Weekly Energy Update (May 19, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices have moved higher this week, touching technical resistance at $115 per barrel.

(Source: Barchart.com)

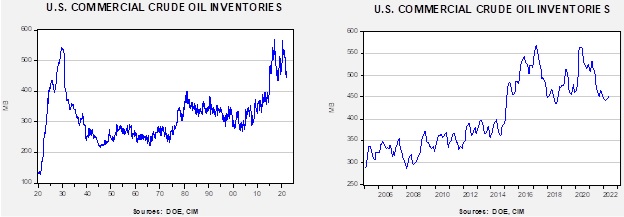

Crude oil inventories unexpectedly fell 3.4 mb compared to a 1.6 mb build forecast. The SPR declined 5.0 mb, meaning the net draw was 8.4 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 11.9 mbpd. Exports rose 0.6 mbpd, while imports rose 0.3 mbpd. Refining activity rose 1.8% to 91.8% of capacity.

(Sources: DOE, CIM)

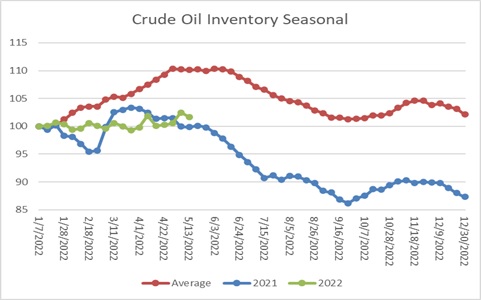

The above chart shows the seasonal pattern for crude oil inventories. This week’s report shows a partial reversal of last week’s rise, with rising crude oil exports and increased refinery activity offsetting the continued draw from the SPR. Seasonally, the draw begins in earnest in June.

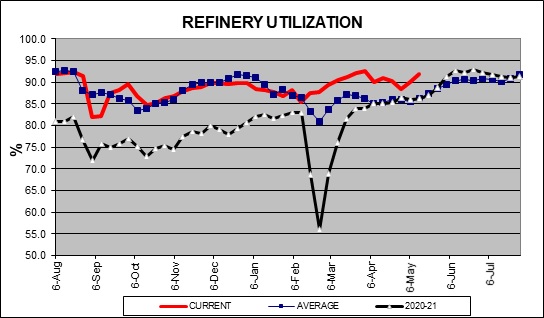

Refinery utilization is ramping up early this year, reflecting attractive refining margins.

Seasonally, refining activity reaches its peak in early June and remains elevated into Labor Day. We expect strong demand for product to keep refinery activity at peak levels through the summer.

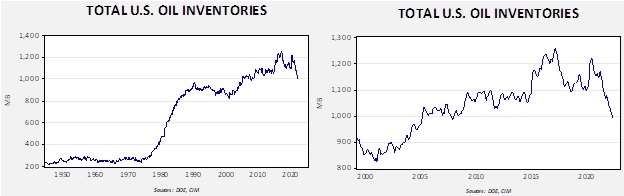

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

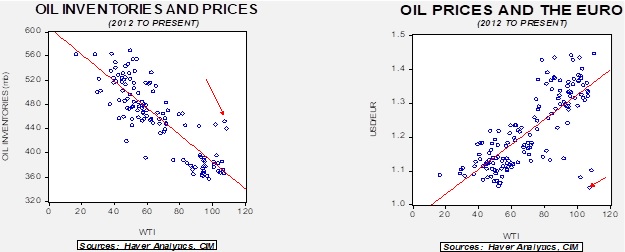

Total stockpiles peaked in 2017 and are now at levels seen in late 2008. Using total stocks since 2015, fair value is $89.15.

With so many crosscurrents in the oil markets, we see some degree of normalization. The inventory/EUR model suggests oil prices should be around $60 per barrel, so we are seeing about $40 of risk premium in the market.

Market news:

- The Biden administration continues to struggle to craft a clear message regarding oil supplies. Reports revealed the administration canceled auctions for oil and gas drilling leases in the Gulf of Mexico (GOM) and Alaska. To be fair, drillers have not shown strong interest in Alaska, and legal complications have made bidding a problem in the GOM. The lack of bidding undermines the ability of the industry to boost production.

- Despite the chilly relations between the oil and gas industry and Washington, company profitability remains strong.

- As supplies of energy tighten, regional shortfalls are being reported, ranging from wider jet fuel margins on the East Coast to the Texas grid operator pleading with consumers to conserve as high temperatures boost air conditioning demand. So far, the Texas grid has continued to function, but we do note it’s May, and the hottest part of the summer lies ahead. Rising diesel costs are pressuring the transportation industry. Jet fuel is becoming increasingly scarce.

