Weekly Energy Update (September 21, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices have continued their rise, with Brent trending toward $95 per barrel. Recent extensions of the production cuts by the Kingdom of Saudi Arabia (KSA) have boosted prices.

(Source: Barchart.com)

(Source: Barchart.com)

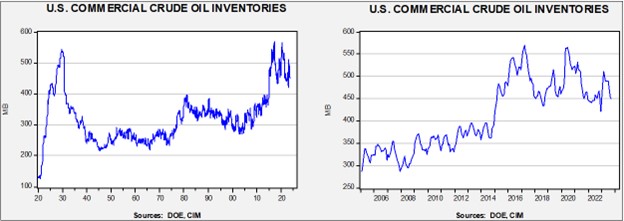

Commercial crude oil inventories fell 2.1 mb compared to forecasts of a 1.7 mb draw. The SPR rose 0.6 mb, which puts the net build at 1.5 mb.

In the details, U.S. crude oil production was steady at 12.9 mbpd. Exports rose 2.0 mbpd, while imports fell 1.1 mbpd. Refining activity fell 1.8% to 91.9% of capacity.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

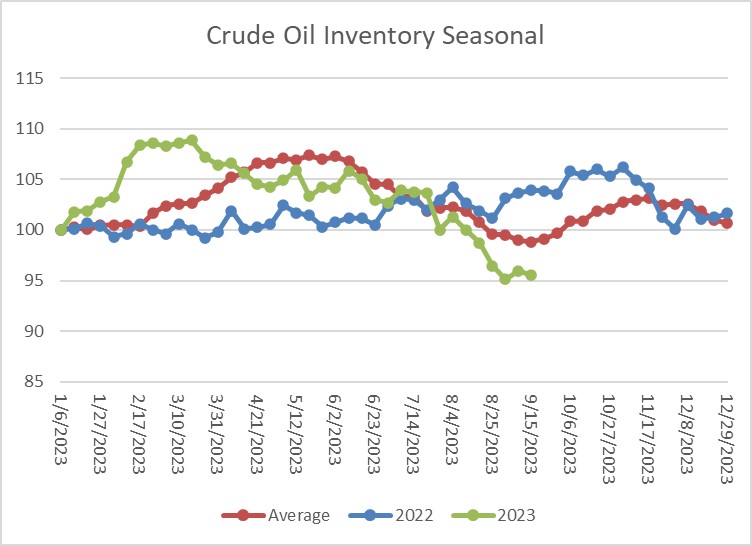

The above chart shows the seasonal pattern for crude oil inventories. Last week’s decline is mostly consistent with expected seasonal patterns. However, we should start to see inventories rise in the coming weeks, but if they fail to do so, it could give another lift to oil prices.

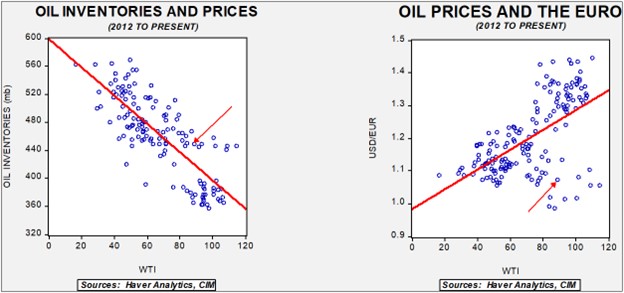

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $74.10. Commercial inventory levels are a bearish factor for oil prices, but with the unprecedented withdrawal of SPR oil, we think that the total-stocks number is more relevant.

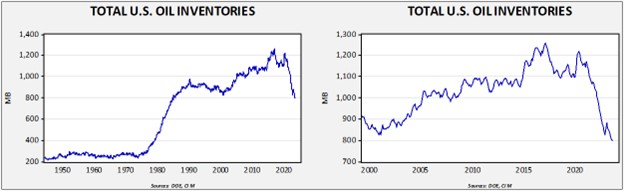

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in late 1984. Using total stocks since 2015, fair value is $95.20.

Market News:

- Last week, we reported on the IEA’s position that peak oil demand is near. We note that this week, skeptics to this idea have responded.

