Weekly Energy Update (November 10, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

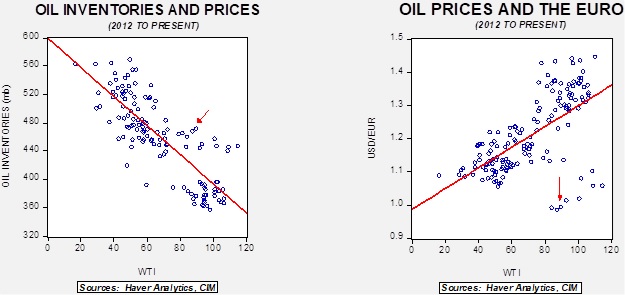

Crude oil prices appear to be building in a base in the mid-$80s.

(Source: Barchart.com)

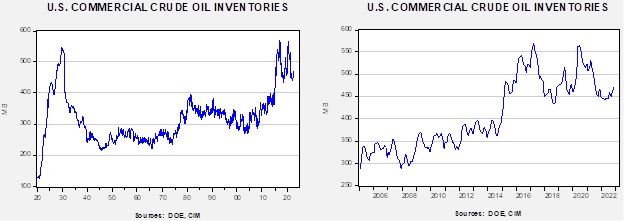

Crude oil inventories rose 3.9 mb compared to a 0.3 mb build forecast. The SPR declined 3.6 mb, meaning the net build was 0.3 mb.

In the details, U.S. crude oil production rose 0.2 mbpd to 12.1 mbpd. Exports declined 0.41 mbpd, while imports rose 0.3 mbpd. Refining activity rose 1.5% to 92.1% of capacity.

(Sources: DOE, CIM)

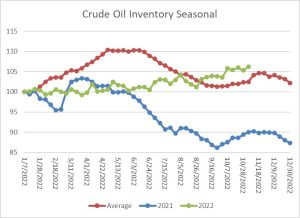

The above chart shows the seasonal pattern for crude oil inventories. As the chart shows, we are past the seasonal trough in inventories and heading toward the secondary peak which occurs later this month. SPR sales have distorted the usual seasonal pattern in this data.

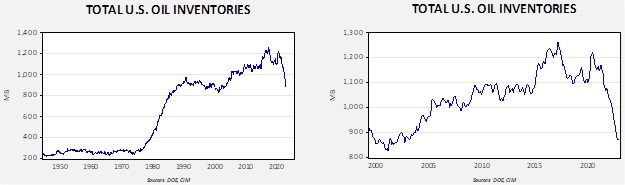

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $105.36.

Market News:

- The Biden administration is providing $4.5 billion of funds to subsidize low income household’s heating needs.

- Oil companies continue to temper investments despite high oil prices and strong earnings. One obvious reason is that all the signs suggest that crude oil demand is near peak, if not past it already. Thus, oil and gas companies must manage in a weaker growth environment, which makes new investment rational only if the payoff is rapid and short term. These worries have stunted production.

- The EU and U.S. are making counterclaims about whose energy companies are profiteering.

- On a related note, the DOE has lowered its estimate for 2023 U.S. oil production to 12.31 mbpd.

- There is increased interest in “refracking,” which is to deploy fracking techniques to already fracked wells to squeeze further production out of existing wells. This could be a low-cost way to lift U.S. output.

- After Fukushima, Japan closed most of its nuclear power reactors and instead began using LNG to generate electricity. With LNG supplies tight, however, the Japanese government is trying to convince the public that returning to nuclear power is wise. If it can’t persuade them, then natural gas supplies will be even tighter this winter.

- Developed-economy demand for LNG is causing shortages in the emerging economies.

- We have noted that the SPR sales have been skewed toward sour crude, which is the preferred feedstock of U.S. refiners. These flows have apparently boosted the profits of refiners this year.

- Although current European natural gas prices have dropped due to mild weather and near-term oversupply (over 30 LNG tankers are currently sitting offshore of Europe), the IEA warns that the real shortage might become more evident in the winter of 2023-24.

- Last week, we commented on diesel shortages. We note that China is about to open two new refineries, adding about 0.5 mbpd of capacity. In light of weak economic growth, China is expected to lift diesel exports to take advantage of high prices. In preparation for opening the new refineries, China’s oil imports rose last month.

- Canada’s new rules on emissions could reduce future oil and gas production.

- Vietnam has run out of gasoline.

