Weekly Energy Update (October 28, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

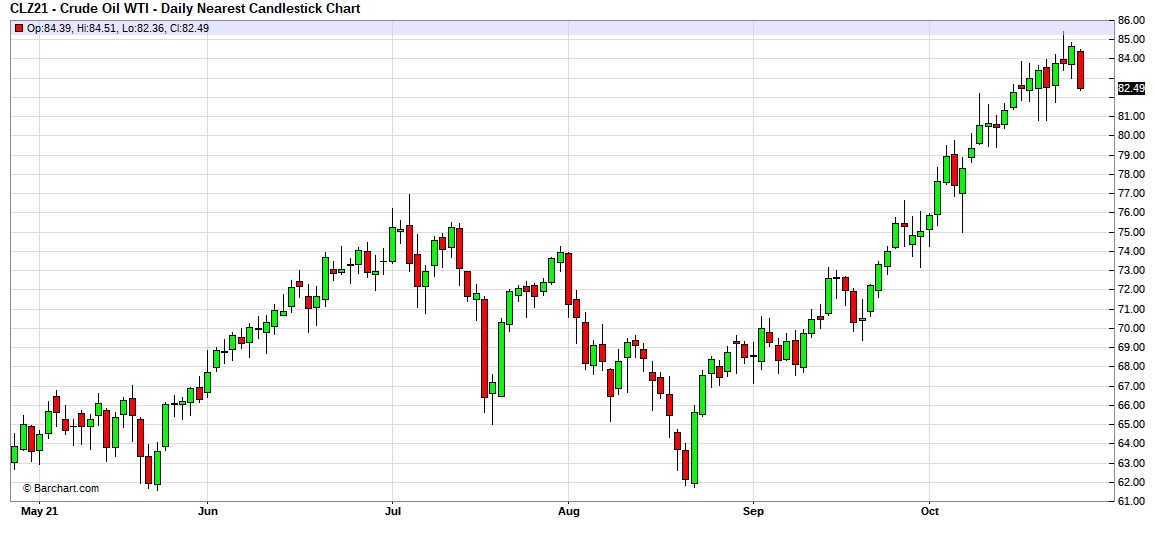

Prices have moved above $85 per barrel this week but retreated on this week’s inventory data.

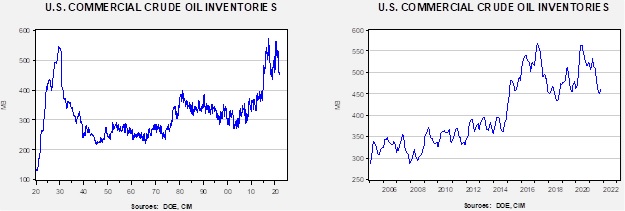

Crude oil inventories rose 4.3 mb compared to a 1.8 mb build forecast. The SPR declined 1.1 mb, meaning the net draw was 3.2 mb.

In the details, U.S. crude oil production was steady at 11.3 mbpd, remaining below the 11.5 mbpd pre-Ida level. Exports fell 0.3 mbpd, while imports rose 0.4 mbpd. Refining activity rose 0.4%. We are in refinery maintenance season, which accounts for the usual seasonal build in crude oil inventories seen in the chart below. This build season usually ends in mid-November.

(Sources: DOE, CIM)

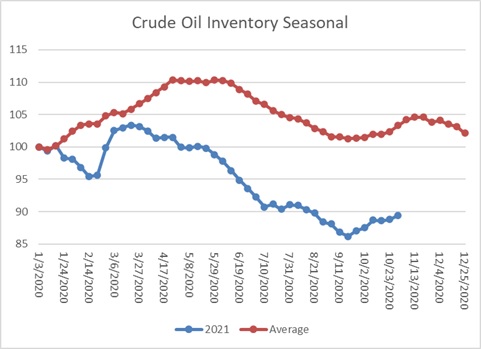

This chart shows the seasonal pattern for crude oil inventories. We are in the autumn build season. Note that stocks are significantly below the usual seasonal trough. Our seasonal deficit is 66.8 mb.

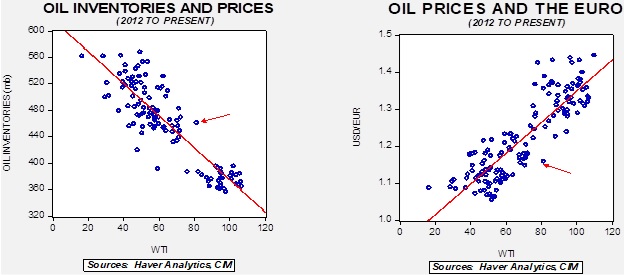

Based on our oil inventory/price model, fair value is $64.34; using the euro/price model, fair value is $58.50. The combined model, a broader analysis of the oil price, generates a fair value of $61.04. We are seeing a notable divergence in the model between inventory and the dollar and a rising level of overvaluation. Part of the overvaluation is likely due to fears of tighter inventories. If the builds continue, which is consistent with seasonal patterns, the model suggests some moderation of prices. However, supply fears are so elevated this may not be the case.

Market news:

- Last week, we noted that despite high oil and gas prices, production hasn’t responded as much as one would expect compared to earlier episodes of higher prices. As with many trends, there are multiple reasons behind the sluggish response. One element is that firms are no longer optimizing for production but for profitability. It means that instead of using all the cash available and borrowing, firms are husbanding liquidity and rewarding shareholders. In the past, U.S. shale producers, in particular, did not focus on shareholder return. In order to attract capital, the industry decided it needed to improve its reputation. As the value of producing property rises, some investors are selling out, suggesting they don’t see a bright long-term future. Another element of this trend is that margins are getting squeezed due to higher production costs. Thus, to maintain margins, firms simply appear more willing to allow higher prices to fulfill that goal.

