Weekly Energy Update (November 4, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

After touching $85 per barrel, oil prices have dropped on rising inventories and worries about tightening monetary policy.

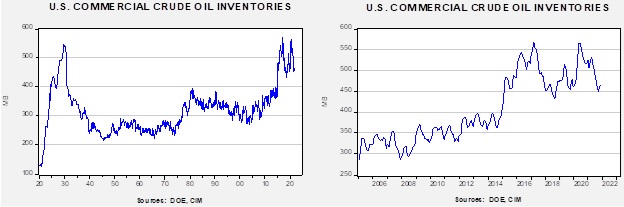

Crude oil inventories rose 3.3 mb compared to a 2.0 mb build forecast. The SPR declined 1.6 mb, meaning the net draw was 1.7 mb.

In the details, U.S. crude oil production rose 0.2 mbpd to 11.5 mbpd; production has returned to the pre-Ida level. Exports rose 0.1 mbpd, while imports fell 0.1 mbpd. Refining activity rose 1.2%, suggesting we are at the end of the refinery maintenance season. This build season usually ends in mid-November.

(Sources: DOE, CIM)

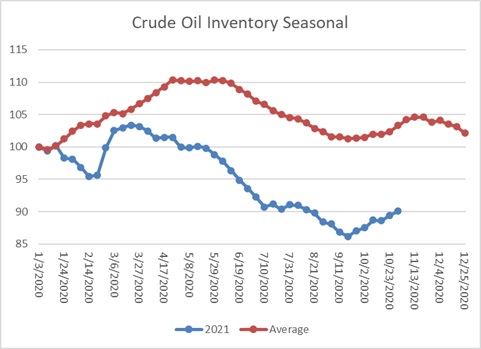

This chart shows the seasonal pattern for crude oil inventories. We are in the autumn build season. Note that stocks are significantly below the usual seasonal trough. Our seasonal deficit is 68.4 mb.

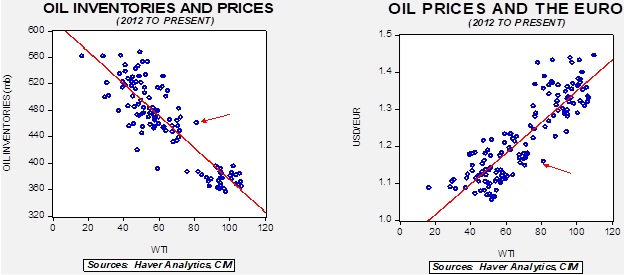

Based on our oil inventory/price model, fair value is $63.30; using the euro/price model, fair value is $58.57. The combined model, a broader analysis of the oil price, generates a fair value of $60.49. Across all models, the current price of oil is overvalued. Although supply concerns, especially the lack of response from producers in the light of high prices, is a bullish factor, it is also arguable that prices have mostly discounted (or perhaps more than discounted) the impact of this issue. If so, we may see a period of consolidation in the coming weeks.

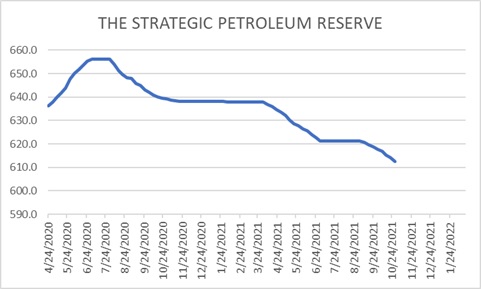

Another factor has been the decline in the SPR. Since July 2020, inventory in the SPR has declined 43.6 mb, or about 2.9 mb per month. As the chart below shows, the withdrawal from the SPR has not been a straight line, but if the SPR had not been reduced, current inventories would be below 410 mb, a level that would be consistent with current prices.

(Sources: DOE, CIM)

The Consolidated Appropriations Act of 2018 mandated 10 mb of sales from the SPR in 2020 and 2021 as part of a 58 mb sales over eight fiscal years beginning in 2018. Since August, we have seen about 10 mb of sales, which means we may be getting near the end of sales for this year.

Market news:

- Although there is clear evidence that ESG practices are reducing domestic production, the administration continues to blame OPEC for high oil prices. The fact of the matter is that if the world is going to reduce carbon emissions, it will be hard to enact that without demand destruction brought about by higher prices.

- The current budget in Congress includes several measures that affect the oil and gas industry. Here are the short takes:

- Methane fees—the EPA would collect fees that would escalate over time based on leakages of the gas.

- Bans on new offshore oil and gas leases—would permanently ban new leases on both coasts and the eastern GOM and protect the ANWR.

- Raises royalty fees—lifts fees on offshore projects to 14% and the onshore rate between 12.5% to 18.75%. These rates apply to new leases.

