mb. We expect the disruptions from Hurricane Ida (see below for updates) will affect this data in the coming weeks.

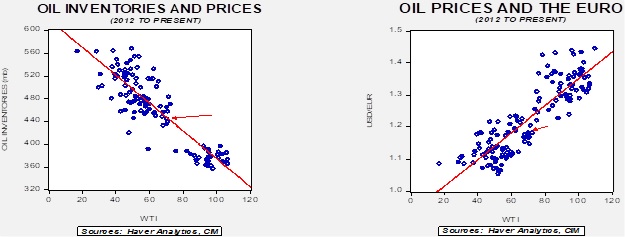

Based on our oil inventory/price model, fair value is $69.58; using the euro/price model, fair value is $62.83. The combined model, a broader analysis of the oil price, generates a fair value of $66.27. Continued dollar strength is weighing on oil prices. The decline in inventory, on the other hand, is a bullish factor.

Ida

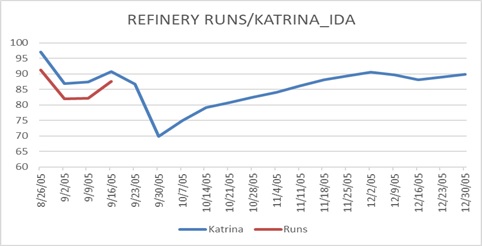

Hurricane Ida followed a path similar to Hurricane Katrina. For the next few weeks, we will track the impact of Ida on the oil and gas market, using Katrina as a baseline comparison.

(Source: DOE, CIM)

This chart compares refinery runs during the two periods following the hurricanes. This week, refinery operations recovered strongly. In 2005, Katrina was soon followed by Hurricane Rita. Barring a repeat, we would assume refineries will continue to come back online.

Market news:

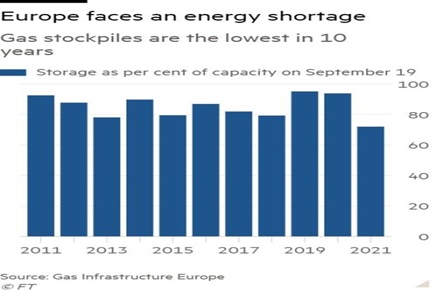

- The European natural gas crisis has intensified as supplies continue to tighten. Inventories are at decade lows.

Three more U.K. natural gas suppliers to consumers have failed this week, stranding 1.5 million homeowners without natural gas service. The firms apparently provided price caps without adequate price hedges, and as natural gas prices have soared, the firms were losing money on each BCF they provided. The firms are asking for government help, perhaps even creating a “bad bank” for customers with contracts that can’t be fulfilled. Meanwhile, other EU governments are considering emergency aid to households faced with soaring power bills.

- Europe is finding itself outbid for U.S. natural gas, as Asian buyers pay up to secure supplies.

- Russia has been focusing its supplies on Turkey and China, curtailing supplies to Europe. Even though Russia is meeting its long-term supply contracts with Europe, its spot supplies have been going elsewhere. We expect Moscow to use Europe’s natural gas supply crisis to push Nord Stream 2 to open.

- Adding to winter gas worries is a volcanic eruption on the Canary Island of La Palma. Volcanic ejections can spew ash into the upper atmosphere, cooling temperatures.

- Energy prices have been rising as oil and gas drilling have slowed on the dismal future demand outlook. Much of this dismal future is a function of environmental regulation. Although curtailing fossil fuel use is necessary to reduce greenhouse gases, the accompanying price increase is unpopular and puts the parties in power at risk.

- There is the possibility that shale oil drilling may be starting to pick up.

Geopolitical news:

- Behind-the-scenes discussions on Iran’s returning to the nuclear deal are underway, but a recent speech by President Raisi suggests Iran is more interested in securing vaccines.

- Although the Arab Gulf states remain dependent on the U.S. for security, China is making diplomatic and economic inroads. Like much of the world, nations loath to choose between Beijing and Washington, but it will be increasingly difficult to remain neutral.

- The Libyan government appears to be failing, raising the potential for additional conflict.

Alternative energy/policy news:

- As EV’s become more common, there are worries about batteries, specifically, what to do with them when a car’s useful life is spent. Ford (F, USD, 13.24) is working on a plat to recycle batteries used in its cars, creating a “closed-loop” solution.

- A bill in Congress, supported by progressive Democrats, appears to require the Fed to act against financial institutions that lend to fossil fuel firms. Although we doubt it will pass, the fact it was considered shows the hostile regulatory environment energy companies face.

- The default of sovereign debt is a constant problem in international lending. A couple of centuries ago, lenders might use the military to force borrowers to pay or collect collateral. Those tactics are no longer deployed, but the problem hasn’t gone away. Belize is working on a novel plan to buy back its heavily discounted debt with funds provided by The Nature Conservancy. It will use the restructuring to pay for marine conservation projects on its coral reefs. If this works, one could see how other nations might try to do something similar.