Weekly Energy Update (October 16, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Here is an updated crude oil price chart. Prices remain rangebound.

Commercial crude oil inventories fell 3.8 mb when a 2.0 mb decline was expected. The SPR declined 1.2 mb; since peaking at 656.1 mb in July, the SPR has drawn 15.3 mb. Given levels in April, we expect that another 6.7 mb will be withdrawn as this oil was placed in the SPR for temporary storage. Taking the SPR into account, storage fell 5.0 mb.

In the details, U.S. crude oil production fell 0.5 mbpd to 10.5 mbpd. Exports fell 0.5 mbpd, while imports declined 0.4 mbpd. Refining activity fell 2.0%. Hurricane Delta affected this week’s data.

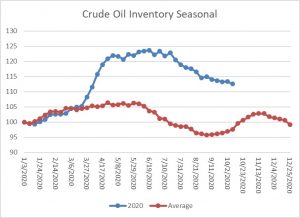

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s data showed a small decline in crude oil stockpiles, which is contraseasonal. Inventories tend to make their second seasonal peak about mid-November. Tropical activity continues, which will affect the data for the next couple of weeks.

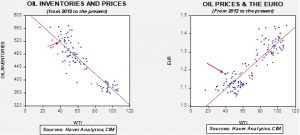

Based on our oil inventory/price model, fair value is $43.91; using the euro/price model, fair value is $62.27. The combined model, a broader analysis of the oil price, generates a fair value of $52.27. The wide divergence continues between the EUR and oil inventory models. As the trend in the dollar rolls over, it is bullish for crude oil. Any supportive news on reducing the inventory overhang could be very bullish for crude oil.

Hurricane activity has affected production, imports, and refining this season. We are at the point, in a normal year, when refinery maintenance usually ends and product production increases. If this develops this year, it should support crude oil prices in the coming weeks.

Refinery utilization is running well below normal due to the pandemic. But we tend to track the seasonal pattern, which would argue for an increase in refining activity, which would lift crude oil demand.

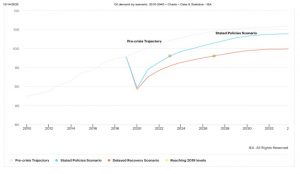

The big news this week came from the IEA which released its World Energy Outlook for 2020. Its forecast suggests that oil demand will peak around 104 mbpd by 2035, about 1.5 mbpd before the pre-pandemic estimate. If the recovery ends up being slower than currently expected, due to delays surrounding treatment, the peak could occur sooner and be around 100 mbpd. The delay scenario assumes that global GDP will not start to expand until 2023. Even in the best scenario, global energy demand is facing its worst situation since the Great Depression. The decline in air travel has played a role in the drop in demand. Another reason for the depressed oil demand forecast is coming from the expansion of electric vehicles. Europe is moving rapidly to force the adoption of battery powered cars. The pandemic has also hastened the shift to renewables. And, financing for oil projects appears to be becoming more difficult. We note that the IEA report is generally in line with OPEC’s estimates.

OPEC+ is facing a serious problem, even if President Trump is reelected.[1] If a market for resources is facing extinction, the rational act would be to monetize the resource as quickly as possible.[2] If the value of the resource is going to zero in the future, it makes sense to produce as much as possible in the short term before the “extinction date” arrives. Although the Saudis are likely to signal that they will maintain output discipline for now, that may not hold in the future. And for U.S. producers, a recent report suggests that aggressive fracking activity may have permanently damaged oil fields. Although this could mean the loss of potential future output, if the scenario outline above is true, it may be perfectly rational to overproduce in the short run at the risk of lost long-term potential if that oil won’t be consumed in the distant future. Meanwhile, bankruptcies among oil companies is up 21% from the first three quarters of this year compared to 2019.

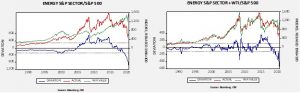

One of the issues we have been monitoring is the divergence in the performance of energy stocks compared to the broad index. The comparison of the energy sector to the S&P shows that, even taking oil prices into account, energy stocks are underperforming.

The chart on the left shows the performance of the S&P energy sector to the overall S&P; we have rebased the indexes to May 1986. From 2005 to 2014, the oil sector outperformed the overall index. Lately, the underperformance has worsened. The chart on the right adds oil prices to the model. As one would expect, the performance does improve. But, over the past two years, the underperformance of energy stocks has worsened even with the stabilization of oil prices. Until recently, if an investor was bullish on oil, they could capture some of the strength in oil prices by purchasing oil equities. That no longer seems to be the case. The models suggest there is something much deeper occurring in energy; energy companies are seeing weaker performance independent of oil prices. This likely means investors are concluding that the future of conventional energy stocks is dismal and this is causing oil stocks to become less sensitive to oil prices. And, given the forecast future of oil demand, the situation probably won’t get better.

On the unconventional front, we are seeing renewed interest in fuel cells. Fuel cells have the reputation of being the future of energy and always will be. We first reported on fuel cells in the mid-1990s. With rising interest in carbon reduction, fuel cells, merely from improved efficiency, should be part of the mix. Fuel cells run on hydrogen; the most used current source is from natural gas. Although fuel cells don’t emit any carbon, natural gas does. The “holy grail” for the industry is hydrogen from solar or wind. On the other end of the spectrum, the U.S. is offering $160MM to fund research into small nuclear reactors. Although nuclear power remains an anathema to the general public, it may be impossible to achieve zero carbon energy without it.

View PDF

[1] Although we doubt a President Biden would be successful in returning to the Iran nuclear deal, the potential for a return of Iranian oil exports of 2.0 mbpd would be difficult for the cartel to manage.

[2] Hence the decision by Saudi Arabia to take Saudi Aramco public.