Weekly Energy Update (October 7, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Prices are approaching $80 per barrel.

(Source: Barchart.com)

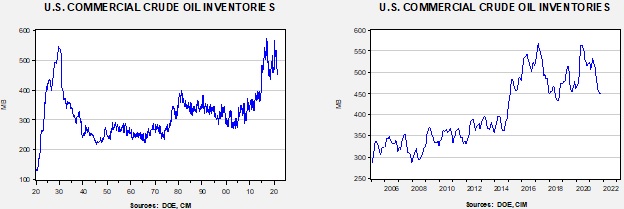

Crude oil inventories rose 2.3 mb compared to the 1.0 build forecast. The SPR declined 0.9 mb, meaning the net draw was 1.4 mb.

In the details, U.S. crude oil production rose 0.2 mbpd to 11.3 mbpd, approaching the 11.5 mbpd pre-Ida level. Exports fell 0.4 mbpd, while imports declined 0.9 mbpd. Refining activity rose 0.3%.

(Sources: DOE, CIM)

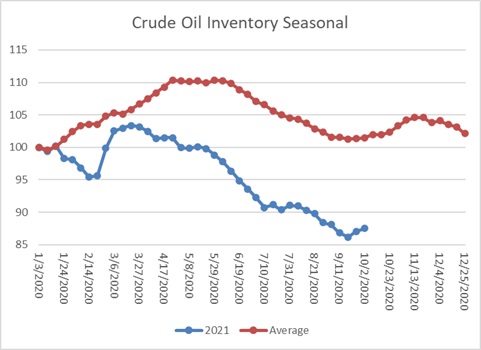

This chart shows the seasonal pattern for crude oil inventories. We are in the autumn consolidation and build season. Note that stocks are significantly below the usual seasonal trough. Our seasonal deficit is 72.3 mb.

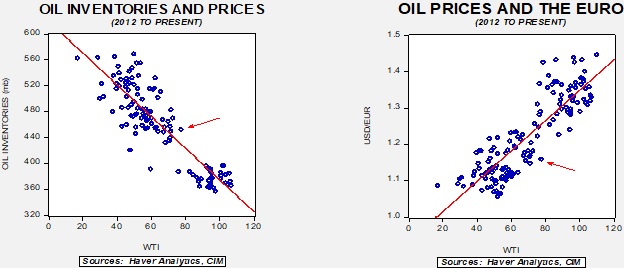

Based on our oil inventory/price model, fair value is $67.48; using the euro/price model, fair value is $58.26. The combined model, a broader analysis of the oil price, generates a fair value of $62.66. We are seeing a notable divergence in the model between inventory and the dollar and a rising level of overvaluation. Some of the overvaluation is likely due to fears of tighter inventories. If builds continue (and the seasonal pattern indicates a modest build that will start later in October), we will probably see some moderation of prices.

Ida

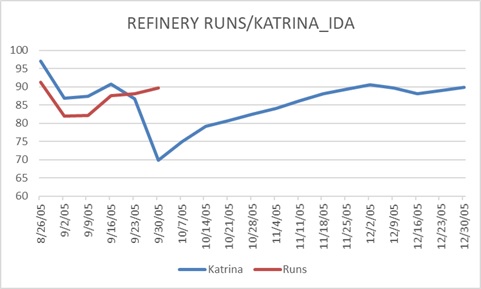

Thankfully, Hurricane Ida was not followed up by a subsequent storm as with Katrina in 2005. Since the comparison is becoming less relevant, this will be the last week of reporting on this issue.

This chart compares refinery runs during the two periods following the hurricanes. In 2005, Hurricane Rita soon followed Katrina. Since that didn’t occur with Ida (at least so far), we have seen refinery activity return to normal this week.

Market news:

- The global natural gas market continues to dominate the headlines as prices rise relentlessly.

- As the global LNG market has expanded, the U.S. natural gas market has become increasingly sensitive to global prices. U.S. natural gas is increasingly being exported to the world, reducing domestic supplies and lifting U.S. prices. Under normal market circumstances, the rise in price would trigger increased investment and production. However, in an ESG world, the normal market response is less effective, meaning that supply constraints are worsening.

- A similar situation is developing in oil; U.S. shale producers are signaling that we probably won’t see an aggressive increase in production (current data supports this signal). OPEC has also indicated that it won’t increase production, despite high prices. A key element behind these decisions is the fear that climate policy will strand investment, leading to a reluctance to invest. Since oil and gas are depleting assets, weaker investment will inevitably lead to less supply over time.

- In a new development, Russian President Putin has indicated he would like to resolve the natural gas shortage; the quid pro quo will likely be the opening of Nord Stream 2. Despite this news, it is unclear whether Russia actually intends to lift supplies.

- An additional factor reported in a Dallas FRB survey is the lack of skilled labor in the Texas oil patch, constraining output.

- As oil and gas prices have increased, even coal, the most shunned of the hydrocarbons, is seeing higher prices and shortages. India, which relies heavily on coal, is facing severe shortages and may be forced to increase imports of higher-priced coal.

- A major oil spill off the coast of California, likely caused by an undersea pipeline rupture, will dominate the headlines in the coming days.

Geopolitical news:

- Mexico’s President Obrador is seeking to change the constitution and deepen the state’s hold on the hydrocarbon industry. The plan would eliminate independent oversight of the state-owned firms and increase state ownership. He also seeks to nationalize the lithium industry. Given the weak performance of the state-owned companies, if he is successful, we would expect Mexican oil production to decline in the coming years.

Alternative energy/policy news:

- As the U.K. energy crisis unfolds, PM Johnson is being pressed on his plans for decarbonization. Part of Britain’s plans to address decarbonization is through subsidies and surcharges designed to encourage conservation and cleaner energy consumption. Although politically unpopular, it will be practically impossible to decarbonize without raising prices on oil, gas, and coal.

- Getting subsidies priced correctly is always a challenge. Poland may have made their solar subsidies too generous.

- Among the alternative energy sources, tapping tides has not received significant attention, but in coastal regions, it could be an important source of clean energy. Tides are powerful and regular, and tapping them could be beneficial.

- We have been reporting on new technologies in nuclear power. We note a recent article in Mother Jones discussing nuclear pellet technology. Although the reporting isn’t breaking new ground, the fact it is in left-wing media suggests a growing recognition that nuclear power will be part of decarbonization.

- Exxon (XOM, USD, 60.10) is continuing efforts to create biofuels from algae.

- Although reducing carbon emissions is important, the reality is that even if we were net carbon zero today, climate warming would likely continue for decades. This fact has led to continued attempts to pull carbon from the atmosphere. It is also likely, at some point, that geoengineering will be deployed to cool the planet.