Weekly Energy Update (May 25, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices are rising back into their earlier trading range of $73 to $82 per barrel.

(Source: Barchart.com)

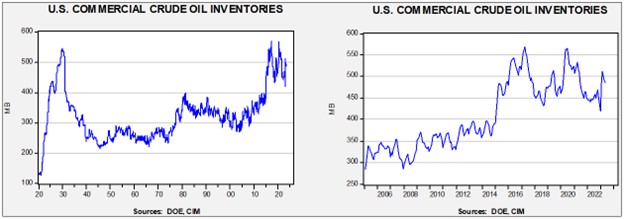

Commercial crude oil inventories fell a whopping 12.5 mb when compared to the forecast build of 1.5 mb. The SPR fell 1.6 mb, putting the total draw at 14.1 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 12.3 mbpd. Exports rose 0.2 mbpd, while imports fell 1.0 mbpd. Refining activity declined 0.3% to 91.7% of capacity.

(Sources: DOE, CIM)

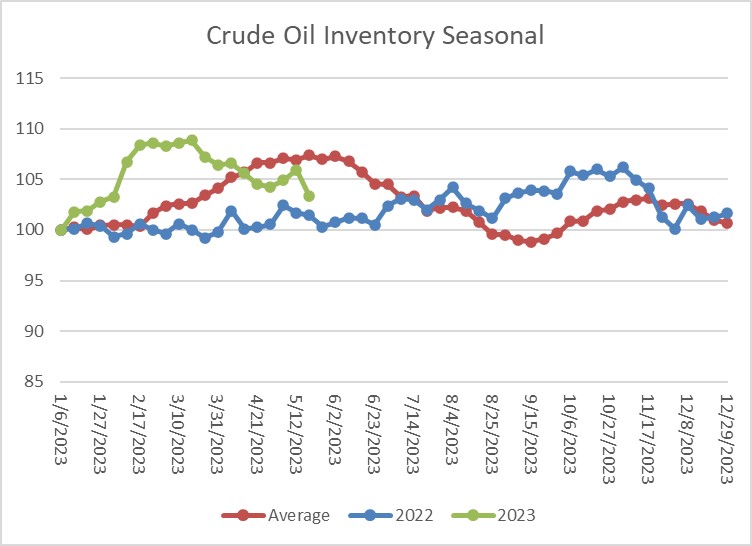

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and then declined. This week’s unexpected drop in stockpiles has put inventories well below seasonal norms.

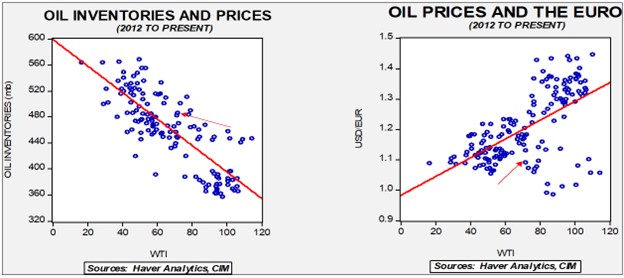

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $60.59. Although OPEC+ is trying to stabilize the market, recession worries are clearly pressuring crude oil prices.

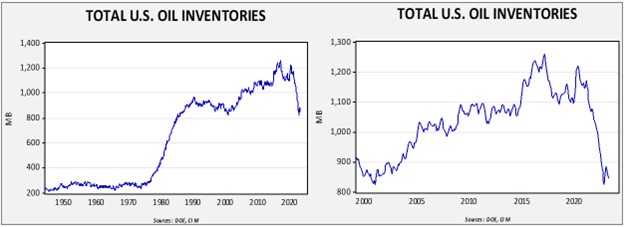

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $94.88.

Market News:

- Despite promises to cut greenhouse emissions, the G-7 disappointed climate activists by avoiding the setting of deadlines for reducing fossil fuel use. In general, maintaining economic growth usually trumps environmental concerns.

