Weekly Energy Update (November 11, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

After pulling back from $85 per barrel, the market made another assault on the price level, but that level is proving to give strong resistance.

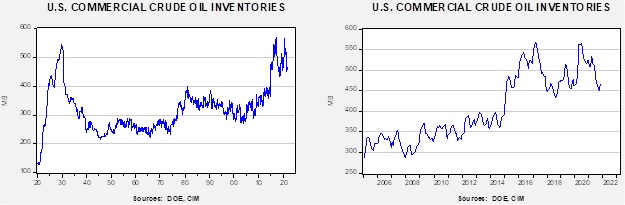

Crude oil inventories rose 1.0 mb compared to a 2.6 mb build forecast. The SPR declined 3.1 mb, meaning the net draw was 2.1 mb.

In the details, U.S. crude oil production was unchanged at 11.5 mbpd. Exports rose 0.1 mbpd, while imports fell 0.1 mbpd. Refining activity rose 0.4%. This build season usually ends in mid-November.

(Sources: DOE, CIM)

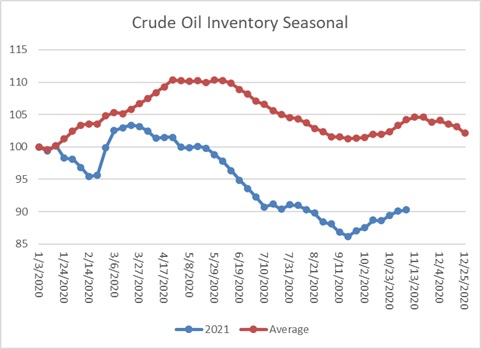

This chart shows the seasonal pattern for crude oil inventories. We are nearing the end of the autumn build season. Note that stocks are significantly below the usual seasonal trough. Our seasonal deficit is 71.9 mb.

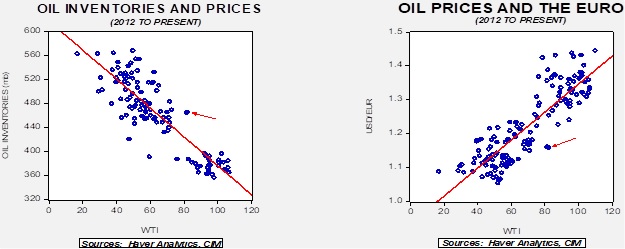

Based on our oil inventory/price model, fair value is $63.15; using the euro/price model, fair value is $58.34. The combined model, a broader analysis of the oil price, generates a fair value of $60.30. Across all models, the current price of oil is overvalued. Although supply concerns, especially the lack of response from producers in the light of high prices, is a bullish factor, it is also arguable that prices have mostly discounted (or perhaps more than discounted) the impact of this issue. So far, the market is consolidating in a range between $80 to $85 per barrel. Breaking out from that range may require a weaker dollar or falling stockpiles.

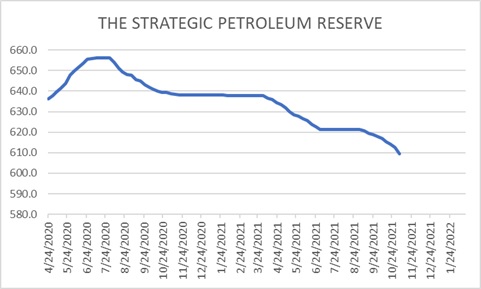

The SPR withdrawal continues and is a bearish factor for oil prices.

(Sources: DOE, CIM)

Perhaps less appreciated is that the SPR is down 117.2 mb from its all-time peak. In the next few weeks, we will examine the geopolitics of the strategic reserve in an upcoming Weekly Geopolitical Report.

Market news:

- Europe has a natural gas shortage problem. Although Russian supply practices are a key reason for the shortage, it isn’t the only problem. Dutch natural gas fields will be closed soon due to the fact that extraction is causing earthquakes, and Algeria is in a dispute concerning tensions with Morocco.