- Société Générale (SCGLY, $5.16) announced it is scaling back its lending to the fossil fuel industry. Reducing available capital to the energy industry is bullish for crude oil prices.

- Although we remain concerned about European natural gas prices this winter, current inventory capacity is essentially full, meaning that LNG cargos destined for Europe have no place to go. Thus, in the near term, prices could come under pressure.

- It appears that China is rapidly building crude oil inventories. Although we don’t know the prices at which the oil was acquired, we are surprised China has been aggressively buying oil in a highly priced environment. We do note that the largest exporter of oil to China is Russia; Moscow has likely given Beijing favorable prices and is allowing China to purchase oil in CNY.

- Ireland has rejected plans to build an LNG terminal, citing its goal of reducing greenhouse gases. It remains to be seen if Ireland can meet its energy needs through other means.

- Although overall U.S. production has been rising, the DOE says that output from leading shale oil areas has fallen for three consecutive months.

- California is putting restrictions on diesel semis starting next year, which is leading trucking companies to aggressively acquire rigs before the deadline.

Geopolitical News:

- The five Americans held in Iran have left Tehran. Despite this diplomatic effort, tensions with Iran remain elevated. Iran has expelled around one-third of IAEA inspectors in what is being called an “unprecedented” action. The move will likely slow, or even prevent, further improvement in relations. We note that European nations have decided to maintain sanctions, suggesting the prisoner swap was a one-off. At the same time, there are hopes that this confidence-building measure could lead to improved relations.

- The Saudi oil minister claims that the recent cuts in production were required to “stabilize” the oil market and were not about raising prices. If so, the oil price chart shown earlier would suggest this effort was an abject failure.

- As tensions rise between Armenia and Azerbaijan in the Nagorno-Karabakh region, there are worries that the Baku oil flows could be interrupted. Fortunately, it looks like a ceasefire has been negotiated.

- There are unconfirmed reports that the KSA has ended talks with Israel on normalizing relations. Israel says negotiations continue.

- Meanwhile, the U.S. is trying to facilitate talks between the KSA, the UAE, and the Houthis on a ceasefire in the Yemen Civil War. Although the KSA and UAE both endorse suppressing the Houthis, they support different groups in Yemen. Thus, the negotiations will be difficult. A ceasefire in Yemen could help stabilize the region.

- In the U.S., as the Democratic Party supports the expansion of green energy, the GOP appears to be increasing its support for the fossil fuel industry…and looking for campaign donations.

- We have noted that the Russian oil and gas embargo has led to a restructuring of global energy flows. This report details recent trends.

Alternative Energy/Policy News:

- Wind energy has recently come under strain as rising costs are leading to projects being postponed or cancelled. Governors on the Atlantic Seaboard are asking for federal help to keep the projects afloat.

- Last week, we noted that the EU is starting to push back against Chinese EVs in a bid to protect their own auto industry. It looks like this pushback is gaining momentum. As the EU starts to close its market, China is eying Japan as a target for its EVs.

- The state of California is suing major oil companies for damages caused by climate change, alleging the firms covered up evidence that fossil fuel consumption would have adverse climate effects. We have no position on the merits of the case, but would suggest that its existence alone could have a dampening effect on future oil production.

- Although the long-term outlook for lithium is bullish, in the near term, supply exceeds demand. Thus, we may be in for a period of falling lithium prices.

- Oil companies are looking to extract lithium from fracking wastewater.

- Researchers at Princeton have developed a new lithium extraction process that promises to enhance the productivity of the metal.

- One important hurdle for EVs is range anxiety. Energy Secretary Granholm’s recent EV demonstration trip was a mess; securing recharging venues was hard and they were not in the most convenient spots. However, it should be noted that we are in the early days of the EV era. Next generation batteries could go a long way toward addressing current problems. Toyota (TM, $187.86) claims its next generation battery will have a range of 497 miles, which rivals gasoline engines. The company says that it will offer solid state batteries by the end of the decade with ranges around 920 miles and 10 minute recharges.

- U.S. EVs have reached two million on the road.

- To acquire key minerals for the energy transition, Norway wants to mine the seabed. We suspect this will be controversial.