- Left-wing legislators in Congress are pushing for a ban on U.S. oil and gas exports. Although we doubt this will get through the GOP-controlled House, such bans do occasionally come up in Congress. Curtailing these exports would be devastating for Europe and may not necessarily lead to more domestic supply.

- Russia has admitted that discounting, in part caused by the price cap, has led to lower revenues from oil sales. Russia is also receiving less for natural gas when selling it to China. China appears to be focusing more on Central Asia for obtaining its natural gas.

- The IMF has a blog report about the growing integration of the global natural gas market. Such integration would be bullish for U.S. natural gas producers.

- There is a growing consensus that this summer will be a hot one. We note that Canadian wildfires have led to lower Alberta oil production. Unusually hot weather in Southeast Asia has led nations to boost energy consumption, lifting the demand for Russian energy.

- Russia claims that lower domestic consumption accounts for its higher levels of exports and its promised production cuts.

- New research suggests that warming temperatures will lead to depopulation in the areas most affected.

- India is looking to refill its SPR; the reserve capacity is 39.8 mb and it is looking to buy about 10 mb.

- Nigeria is opening a large refinery. Its goal is to meet domestic demand for oil products in order to curtail imports.

Geopolitical News:

- Iran and Russia are negotiating to build a rail/shipping line from Moscow through Iran to the Indian Ocean. Shipping facilities to India are also a part of this plan. Not only would this transportation facility bring Russia and Iran closer, but it would also make India more likely to align with the emerging China-led bloc.

- Iran and Russia are also increasing cooperation in energy.

- Iran’s liquid assets in its sovereign wealth fund are reportedly down to $10 billion; the fund is said to hold other assets of $140 billion. The low level of cash suggests there is little available in the fund to meet possible funding issues.

- Iran’s religious government is facing a potential threat from within the Shiite movement. Religion and government don’t always mix very well, even in theocracies. Religion has differing goals to governance, and even authoritarian regimes have to make compromises that don’t often sit well with zealots. Is this development a threat to the current regime? As with all such issues, it is hard to say, but its mere existence does raise concerns.

- Iran dismissed Ali Shamkhani, the secretary for the Supreme National Council, which is the body that steers Iran’s security and foreign policy. He had ties to Alireza Akbari, who was deemed to be a spy.

- In response to recent vessel seizures by Iran, the U.S. Navy is increasing patrols in the Persian Gulf.

- Iran has put its nuclear development facilities underground, and recent reports suggest that it has tunneled deeper to the point where U.S. conventional “bunker-buster” weapons would not be able to destroy these facilities. Although this may prompt Iran’s enemies to use sabotage and cyberattacks, it also could lead to the use of nuclear bunker-busters instead.

Alternative Energy/Policy News:

- An industry report shows that one of the key factors holding back the energy transition is the lack of profitability. Although we expect this factor to improve with expansion, it also highlights the need for government subsidies until scale can be achieved.

- Another important issue was noted by David Calhoun, the CEO of Boeing (BA, $2007.00), who indicated that there is no cheap way to decarbonize air travel and doing so would likely lead to much higher prices and less air travel.

- As lithium demand soars due to EVs, Latin American nations are trying to manage the potential boom to benefit their societies. As we have noted recently, a couple of countries are considering nationalizing lithium mining. We could also see them follow the Indonesian model with nickel—force firms to build fabrication and refining plants within their country to prevent these nations from being mere suppliers of raw material. Chile has announced new taxes on copper miners.

- We note that China has been aggressively buying into lithium mines worldwide to secure the metal for EVs.

- JP Morgan (JPM, $138.40) announced $200 million in support for carbon removal. Direct carbon capture will likely be necessary to maintain temperatures, and the support by this bank is a good sign for the industry.

- In the scramble to secure metals for EVs, even oil companies are looking to buy into production. Meanwhile, Ford (F, $11.82) is aggressively working to gain access to lithium.