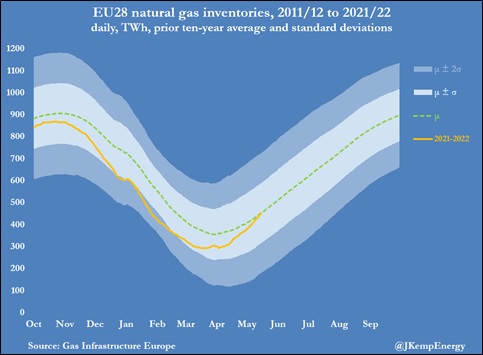

- In Europe, Spain and Portugal are capping natural gas prices; the EU is also thinking about a cap on Russian gas prices. Often, capping prices leads to supply shortfalls. Talk of price caps is occurring while the EU is attempting to rebuild natural gas inventories before next winter. To date, natural gas stocks are rising in Europe, with inventories at normal levels for this time of year.

- Spain has natural advantages for LNG distribution. Its ports are generally sheltered from weather issues, and being a peninsula, it can create facilities on three sides. However, its pipeline network is not developed enough to support increased LNG capacity.

- As lockdowns in Shanghai ease, China has been making inquiries about LNG supplies. Even though this news suggests the economic fallout from zero-COVID may be easing, it also could lead to stronger demand for LNG, which is bullish for prices.

- The most recent IEA report is more optimistic that markets could absorb the loss of Russian oil, mainly due to falling consumption.

- Energy leaders suggest Russia will be “permanently decoupled” from the Western energy system. If true, this will likely lead to permanent price differences that won’t be arbitraged away.

- Higher energy prices are leading commodity clearinghouses to lift margin requirements dramatically on derivatives. The rising costs of margin are reducing liquidity and potentially lifting risk in the commodity markets.

- China is aggressively lifting coal production. At the same time, to keep inflation under control, it has price controls in place, leading China’s coal futures markets essentially to stop trading.

- Saudi Aramco (2222, SAR, 42.50) now has the largest market capitalization of any publicly traded company in the world.

Geopolitical news:

- Italian PM Mario Draghi has proposed creating a consumer cartel for oil. Although we doubt this will work, such consideration suggests high oil prices are straining Western economies.

- So far, the EU has not banned Russian oil, as Hungary wants to continue to receive Russian supplies for at least two more years. A deal may not be reached for several weeks.

- European negotiators continue to express optimism that the U.S. and Iran can return to the JCPOA. We continue to harbor serious doubts.

- In a bid to improve the oil supply situation, the Biden administration has offered to ease some sanctions on the Maduro regime. The relief offered isn’t substantial, and the proposal is more about opening negotiations. We don’t expect Venezuelan oil to flow to the U.S. anytime soon.

- Last week, we noted Iran was cutting subsidies on key foods. Pasta prices have jumped nearly 2.5x over the past month as support has been reduced. Rising food prices are politically unpopular.

- As the West implemented sanctions on Russia that excluded some elements of energy, there has been concern that Russia would retaliate by restricting supplies to Europe. We are seeing growing evidence that Moscow is starting to disrupt oil and gas flows. Recent analysis suggests that ending the importation of Russian gas and oil would cost the EU €195 billion.

- Treasury Secretary Yellen has suggested the EU could create a package of tariffs and a price cap on Russian oil in an attempt to reduce dependence on Russia and make the trade less favorable for Moscow.

- Shell (SHEL, USD, 58.16) has announced it has sold its Russian gas stations to Lukoil (LKOH, RUB, 4523.50).

Alternative energy/policy news:

- As CO2 concentrations continue to rise, it is becoming clear that mere reduction programs probably won’t be enough to slow accumulations of the gas. One area attracting attention and funding is carbon capture and storage. This process takes the CO2 generated by various processes, captures it at the source, and sends it into underground storage or some other disposal method. BP (BP, USD, 31.49) and Linde (LIN, USD, 371.18) announced a venture to capture greenhouse gases in Houston.

- Another potential action is geoengineering, which can cover everything from directly cooling the earth to other forms of carbon storage. However, governments are leery of private actors or other governments essentially conducting climate experiments that may have uncertain outcomes.

- Although commodity demand will always be cyclical, the structural demand for metals required for transitioning to EVs will likely support prices for an extended period. EVs are starting to have an impact on easing demand for gasoline.

- EU companies are supporting a measure that would outlaw the sale of new gas and diesel vehicles by 2035. Policies such as these have a dampening effect on oil and gas investment.

- One solution to expanding hydrogen use is to send the gas, along with natural gas, using existing natural gas pipelines.