Weekly Energy Update (October 21, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

[N.B. Today’s report was delayed one day due to the Columbus/Indigenous Day holiday.]

Prices have moved above $80 per barrel.

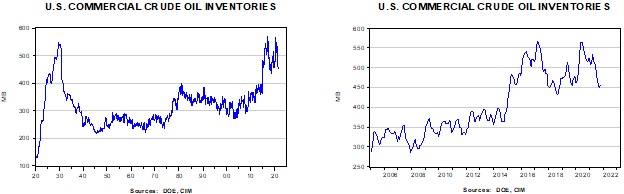

Crude oil inventories unexpectedly fell 0.4 mb compared to a 2.0 mb build forecast. The SPR declined 1.7 mb, meaning the net draw was 2.1 mb.

In the details, U.S. crude oil production fell 0.1 mbpd to 11.3 mbpd, remaining below the 11.5 mbpd pre-Ida level. Exports rose 0.5 mbpd, while imports declined 0.2 mbpd. Refining activity fell 2.0%. We are in refinery maintenance season, which accounts for the usual seasonal build in crude oil inventories seen in the chart below. This week’s draw is contraseasonal.

(Sources: DOE, CIM)

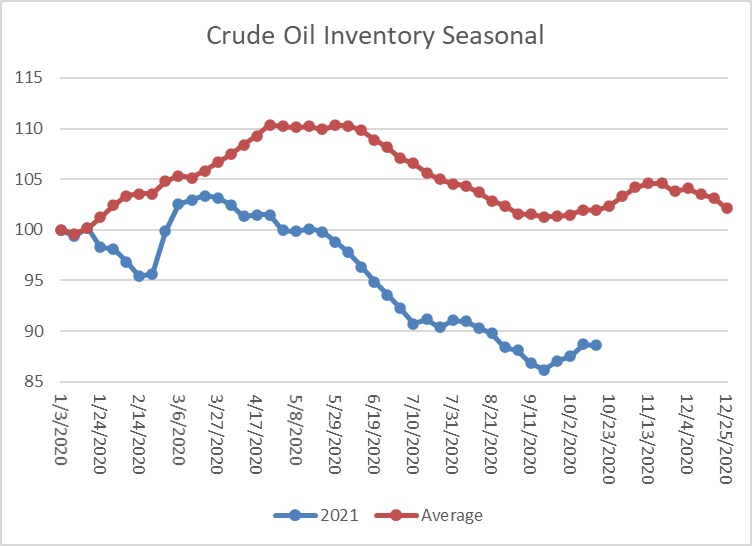

This chart shows the seasonal pattern for crude oil inventories. We are in the autumn build season. Note that stocks are significantly below the usual seasonal trough. Our seasonal deficit is 68.8 mb.

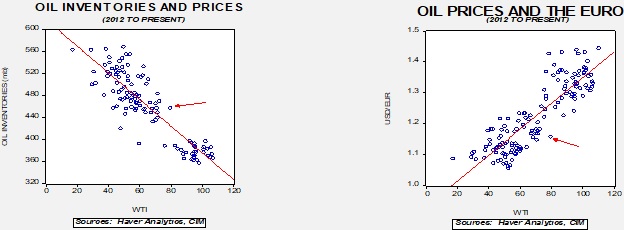

Based on our oil inventory/price model, fair value is $65.70; using the euro/price model, fair value is $58.26. The combined model, a broader analysis of the oil price, generates a fair value of $61.67. We are seeing a notable divergence in the model between inventory and the dollar and a rising level of overvaluation. Part of the overvaluation is likely due to fears of tighter inventories. If the builds continue, which is consistent with seasonal patterns, the model suggests some moderation of prices. However, supply fears are so elevated this may not be the case.

Market news:

- A key issue regarding why oil prices are high is that the world is rapidly moving to reduce investment in fossil fuels before renewables are ready to replace them. This situation is leading to a supply shortage that higher prices will struggle to resolve, at least easily. High prices will eventually curtail demand, but not quickly. Energy demand, due to the lack of substitutes, traditionally has an inelastic demand curve, meaning it takes excessive price increases to reduce consumption. High prices would normally spur oil drilling, but with financing constrained, we are not seeing the usual response from the fossil fuel industry.

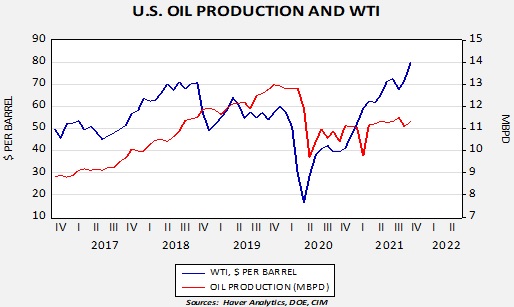

The relationship between oil production and prices varies over time, but in recent history, a $60 per barrel oil price generated 13.0 mbpd of production. Nearly $80 now is only fostering production marginally over 11.0 mbpd. To some extent, higher prices will speed the transition to alternative energy, but the pain it involves will not be popular.

- In related news, Exxon (XOM, USD, 63.53) is considering whether it should continue with several oil and gas projects. Earlier this year, the board added members of Engine No. 1, an environmental activist group. It appears their presence may be affecting the company’s production, potentially reducing future oil and gas supplies.

- As fossil fuel production is being restricted, it’s affecting electricity production globally. From California to China, generators are struggling to acquire fuel for electricity production. If shortages persist, it will further crimp industrial activity.

- Although banks are pledging to cut funding for Arctic oil development, the promises apparently have some loopholes. Still, the trend in place suggests that financing will remain difficult for fossil fuel companies.

- Rising U.S. LNG exports are lifting flows at the Henry Hub in Louisiana.

- The oil futures options markets are starting to see activity in the far out-of-the-money call options.

Geopolitical news:

- As the U.S. reduces its activities in the Middle East, the KSA and Iran are trying to improve relations. The two nations are long-time adversaries, but the KSA has relied on the U.S. to contain Iran. As the U.S. focuses on containing China, Riyadh appears to have concluded that it will need to live with Iran and thus needs to foster a new relationship.

- Although the U.S. continues to work toward Iran returning to the 2015 nuclear deal, there is no discernable progress on this issue. However, we note that the JCPOA is popular with Iranians because it could relieve the current sanctions regime. So, eventually, Tehran may decide to return to negotiations.

- In recent Iraqi elections, Muqtada al-Sadr’s bloc won a plurality and is the most powerful party in the parliament. Iran has mixed views about al-Sadr. They appreciate his anti-U.S. stance, but he is also pro-Iraqi and may oppose Tehran’s efforts to control Iraq.

- There had been tentative steps to improve relations with Venezuela, but the U.S. extradition of an ally of Venezuelan President Maduro has frozen talks. Alex Saab, a Colombian businessman with ties to Caracaras, was arrested in the African state of Cape Verde in June 2020. The country has agreed to extradite him to the U.S., where he will be arraigned on money laundering charges.

- Russia has been using the current energy crisis in Europe to press for EU concessions. Long-term forecasts suggest Russia’s hold on the natural gas market will likely increase in the coming decades.

Alternative energy/policy news:

- Part of the White House budget and infrastructure package was designed to shift the U.S. away from fossil fuels. However, it appears that Congress is not going to agree with all these projects, meaning policy moving the U.S. toward greener energy will likely be slowed.

- The IEA is warning that alternative energy investment isn’t big enough to replace the loss of fossil fuels.

- Texas, a major oil and gas state, is also a hotbed for alternative energy output.