- One of the problems with EVs is the time required to recharge batteries. At best, it’s a 20-minute process but often requires hours to fully charge a vehicle. For EVs used in normal commuting, recharging at home usually addresses this issue. However, for road trips, EVs are simply less convenient when compared to internal combustion engine vehicles. One idea that has been around for a while is battery swapping. If an EV is built to have removable batteries, it is then possible to build facilities that will house charged batteries where drivers can swap their discharged batteries for charged ones. If such infrastructure is built, it would shorten the downtime of getting a recharged battery to that of buying gasoline. There is renewed interest in this idea, but the problem is that if solid-state-battery technology evolves, recharging times should decline to rival gasoline refilling.

- We have been closely watching the evolution of China’s EV manufacturing. Increasingly, it looks like China has developed world-class quality vehicles at low prices. We recommend this Sinocism podcast for details. Chinese cars represent a serious threat to European and U.S. automakers. Essentially, Western governments are facing a dilemma. If they open up their markets to Chinese EVs, the energy transition will move faster and doing so will likely contain inflation, but the cost would be losing this market to China. Or they could use tariffs and quotas to ban Chinese vehicles, slow the energy transition, and face higher inflation. Our expectation is that the second outcome is most likely.

- On a related note, Honda’s (HMC, $28.48) Chinese joint venture is starting to export EVs and plug-in hybrids abroad. The first sales are going to Europe.

- Although we have been reporting on the world’s dependence on China for energy transition materials, this link has an attractive graphic that highlights China’s dominance.

- An important element of China’s dominance is in the processing of energy transition metals. Other nations are trying to build more processing outside of China, but one of the reasons China leads the industry is that it has lower costs. China’s processing superiority has led to vertical integration in components. On a related note, Indonesia is trying to build a nickel processing industry to complement its preeminence in nickel mining; it’s not as easy as it looks.

- Europe was hoping to get access to U.S. subsidies for EV production. It looks like negotiations have stalled, leaving the EU at a disadvantage.

- As EVs become more prevalent in the West, ICE vehicles are ending up in the developing world.

- China is also rapidly expanding into nuclear power.

- Although fixed solar-panel arrays are the most typical deployment of these generating devices, floating panels in bays or lakes are common in Asia. We are starting to see such arrays in the U.S. as well.

- One of the problems with solar and wind power is its intermittency. Because the power doesn’t flow regularly, utilities must keep traditional power backups to meet conditions where wind or sun power isn’t available. Obviously, batteries would solve this problem, but sadly, “metal” batteries are expensive. We are seeing increasing reports, though, of creative ways of storing energy by either heating water or salt in the earth and using it to push a turbine or by using pumped storage.

- The EU’s joint purchasing program for natural gas is being seen as a success. By combining buying power, the Europeans have been able to purchase natural gas at lower prices than they otherwise would have been able. Now the EU wants to branch out by using that same buying power to purchase hydrogen and other “green” materials.

- Last week, we commented on U.S. funding for carbon capture projects. One of the downsides is that if the CO2 escapes, it can be deadly. It is this fear that drives the permitting delays.

- California has approved 45 new transmission projects worth a total of $7.3 billion.

- In Europe, refiners are experimenting with using cow manure processed into methane to provide the energy needed for refining crude oil.

- There are constant tensions between those who aim to streamline permitting and the parties that want to prevent any sort of disruption. Interestingly enough, this opposition is not just against fossil-fuel development. A recent example involves the Burning Man festival in Nevada, which is tangling with a geothermal development.

- Although lithium, rare earths, and cobalt dominate the headlines regarding the energy transition, aluminum is also a key metal. It is an important component for solar power and it reduces weight in vehicles which in turn improves fuel efficiency. Despite this importance, it has been mostly neglected by policymakers. Aluminum is sometimes called “molten electricity” due to the large amount of electricity needed to smelt the metal. Because it takes so much electricity to make, production in the West has been falling. This neglect may sadly lead to yet another supply problem in the future.