- A negative harbinger for the future is that the University of Calgary will no longer admit new students into its bachelor’s degree program in oil and gas engineering. The school reports that enrollment in this department has fallen 77% between the years 2015-19. The program will continue, but without new students, it is just a matter of time before the program will end.

- ESG investors have been missing out on this year’s lift in energy stocks.

- Coal is admittedly one of the dirtiest fuels. Not only does it emit large amounts of greenhouse gases, but it also fouls the air with sulfur, particulates, and nitrous oxide, the key catalysts for acid rain. Over the past decade, coal has seen its market share drop, replaced by renewables and natural gas. But with natural gas prices soaring this year, coal is making a global comeback. China, facing a severe energy crunch, has eased restrictions on its use and is boosting imports from Indonesia.

- In Europe, nations are doling out subsidies to help pay for higher energy costs. Sadly, this practice won’t increase energy supplies and delays the necessary demand destruction to reduce the use of fossil fuels.

- The World Bank is warning that inflation risks are elevated due to the spike in energy prices.

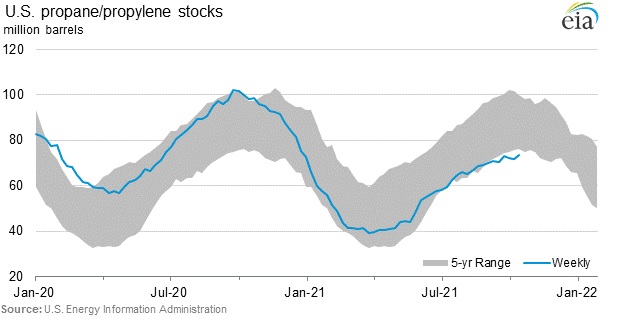

- Propane, a fuel with a wide variety of uses, is seeing supplies tighten. The U.S. has been increasing its exports of the fuel, which is derived mostly from natural gas. For urban and suburban home heating, natural gas and electricity are common fuels. These are regulated by public service authorities that limit price changes. Propane is commonly used in rural homes, and prices are set in the spot market. In addition, the fuel is used in crop drying, which can exacerbate local shortages. Tight supplies will tend to lift propane prices this winter. The chart below shows that current stockpiles are below the five-year range, signaling low inventories.

Geopolitical news:

- Russia is using the current energy supply crisis to expand its influence in Europe. Moldova has faced pressure from Moscow for years. Wedged between Ukraine and Romania, the Kremlin wants a friendly government in Moldova to increase pressure on Kiev. Gazprom (OGZPY, USD, 10.33) has reduced natural gas supplies to Moldova, causing gas pipeline pressures to fall to dangerous levels. A long-term contract with the company expired last month, and the new contract called for a more than doubling of prices. The current government of Maia Sandu is Western-supporting, and it is widely suspected the Kremlin wants to undermine the current administration. Moldova is asking for help from the EU.

- More broadly, President Putin has indicated Russia could increase natural gas supplies to Europe by 10% if Nord Stream 2 was approved.

- U.S. intelligence agencies and the Pentagon are issuing warnings that climate change is a threat to global security. From disruptions to supply chains, refugee flows, and damage to infrastructure, climate change will require significant remediation costs over time.

- China’s Sinopec (SNP, USD, 48.65) has signed a “huge” LNG deal with U.S. natural gas firms. Although the U.S. and China appear headed toward decoupling, there is still a significant level of trade and investment occurring between the two countries, which complicates the politics of separation.

- Iran, the EU, and the U.S. are continuing to try to restart JCPOA talks, but so far, there has been no observable progress. The problem appears to be with Iran; it doesn’t look like Tehran really knows what it wants. Or, perhaps better said, it wants sanctions lifted without having to offer anything in return.

- Iran’s economic future appears to be dependent on the lifting of sanctions, but the politics of compliance with JCPOA remains a problem.

- Iran was hit with a cyberattack on its gas stations, causing widespread disruption in supplies.

- As the KSA prepares for a world without extensive U.S. security support, it is using its economic clout to bend regional nations to its will.

- Riyadh has set 2060 to achieve net-zero carbon emissions.

Alternative energy/policy news:

- Rare earth metals are critical to the building of alternative energy systems. China, which is dominant in this industry, is consolidating its industry to give Beijing more control. Western nations used to produce these metals, but they are environmentally difficult. Restarting their production in the U.S. and Europe has been a problem.

- One area we have been monitoring is the nuclear power industry. There is a strong case to be made that a carbon-reduced future will need nuclear power to succeed. As part of this process, some nations are pressing international groupings to consider nuclear power a “green industry,” which would allow it to access green finance. The EU is delaying a French request for this designation.

- The mini-reactor industry is targeting the U.K. to help reach its climate goals.

- The expansion of EVs is fostering the need for battery production. Automakers are scrambling to secure battery supplies. Meanwhile, Tesla (TSLA, USD, 1046.76) could be opening a path for Chinese battery producers to gain market share in the U.S.

- Although nations are making climate pledges, their actions suggest they are not abandoning fossil fuel activity. There have been charges that major commodity-producing nations are trying to modify pollution targets.

- Climate modeling suggests that without some form of carbon absorption, the path of warming will lead to disruptions, even if we stop emitting carbon now. So, there is great interest in figuring out how to absorb carbon dioxide already in the atmosphere. One area being examined is using asbestos in this process.

- China is experimenting with compressed air for energy storage.