- Increases the minimum bid for oil and gas leases to $10 from $2 with an inflation escalator attached.

- New per acre fees for Federal leases and on expressions of interest—there will be a $4 per acre Conservation of Resources fee for new production leases along with a $6 per acre fee on non-producing (speculative) leases.

- Severance fee—a collection of $0.50 per barrel on oil produced from Federal lands or the Outer Continental Shelf and $2 per metric ton of coal output.

- Other—rental rates are raised, lease terms reduced, and bonding requirements added.

- Offshore pipeline fees—charge pipeline owners a fee of $1,000 per mile for undersea pipelines up to 500 feet, $10,000 per mile for greater depths.

- All these obviously raise the cost of extracting oil and gas. However, it is still not clear they will become law. For example, Sen. Manchin (D-WV) opposes the methane salvage fee.

- China is tapping its strategic reserves and implementing rationing in a bid to deal with supply shortages and price increases. However, there are reports that strategic stockpiles are so low that Beijing may have no choice but to step up imports. That is already happening with LNG.

- Although Russia continues to claim it is supplying adequate levels of natural gas to Europe, there is evidence it is actually withdrawing gas from the continent.

- One way EU nations could reduce energy prices to households would be to lower taxes on energy products.

Geopolitical news:

- Iran’s gasoline distribution system was hit with a cyberattack, leading to gas lines and shortages. Israel was blamed for the attack.

- Gulf states withdrew ambassadors from Lebanon after a junior official criticized the war in Yemen. The KSA also cut all imports from Lebanon, a move that will adversely affect an economy already under strain.

- Although Iran publicly claims it wants to return to the JCPOA negotiations, its actions suggest, at best, Tehran is in no hurry. Hardliners, of which President Raisi is a member, have mixed feelings about the deal. They deeply distrust the U.S. and view Washington as unreliable. So, there is little incentive to make any concessions. But, given that Iran has strayed from the restrictions, the U.S. would need assurances that Iran would go back to the 2015 agreement, which is unlikely. Thus, there is little chance that negotiations will yield a return to the pact, even though Iran continues to demand President Biden use an executive order to end U.S. sanctions. Politically, in the U.S., there is no discernable pro-Iran lobby, and with President Biden’s approval ratings in a deep slump, we doubt the president has the political capital to give into Iran.

- Iran’s new central bank governor, Ali Salehabadi, has announced a plan to end subsidized exchange rates. This action will likely lift the price of imports and boost domestic industry.

- Islamic State (IS) activity has been increasing across the region. Iraq has arrested some IS fighters who attacked areas in the Kurdish regions of Iraq.

- Iraq is broadening its energy partnership with the KSA.

- Russia has been disrupting natural gas supplies to Moldova; the Kremlin opposed the EU-leaning government in Moldova and is using natural gas supplies to pressure the government. The EU has pledged €60 billion in aid to counteract Russian activities.

- The head of the KSA’s sovereign wealth fund has disappeared. Although it is possible, he didn’t attend a recent investment conference he usually hosts due to COVID-19, there has been a definitive lack of transparency that is making investors nervous.

Alternative energy/policy news:

- The current budget also has spending on green projects. Here are the short takes:

- Investment tax credit for investments in energy conservation; a 30% credit is available but only by using prevailing wage standards. Otherwise, the credit is 6%.

- Clean hydrogen tax credit of $3.00 per kilogram.

- Zero-emission nuclear power production credit.

- Refundable EV tax credit up to $12,500 with means testing.

- Commercial EV tax credit.

- Extension of the excise tax credit on biofuels.

- Carbon capture expansion.

- Civilian climate corps.

- Again, all these are dependent on the passage of the budget.

- Britain is taking steps to attract financing for nuclear power plants.

- Although fusion reactors remain the “holy grail” of nuclear power, and have not achieved their promise, they are attracting new investment.

- Japan’s new PM is pushing for a reopening of Japan’s nuclear power sector. Much of the country’s nuclear power industry shut down after the Fukushima meltdown.

- New economic research suggests that heavy investment in reducing carbon emissions is justified, a finding not supported by earlier research.

- China is beginning to export EVs to Europe.

- 105 nations have approved a pact to reduce methane emissions, which may be the biggest win from COP26. The financial system is also making major promises, which may result in less fossil fuel investment (and lower supplies). The industry is promising $130 trillion in investment to achieve zero carbon emissions.

- COP26 is also making promises to reduce deforestation.

- The use of carbon tariffs to create incentives to reduce fossil fuel use is gaining traction.

- Although the KSA made headlines by announcing plans to achieve net-zero carbon emissions by 2060, that doesn’t mean it actually plans to reduce oil output. Falling oil demand would be a major negative for the Persian Gulf states.