- The White House continues to press OPEC for more production to lower the price of crude, but so far, the cartel is resisting the pressure. The administration is also threatening to release SPR oil but hasn’t yet taken action on that alternative. However, after reviewing the recent DOE short-term energy forecast, the administration has decided to wait for a major sale from the SPR.

- Natural gas exports are reducing U.S. domestic supplies and lifting prices. It will be worth watching to see if the U.S. uses regulatory tools to boost American supplies by restricting imports.

- Current high prices for oil and natural gas would usually lead to higher production. That isn’t happening to the same degree now due to capital discipline and regulatory hurdles.

- The SEC has fined United States Commodity Funds for disclosure failures tied to its oil ETF, USO (USO, USD, 57.92). The disclosure issues are related to the sharp drop in oil prices that occurred in May 2020.

Geopolitical news:

- Iran and the U.S. continue to discuss a return to the JCPOA, but our view is that both sides are still far apart. Iran is worried that Washington’s position on the nuclear agreement can change radically with a new administration and is thus looking for changes to the agreement that would outlast a new government. Essentially, Iran wants a new agreement; we don’t see the Biden administration giving them one.

- Iranian President Raisi is facing pressure to comply with the Paris-based Financial Action Taskforce, which works against money laundering. Iran is on the group’s blacklist (along with North Korea), and reformist elements in Iran want Raisi to pass legislation that would get the country off the blacklist.

- Although Iranian supported groups are said to be behind that recent drone attack on Iraqi PM Mustafa al-Kadhimi, the head of the Quds Force of the Iranian Revolutionary Guard Corps visited the PM and offered Kadhimi his support. We suspect this visit was designed to send a clear signal to various Iran-backed insurgent groups that such attacks were not supported.

- Saudi Arabia and Iran have been holding talks but are postponing them until the new Iraqi government is formed. This decision shows both Iran and the KSA the importance of controlling Iraq.

- Recent Iraqi elections have changed the balance of power in Iraqi Kurdistan as well. The Kurdistan Democratic Party has increased its dominance, gaining eight seats, giving the party a total of 33 seats in the Iraqi Parliament.

- Iran claims the U.S. attempted to seize one of its oil tankers. The U.S. has rejected the charge, and there isn’t clear evidence anything like this occurred.

- The EU is engaging in actions that will likely improve the legitimacy of President Maduro of Venezuela. The U.S. generally opposes such activities.

Alternative energy/policy news:

- COP26 continues, and although the agreements are falling short of the most optimistic projections, there is some progress being made. Seventeen nations, for example, have promised to phase out coal in electricity generation.

- As nations move to reduce fossil fuel use, they are being forced to cope with higher oil and natural gas prices.

- Climate pledges are part of the COP26 plan for reducing carbon emissions. However, measurement standards are lacking, which means it is nearly impossible to monitor the pledges.

- One political risk of “greening” the economy is that it could exacerbate the problem of populism by reducing employment in the fossil fuel industry. This article compares the greening of energy policy to the China shock of manufacturing and argues that if policymakers want to make the world support green energy, they will have to work harder to protect those who will lose their jobs in the process.

- Although technology has the aura of being less energy-intensive, in reality, the global chip industry emits significant levels of carbon.

- Polysilicon, a key material for solar panels, is in short supply, and prices are soaring. If this continues, it will slow the adoption of solar energy. Supply chain problems are also affecting wind power.

- The EU is warming up to nuclear power.

- Carbon capture and storage is one way to reduce the carbon emissions from burning fossil fuels. This link provides a tutorial.

- Honeywell (HON, USD, 227.34) reports it has developed a process to turn low-grade plastics into refinable oil.

- One way the Biden administration is looking to promote energy conservation and EVs is by tax credits. However, Mexico and Canada have both noticed that the tax credits skew toward rewarding Americans for buying union-made cars built in America, a clear disadvantage to Canada and Mexico.