Geopolitical News:

- There are reports that President Xi is planning a state visit to the Kingdom of Saudi Arabia (KSA), likely in December. Given how fraught U.S./Saudi relations have become, this trip is symbolically important. The KSA wants to hold significant market share of China’s imports because it perceives China as the world’s dominant oil importer. The U.S. used to have this role, but the combination of shale oil and imports from Canada have reduced the KSA’s share of the U.S. import market. However, there is one problem for Riyadh in increasing its reliance on China: Beijing doesn’t have the power projection that the U.S. has, so if the KSA needs to be defended, it likely cannot rely on the PLA to do so.

- Protests and suppression continue in Iran. We do note that Ayatollah Khamenei offered a softer tone to protestors, trying to suggest that there are some who are tools of the West but others who have legitimate complaints.

- Iran seized a small tanker in the Persian Gulf which it accused of smuggling.

- Last week, we reported on a threat that Iran was about to attack Saudi Arabia. Apparently, that threat has been eased somewhat.

- Crypto exchanges have helped Iran evade sanctions.

- Iran has become an important arms supplier to Russia.

- The U.K. has announced an insurance ban on Russia oil shipments unless the oil is priced at or below the G-7 cap. The plan is expected to be in place by December 5. Although China and India are not expected to comply, we doubt major shipping chokepoints will allow passage for tankers without Western insurance. This would mean that the seaborne shipping costs for India and China will likely rise and either discourage imports or force Russia to cut its price.

- One issue that has emerged from the war in Ukraine is that the U.S. was trying to walk a fine line between punishing Russia and trying not to create an energy crisis. The whole price cap structure is a response to worries about losing Russian oil on world markets. In fact, the price cap was a way to moderate the impact of the EU insurance ban noted in the previous bullet point. One important “tell” is that if the U.S. really wanted to hurt Russia, it would have enforced secondary sanctions on buyers of Russian oil. That didn’t happen for a reason. Adding to evidence of this less-than-full commitment is that the White House has quietly supported major U.S. banks maintaining ties to Russian companies. We note that Congress has tended to push for more aggressive policies against Russia, and if we see a change in control at the midterms, it may be more difficult for the administration to keep some Russian oil on world markets.

- The lack of secondary sanctions has allowed Russia to become the largest oil supplier to India.

- Although the G-7 price setting plan probably won’t work, it could become the structure of a buyers’ cartel. Sellers’ cartels, attempting to create a monopoly, are nothing new; but a buyers’ monopsony would be a new twist to the oil market.

- A U.S. aid worker was assassinated in Iraq.

Alternative Energy/Policy News:

- Cop-27 is underway this week. We won’t have much to say because we doubt anything binding will emerge. We do note that the U.S. is proposing a system of carbon credits that can be purchased by firms. Although the idea makes some sense, it should be noted that no accreditation process has been created, which means it could be merely a form of greenwashing.

- Canada has ordered three Chinese firms to exit the lithium mining sector, citing national security concerns.

- U.S. spending for wind and solar power has been weak this year.

- Geoengineering is the process of directly acting to offset various climate issues. For example, one way to cool the planet is to inject aerosols into the upper atmosphere to reflect sunlight back into space. Geoengineering is controversial because the potential side effects are hard to predict, and those side effects might be “levied” against those who don’t benefit from the action. Despite the controversy, DARPA is quietly funding various projects probably because the government wants to know how they would work if we were to reach a situation where such measures became necessary.

- There are a number of new nuclear technologies being developed. Here is a primer on molten salt reactors.

- Researchers claim a breakthrough related to creating renewable jet fuel.

- Similarly, researchers in Singapore note that they have made the process of pulling hydrogen out of water more efficient by using a procedure involving light. Meanwhile, researchers at Rice University have devised a way to pull hydrogen from hydrogen sulfide (rotten egg gas), which is an unwanted byproduct of desulfurization in refining and natural gas processing.

- One of the problems with expanding solar and wind power is that it takes up lots of space and the least costly place to acquire that space is rural areas. However, residents are cooling to these facilities, worried about the impact on farming, ranching, and property values.

- U.S. automakers are lobbying for the Treasury to widen the nations for which EV components can be imported and thus be eligible for subsidies. We suspect this is to leave room for China to participate.

- The EU is growing increasingly upset with the Inflation Reduction Act’s EV subsidy rules that restrict payments to consumers only if they buy vehicles mostly constructed in the U.S. European automakers wanted carve outs so they could participate, but the U.S. countered with “make your own subsidies.” We could see an EU trade retaliation, but we doubt this will change U.S. policy.

- Last week, we noted that the EU voted to end the sale of internal combustion engines in Europe by 2035. As regulators tally up the potential job losses, there are new calls to delay that transition.